SpaceX goes for aggressive retention pricing to re-attract former Starlink customers, emailing dormant American, Canadian, and Australian users with a 50% discount on residential service. The offer, which quickly spread in Reddit threads and Facebook groups, reduces the regular US monthly rate of about $120 to half that amount — a two-year stretch is also a noteworthy duration for any telecom promotion.

Some current customers say they are also seeing targeted incentives. It’s currently offering active accounts six months at half price, and discounts even steeper than that as an introductory offer (when we posted this on our website, several Canadians wrote in to let us know about thresholds as low as 75% off). It’s been a predictable headache for loyal customers who have been paying full freight; the patchwork nature of these deals, some get them, some don’t, has predictably caused frustration.

What the two-year discounted Starlink offer includes

The headline offer is a two-year, 50% monthly service discount for dormant accounts that are renewed via a bespoke email as opposed to a public sign-up page. You will continue to pay equipment fees and taxes still apply, and the terms imply that this is a retention play rather than a permanent reset of prices. The discount is applied in most cases when they re-enable the offer, implying a controlled, invite-only campaign.

This latest push comes after a series of trials and initiatives. Former customers in several regions recently were offered a free month’s worth of service. SpaceX has also teased “free” Starlink Mini hardware to certain subscribers, as well as temporarily reduced the price of its residential plans in US areas where it claims there is a high volume of surplus capacity — to either $49 or $59 per month. The hardware promos have been aggressive, too, with the base and Mini dishes costing less than $300 in limited-time sales.

Why Starlink is using such aggressive pricing now

Two dynamics are now converging: capacity management and competitive pressure. The constellation of Starlink is expanding, and usage depends on the cell and region. Steeply targeted discounts also enable SpaceX to fill up on lightly used beams without overloading the busiest ones, balancing demand where the network has capacity. A multi-year discount window also reduces churn risk in addition to spreading the cost of customer acquisition over a larger time-scale.

Competition, meanwhile, is intensifying. Fiber-to-the-home construction is speeding up with the help of programs administered by the National Telecommunications and Information Administration, and when fiber comes to town, many satellite users switch. The fixed wireless access service from T-Mobile and Verizon has established a range of $50–$60 pricing in many suburbs and exurbs, thus undermining the value gap that Starlink once enjoyed there. Against that backdrop, $60 for satellite looks more attractive.

What Starlink users are saying about the discounts so far

According to community posts, the reactivation emails are being received by people who have paused service for a season and those who outright canceled, sometimes many months ago. A portion of active customers are getting automatic bill credits for six cycles; some in the same market got nothing. That implies a campaign that truly was tuned by geography and network load, with pricing power being used to push growth where SpaceX wants it most.

It’s not just always performance, however. Independent testing organizations like Ookla have been recording Starlink’s median download speeds in the United States as a rule in the tens to low hundreds of megabits per second over the past year, with speeds differing by state and time of day. In rural counties in particular, that’s often a leap over legacy DSL and those many WISPs; in fiber-fed neighborhoods, it’s still the spoiler who offers gigabit service at similar prices. The Federal Communications Commission’s availability filings also demonstrate a consistent growth in overlapping options, underlining the importance of banded retention.

The bigger picture for Starlink’s pricing and growth

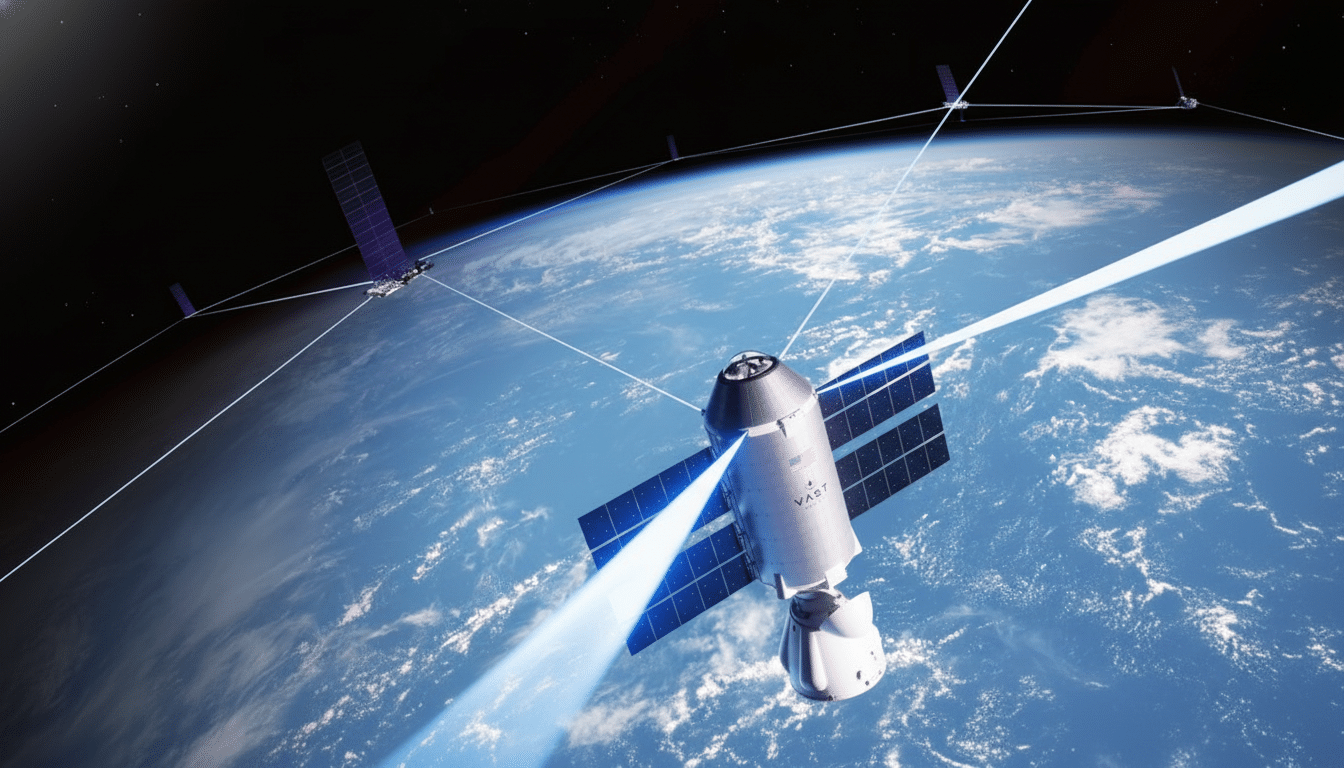

SpaceX has said Starlink already serves millions of subscribers around the world, and the constellation’s capacity has grown with more launches and inter-satellite links. Beyond home internet, the company is experimenting with direct-to-cell services along with carriers and growing mobility offers for vehicles, maritime and aviation — business lines with higher revenue per user but different coverage and capacity requirements.

The new discounts are part of a larger pattern: dynamic pricing to meet local supply and demand, hardware rentals to lower barriers, and time-limited promos to reactivate dormant lines before rivals lock them in. Expect more of this playbook—super-targeted offers, regional price experiments, occasional equipment deals—as Starlink fine-tunes the network load with subscriber growth against the reality that fiber and fixed wireless have been pinching into many of the markets it cracked open.