A new consumer survey points to a sharp mood shift in the smartphone market: most respondents say flagship phones are no longer worth buying. In a poll with over 18,800 votes, 66.5% of participants concluded that top-tier devices don’t justify their price tags, signaling growing confidence in mid-range models and a widening gap between premium marketing and real-world value.

What the survey reveals about flagship phone value

The results were decisive. Nearly two-thirds dismissed flagships as poor value, just under 20% defended them as worthwhile, roughly 8% said they were unsure, and just under 6% admitted they still buy them despite thinking they aren’t worth it. The takeaway is clear: even engaged smartphone users feel that mid-range phones now cover their needs.

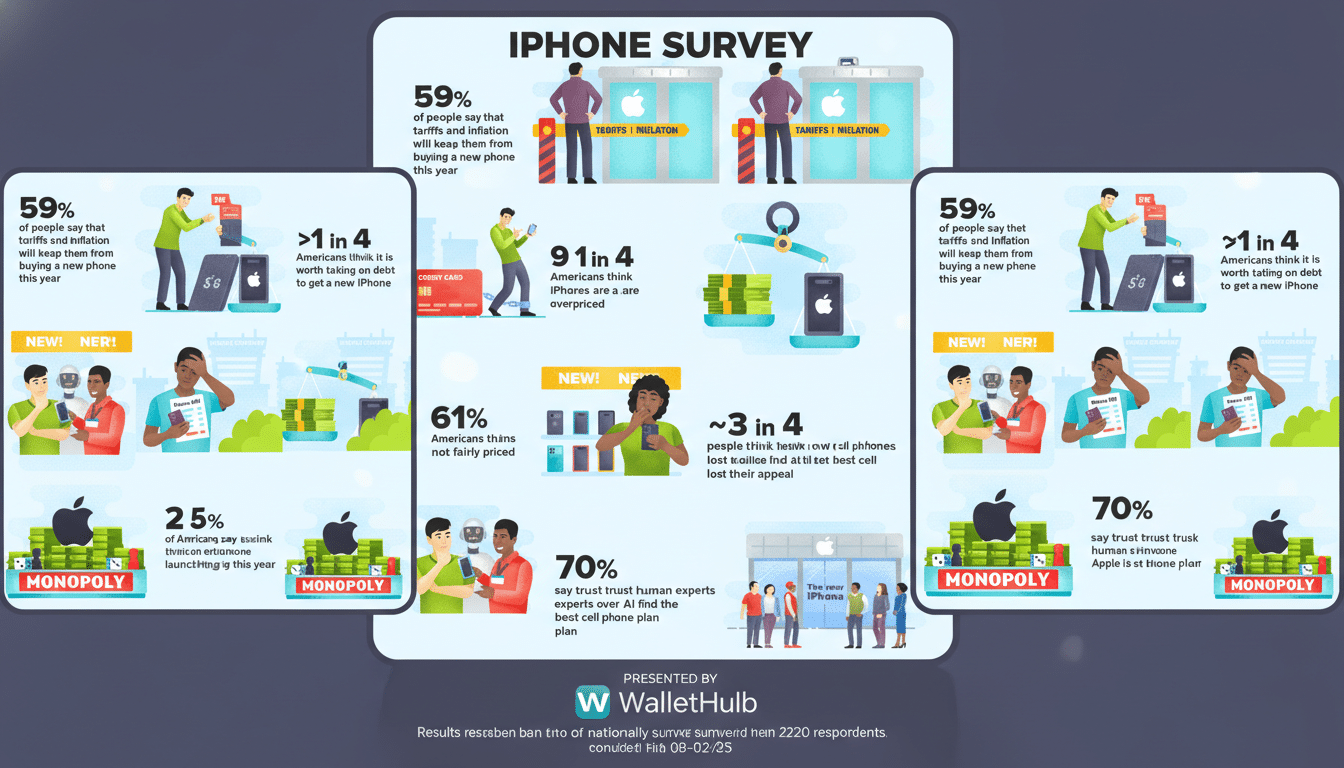

This sentiment aligns with broader industry trends. Counterpoint Research has reported steady growth in the premium segment’s revenue share, driven by higher prices, while overall unit sales have softened and upgrade cycles have lengthened. IDC has similarly noted replacement cycles stretching past three years in mature markets, suggesting buyers weigh longevity and cost more heavily than the latest spec bump.

Why mid-range phones now feel truly “good enough”

