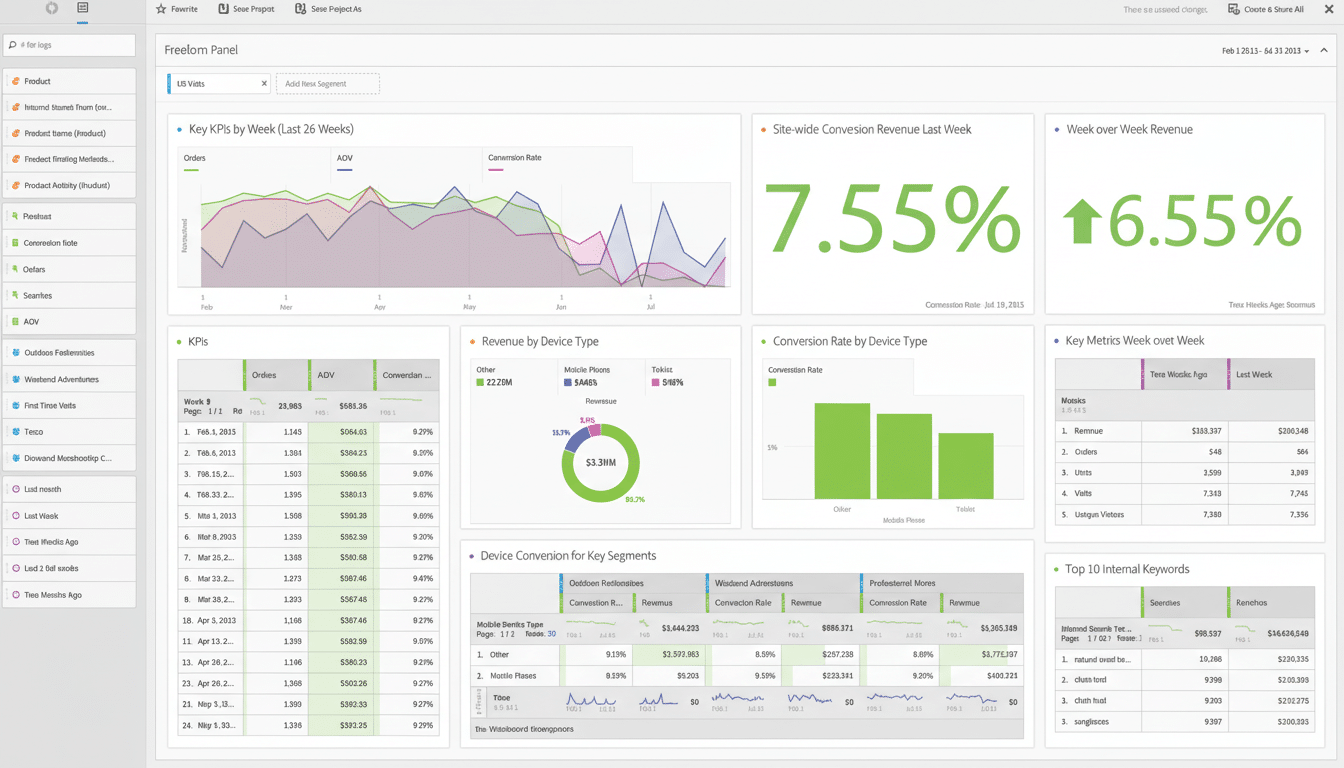

U.S. shoppers opened their wallets during the long holiday weekend, spending a record amount online and making trips to stores despite restrictions over the Thanksgiving period. Adobe Analytics projects about $44.2 billion in online purchases for the five-day stretch, and in-store traffic also edged higher, suggesting consumer demand remains robust even against lingering concerns about a budget crunch.

