Spotify closed its latest quarter with a record 751 million monthly active users, an acceleration driven by its viral Wrapped campaign and a slate of upgrades to its free tier that lowered friction for first-time listeners. The company added 38 million users in the quarter—its biggest quarterly net add on record—lifting total MAUs 11% year over year and reinforcing the platform’s flywheel of discovery, sharing, and retention.

Wrapped Supercharges Engagement Across Platform

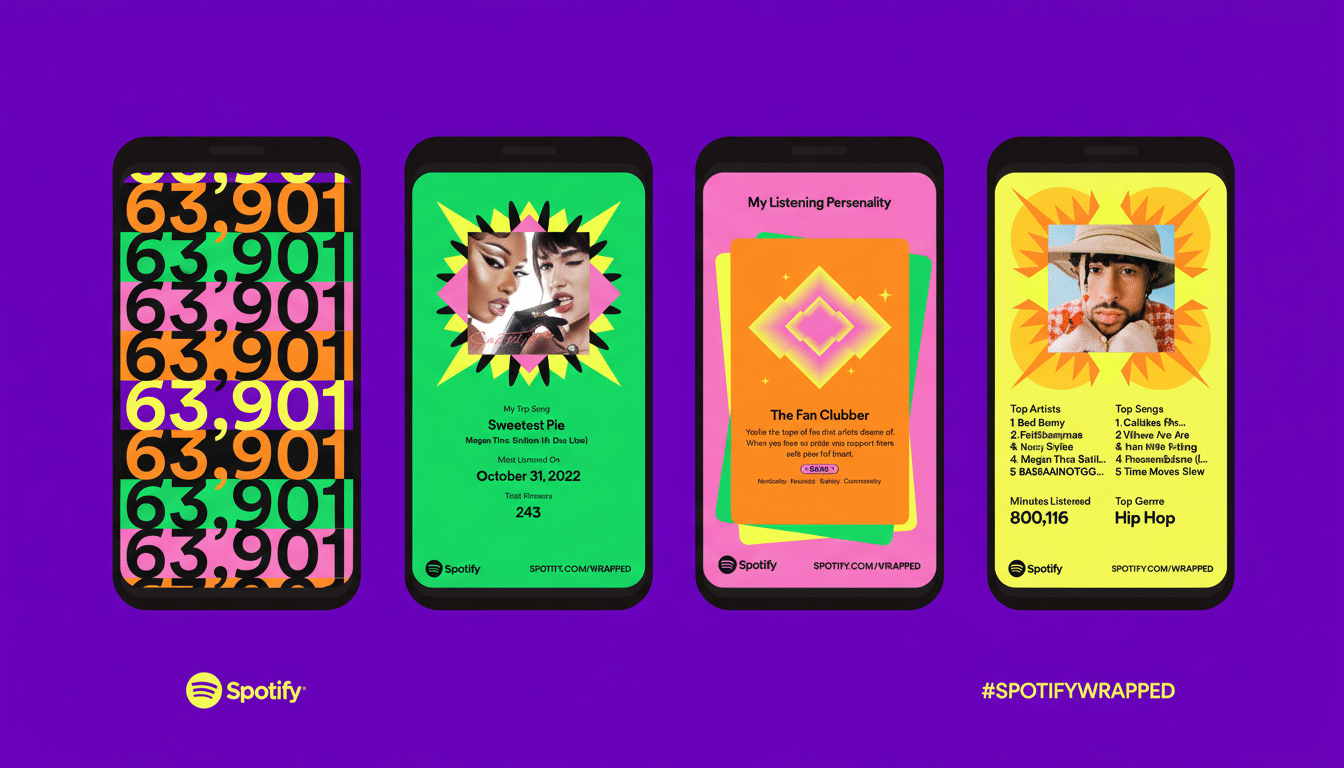

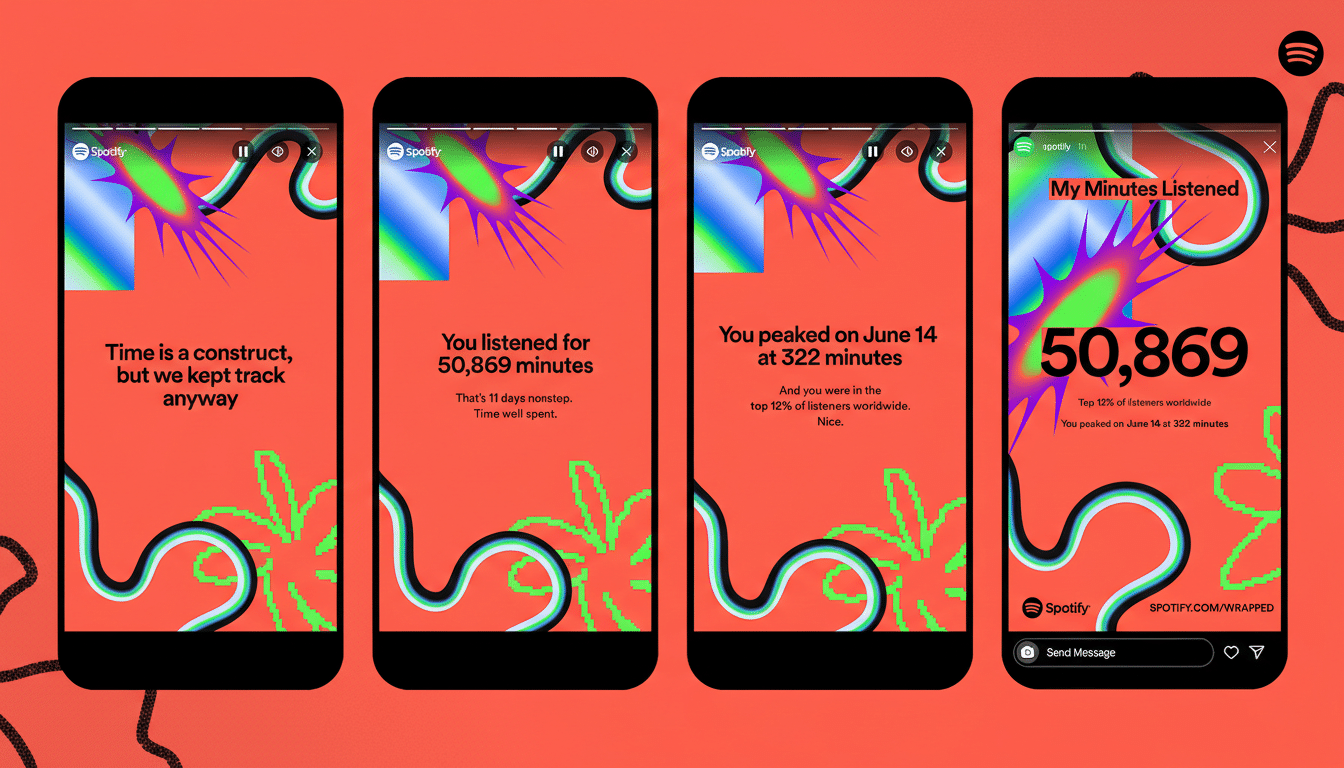

Spotify’s year-end Wrapped once again functioned like a mass-participation marketing engine. According to the company’s shareholder update, more than 300 million users engaged with Wrapped and generated roughly 630 million social shares across 56 languages, turning personal listening stats into viral cultural currency. That surge reliably pushes lapsed users back into the app, gives emerging artists a visibility boost, and feeds the recommendation system with fresh signals.

- Wrapped Supercharges Engagement Across Platform

- Free Tier Tweaks Pull In New Listeners Worldwide

- Subscribers and Revenue Still Climb Despite Headwinds

- Product Expansion and Leadership Shift Reshape Strategy

- Competitive Context and the Profit Path Ahead

- Outlook for Users, Subscribers, and Growth Next Quarter

For creators, Wrapped now doubles as a promotional toolkit, with artists sharing their own dashboards to amplify momentum. The effect is tangible: spikes in playlist follows, revisits to catalog tracks, and more session starts that carry over into January when streaming typically dips after holiday peaks.

Free Tier Tweaks Pull In New Listeners Worldwide

Beyond the Wrapped halo, Spotify leaned into product changes that make the ad-supported experience feel less constrained. The company highlighted improvements that allow more direct song selection and easier search for specific tracks, narrowing the gap with premium and making the on-ramp to subscription less jarring. That strategy appears to be working as a high-volume funnel: MAU growth hit a record even as price increases continued in mature markets.

AI features also played a role. The AI DJ and AI-generated playlists have become sticky entry points for casual users, while a new control to exclude tracks from recommendations gives listeners a way to fine-tune personalization without starting over. Small quality-of-life fixes like these compound, reducing churn risk, especially among new or returning free users.

