Spotify and SeatGeek are joining forces to let listeners buy concert tickets without leaving the music app, tightening the loop between discovery and purchase at a moment when fan demand and live event revenues remain robust. The integration places SeatGeek-powered ticket links directly on eligible artist pages and tour listings, turning Spotify’s massive listening audience into a potential on-ramp for venue box offices that SeatGeek powers as the primary ticketing provider.

How the Spotify and SeatGeek Ticketing Integration Works

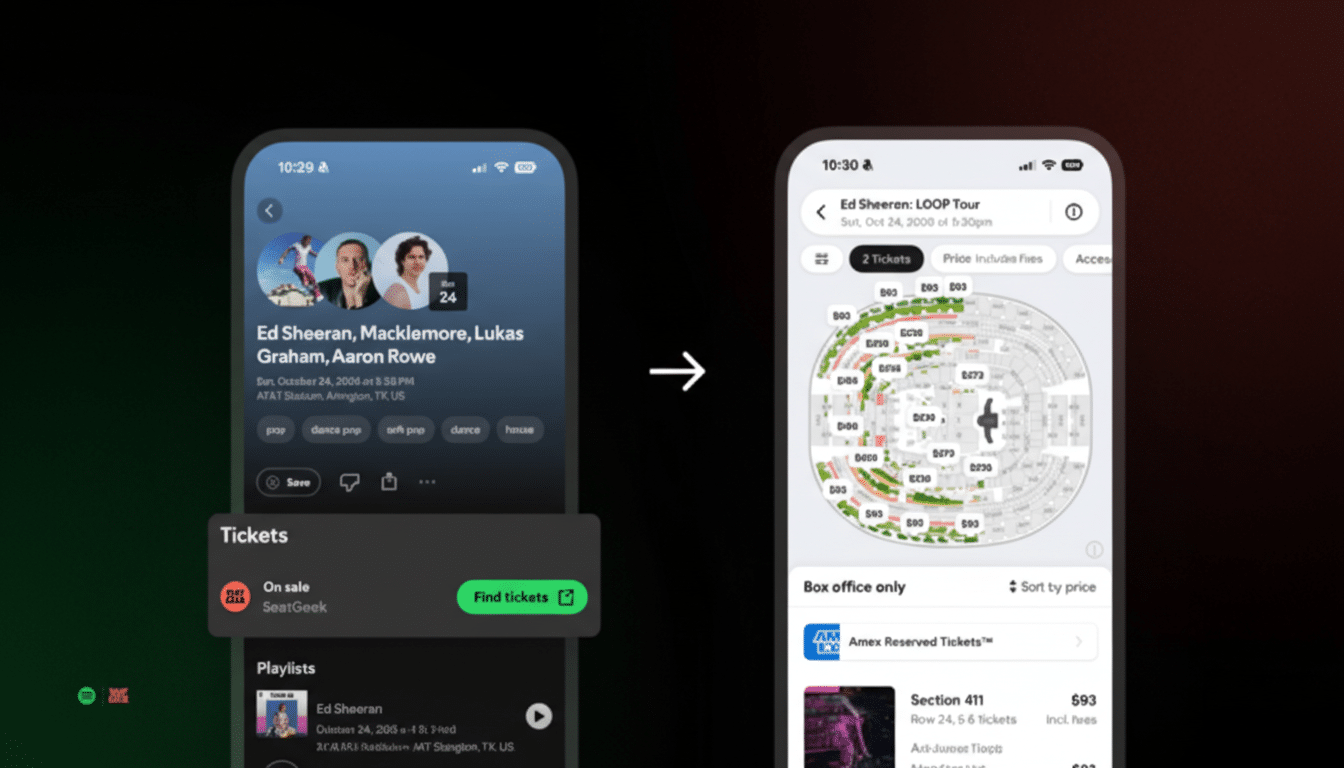

For artists performing at participating venues, Spotify will surface SeatGeek buy options alongside upcoming dates, sending fans into a streamlined, in-app checkout flow. The rollout is limited to venues where SeatGeek is the primary ticket seller, spanning 15 major U.S. partners such as State Farm Stadium in Glendale, Nissan Stadium in Nashville, and AT&T Stadium in Arlington. That constraint matters: while SeatGeek is a major player in secondary resale, this tie-up taps its direct box office inventory first, ensuring price and seat accuracy at the source.

The placement lines up with Spotify’s existing Live Events features, which personalize concert recommendations based on listening history and location. By embedding a direct path to purchase at the exact moment of interest, both companies are betting that fewer taps equal higher conversion and fewer abandoned carts — a persistent friction point when fans are forced to hop across multiple apps and web pages.

Why It Matters for Fans and Artists Using Spotify

For fans, the appeal is convenience and context: you hear an artist, you see a nearby date, you buy. For artists and teams, the upside is a potentially larger, more targeted funnel. Spotify has said its platform has already helped generate over $1 billion in ticket sales through its network of ticketing partners, which spans more than 45 companies including Ticketmaster, AXS, Eventbrite, DICE, and Bandsintown. Tapping directly into that discovery surface gives SeatGeek a premium shelf position in front of millions of high-intent listeners.

Scale is the kicker. Spotify reported more than 750 million monthly active users and 290 million premium subscribers, and projected continued growth in both measures on its latest earnings call. Even modest conversion lifts inside an audience that large can translate into meaningful incremental ticket revenue, particularly for stadium and arena tours where primary inventory moves quickly and ancillary fees are material.

SeatGeek’s Strategic Play in Primary Ticketing Growth

Visibility at the point of discovery is a strategic win for SeatGeek as it pushes deeper into primary ticketing. The company’s playbook includes embedding commerce inside high-usage consumer platforms; it previously enabled ticket purchases inside Snapchat, establishing proof that social and entertainment apps can serve as effective demand funnels for live events.

Crucially, this partnership focuses on primary sales where SeatGeek controls the box office relationship. That not only reduces fulfillment risk but can also improve data fidelity around who is buying and attending — information that teams, promoters, and artists prize for marketing and remarketing. While financial terms were not disclosed, such integrations typically involve referral economics or shared upside tied to completed transactions.

A Crowded and Concentrated Ticketing Market Landscape

The move lands in a ticketing landscape dominated by long-term venue contracts and entrenched incumbents. Ticketmaster and AXS maintain broad control of primary inventory across major arenas and amphitheaters, a dynamic spotlighted in industry reports and regulatory scrutiny in recent years. Even when SeatGeek wins marquee accounts, retention is not guaranteed; Barclays Center famously returned to Ticketmaster less than a year into a planned multi-year SeatGeek deal, underscoring how complex and sticky venue relationships can be.

Against that backdrop, distribution becomes a differentiator. If SeatGeek can convert Spotify listeners at scale — especially for its stadium and NFL venue partners — it could improve sell-through on premium events and cut customer acquisition costs relative to pure paid marketing. For Spotify, tighter integration with live events reinforces a broader push to monetize the listening graph beyond audio ads and subscriptions, an area it has explored before with direct ticket experiments.

What to Watch Next as Spotify–SeatGeek Rollout Grows

Key indicators will include how quickly the integration expands beyond the initial 15 venues, whether artists lean into promoting in-app ticketing on their Spotify profiles, and how prominently SeatGeek links surface compared with other partners. Transparency around fees, queuing, and seat availability will also shape fan sentiment, particularly as consumers grow more vocal about checkout complexity in live entertainment.

If execution matches the opportunity, embedding ticketing where fans already listen could become one of the most efficient distribution pipes in live events — and a meaningful test of whether discovery-to-purchase can be truly seamless at global scale.