Snapchat is rolling out a creator subscription offering in the U.S., opening a new paid layer for fans while adding another income stream for Snap Stars. The alpha program launches with a small roster that includes Jeremiah Brown, Harry Jowsey, and Skai Jackson, giving early adopters a template for how premium access could work on a platform long known for ephemeral messaging and Stories.

What Subscribers Get with Snapchat Creator Subscriptions

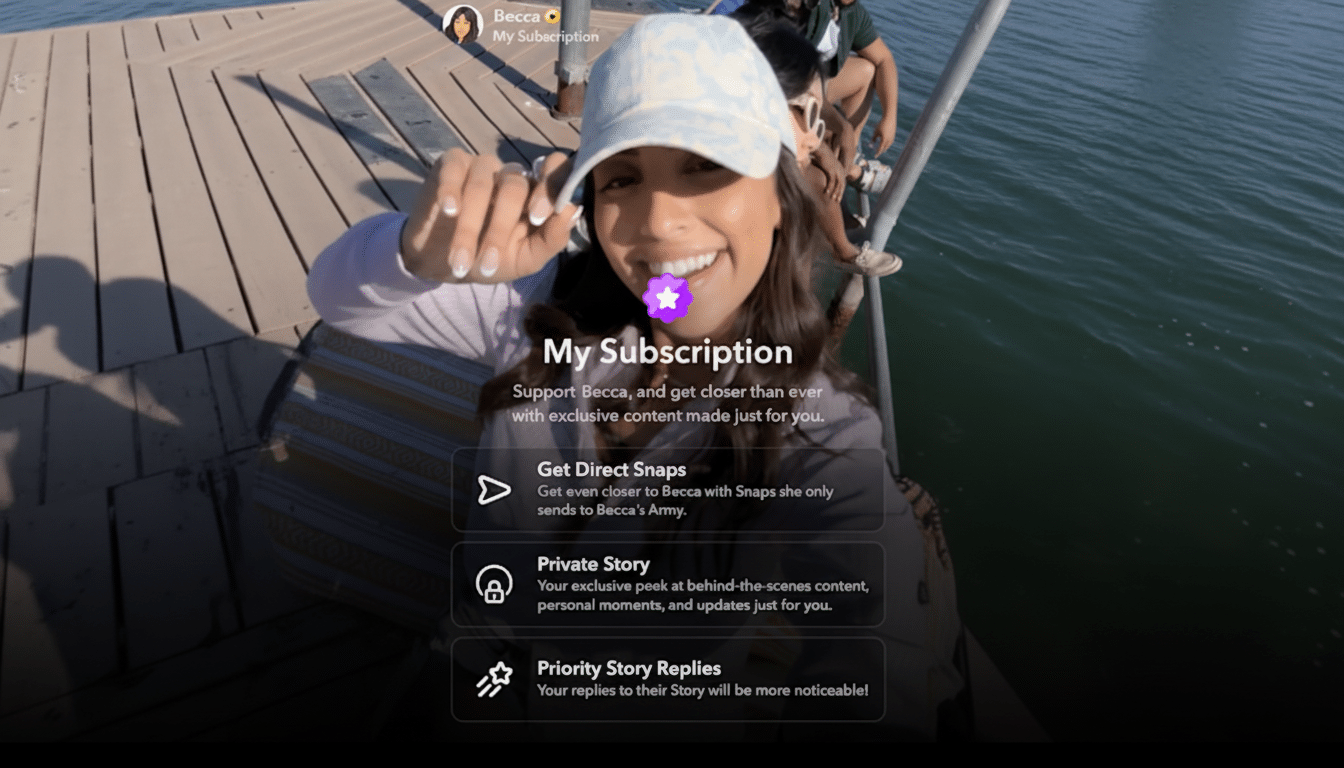

The subscription unlocks exclusive content, priority placement for subscriber replies on a creator’s public Stories, and an ad‑free viewing experience for that creator’s Stories. In practice, that could mean behind‑the‑scenes snaps, early looks at projects, sub‑only Q&As, or more personal Chat interactions—features designed to deepen loyalty and justify a recurring fee without overhauling how creators already post on Snapchat.

