Pulley, 645 Ventures, and Epigram Legal come together to discuss HRTech on the builders stage of Disrupt 2025, where we zero in on one of the most head-scratching puzzles in startup growth, crafting offer packages that bring top talent in the door, leave enough runway room to hit the next round of milestones, and stand up to legal and investor scrutiny.

Look forward to a candid, operator’s take of what actually moves the needle in hiring— from equity architecture and 409A realities to compensation bands, retention mechanics, and how to sidestep the landmines of legal that blow up momentum.

Why this panel is important for founders and talent leaders

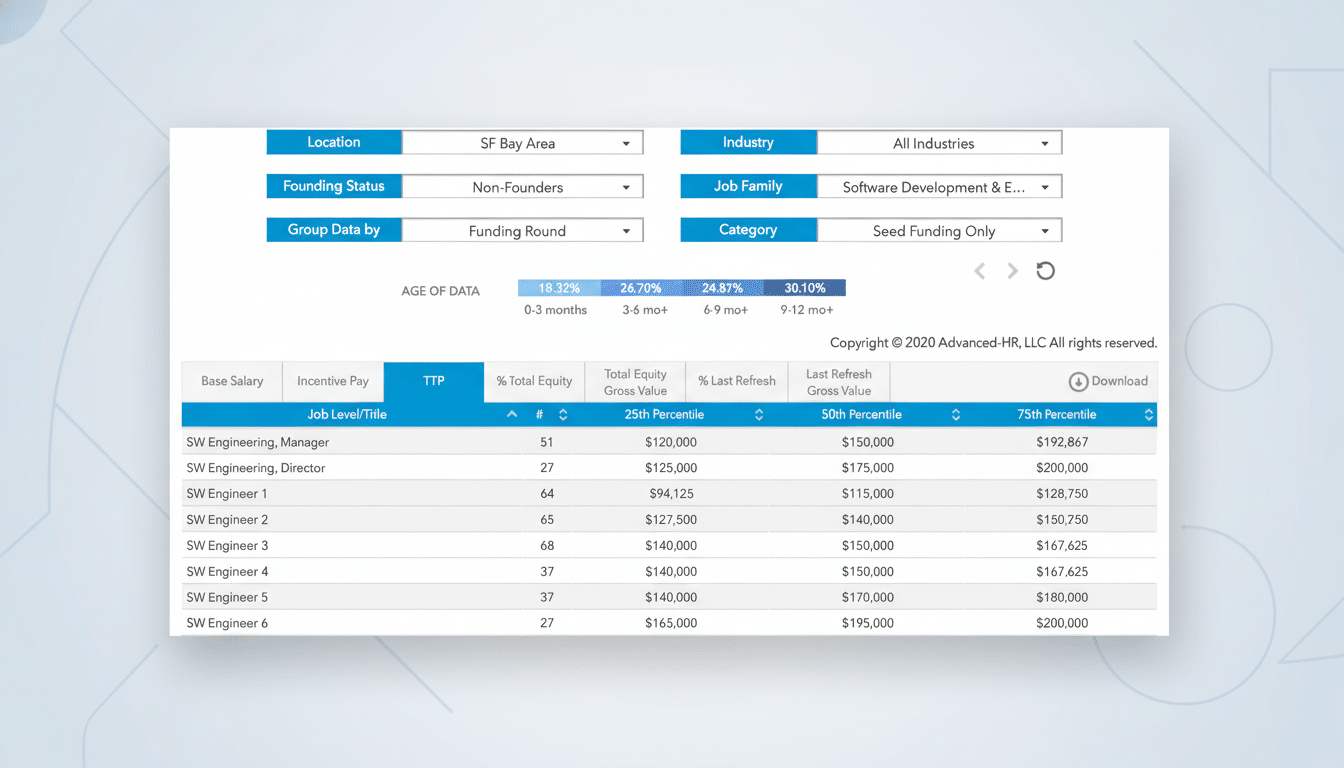

Some hiring has bounced back in corners of the startup ecosystem, but it’s a precision game now. Based on its own analysis of compensation data sets from Pave and Option Impact, salary bands and equity grants fluctuate significantly from role to role, stage to stage, and location to location, with candidates increasingly comparing offers based on long-term value, liquidity prospects, and work-life policies, not the sizzle of the pitch. The panel offers three perspectives on that reality: Pulley on equity and cap table mechanics, 645 Ventures on how plans map to milestones, and Epigram Legal on compliance and risk.