Subscribers and Revenue Still Climb Despite Headwinds

Paying subscribers reached 290 million, up 10% year over year, reflecting a healthier conversion pipeline even after price hikes in the U.S. and Europe. Total revenue rose to €4.53 billion, up 7%, powered by an 8% increase in subscription revenue. Advertising was softer, with ad-supported revenue slipping 4% to €518 million, a reminder that brand budgets remain uneven across regions and categories.

Profitability metrics continued to move in the right direction. Spotify’s gross margin expanded 83 basis points to a record 33.1%, helped by stronger podcast and music ad yield, catalog efficiencies, and tighter operating discipline. Investors have treated gross margin as the clearest signal that the platform’s scale advantage is finally translating into durable economics.

Product Expansion and Leadership Shift Reshape Strategy

Under new co-CEOs Gustav Söderström and Alex Norström, Spotify is operating as a multi-format platform rather than a pure music app. The company has invested in podcasts and audiobooks, introduced music videos and video podcasts within the app, and layered in social surfaces—from sharing to group listening sessions—to keep engagement loops tight. Ticketing integrations and in-app storytelling features around tracks and songwriters further knit the ecosystem together.

The through line is retention: make Spotify the default place to start any audio session, then use format breadth and personalization to keep users from defecting to rivals for specific needs.

Competitive Context and the Profit Path Ahead

Competition from Apple Music, YouTube Music, and Amazon Music remains intense, particularly on bundles and device tie-ins. Spotify’s counter is a mix of better discovery, social virality, and AI-led curation on top of a broadened content slate. Price increases have tested loyalty, but so far conversion and engagement data suggest the product moat is holding. The main swing factor is ads: when the ad market softens, growth leans harder on subscriptions; when it rebounds, Spotify’s margin picture brightens more quickly.

Outlook for Users, Subscribers, and Growth Next Quarter

Spotify guided to 759 million monthly users and 293 million subscribers in the current quarter, setting up another period of double-digit audience growth. If Wrapped remains the industry’s most effective organic campaign and free-tier improvements keep lowering the barrier to entry, the company’s scale advantage should deepen—even as it navigates ad volatility and competitive pressure.