Replit, the online coding platform known for its AI-powered code suggestions and one-click hosting, has raised a new financing round from a16z that values the company at $3 billion. Now, the company says that its annualized revenue has bloomed to around $150 million, a run rate that quite literally alters where the startup is placed in the pecking order of AI-native developer tools.

Explosive growth and questions about the quality of revenue

Replit says its annualized revenue jumped from roughly $2.8 million to $150 million in under a year — rates of acceleration eye-popping even by today’s AI-bonkers metrics.

Earlier, the company said that it surpassed the $100 million ARR threshold, indicating that it’s monetizing quickly atop its free-to-use base. The difference is meaningful: “annualized” generally indicates recent monthly momentum extended out, not audited revenue. Still, the scale says Replit has discovered a pricing and usage cocktail that translates free hobbyists and students into paid developers — and teams and orgs of them, once they have more serious needs.

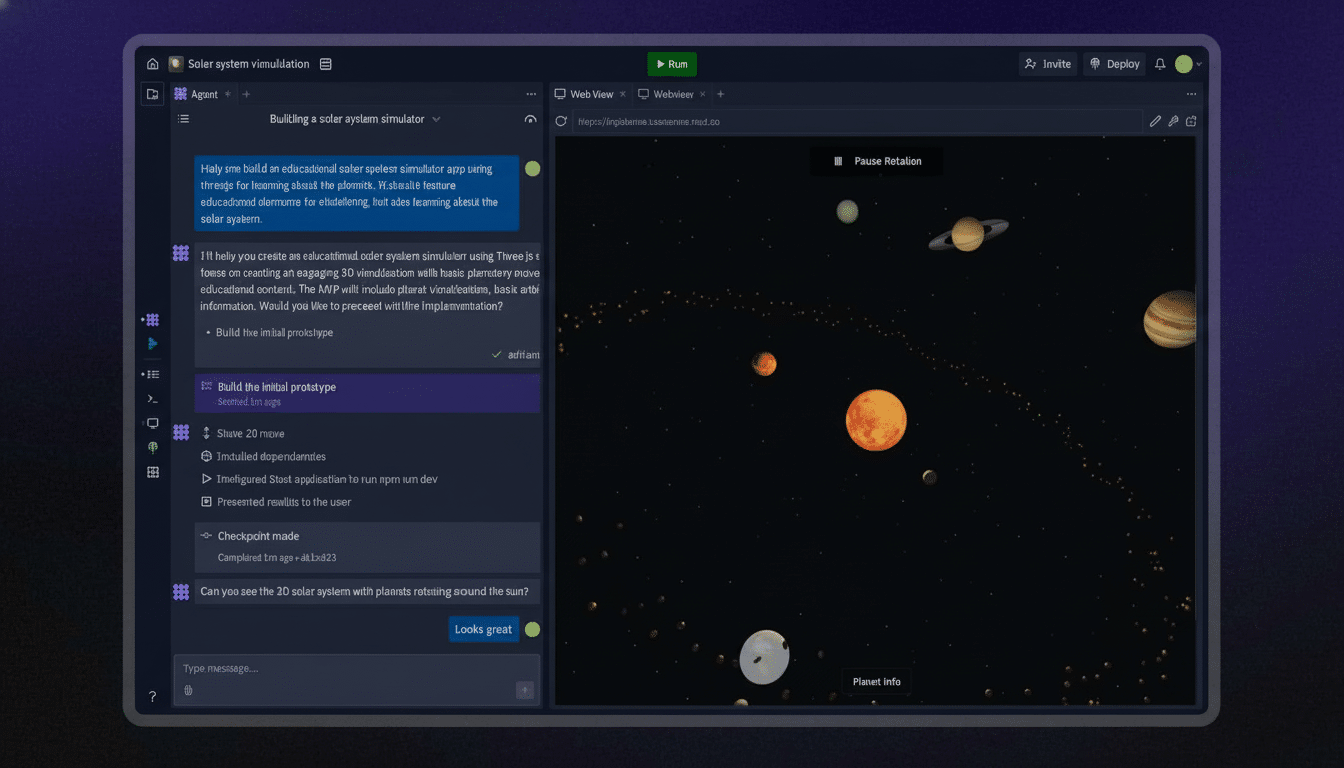

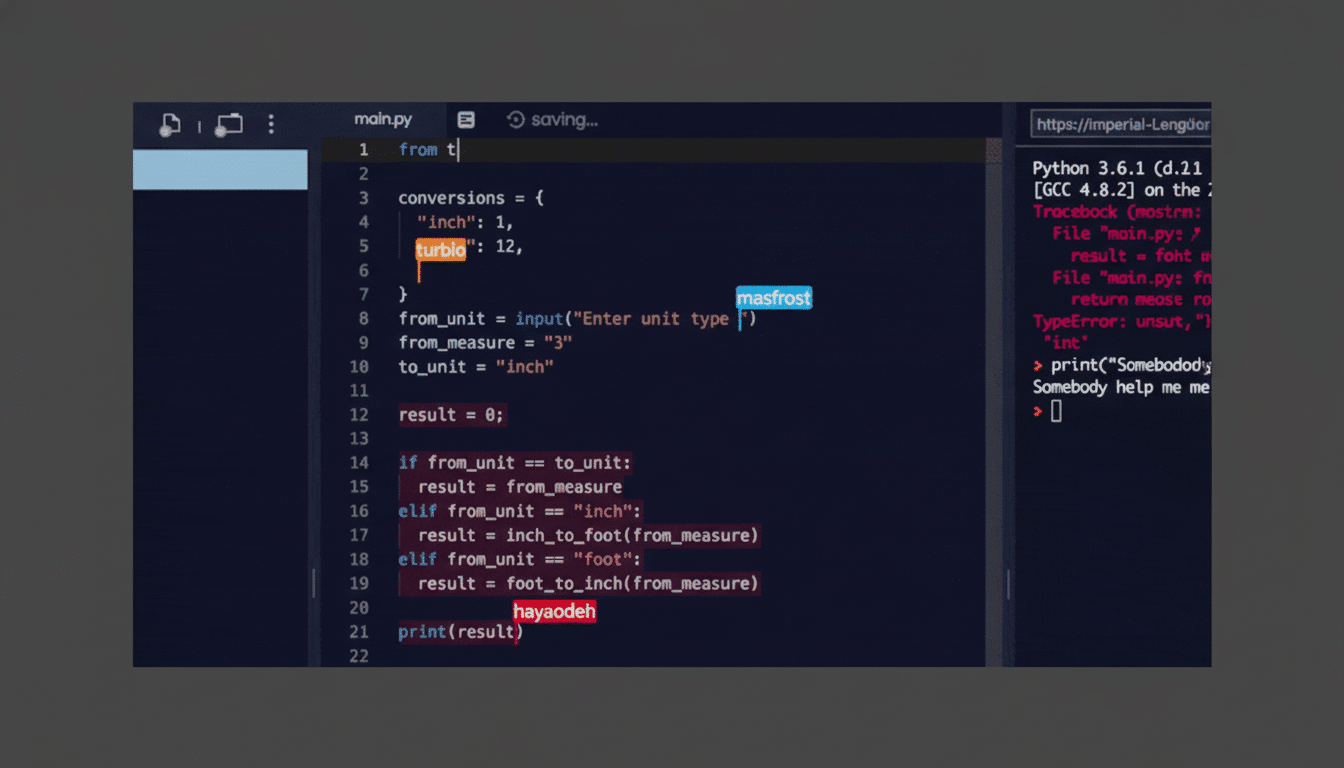

And here’s the product thesis: a multiplayer IDE in the browser, with AI assistance while typing, integrated deployments, takes away the setup friction and keeps a project in one workflow. That full-funnel experience — learn, prototype, collaborate, ship — has proven to be a competitive differentiator as the coding agents and copilots multiply.

For a funding round designed for speed

The latest round is $250 million led by Prysm Capital along with Amex Ventures and the Google AI Research Fund. Previous backers like Y Combinator, Craft, Andreessen Horowitz, Coatue and Paul Graham also participated. Replit has raised about $478 million to date, according to PitchBook. The company’s previous financing valued it just over $1.1 billion on a post-money basis, according to data from Crunchbase, which makes today’s mark a huge step up in terms of investor confidence in the company’s path.

At a valuation of $3 billion on a $150 million revenue run rate, Replit is in the neighborhood of 20x on an implied running-revenue multiple basis; that’s rich compared to the median revenue multiple in public cloud software (per Bessemer’s Cloud Index), but it’s not out of the market for high-growth AI players with strong user flywheels and increasing enterprise footprints.

Cloud alliances bring distribution and scale