- What Subscribers Get with Snapchat Creator Subscriptions

- How Pricing Works for Snapchat Creator Subscriptions

- How It Fits Into Snap’s Monetization Stack

- Competitive Context Across Major Social Platforms

- Early Use Cases to Watch as Subscriptions Roll Out

- Strategic Signals From Snap on Creator Monetization

- What to Watch Next as Snapchat Tests Subscriptions

Because the premium layer sits atop Stories and Chat, the product aligns with existing user behavior rather than asking creators to spin up an entirely new format. That’s a strategic contrast with platforms that lean on separate paywalled feeds or gated Discord-style communities.

How Pricing Works for Snapchat Creator Subscriptions

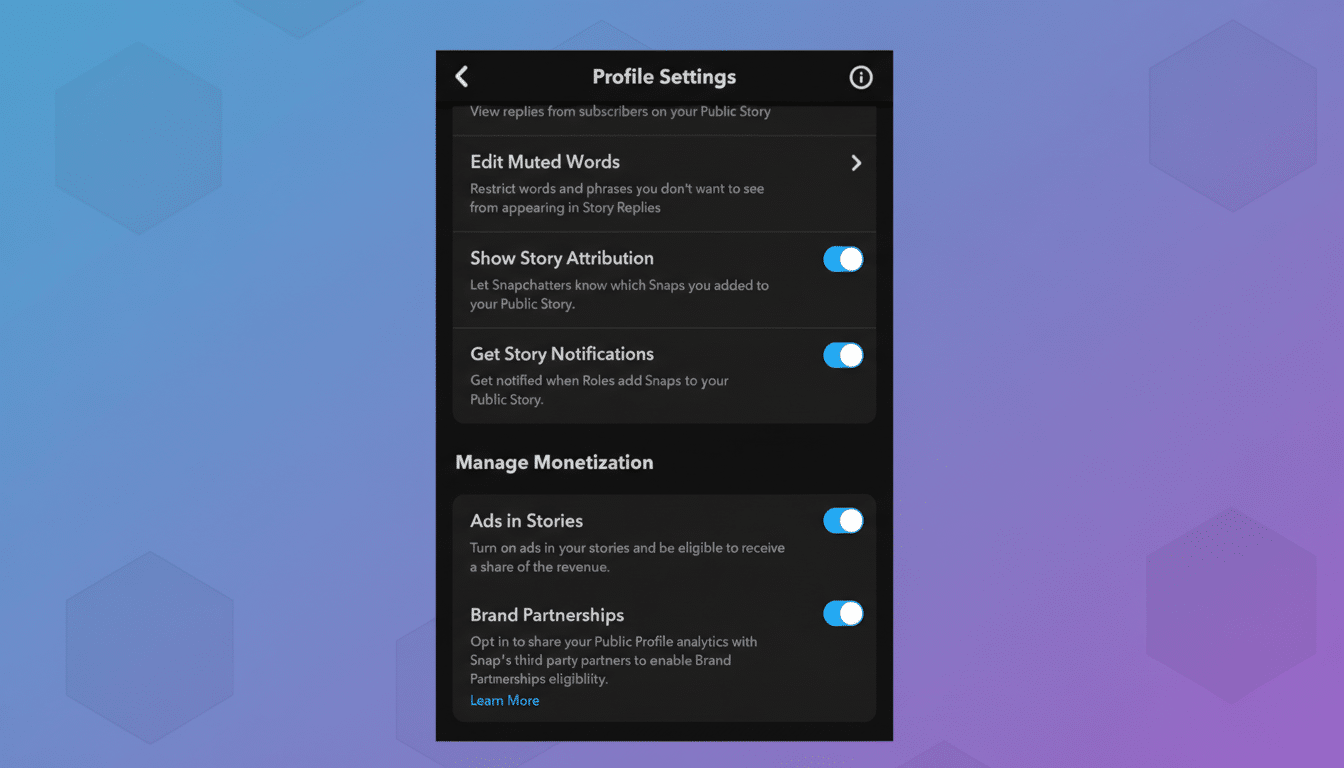

Creators can set their own monthly price inside the app, with Snap providing suggested tiers. The company did not publicly detail revenue share or platform take rates for the new product. As with any in‑app subscription, creators should consider standard app store fees that can reach up to 30%, which often shape how prices are set across mobile services.