Equity is the centerpiece — structure it to keep it

For companies at earlier stages, stock options are still the default, but the specifics are important. Investors will seek crisp option pool planning (often refreshed at financing events), consistent grant guidelines by level, and a refresh grant policy to deter mid-tenure attrition. Pulley’s take on scenario modeling — and its implications for fully diluted ownership, future pool top-ups, and dilution across different fundraises — helps founders avoid surprises later on when that growth necessitates multiple hiring waves.

Later stage companies are now turning to RSUs with double-trigger vesting especially during times of fluctuating valuations and employees looking for sight of liquidity. Cooley’s Quarterly and Wilson Sonsini’s Entrepreneurs Report both noted a period has seen a slow rise in RSUs in larger private rounds and Carta’s State of Private Markets has been noting the role tender offers are playing in allowing employee liquidity between fund raises. Real-life examples — like Pinterest’s publicized stretch exercise window policy and company-wide liquidity events like periodic tender offers at employers including Airbnb — demonstrate how equity design can have a material impact on both retention and employer brand.

Founders should be acting to consolidate vesting norms as well. Four-year vesting with a one-year cliff is still the norm, but refreshers aligned with performance reviews and milestone completion can be more impactful than ad hoc grants. Further, documenting a longer post-termination exercise policy (to the extent possible) can help to lessen the impact of “golden handcuffs” without sacrificing retention.

The legal fine print many teams ignore

Equity is more than math — it’s compliance. Epigram Legal will carve through the basics that even slip through the cracks when teams under hiring pressure: including the importance of the 409A valuations happening on time (to protect those ISO tax benefits), the ISO cap of eligibility, and making sure employees understand early exercises and 83(b) elections. Offer letters need to be consistent with board-approved equity plans, and proprietary info and invention assignment agreements need to be signed on the dot by day one to protect IP.

Employment law is evolving, and noncompete restrictions are becoming more stringent in many jurisdictions even as non-solicit and confidentiality restrictions are being scrutinized more closely. With pay transparency guidelines on the books in states like California, New York, Colorado and Washington, salary ranges in job postings are mandated, and non-compliance can lead to fines and hit an employer’s reputation. For distributed teams, poorly classifying contractors, mishandling international hires or taking short cuts on employer-of-record can lead to liabilities that come to light in diligence.

What your hiring plan needs to show investors

From 645 Ventures’ perspective, solid hiring plans tie the number of heads to milestones with measurable results — revenue, activation, or product milestones — and a clear burn-multiple target. They’ll advocate for discipline around compensation bands with support from reputable market data (Compa, Pave, Radford are frequent benchmarks), a philosophy for location based pay, and a glide path for option pool top ups so ownership doesn’t get diluted unexpectedly two rounds later.

Anticipate investor advice on when to layer in senior hires vs. contractors, how to stage recruiting for go-to-market vs. product roles, and when to invest in in-house recruiting infrastructure. They’ll also seek a story about culture and retention — not perks, but machines like leveling frameworks, promotion cycles and equity refresh policies that keep feeding the engine.

Key takeaways attendees can apply today

Make your compensation philosophy explicit before you list any roles. Establish salary bands, equity bands and refresh guidelines at the same time, and socialize them with hiring managers to prevent one-off exceptions that escalate out of control.

