The US Supreme Court has sharply curtailed a major source of tariff authority, a move that could translate into lower prices on phones, tablets, laptops, and other consumer tech. In a 6-3 decision, the Court concluded that President Donald Trump exceeded his powers when using the International Emergency Economic Powers Act to levy broad import duties — invalidating most of the tariffs tied to that statute and setting the stage for potential refunds and price adjustments across the device market.

What the Supreme Court Actually Decided in the Case

According to national reporting, the justices ruled that IEEPA, a law designed for true national security emergencies, does not grant the executive branch an open-ended license to impose sweeping tariffs. Chief Justice John Roberts, writing for the majority, signaled that Congress never conferred such expansive tariff powers under IEEPA. Justice Brett Kavanaugh, in dissent, flagged uncertainty about how the federal government should return money already collected from importers — a question the ruling leaves to the political branches and agencies to sort out.

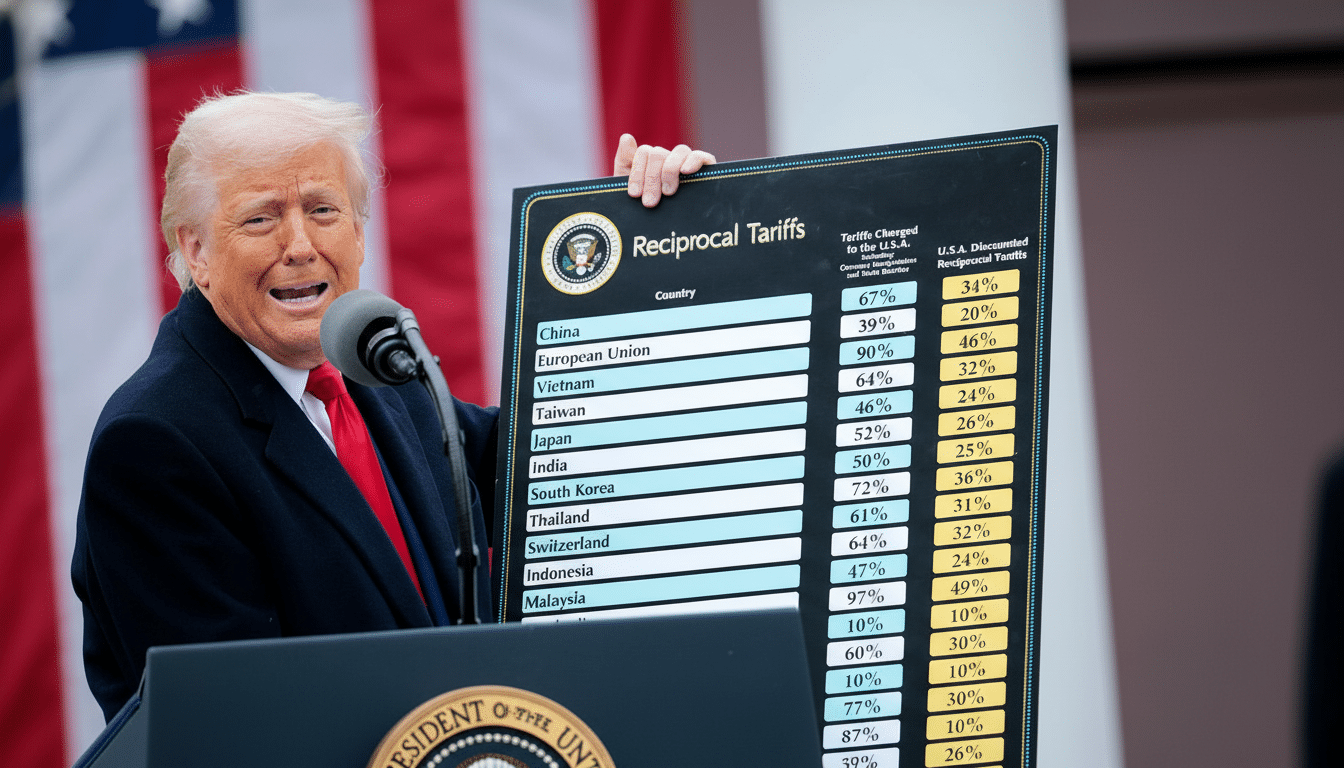

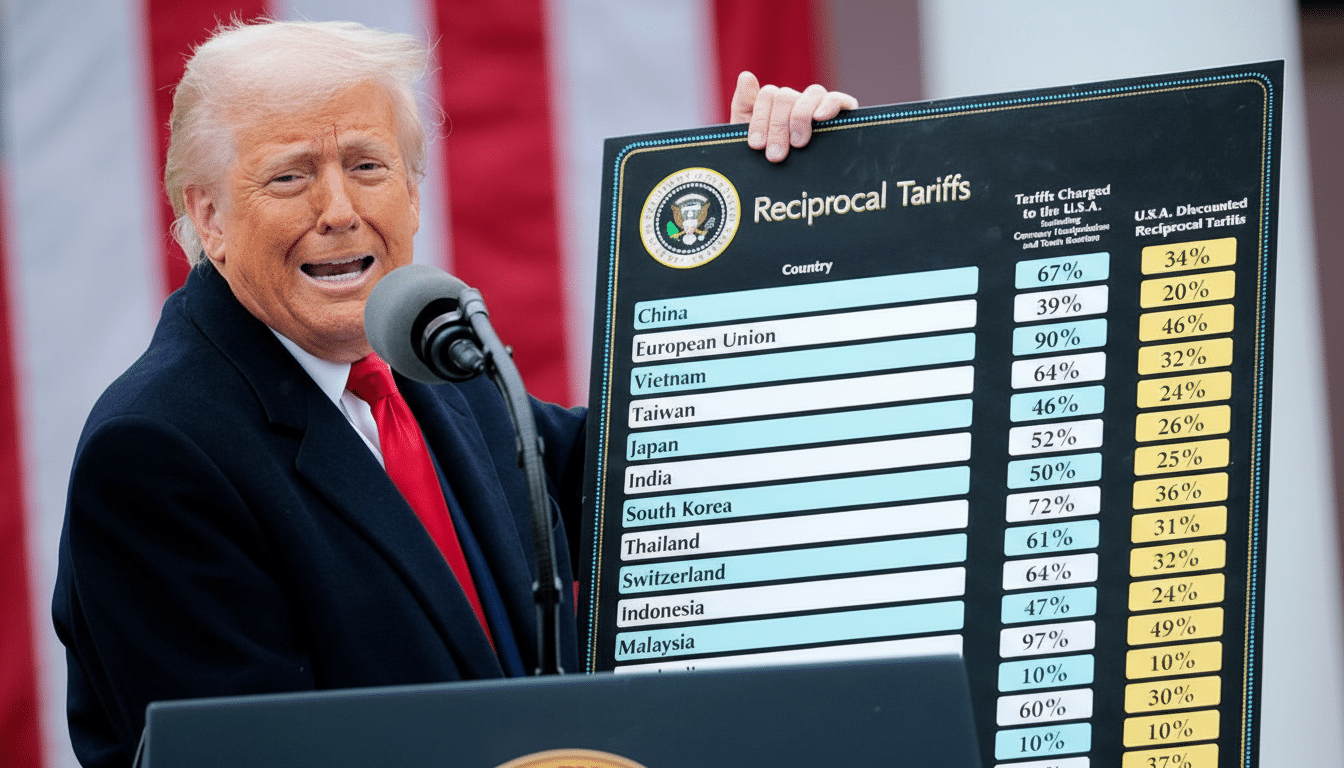

Not every duty vanishes. Tariffs imposed under other legal authorities, notably national-security measures on aluminum and steel, remain on the books for now. But the decision strikes at the heart of the country-by-country “reciprocal” tariffs, including a 34% rate on many Chinese goods and a 10% baseline duty applied to a wide range of other nations, as well as a 25% tariff tied to fentanyl-related concerns for select products from Canada, China, and Mexico.

Why Tech Prices Could Ease After the Tariff Ruling

Tariffs typically flow through to retail price tags. Research from the Federal Reserve Bank of New York and academic economists has found near-full pass-through of recent US tariffs to import prices, with limited absorption by suppliers. In consumer tech, where margins are tight and bills of materials are transparent, those extra costs have often shown up as higher list prices or thinner discounts on everything from smartphones to routers.

Supply chains amplify the effect. The Consumer Technology Association has long noted how concentrated device assembly and component sourcing are in Asia, especially for smartphones, PCs, wearables, and accessories. When a 10% or 25% duty lands on a finished device or a critical subassembly, retailers and OEMs usually adjust pricing or reduce promotional intensity to protect margins. Removing those duties can work in reverse, especially in competitive categories where brands fight for share.

What Savings Might Look Like for Popular Devices

