SpendRule, a healthcare spend control startup, emerged from stealth with $2 million in seed funding to help hospitals prevent invoice errors and contract leakage before payments go out. The round was led by Abundant Venture Partners with participation from MemorialCare Innovation Fund and Zeal Capital Partners.

AI Guardrails For Purchased Services In Hospitals

Co-founded by industry operator Heckler and fintech veteran Joseph Akintolayo, SpendRule focuses on the thorniest corner of hospital procurement: purchased services such as facility maintenance, linen, biomedical equipment repairs, and language access. Unlike supplies with barcodes that fit a standard three-way match, these services are governed by dense contracts, fluctuating volumes, and rate cards that make pre-payment validation difficult.

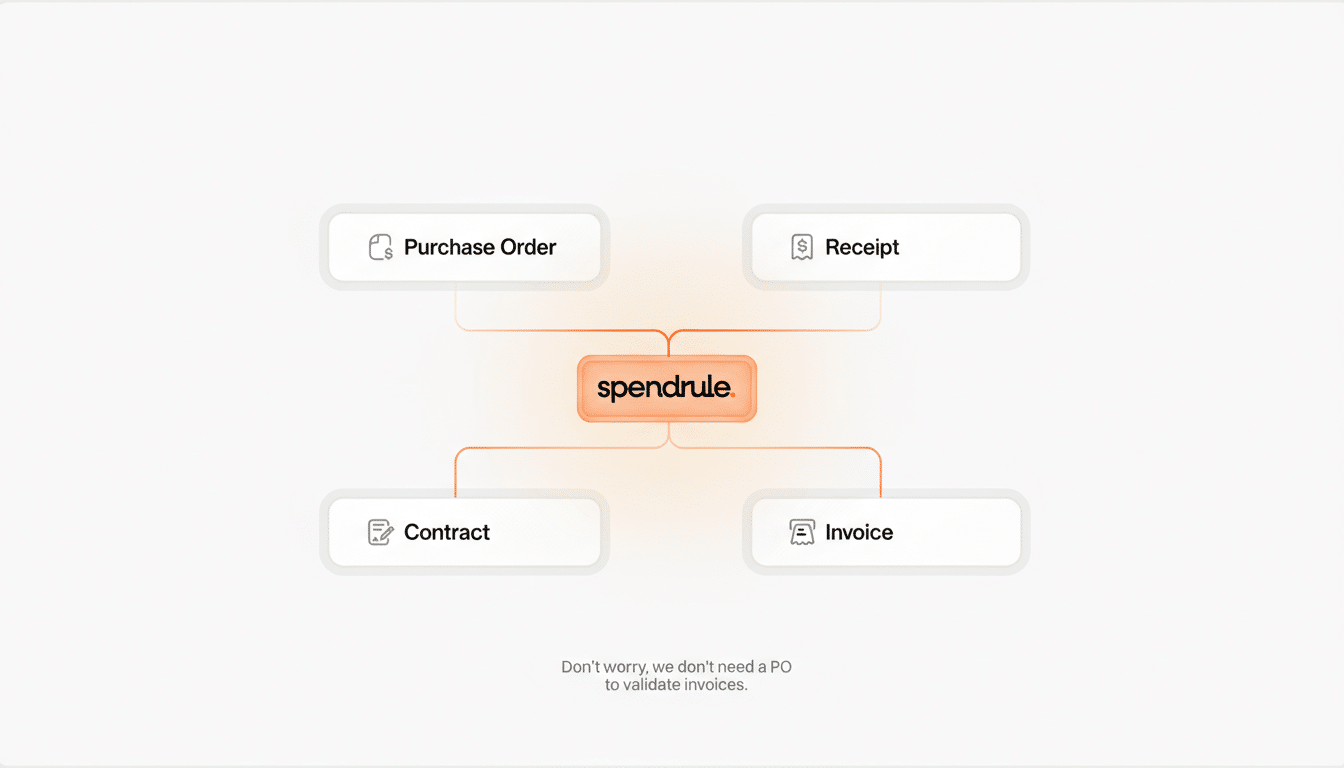

SpendRule integrates on top of a health system’s ERP, contract lifecycle management tools, and accounts payable workflows to compare invoices against negotiated terms in real time. The platform ingests contracts, SOWs, and historical utilization data, then flags discrepancies before checks are cut—turning what has traditionally been a retrospective audit into a proactive control.

Why Hospitals Need Tighter Spend Controls

Margins across U.S. hospitals remain thin, even as volumes rebound. Analyses from Kaufman Hall show median operating margins hovering in the low single digits, while the American Hospital Association reports overall expenses climbed double digits since 2019. Contract labor costs alone surged 258% between 2019 and 2022, and supply and purchased services inflation has proven stubborn.

In this environment, leakage on non-labor, non-barcodable spend is a quiet drain. HFMA case studies and recovery audits routinely find material overpayments stemming from rate misapplication, outdated fee schedules, unapproved surcharges, and missed credits. Many systems rely on manual spot checks or biennial audits, which surface issues months or years after money has left the building.

How The Technology Works Across Hospital Systems

SpendRule uses a mix of document understanding and rules-based validation tailored to healthcare contracts. It parses service agreements and addenda to extract SLAs, escalators, rate tables, and exclusions; normalizes vendor invoice line items; and reconciles quantities and units of measure against purchase orders or utilization logs. When it detects off-contract rates, unallowed fees, or volume misalignments, it routes exceptions to AP teams with evidence and recommended actions.

The company says it can sit alongside common ERPs in healthcare—such as Infor, Oracle, SAP, or Workday—without displacing existing processes. By intervening at the pre-payment stage, finance leaders can enforce negotiated terms while preserving vendor relationships, rather than relying solely on clawbacks after the fact.

Early Customers And Competitive Landscape

Kettering Health, MemorialCare, and MUSC Health are among the early adopters. Their shared challenge: thousands of service contracts across facilities, each with unique rate structures and service definitions, and too few analysts to keep up.

SpendRule’s primary competition comes from traditional invoice recovery and audit providers, including SpendMend and GHX, which have long histories uncovering overpayments post hoc. The startup’s pitch is different: focus deeply on purchased services and move controls earlier in the payment cycle, so compliance becomes continuous rather than episodic.

What The $2M Will Fund for SpendRule’s Growth

The seed financing will support hiring across product and customer success and further build out the company’s AI infrastructure. On the roadmap: broader service taxonomy coverage, vendor scorecards that benchmark contract adherence over time, and tighter connectors into health system data lakes to enrich utilization signals.

For CFOs and supply chain leaders, the appeal is pragmatic. Even single-digit recovery on purchased services can translate into seven figures annually at multi-hospital systems. With regulatory pressures, payer mix shifts, and persistent cost inflation, automated pre-payment controls are transitioning from a nice-to-have to a core capability.

The Bigger Picture for Hospital Spend Management

Health systems have invested heavily in clinical analytics and revenue cycle automation; non-labor expense governance is catching up. If SpendRule can consistently convert contractual fine print into machine-checkable controls without disrupting AP throughput, it taps a sizable opportunity hiding in plain sight.

In a sector where every basis point matters, closing the gap between what hospitals negotiate and what they actually pay isn’t just operational hygiene—it’s a margin strategy.