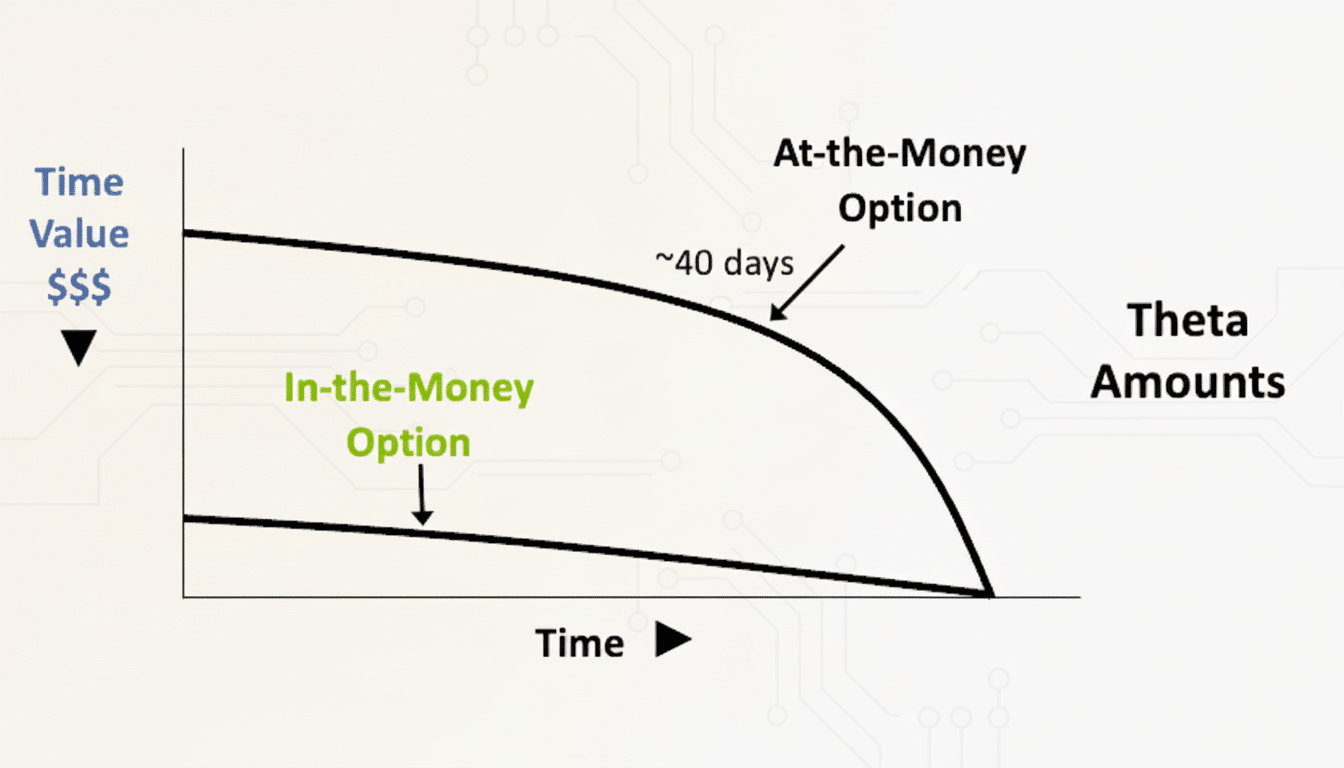

Model equity forward. Leverage cap table scenarios to model the effects of each round, pool expansion, and waves of hiring. Candidates care about the diluted outcome of what they achieved in realistic terms, not the headline grant numbers.

Design for liquidity and understanding. Explain vesting, tax consequences, and potential exit strategies in simple terms. Again — consider hosting employee education sessions with outside counsel or your equity platform to demystify options versus RSUs and the trade-offs of early exercise.

Tighten the legal stack. Get up-to-date 409A valuations, board-approved offers, IP assignments and compliant, transparent job postings that can be used for all regions in which you want to hire.

That’s why Disrupt 2025’s Builders Stage session called “Your Way Out of Expensive Startup Legal: Build Teams That Scale” featuring Pulley, 645 Ventures, and Epigram Legal will get into the nitty and gritty details that’ll make all the difference in whether or not a startup can scale its team without losing control of its cap table, culture, or compliance.

For founders and talent leaders, it’s timely, it’s practical, and it’s directly connected to the metrics that matter.