Score, the provocative dating app that once required a strong credit score to even sign up, is making a comeback with a broader on-ramp and fresh product decisions aimed at defusing old criticisms while doubling down on its money-meets-matching thesis.

Launched originally with a 675-and-up credit score gate, Score quickly drew headlines for blending personal finance with romance, racking up roughly 50,000 users before shutting down. Now it’s reemerging on the iOS App Store with a two-tier model that lets anyone join while reserving premium perks for users who choose to verify their identity and credit standing.

What Changed and What Did Not in Score’s Relaunch

The new Score keeps its financial-responsibility angle but removes the hard barrier to entry. A basic tier requires no ID or credit check, allowing open browsing and connecting. A verified tier, powered by Equifax, adds optional ID and credit verification via a soft pull that does not affect scores and unlocks extra features like seeing nearby members, who saved your profile, video intros, and messaging before a match.

Score’s founder, Luke Bailey, maintains that credit scores are not a proxy for wealth, but a signal of consistency. The company says it does not store full credit reports, does not sell personal data, and uses encrypted infrastructure to protect sensitive information. Verification simply confirms whether a member meets criteria for the Verified tier.

It’s a notable pivot from the original 90-day experiment that ran six months because of demand. Back then, access hinged solely on a credit threshold; this time, Score pitches inclusivity first while letting those who value financial signals opt into visibility.

Money Talks in Modern Matchmaking and Online Dating

Score’s return reflects a broader shift in dating, where transparency around personal finance is inching from taboo to table stakes. The American Psychological Association has long reported money as a leading source of stress in relationships, and Pew Research Center says roughly 3 in 10 U.S. adults have used online dating—meaning financial compatibility questions increasingly surface in app-first courtships.

