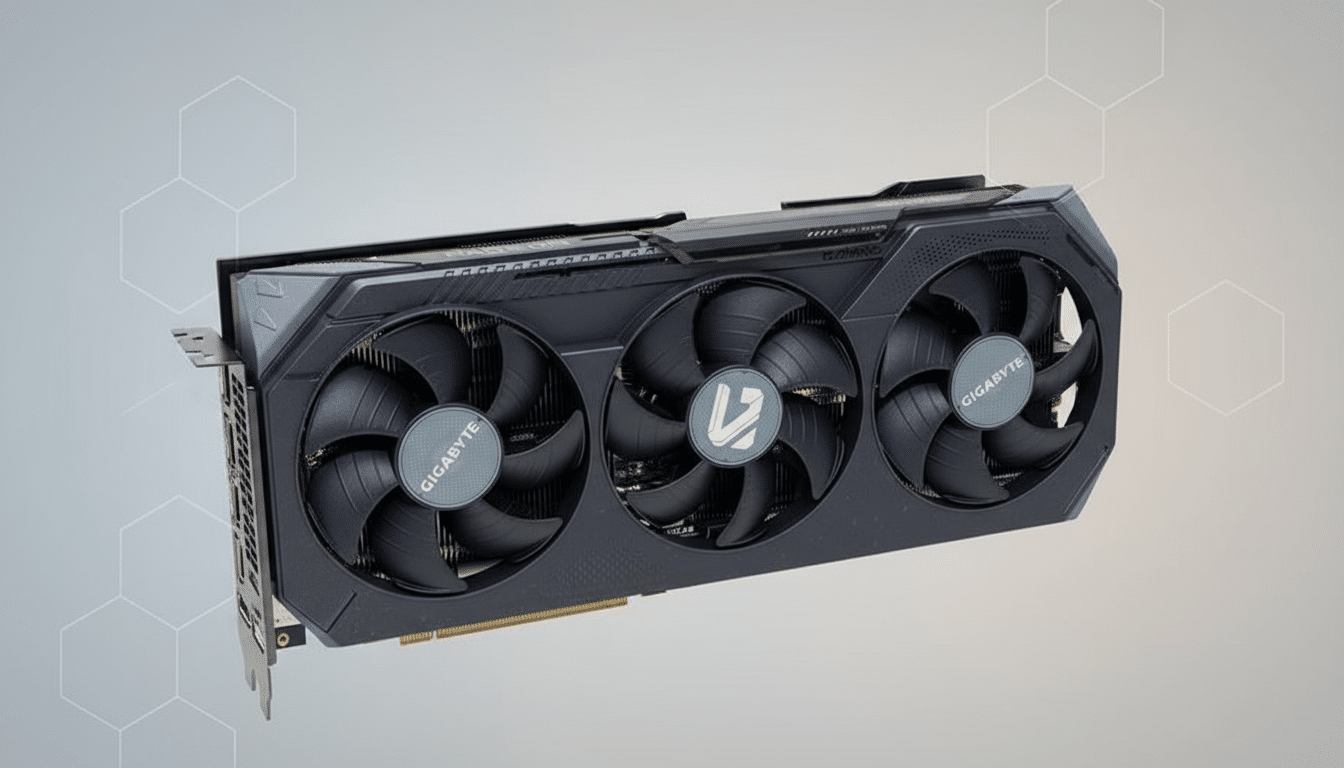

A fresh industry rumor points to looming price increases on graphics cards from Asus and Gigabyte, with hikes reportedly reaching up to 15%. The adjustment is said to scale with VRAM capacity, meaning higher-memory models could bear the brunt, while entry and midrange cards might see smaller bumps.

What the rumor says about upcoming GPU price hikes

NotebookCheck, citing a report from Taiwan’s component channel, indicates that Asus and Gigabyte are preparing across-the-board increases on current-generation AMD and Nvidia GPUs. The guidance suggests a tiered approach: cards with 16GB of VRAM or more could rise by the full 15%, while 8GB models may climb closer to 10%. Neither AMD nor Nvidia has announced changes to official MSRPs, and both vendors typically leave retail pricing to add-in board partners.

There’s precedent. Industry chatter has already pointed to at least one major board partner raising quotes, and retailers have shown widening gaps between MSRP and shelf prices on certain 16GB models. While vendors have pushed back on claims of discontinuations, the market has clearly tightened for some configurations.

Why rising memory costs could push GPU prices higher

Memory is a substantial slice of a GPU’s bill of materials. For a mid- to high-end card, VRAM can represent a double-digit share of the total cost, and that share grows as capacities reach 16GB, 20GB, or more. When memory prices move, board partners feel it immediately.

Analysts at TrendForce have chronicled rising DRAM and NAND contract prices amid the AI boom. Even though gaming GPUs typically use GDDR6 or GDDR7 rather than HBM, capacity at memory makers is not limitless. When suppliers prioritize high-margin AI memory like HBM, it can tighten the pipeline for other product lines. That ripple effect raises the cost of VRAM chips, which directly impacts the price of graphics cards carrying eight to a dozen memory packages.

Add in the early-cycle costs of next-gen interfaces and faster GDDR7 bins, plus PCB layer counts and power delivery upgrades on premium boards, and a stepped increase keyed to VRAM capacity starts to look like a pragmatic way for AIBs to protect margins.

Potential impact on street prices for current GPUs

A 15% hike compounds quickly. An $800 card would jump to $920; a $1,000 flagship would land at $1,150. If the rumor holds, 8GB models at $350 could move to roughly $385 with a 10% rise. Street prices already float above or below MSRP based on demand, so these changes would likely show up first in partner-specific SKUs with factory overclocks or larger coolers, followed by mainstream models as inventories turn.

For shoppers, the bigger swing will be felt in the bandwidth–capacity sweet spot, where many buyers target 12GB–16GB cards. Those SKUs are sensitive to memory cost fluctuations and often carry the most competitive feature sets for 1440p and creator workloads. Retailers could also use promotional pricing to mask list increases, making the net change harder to spot until launch-day discounts fade.

How this rumored pricing shift fits the GPU market

Board partners operate in a narrow window. Chip costs, memory prices, cooler design, and logistics all squeeze margins. When vendors keep MSRPs static, AIBs sometimes adjust their own pricing to balance component swings—especially during transitions between memory standards or when supply shifts toward data center products.

Community outlets such as Hardware Unboxed have noted volatility around certain 16GB models, highlighting how fast stock and pricing can change when supply tightens. Meanwhile, GPU shipments have been recovering from prior lows, and that rebound adds demand-side pressure just as component costs trend up.

What buyers can do now to navigate possible GPU hikes

If you’re shopping soon, a few tactics can soften the blow. Watch for older inventory on 12GB–16GB cards before new batches arrive at higher prices. Cross-shop partner models with simpler coolers or reference designs, which often track closer to nominal MSRPs. Consider capacity needs honestly: for 1080p and many 1440p titles, 8GB–12GB remains viable, while heavy creators and modders may still want 16GB.

Keep an eye on pricing trackers and retailer bundles. If memory costs stabilize or supply improves, partners can ease off; but if the AI-driven memory crunch persists, the rumor of 10%–15% hikes from Asus and Gigabyte could be the new baseline rather than a blip.

As always with rumors, the final word will come from what shows up on shelves. For now, the signal from the component channel is clear: VRAM is the lever, and GPUs with more of it are likely headed higher first.