What the Numbers Show About Holiday Weekend Spending

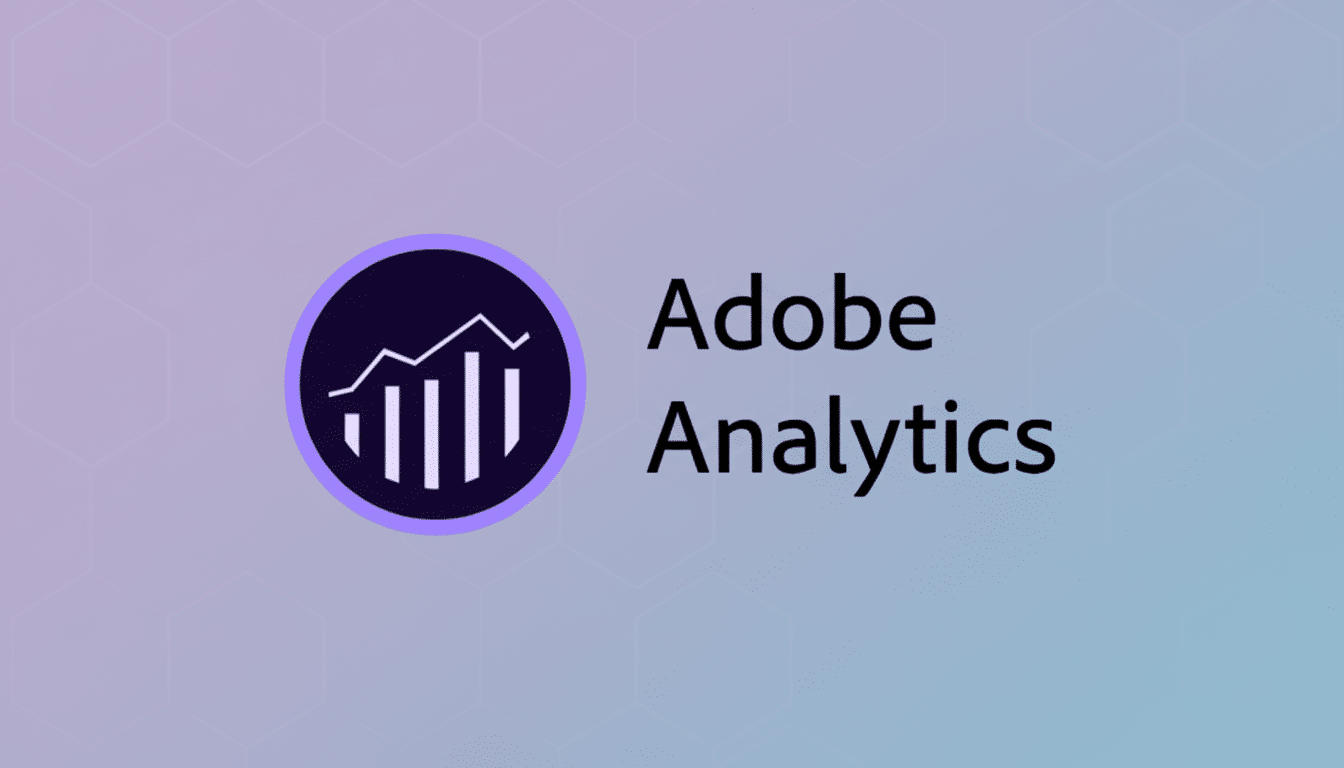

According to Adobe Analytics, online spending banners fluttered: $11.8 billion on Black Friday itself and $6.4 billion on Thanksgiving Day, with an additional $11.8 billion across the weekend and a Cyber Monday harvest of about $14.25 billion. Taken together, those tallies signal that digital deal hunting has become just as much a part of the holiday ritual as crowded malls and doorbusters.

On the ground, the National Retail Federation said there were 129.5 million in-person shoppers over the weekend, a 3% year-over-year increase. The NRF also found that the average shopping tab was $337.86, compared with $315.56 last year — a sign that even tightfisted households made space for the right discounts.

Why Shoppers Spent More During the Long Weekend

Three forces were at work: even deeper promotions in must-have categories, smoother omnichannel experiences, and selective splurging after months of trading down. Retailers played aggressively with pricing on big-ticket electronics, in gaming, toys, small appliances, and smart home gear — traditionally strong traffic drivers — while also activating limited-time online drops to give purchases some immediacy.

Meanwhile, retailers have polished the playbook of convenience. Curbside pickup and buy-online-pickup-in-store options assist shoppers in sealing the deal on online prices and sidestepping shipping delays, a behavior that has gained traction since 2020. Other industry trackers, like Adobe Analytics and the National Retail Federation, have seen mobile checkout rising as well as greater use of flexible payment options from buy now, pay later agreements in the last stretch of the holiday — telltale signs that consumers are keeping tabs on their budgets without cutting things out of their carts entirely.

Macro dynamics likely added lift. Promotional depth met consumers at a time when some input costs have abated, inventories are cleaner than in the same period a year ago, and retailers can price to remain competitive without the same supply chain snarls. Households are still price-sensitive, but the right mix of discounts and convenience seems to have unlocked a little more spending.

Online and In-Store Momentum Over the Holiday Weekend

Digital storefronts generated the most breathless headlines, as shoppers comparison-shopped across retailers and pounced on algorithmically surfaced deals. Black Friday has turned into more of a digital-first event, with doorbusters released online days before stores even open and then replenished in waves to keep conversion high. Cyber Monday, originally a pure-play e-commerce phenomenon, is now the robust finish to a week of rolling promotions.

But the store still matters. The NRF’s number of in-store shoppers suggests that brick-and-mortar made a comeback, driven by experiential draws, same-day fulfillment, and gift discovery that is more difficult to replicate on a screen. For numerous chains, the sweet spot was hybrid: online perusal and ordering, in-store pickup and returns — which drove both sales and important foot traffic.

What Retailers Learned From the Holiday Weekend Sales

Success this weekend depended on accuracy: targeted markdowns, visibility to real-time inventory data, and quick fulfillment. Retailers that were able to offset deep discounts on hero items with margin-protecting deals on accessories and services likely fared better. Look for increased attention to returns management in the coming weeks, for the cost of volume can melt away with bright reverse logistics lights and no convenient station.

The data also reinforces what appears to be a larger calendar shift. While shoppers were warmed up by sales events in October and early November, with peak demand still centered around the five-day stretch, more spending gets spread over the quarter. That means merchandising and marketing plans have to keep up momentum — price transparency, clear value, and availability — well beyond a weekend.

The Bottom Line on Record Black Friday–Cyber Monday

Black Friday–Cyber Monday exceeded expectations with record online sales and a noticeable increase in store visits. Data from Adobe Analytics and the National Retail Federation suggest a consumer who is picky but ready to splurge when the right deal comes at the right time in the right channel. Retailers will next be put to the test during the holiday season, in which they have experienced early strength; now they need to make that momentum translate into profitable sales this December while keeping returns and fulfillment costs under control.