Rocket Lab has secured its largest contract yet — an $816 million award from the U.S. Space Development Agency, confirming that the nascent satellite launch provider’s defense business is rapidly expanding.

The contract includes the delivery of 18 satellites for the SDA Tracking Layer Tranche 3, a proliferated low Earth orbit constellation supporting missile warning, missile tracking, and missile defense. The win boosts Rocket Lab’s combined SDA awards to more than $1.3 billion.

Details on SDA Tracking Layer Tranche 3 Satellites

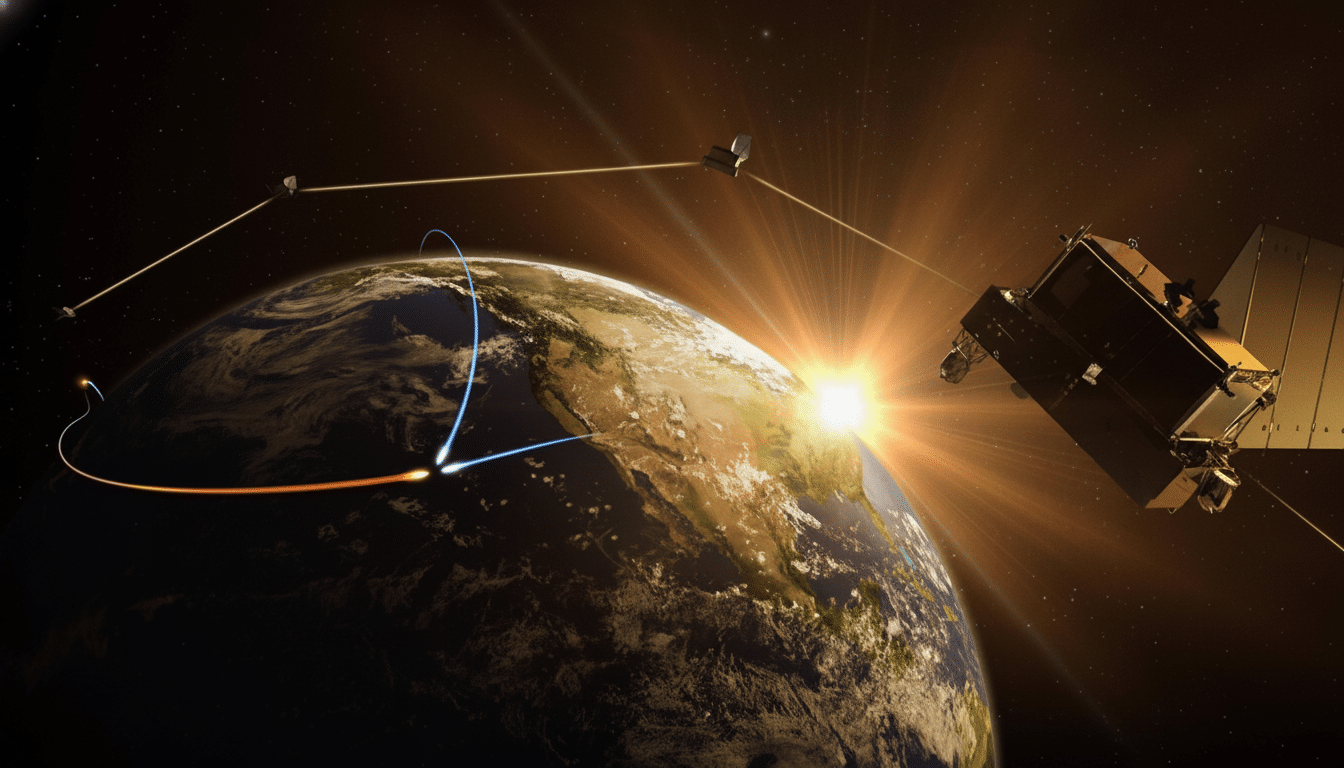

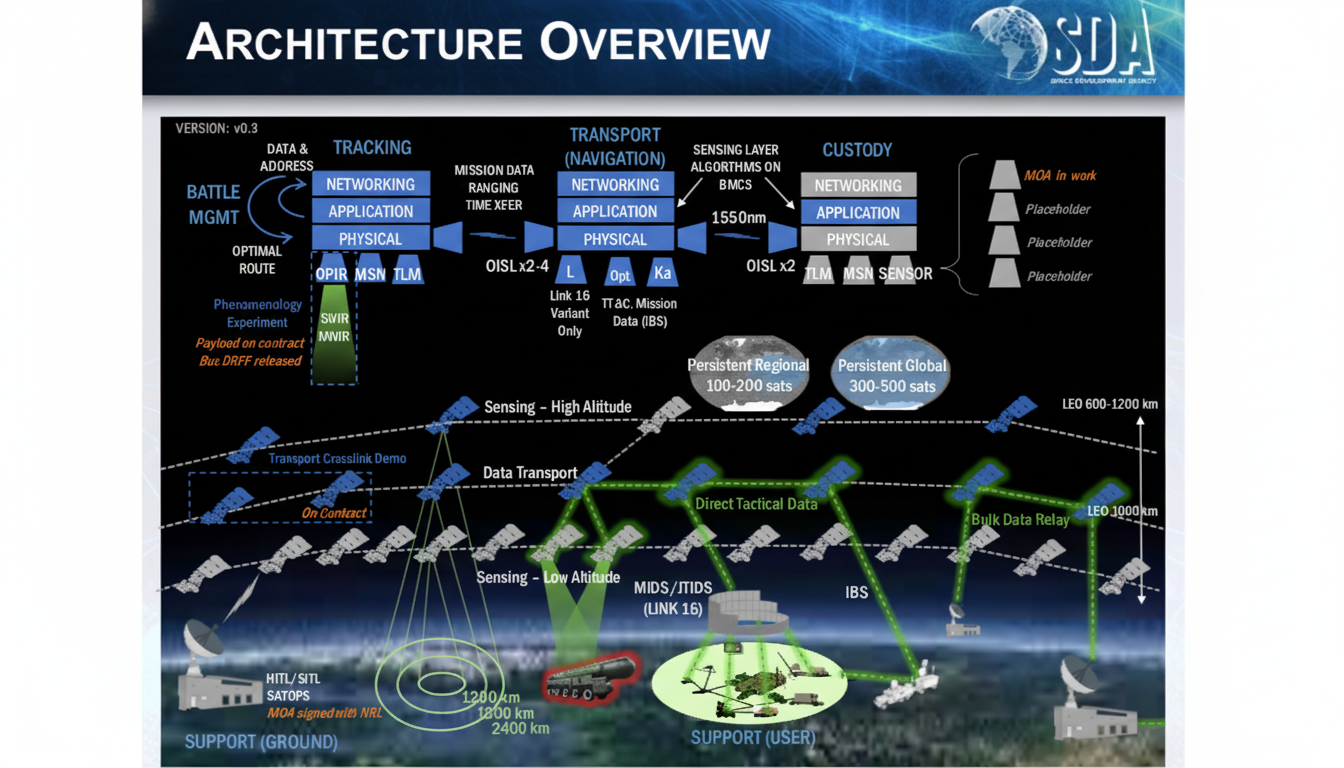

The Tracking Layer is the heart of the Pentagon’s plan to find and track advanced threats, such as dim, fast, and maneuverable targets. Onboard satellites in this layer carry infrared sensors to detect launches, identify objects during flight, and relay that data to users within seconds via space-based laser links and directly to the ground.

Rocket Lab’s 18 satellites will join a proliferated architecture being purpose-built for resiliency and rapid refresh. Instead of depending on a few exquisite, high-orbit platforms — with the millions or billions of dollars tied up between launch and deployment — SDA is launching hundreds of smaller satellites in small tranches for better survivability and turnover. The Tracking Layer teams with the SDA’s Transport Layer, which transmits encrypted, low-latency data to tactical users.

Rocket Lab’s Growing Defense Footprint and Strategy

This award comes on the heels of Rocket Lab’s previous $515 million in funding for the Transport Layer Beta as part of Tranche Two, in which the company is also providing satellites for SDA’s data relay network. It highlights a more intentional pivot to be seen less as a launch provider and more as a vertically integrated space systems prime.

Rocket Lab has assembled that capability through a series of acquisitions and investments at different points in the spacecraft value chain, such as satellite components, flight software, solar power systems, and deployment hardware. That includes space-qualified solar panels from the former SolAero business, separation systems from Planetary Systems, and avionics and software from Advanced Solutions, as well as heritage components from Sinclair Interplanetary. That stack allows for tighter schedule control, which is paramount when it comes to defense programs and rapid iterations.

The company has also built defense relationships on suborbital hypersonic test flights with its HASTA variant and responsive launch with Electron across multiple campaigns. Recent company earnings suggest that Space Systems has been the leading source of income, and this new award is likely to only cement it further.