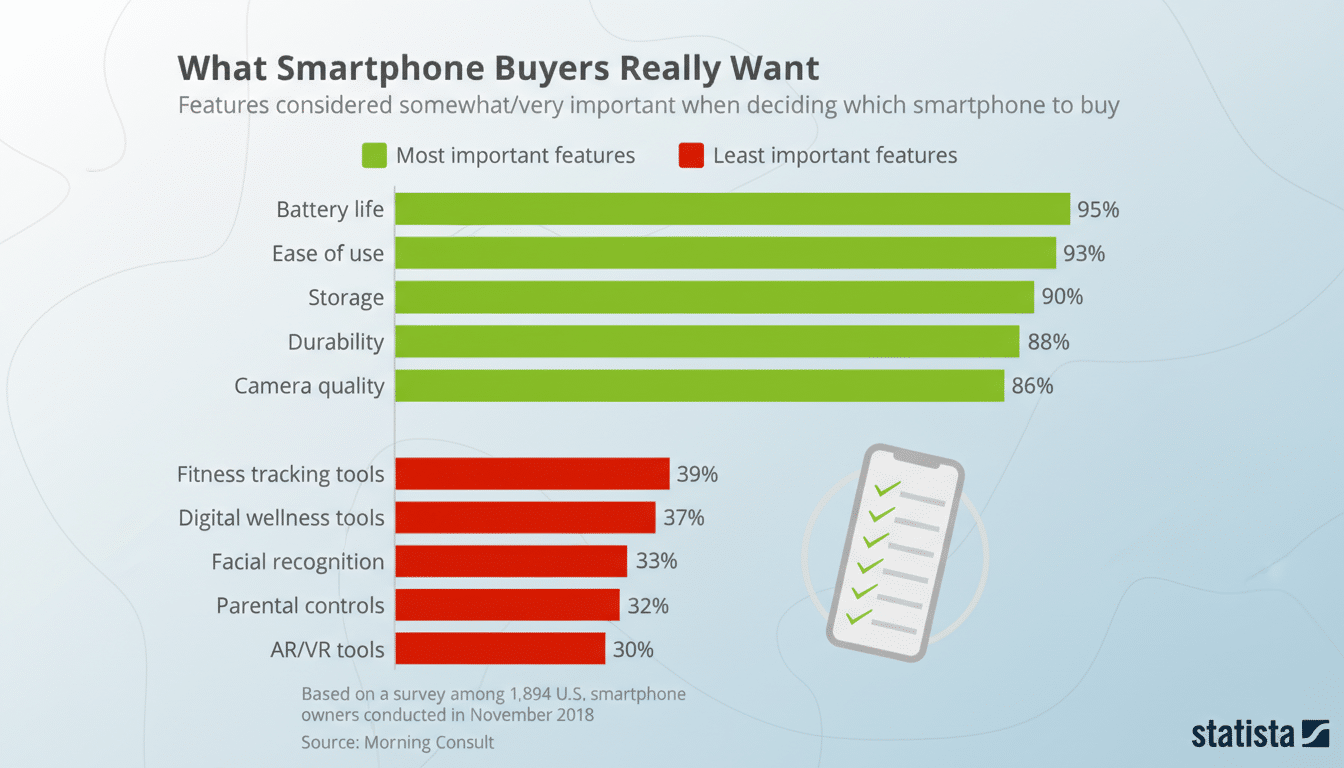

Mid-range devices increasingly ship with features once reserved for flagships: bright OLED displays with 120Hz refresh rates, large batteries with fast charging, robust build quality with water resistance, and capable multi-camera setups. Crucially, software support is no longer a flagship-only perk. Google’s Pixel 8a, for example, promises seven years of updates, and Samsung’s A-series commonly sees four major Android upgrades with lengthy security coverage.

Performance is also less of a differentiator. For messaging, social apps, HDR streaming, and casual photography, mid-tier chips from Qualcomm’s Snapdragon 7 series or Google’s Tensor G iterations feel nearly indistinguishable from top-end silicon. Benchmarks still crown flagships, but day-to-day gains are diminishing, and thermal management on compact high-end phones can blunt peak performance outside of gaming or heavy video editing.

Battery life and heat are another quiet equalizer. With restrained power draw and mature 6nm–4nm processes, many mid-range phones last longer on a charge than performance-first flagships. Independent lab testing from groups like DXOMARK has repeatedly shown mid-tier models punching above their weight in endurance.

When a flagship phone still makes practical sense

There are valid reasons to buy a high-end phone. If you keep devices for four to six years, the best displays, top-tier cameras with larger sensors and advanced stabilization, mmWave-capable radios, stronger aluminum or titanium frames, and the longest software support windows can pay off over time. Creators benefit from 10-bit or ProRes-style video, faster sustained storage, and superior microphones. Enthusiast gamers will notice high-end GPUs and better cooling.

Brand ecosystems also matter. Pencil or stylus input, desktop modes, satellite messaging, on-device AI features, and accessories like robust MagSafe-style ecosystems remain concentrated at the top end. And with aggressive carrier promotions and trade-in credits, some buyers effectively pay mid-range prices for a flagship—though those deals usually bundle long contracts and insurance add-ons.

The Price Problem Manufacturers Must Solve

The survey’s message is blunt: raise the value, not just the price. Average selling prices have marched upward for years, but meaningful differentiation hasn’t kept pace. To win back skeptics, manufacturers need clearer, user-facing gains—think multi-day batteries without bulk, faster and more reliable AI features that work entirely on-device, true optical zoom across focal lengths, and durable designs that are easier to repair.

Repairability and longevity will be especially important. Consumer groups and right-to-repair advocates have pushed for easier parts access and stronger warranties. Moves like explicit battery health guarantees, transferable warranties, and seven-year update policies across a broader range—not just halo models—would reset the value equation in favor of premium devices.

How to decide your next smartphone upgrade wisely

Ask three questions.

- What do you really gain by going flagship—camera features, long support, unique accessories, or better connectivity—and do you use those advantages weekly, not just in theory?

- How long will you keep the phone; if it’s three years or less, a well-supported mid-ranger likely delivers better value.

- Factor total cost of ownership: trade-ins, battery replacements, cases, and carrier fees can eclipse sticker price differences.

The new survey underlines a turning point. Mid-range phones have matured to the point where they satisfy most people most of the time. Flagships aren’t obsolete, but they must offer clearer, everyday benefits to win back a crowd that increasingly sees premium as unnecessary.