Spotify is expanding from listening to owning, introducing physical book sales inside its app while debuting Page Match, a tool that lets readers jump seamlessly between print, e-books, and audiobooks. The move signals a broader strategy: turn Spotify into a start-to-finish book platform, from discovery to completion to purchase.

What Spotify announced about Page Match and book sales

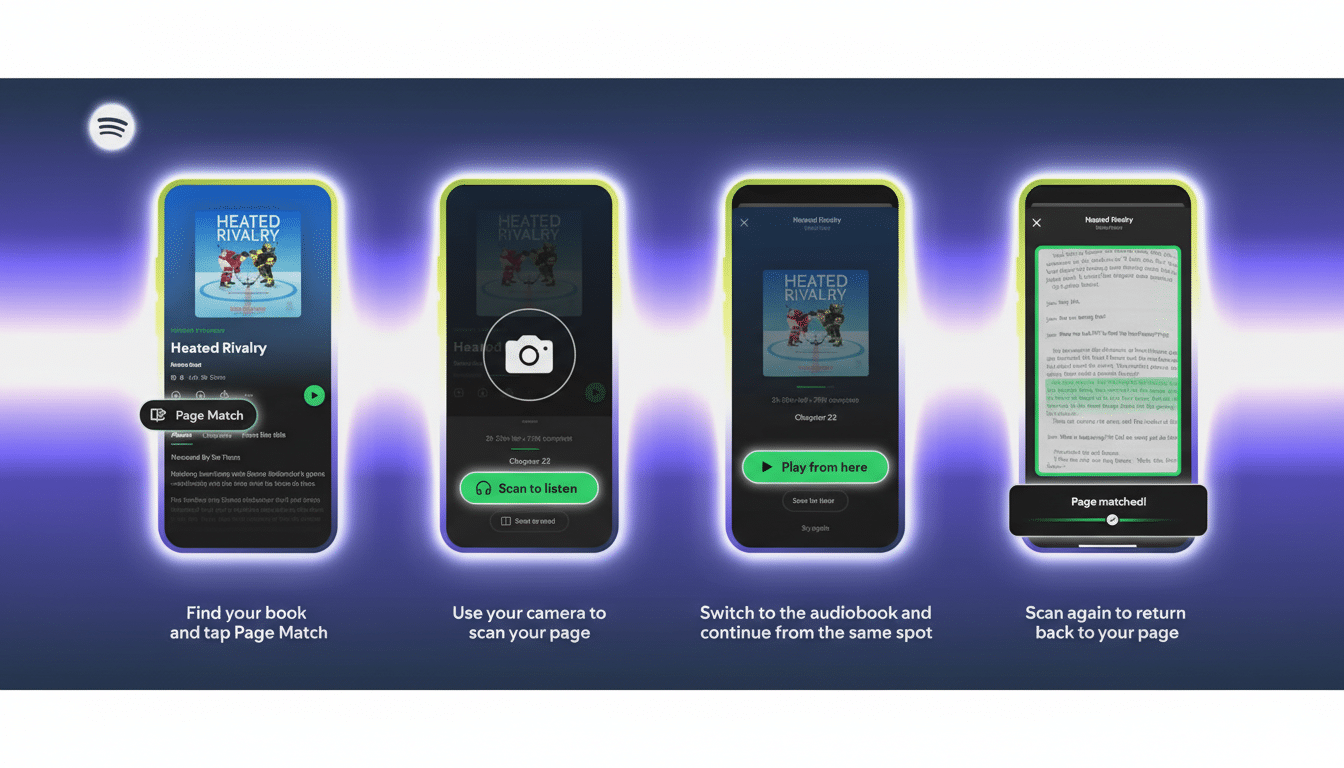

Page Match is a new feature that uses computer vision and text matching to sync the page in your physical or e-book with the exact moment in an audiobook. Open the camera in the Spotify app, scan a page, and it drops you into the right spot in audio; scan again later to return to the page you were reading. Spotify emphasizes this is built on deterministic matching, not a generative AI model, to ensure accuracy and speed.

The experience aims to remove the friction many readers feel when switching contexts—say, reading at home and listening on the commute. It complements Audiobook Recaps, Spotify’s short refreshers designed to help listeners re-enter a story after time away, underscoring a focus on continuity rather than just catalog size.

Page Match is rolling out across most English-language audiobooks. Premium subscribers can use it within their monthly audiobook hours, with broader availability to free listeners following as the feature scales.

Buying books through Bookshop.org inside Spotify

Spotify will also sell physical books in-app via a partnership with Bookshop.org, beginning in the US and UK. Bookshop.org handles pricing, inventory, and fulfillment, routing sales to independent bookstores rather than a single centralized warehouse. For Spotify, the app becomes a new retail surface tied directly to the moment of interest—hear a chapter, buy the book, pick it up in print.

Bookshop.org’s track record suggests there’s real upside for indies. According to its founder and CEO Andy Hunter, the platform has sent more than $52 million to independent bookstores in recent years. The American Booksellers Association has grown from roughly 1,900 to 3,200 member stores, and about 90% of them sell through Bookshop.org—evidence of a post-2020 resurgence in local bookselling. Spotify’s integration could channel a vast audience into that ecosystem without disintermediating it.

Why physical books matter now for Spotify’s strategy

Spotify executives point to a striking constraint on book engagement: only 16% of US adults say they read for pleasure. The company’s thesis is not that demand has evaporated, but that attention and time are fragmented. Page Match and Recaps are designed to lower the cognitive cost of re-entry, turning stop-and-start behavior into steady progress and, ideally, finished books.

Audiobooks in Premium have grown from about 150,000 to more than 500,000 English-language titles across 22 markets, with Spotify saying it has paid hundreds of millions of dollars to authors and publishers. Engagement is rising—the number of people starting an audiobook is up 36% year over year and total listening hours are up 37%—and more than half of audiobook listeners on Spotify are under 35. Adding print purchases gives publishers and authors a clearer path from listening to ownership, especially for genres where readers still prefer the physical object.

How it stacks up against Amazon and other rivals

Amazon’s Whispersync has long tied Kindle e-books to Audible audiobooks, but it requires you to own specific digital editions. Spotify’s twist is hardware-agnostic: scan any page from a print copy or many e-books and find your place in audio. If it works as reliably as promised, Page Match could become the new default for hybrid reading, especially among younger listeners who already treat Spotify as a daily habit.

For publishers and retailers, the integration raises practical questions—metadata consistency across editions, rights windows, returns in the print supply chain—but it also offers a fresh funnel: discovery via playlists, podcasts, and audiobooks that convert to print sales at the moment of peak intent. Because Bookshop.org manages fulfillment, the partnership could shift incremental demand toward local stores rather than away from them.

What to watch next as Spotify links print and audio

Key engagement and conversion metrics to track

- Attach rates from audiobook sessions to print purchases

- Completion rates among Page Match users

- Expansion into non-English catalogs

Expected refinements and language expansion

- Improved camera recognition in low light

- Better edition matching across paperbacks and hardcovers

- Clearer controls for syncing progress between formats

If Spotify can convert listeners into finishers—and finishers into buyers—this hybrid model could redraw the lines between streaming and retail while sending meaningful dollars to independent bookstores. For an industry chasing both attention and margin, that’s a convergence worth watching.