It’s been clear for some time that Replit has a close relationship with Google Cloud, as the default hosting for many projects on Replit. More recently, the platform was introduced as an option on Microsoft Azure. That multicloud posture is no accident: hyperscalers need AI developer workloads, Replit needs low-latency inference, global coverage, and predictable unit economics. Replit will push further into enterprise accounts So expect deeper go-to-market ties (credits, marketplace listings, packages) to be important as Replit scales work on its next bet.

How the money is spent

Replit’s business model mixes seat-based subs with compute, memory and AI tokens overage charges. Paying brings private workspaces, a little collaboration and more resources. The AI stack—code completion, chat, increasingly autonomous agents—generates incremental consumption by making developers iterate faster, or getting more to tooling to make faster. Toss in deployments and long-lived environments, and Replit is monetizing not just the editor, but the entire lifecycle of small apps and internal tools.

What enterprises get is speed and governance as a single offering: standardized workspaces, policy control, and auditability, running on top of the clouds they want. All of that alignment is relevant as CIOs weigh the productivity gains of AI coding with data sensitivity and cost visibility.

Competitive landscape and defensibility

The field of battle is packed: There’s GitHub’s Copilot and its ecosystem, Sourcegraph’s Cody, Codeium, Cursor, the offerings from the big clouds, all shooting for the attention of the developer. Replit’s value is in its broadness and immediacy — open a web browser and you can build, test and ship within minutes — and its community that’s seeding templates, examples and tutorials. Combined, all those things make a distribution moat: more projects beget more users, who fuel more AI training signals and marketplace activity.

Risks remain. AI inference costs can squeeze gross margins if utilization outstrips optimization and incumbents bundle hard. The company will succeed or fail based on its ability to make model efficiency, cache results and route workloads across vendors. Inferences spend is a top constraint on AI-native businesses, as both investors and consulting firms have independently reported in their research — and several of its cloud partnerships indicate how early it’s going after that problem!

What this valuation signals

The new mark is that the market is now signaling it doesn’t feel like AI-assisted software development is a feature, it’s a platform shift.

If Replit can indeed maintain conversion, deepen its enterprise penetration and defray compute costs, a 20x multiple might look more like a bridge than a peak. Next, here are a few proof points to watch for: momentum in enterprise logos, the mix of paid user versus free, gross margin trend, and how fast this broad, diverse, band of autonomous minded agents goes from fun browser novelty to daily teammate.