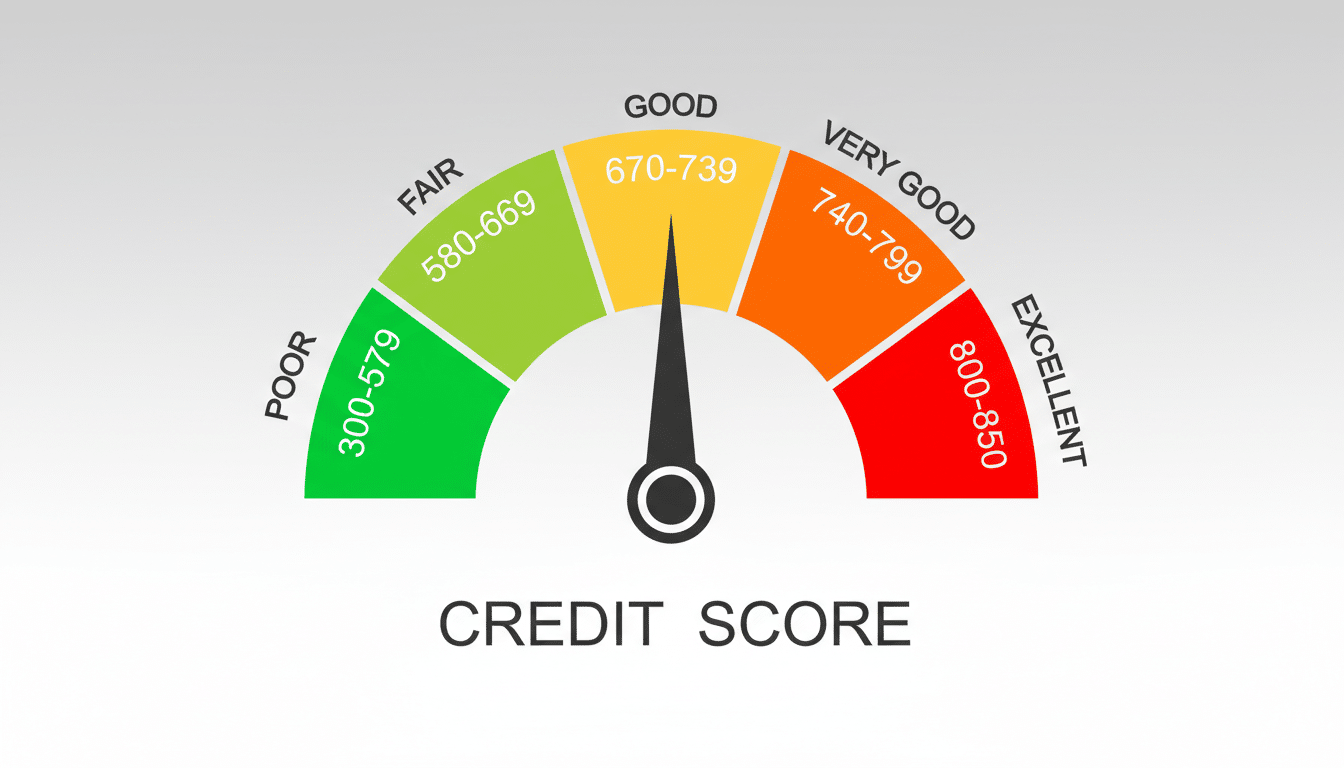

For context, FICO reports the average U.S. FICO Score hovered around 717 in 2024 after years of gradual gains. Younger adults often sit earlier on the credit-building curve—fewer accounts, thinner files—which complicates simple score thresholds. Score’s opt-in verification may appeal to daters who view measured financial habits as a stand-in for reliability, without walling off the rest of the pool.

Other platforms have tested signals adjacent to life stability—job titles, education history, even profiles built around daily routines. Score is betting that a quantifiable, third-party-verified indicator will be more credible than self-claimed markers, and that it can fold those signals into discovery and messaging features users actually want.

Privacy Safeguards and Risks of Credit Verification

Using Equifax for both identity and credit verification will raise eyebrows among privacy hawks. While soft pulls are standard and don’t move scores, any link between personal identifiers and credit data invites scrutiny—especially given Equifax’s highly publicized 2017 breach. Score says it minimizes data exposure by not storing full reports and limiting what’s ingested to pass/fail-style confirmation.

Consumer advocates have also cautioned that bringing credit scoring into non-lending contexts can amplify socioeconomic bias. The Consumer Financial Protection Bureau has examined credit-model limitations and disparities across demographics; academics studying algorithmic fairness warn that financial proxies can mirror systemic gaps. Score’s previous dataset hinted at generational shifts: it found millennial men’s credit scores were about 11% higher than women’s, while among Gen Z the gap narrowed to 3%—a trend the company says it will keep watching.

The balancing act for Score is clear: make verification valuable without turning it into a status badge, and protect user data in a category where trust is fragile. The company’s messaging around consent, soft inquiries, and limited retention will likely be tested by regulators and researchers if the app scales.

Product Roadmap and Expansion Plans for the Score App

Beyond its iOS debut, Score is plotting a phased international rollout, starting with Canada. The team is also teasing partnerships—potentially with financial wellness platforms or credit-education providers—that could frame verified status as part of a broader toolkit rather than a pass/fail gate.

Feature-wise, the app is leaning into discovery mechanics that make verification feel pragmatic: surfacing verified users nearby, enabling pre-match messages for higher-intent outreach, and letting people send short video intros that convey tone and trust. Expect iteration on how much weight the algorithm gives to verification versus other behavioral signals as feedback rolls in.

The Bottom Line on Score’s New Inclusive Model and Rollout

Score is back with a softer edge and a clearer thesis: money habits matter in long-term compatibility, but access should be open. If the company can turn opt-in credit checks into a trusted, privacy-conscious feature rather than a gatekeeping tool, it may carve out a distinct lane in an app market hungry for quality signals over endless swipes.

Whether daters embrace financial verification at scale will depend on execution and trust. For now, Score’s reboot pulls a once-viral experiment into a more durable product story—one that treats fiscal responsibility as a dating data point, not a velvet rope.