Consider a midrange phone with a $350 landed cost largely tied to Chinese manufacturing. A 34% tariff adds about $119 before shipping, marketing, and retail markups. Scrapping that duty clears meaningful room for price cuts or richer promos. For laptops, monitors, and accessories — categories heavily exposed to earlier tariff rounds — similar math applies. Even a 10% baseline tariff removal on a $500 device can free $50 in cost, enough to flip a tepid sale into an aggressive one.

The near-term impact is likely to show up first in discounts rather than sweeping MSRP changes. Expect carriers, big-box retailers, and direct-to-consumer brands to test deeper trade-in credits, bundle deals on chargers and earbuds, or limited-time price drops as inventories cycle and new purchase orders reflect the post-ruling landscape.

Refunds Could Turbocharge Competition in Tech Retail

Importers can now seek refunds for duties paid under the invalidated tariffs, via the Treasury Department and Customs processes. Reporting indicates hundreds of companies have already filed claims or lawsuits. If billions of dollars flow back to balance sheets, expect some of that relief to surface in marketing budgets and price competition — particularly in fast-moving segments like tablets, Chromebooks, PC components, and home networking gear.

However, refunds won’t arrive overnight. Administrative reviews, documentation requirements, and potential legal wrangling could stretch timelines. Manufacturers and retailers often hedge currencies and costs quarters in advance, so any pricing recalibration may phase in gradually as new shipments arrive.

Why Prices May Not Plunge Everywhere Right Away

Not all the headwinds are gone. Steel and aluminum tariffs still affect enclosures, frames, and certain components. Freight rates, which have swung sharply in recent years, remain a wild card. And political risk persists: alternative legal pathways, such as trade statutes managed by the US Trade Representative or defense-related measures, could be used to reimpose targeted duties. In short, downward pressure on prices is real, but volatility hasn’t vanished.

There’s also the inventory overhang. Goods already imported with tariffs baked in were priced for that cost structure. Retailers may prioritize clearing older stock before fully passing along the new cost savings on refreshed inventory.

What to Watch Next as Tech Sellers Adjust Pricing

Keep an eye on carrier promotions for marquee phones, notebook pricing at major retailers, and accessory multipack deals — the earliest signals of competitive follow-through. Industry watchers will also track the Bureau of Labor Statistics’ consumer price indexes for tech categories to gauge pass-through over the coming months.

For now, the Supreme Court’s ruling resets the negotiating table. With a major tranche of tariffs off the field and refunds in motion, the device market has fresh incentive to sharpen price tags — a welcome shift for shoppers, even if the full effect lands in stages.