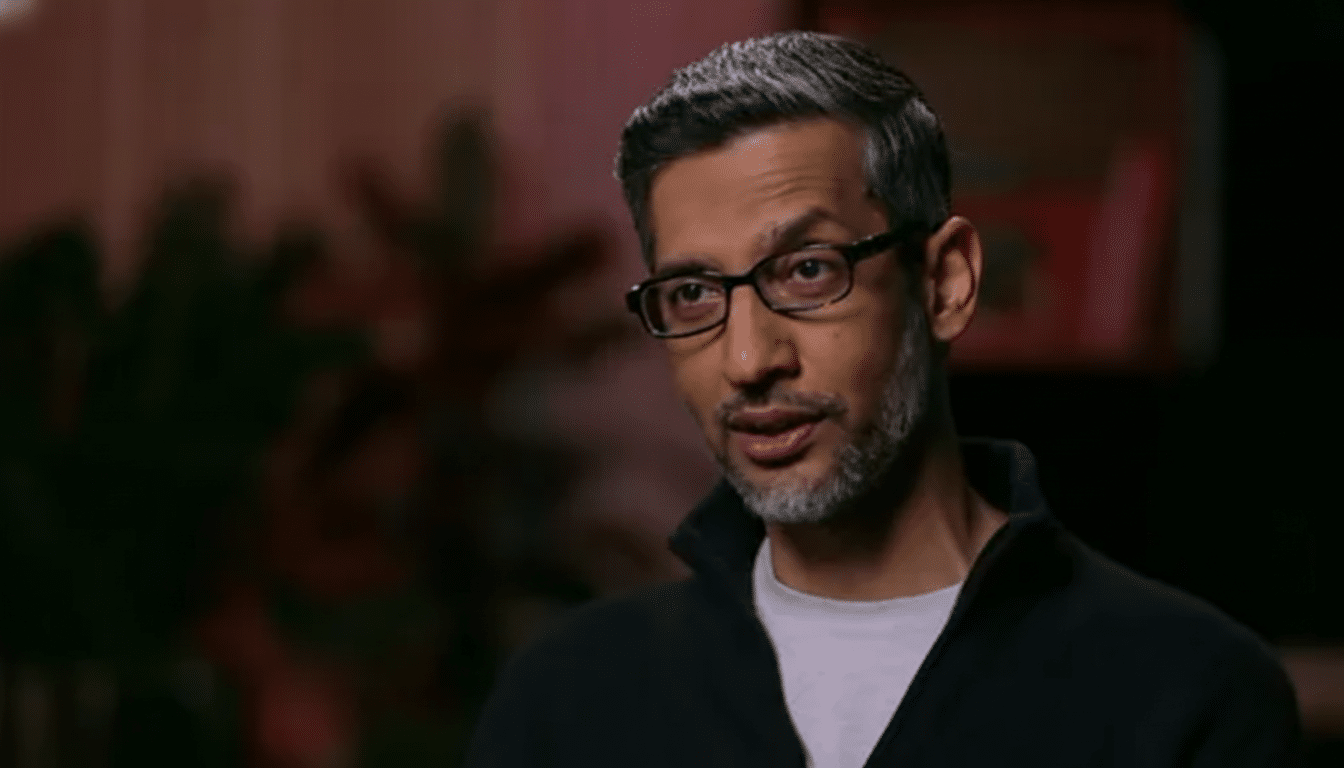

Google chief executive Sundar Pichai is cautioning that the next big AI gold rush resembles the dot-com bubble of decades past, and everyone needs to be mindful of what’s at stake if it all comes crashing down.

Citing an account Pichai gave to the BBC, CNBC reports that he said companies are pursuing artificial intelligence “in ways that they can’t just be dismissed as a fad,” before adding: “We know there have been moments in time where new technologies have forced renaissances that we got into a tech parlance with, with the boom and then came the bubble burst.” His overarching point seemed to simply be this: if such a bubble does burst, “no company” will survive it without sustaining some kind of damage.

