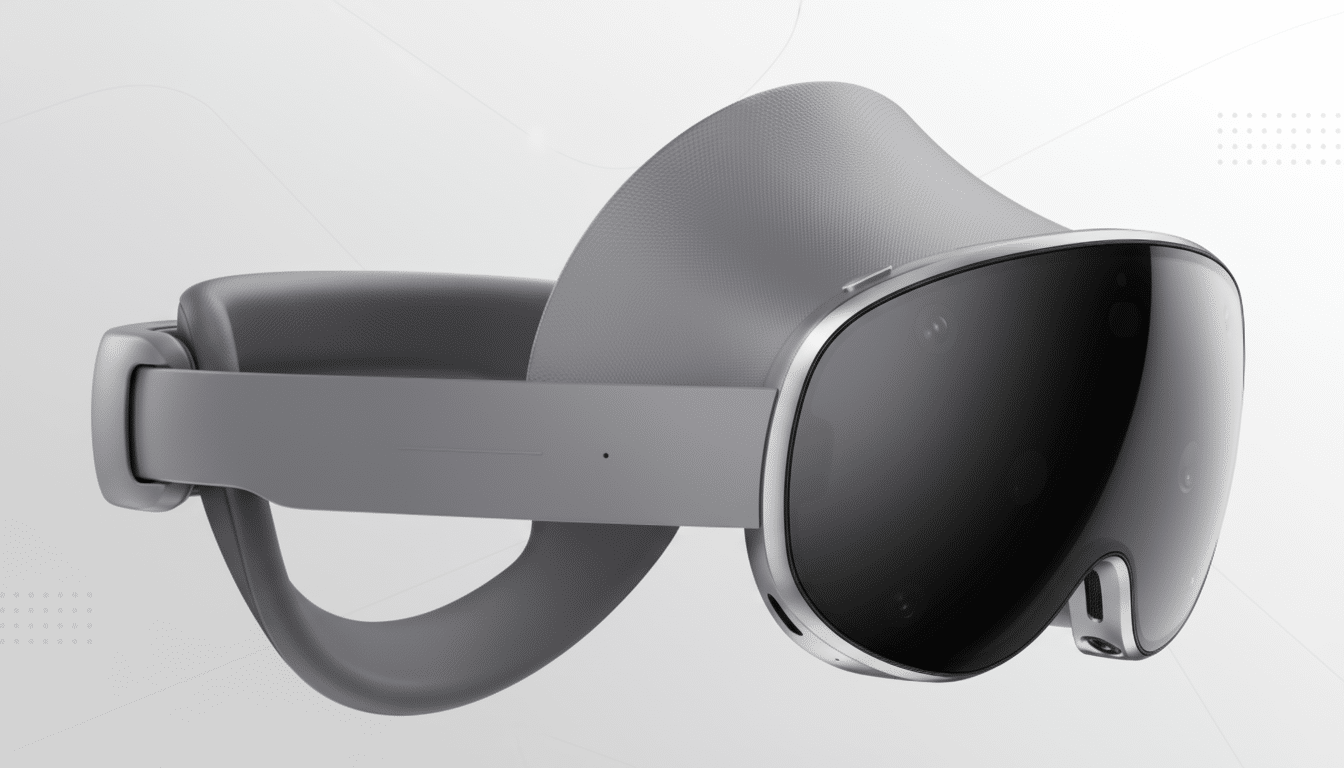

Samsung’s $1,800 Galaxy XR headset could be headed for a major expansion into new markets outside of its launch territories, hinting the company may be getting serious about scaling its spatial computing ambitions and the Android XR platform that powers them.

New leak suggests wider international rollout in 2026

According to SamMobile, Samsung is planning to further the availability of the Galaxy XR in Germany, France, Canada, and the UK in 2026, but adds that such a list could grow if production and software are ready. The headset is already on sale in the US and South Korea — but a multi-country expansion would be one of the product’s first major geographic pushes.

If true, the plan indicates that Samsung is working on getting hardware supply, regional certifications, and content localization in place for a broader consumer and developer audience. That sort of staging isn’t unusual for players in complex categories such as mixed reality, where bringing partners, services, and retail support on board determines when new experiences are introduced about as much as the underlying hardware.

The significance of expansion for Android XR

Samsung’s headset is widely regarded as a flagship device for Google’s Android XR platform, made in collaboration with Qualcomm. More markets, in turn, mean a larger installed base — which is key to attracting marquee apps, games, and productivity suites. Developers won’t invest in feature-rich applications unless they can access multiple regions through a single platform and storefront.

Momentum is critical right now. The AR/VR market saw a decline in 2023, but rebounded and grew shipments by double digits early in 2024, according to IDC. A wider Galaxy XR footprint could further buoy that trend on the Android side, offering content creators a definitive alternative to Apple’s ecosystem, and using open standards like OpenXR from the Khronos Group as a means of cutting down on porting friction.

Enterprise interest also looms large. Training, remote assistance, design review, and digital twin workflows are transitioning from pilots to typical use across manufacturing, health care, and field services. Local availability means local integrations, support for the native language, and carrier partnerships that enterprises need — especially in Europe, where GDPR compliance and secure identity are table stakes.

Pricing and the competitive landscape for mixed reality

At $1,800, Galaxy XR is priced 49 percent lower than Apple Vision Pro’s $3,499 price, a significant delta in a category where price has been one of the primary roadblocks to adoption. While Meta’s Quest 3 continues to be the value leader for mainstream VR, Samsung is aiming at the high end for mixed reality with a device that strikes a balance between high-end features and price point — the latter of which has been easier to stomach for prosumers and early enterprise buyers.

Price, though, is only half the tale. Content depth, quality of hand and eye tracking, display clarity, and consistent full-color passthrough have become the new bar for experience. Apple made its stake with high-end optics and a streamlined app model. Samsung’s rebuttal will revolve around the use of core Android services, possible partnerships that might be struck for productivity (that means cloud collaboration and 3D design tools), and tight integration with Galaxy phones and tablets for companion experiences.

The supply chain is another thing to keep an eye on. Qualcomm’s most recent XR silicon has focused on improved thermal headroom and support for higher-resolution displays and more advanced sensors. If Samsung can source components at scale with dependable regularity and still sell for less while delivering battery life and comfort, that edge, combined with a more affordable sticker price compared to Apple Vision Pro, may be compelling in places where household funds are tight.

Key things to watch as Galaxy XR availability expands

Look for Samsung to prioritize the essentials that will make or break daily usability: strong passthrough for mixed reality, reliable hand tracking, simple prescription lens options, and a streamlined onboarding flow. Dealer demos and carrier bundles might be a boon in new territories, letting prospective customers spend hands-on time with the device in question and easing the entry price and local buyers’ motivation to pony up.

On the drivers and software side, expect developer incentives, better spatial app discovery in the store, and deeper OpenXR support to speed up cross-platform ports. If Samsung can nab some big-impact apps — think 3D productivity, entertainment from major studios, and education kits for classrooms — it may be able to turn regional launches into ongoing engagement instead of one-off flurries.

If the reported 2026 expansion happens, the Galaxy XR experience could go from testing the waters in two markets to a legitimately global presence. That’s not just expanding Samsung’s reach; it would make competition fiercer and further define Android XR while making mixed reality more practical in everyone’s day-to-day.