Redwood Materials has raised $350 million to accelerate the adoption of its business of storing energy, an approach based on second-life batteries that could help meet surging power demands from AI data centers and heavy industry.

The funding will also increase the company’s refining and cathode materials production capacity, as well as hiring across engineering and operations.

Established by former Tesla CTO JB Straubel, Redwood made its name on battery recycling and domestic materials manufacturing. The company is now hoping to stitch all of that together into a closed-loop platform, one where it can take in end-of-life and surplus batteries as it then processes critical minerals, manufactures battery materials and then deploys repurposed packs out into the grid or behind-the-meter storage.

Second-Life Battery Storage Pushes Forward With Funding

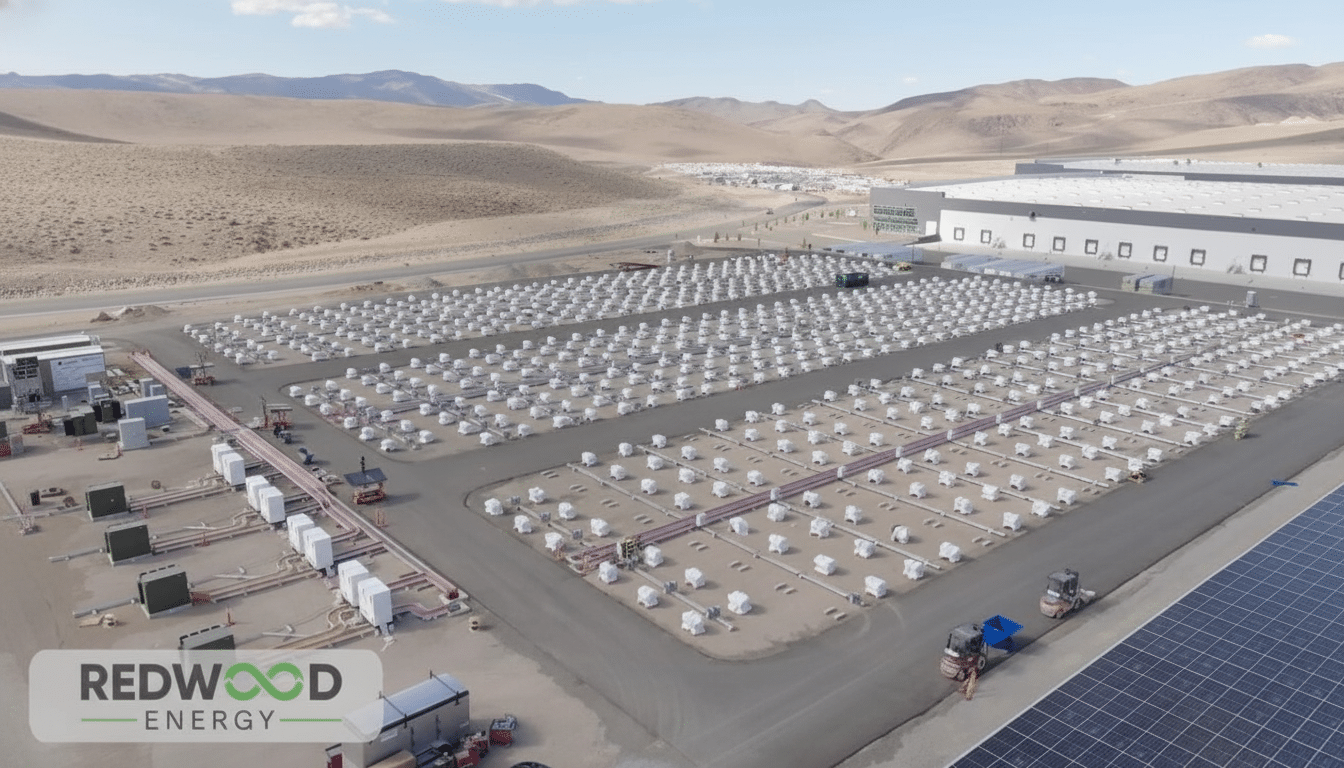

Redwood’s ESS is putting used EV battery packs that don’t need to be shredded back together and turning them into stationary systems. The firm strings these packs to on-site solar or wind and can work in off-grid or grid-tied modes offering peak shaving, backup power and frequency support. Redwood says the systems can also be combined with natural gas turbines today, and eventually with advanced nuclear generators.