He also said the underlying technology was transformative enough to withstand a shakeout, much as the internet did after the dot-com crash.

Why Pichai Is Seeing Dot-Com Echoes in Today’s AI

Pichai’s analogy rings true because in both waves something about the pattern of innovation feels recognizably familiar: a breakthrough platform inspires real breakthroughs alongside pockets of exuberance. In the late 1990s, money poured into anything with a web address; today, it’s pouring into makers of computer models, chip designs and data centers and companies claiming AI in every nook and cranny. The chief executive described the moment as a combination of rational investing in a foundational technology and “aspects of irrationality” around valuations and assumptions about growth.

History offers a cautionary baseline. In the dot-com boom, the Nasdaq skyrocketed, only to lose about 78 percent of its value from peak to trough in a decline that annihilated trillions in market capitalization and tens of thousands of jobs before sustainable internet businesses had been identified. Pichai’s argument is that openness doesn’t always prevail; the eventual pervasiveness of the internet didn’t stop a painful reset — and we could see something similar with AI.

The Bubble in the AI Market — And Its Dangers

Signs of froth are easy to identify. OpenAI is said to have soared in recent tender offers to a value of over $80 billion, and chip leader Nvidia has recorded triple-digit year-on-year revenue growth as the thirst for accelerators outstrips supply. Indeed, IDC projects that global revenue for AI-focused systems will exceed $500 billion by 2027, and McKinsey estimates that generative AI has the potential to contribute between $2.6 trillion and $4.4 trillion per year in added value to the worldwide economy. Those headline numbers lure big bets — and occasionally creative financing.

Analysts have warned that the transactions supporting the surge are growing more complicated, involving circular investments, pre-purchases of compute and generous issuance of cloud credits that can inflate demand on paper. (Bloomberg) — Deals among top labs and their patrons could “prop up” valuations, Bloomberg has reported. On the cost side, meanwhile, things are fierce. It can cost tens or hundreds of millions of dollars to train a state-of-the-art model, and inference costs also rise continuously with usage. That’s breeding ground for mismatches between expectations and unit economics.