Importantly, the ad‑free element is scoped to a specific creator’s Stories, not the entire Snapchat experience. That gives fans a clear value proposition while helping Snap preserve broader advertising inventory across Discover and other surfaces.

How It Fits Into Snap’s Monetization Stack

Creator Subscriptions slot alongside Snapchat’s existing programs, including the Unified Monetization Program and the Snap Star Collab Studio. Those initiatives aim to consolidate revenue opportunities—from revenue sharing to brand deals—while this new subscription product adds recurring, direct‑to‑fan income. The approach mirrors a wider industry shift: creators want diversified earnings that blend ads, commerce, and paid memberships to smooth out volatility.

Snapchat’s scale gives the feature immediate relevance. The company has reported 946 million daily active users globally, and it has highlighted that U.S. users posting to Spotlight grew more than 47% year over year. A fast‑rising pool of short‑form creators plus a large daily audience is fertile ground for paid communities—especially if even a small fraction converts to subscriptions.

Competitive Context Across Major Social Platforms

Meta already offers subscriptions on Instagram and Facebook, granting fans exclusive content and badges. YouTube has Channel Memberships and Patreon-style perks, TikTok has Series and subscriber chats, and X promotes creator subscriptions with custom badges and locked posts. Snapchat’s twist leans into its core strengths—ephemeral Stories, rapid‑fire Chats, and a younger user base—while adding ad‑free viewing at the creator level to reduce friction for superfans.

The economics will be critical. Across social platforms, successful subscription programs often convert low single‑digit % of a creator’s audience, with retention hinging on consistent perks and perceived closeness. Features like priority replies can materially increase the sense of access—often a bigger driver than bonus content alone.

Early Use Cases to Watch as Subscriptions Roll Out

Expect early participants such as Jeremiah Brown, Harry Jowsey, and Skai Jackson to test a mix of tactics: serialized Stories that only subs can finish, limited‑window drops, and scheduled subscriber chats that reward immediacy. For creators who already field heavy DM traffic, priority replies could become a standout benefit that scales intimacy without overwhelming inboxes.

Brands and talent managers will also watch how ad‑free Story views interact with sponsored content. If subscribers skew toward a creator’s most engaged fans, sponsor integrations inside premium Stories could command higher rates—even with smaller reach—thanks to stronger purchase intent.

Strategic Signals From Snap on Creator Monetization

Snap recently separated its hardware efforts into a standalone entity called Specs, a move that underscores the company’s focus on software monetization and platform‑level creator tools. A successful subscription rollout would complement ads and AR commerce while giving Snap more predictable, subscription‑based revenue tied to creator performance rather than pure impression volume.

The company says it will expand Creator Subscriptions to Snap Stars in Canada, the U.K., and France in the coming weeks, signaling intent to scale quickly once product‑market fit is validated in the U.S. Alpha feedback will likely shape packaging, pricing guidance, and discovery mechanics inside the app.

What to Watch Next as Snapchat Tests Subscriptions

Key open questions include revenue split specifics, off‑platform subscription management, and how subscriber‑only content is surfaced without alienating non‑paying fans. Discovery will matter: a native subscription shelf on Profiles and smart prompts during high‑engagement moments could drive conversion far more than static paywalls.

For creators, the calculus is straightforward: if priority access and ad‑free Stories elevate connection, recurring revenue follows. For Snap, the win is a stickier creator ecosystem that can better compete with rivals while aligning incentives around the content formats users already love.