The company says that over 70 percent of used or discarded battery packs find their way back to its reclamation system in North America, giving it an unusually deep pipeline of candidates for repurposing. By the middle of this year, Redwood had accumulated over 1 gigawatt-hour of energy-storage-grade batteries suitable for second use, with a goal of landing 20 gigawatt-hours worth in deployments by 2028 — enough to compete among the top tier globally of second-life integrators.

Second-life storage is attractive because the battery has largely been “paid for” in service as a vehicle battery. Even with the addition of integration, testing and warranties, market analyses by BloombergNEF and McKinsey indicate that repurposed packs can be less expensive upfront than systems made from fresh cells — especially for two- to four-hour applications typical in peak management.

AI Data Centers Are Spearheading A New Storage Wave

AI clusters are energy-hungry and highly dynamic, with 5x growth. Data center electricity demand worldwide is projected to almost double by the middle of this decade as a result of AI, according to an estimate from the International Energy Agency. So, we increasingly have hyperscale build plans of tens to hundreds of megawatts or more under planning by larger companies in places where the grid doesn’t yet connect; there are multi-year delays that have been documented and studied by Lawrence Berkeley National Lab.

That gap is helped by large stationary batteries. They allow developers to smooth out demand spikes, to capture value from ancillary services and to keep critical compute running during an outage. Second-life systems are particularly well-suited for short-duration needs, and can be deployed more rapidly than new-build generation — providing a pragmatic tool as utilities construct new transmission and firm power.

Real-world precedents are emerging. Projects in California and Europe have already demonstrated that retired EV packs can be pooled into multi-megawatt storage assets that perform on par with conventional battery offerings. Redwood’s differentiator is scale of supply, via its recovery network, and the ability to profile, repurpose and warrant packs at industrial throughput.

Vertical Integration & Materials Advantage

Beyond storage deployments, the new funding fortifies Redwood’s upstream operations: recycling, refining and cathode production. The company provides materials to such manufacturers as Panasonic, GM, and Toyota and has a conditional commitment for a multibillion-dollar loan from the U.S. Department of Energy to develop domestic battery materials capacity.

This integrated model matters. By fueling feedstock collected from consumer electronics and EVs into the course of extracting nickel, cobalt, lithium and copper through to producing cathode-qualified materials or copper foil production in the country, Redwood is able to save costs by compressing logistics, carbon footprint and its energy bill. It also puts the firm on a path to satisfy traceability requirements and access incentives under U.S. industrial policy, such as tax credits for storage and domestic manufacturing.

For customers, that’s a storage infrastructure vendor that is one-and-done from quotes to install and has a single responsible party for the hardware itself, lifecycle services and end-of-life processing — all too uncommon in the market where it’s frequently bifurcated among integrators, recyclers and materials suppliers.

What to watch as second-life storage deployment expands

Its success will be based on quality control. Used batteries need to be closely graded, be repacked, and meet standards such as UL 1974 and UL 9540 for safety and performance that is predictable. How quickly hyperscalers and industrial customers adopt the technology will depend on Redwood’s ability to standardize heterogeneous packs into bankable products — and provide strong warranties.

Supply dynamics are another variable. While EV retirements are increasing, chemistry mixes are changing, with lithium iron phosphate more prevalent. Meanwhile, new LFP cell prices have dropped lower, increasing competition with first-life storage. If Redwood can keep its cost and speed edge, which is grounded in integration and scale, second-life assets should be able to carve out a lasting market position.

The new $350 million round is evidence that investors buy into that thesis. With a growing bounty of pack supply and customers who are already embedded in the EV supply chain, Redwood is wagering that second-life storage will be a matter-of-fact tool in the data center and industrial power toolkit — not an exotic experiment.