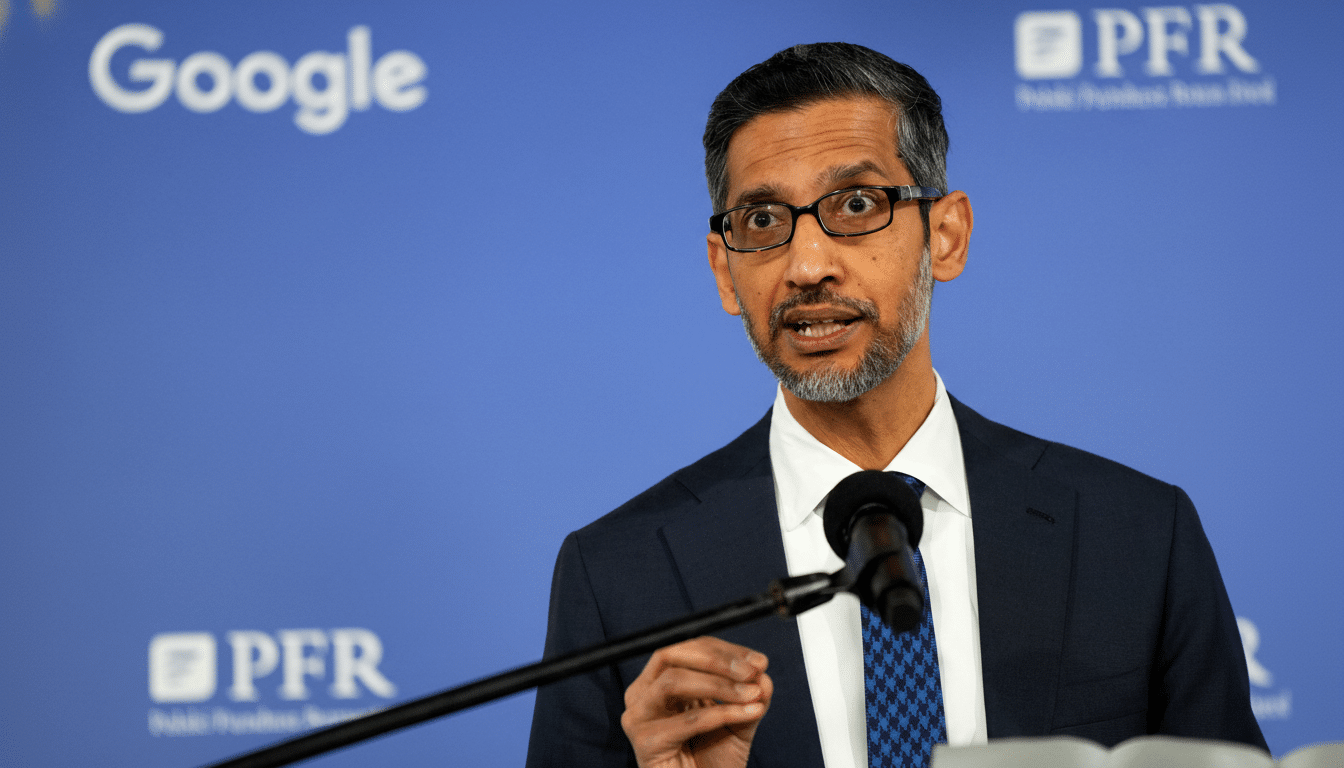

Google’s Place in an AI Shakeout and What It Means

Shares of Alphabet have soared on AI hopes and dreams, propelling the company into the multi-trillion-dollar valuation league, while Google has stepped up investments across its stack — from TPU custom silicon and Gemini models to new US data center capacity in Texas (and others). Pichai’s “no one is immune” comment echoes a bifurcated industry reality: Google is flush with capital and boasts huge distribution, but the business also faces the same capex cycle, talent markets and demand uncertainties as the rest of the sector.

Another constraint lies beyond balance sheets: power and infrastructure. The International Energy Agency estimates that demand for electricity by data centers, AI and crypto could roughly double globally by 2026, forcing operators to race after grid capacities, alternative cooling methods and efficiency gains. Those pressures might play to the advantage of companies with proprietary hardware, optimized models and integrated cloud platforms — the benefits that Google has been keen to underline.

What Today’s A.I. Can Learn From Watching ’90s TV

The dot-com survivors had a playbook they shared:

- Ship products that actual customers are going to use

- Maintain discipline on costs

- Leverage durable network effects

For AI, that means concrete productivity gains, safer and more reliable models and a lower cost per token or query. Google has been threading Gemini through Search, Workspace, Android and Cloud, betting that embedded everyday utility will persist beyond hype cycles.

The signals to look for now, which priors made sense, are not theatrical but pragmatic: enterprise renewal rates, developer retention, inference margins and energy efficiency per unit of compute. Regulatory and safety guardrails — in the form of the NIST AI Risk Management Framework, the EU AI Act, etc. — will also emerge as winners by enforcing transparency around data provenance, model evaluation and responsible deployment. Trust and documented performance, not just demonstrations, are likely to distinguish the enduring from the perishable.

What a Reset Might Look Like if the AI Boom Cools

If a correction comes, capital will get pickier and consolidation for model startups will be the result, with cloud providers and enterprises having to squeeze margins.

Open-source models, which are getting better and better in power and efficiency, could pick up share if the budget noose tightens. Hardware supply should normalize as new fabs and packaging capacity ramp, alleviating the constraint-driven pricing of today.

However, as ever, AI isn’t going anywhere; it’s just going to keep getting more pointed. The big winners are those who combine state-of-the-art models with solid economics and clear use cases, such as:

- Customer support deflection that actually shortens handle time

- Code tools that increase throughput without increasing defect rates

- Search experiences that raise satisfaction without cannibalizing core revenue

Pichai’s bet is that AI, like the internet itself, will outlive any bubble. The only real question is who will be left standing when reason has its say.