Why the Contract Is Important for U.S. Space Security

SDA’s distributed approach seeks to bring resilience, “layered” sensing, and communications at scale. Government Accountability Office examinations of these programs, meanwhile, have pointed out that spreading capabilities across many satellites can reduce individual points of failure and allow faster refreshes in technology. The inclusion of an additional nontraditional prime further expands the industrial base, a priority mentioned often by leaders in both the Department of Defense and U.S. Space Force.

Rocket Lab’s participation also applies competitive pressure in a market that has been dominated by large aerospace primes. Previous tranches have involved work from companies such as Lockheed Martin, Northrop Grumman, L3Harris, and York Space Systems. Increased supply chain diversity can help avoid bottlenecks and add cost control as SDA grows from dozens to hundreds of satellites across its layers.

Production, Risks, and What to Watch in Delivery

Delivering a program of this scale requires disciplined manufacturing and test capability. Rocket Lab has also put money into spacecraft manufacturing in Long Beach, Calif., and space-grade solar panel manufacturing in New Mexico that ought to help the company lock down more of its materials and shrink lead times. The company will have to make tight timelines for payload design reviews, payload integration, environmental testing, and ground segment integration.

Keep an eye out for signals on the health of supply chains in areas including infrared sensors, star trackers, reaction wheels, and space-qualified computing. GAO and other independent assessments have also warned of risks from overlapping tranches. Clearly defined progress under qualification and acceptance milestones would be the best assurance that schedule and costs are being met.

Strategic Outlook for Rocket Lab and SDA Architecture

The $816 million award cements Rocket Lab’s position as a leading provider to one of the Pentagon’s most significant space endeavors. When combined with the Transport Layer contract and an expressed interest in feeding larger efforts like Golden Dome, the company is also poised to bid for more defense work as SDA’s architecture expands.

For the United States, the deal represents a proliferated model that mixes speed, resiliency, and incremental upgrades. It validates a bet on vertical integration for Rocket Lab, and it helps drive the company further from being considered only a “rocket company,” toward becoming a more diverse player in the space systems defense sector.