Two of China’s most closely watched autonomous driving companies, Pony.ai and WeRide, have won regulatory clearance to list in Hong Kong, a step that could broaden their investor base and raise liquidity as the commercialization of robotaxi services revs up.

Both companies, which announced the China Securities Regulatory Commission approval notices of their respective Hong Kong offerings in filings with the U.S. Securities and Exchange Commission, said they planned to sell no less than half the shares being offered in Hong Kong to retail investors there. The approvals remove a significant procedural barrier for each under China’s filing-based system for overseas listings and suggest that each is poised to move forward with a secondary listing (or dual primary listing) on the Stock Exchange of Hong Kong.

WeRide has appointed Morgan Stanley and China International Capital Corp. as advisers on a dual primary listing, Reuters reported, highlighting the fact that it seeks to have more than just a secondary line in Hong Kong’s stock market for technical reasons.

CSRC Greenlight Paves Way for Dual-Listing

The CSRC’s approval is within China’s new standardized overseas listing framework, which emphasizes transparency of ownership structures, data management and cybersecurity. For issuers already trading in the U.S., one path it creates is a secondary listing that follows down the U.S. line — or, for transactions without an apparent home, a dual primary listing that puts Hong Kong on the same footing as the other exchange.

Technology issuers may find dual primary listings appealing because the listings can enable index inclusion and access to Southbound Stock Connect, which brings mainland investor dollars into Hong Kong. Dozens of U.S.-listed Chinese firms have pursued secondary or dual listings in the city in recent years, looking to diversify their regulatory risks and secure more local financial sponsorship.

Why Hong Kong Matters For Robotaxi Players

For developers of autonomous vehicles, Hong Kong offers close proximity to core markets and a tradition of analyst coverage suited for China tech as well as a pool of investors who are versed in mobility platforms and smart-city infrastructure. And it’s also a hedge against changing geopolitical and audit-compliance dynamics in the U.S., where audit access has improved under ongoing oversight by the Public Company Accounting Oversight Board.

Most crucially, Hong Kong’s rulebook has been cut and sliced to suit high-growth but pre-profit “specialist technology” issuers. While Pony.ai and WeRide already generate revenue from pilot services and partnerships, the robotaxi unit economics are still in the early innings. By moving money from Hong Kong capital, high-compute training, safety validation and large-scale fleet deployment could be funded without the reliance on private rounds.

Business Footprints and Differentiation Details

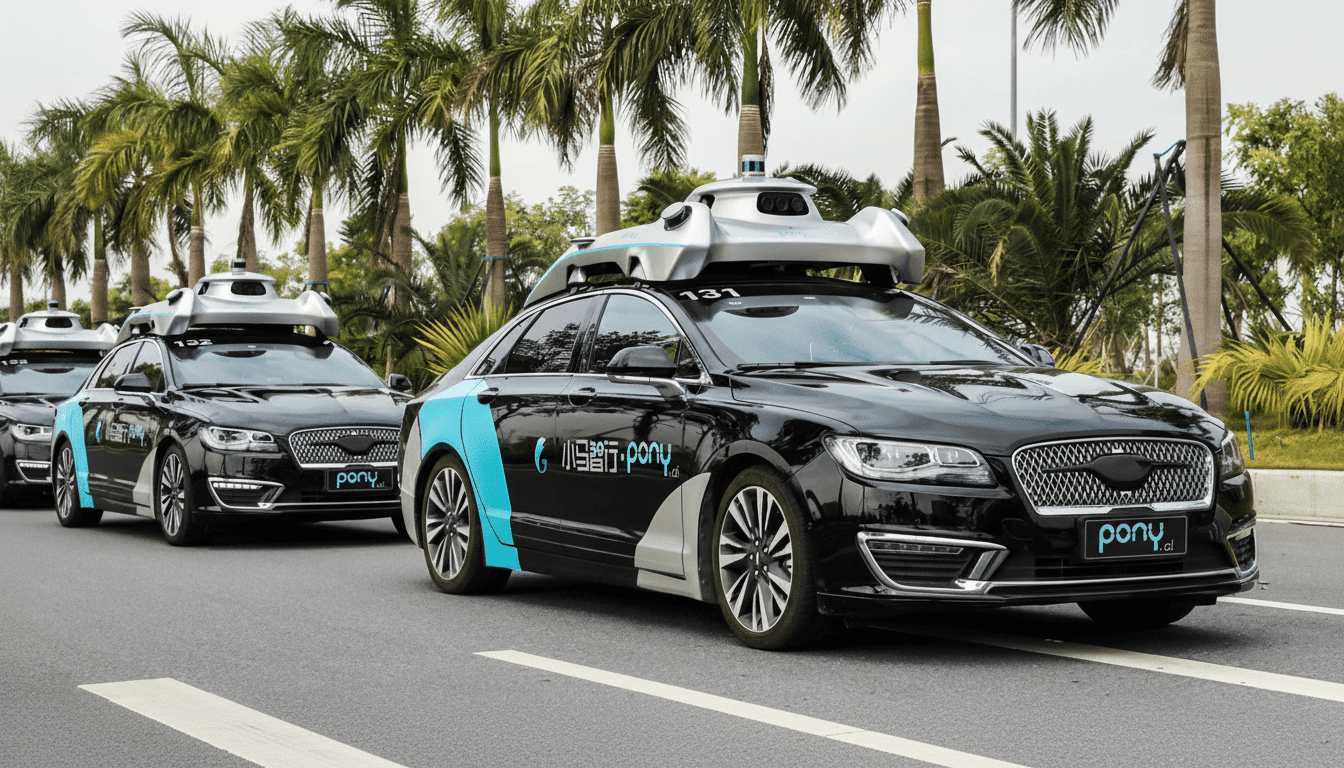

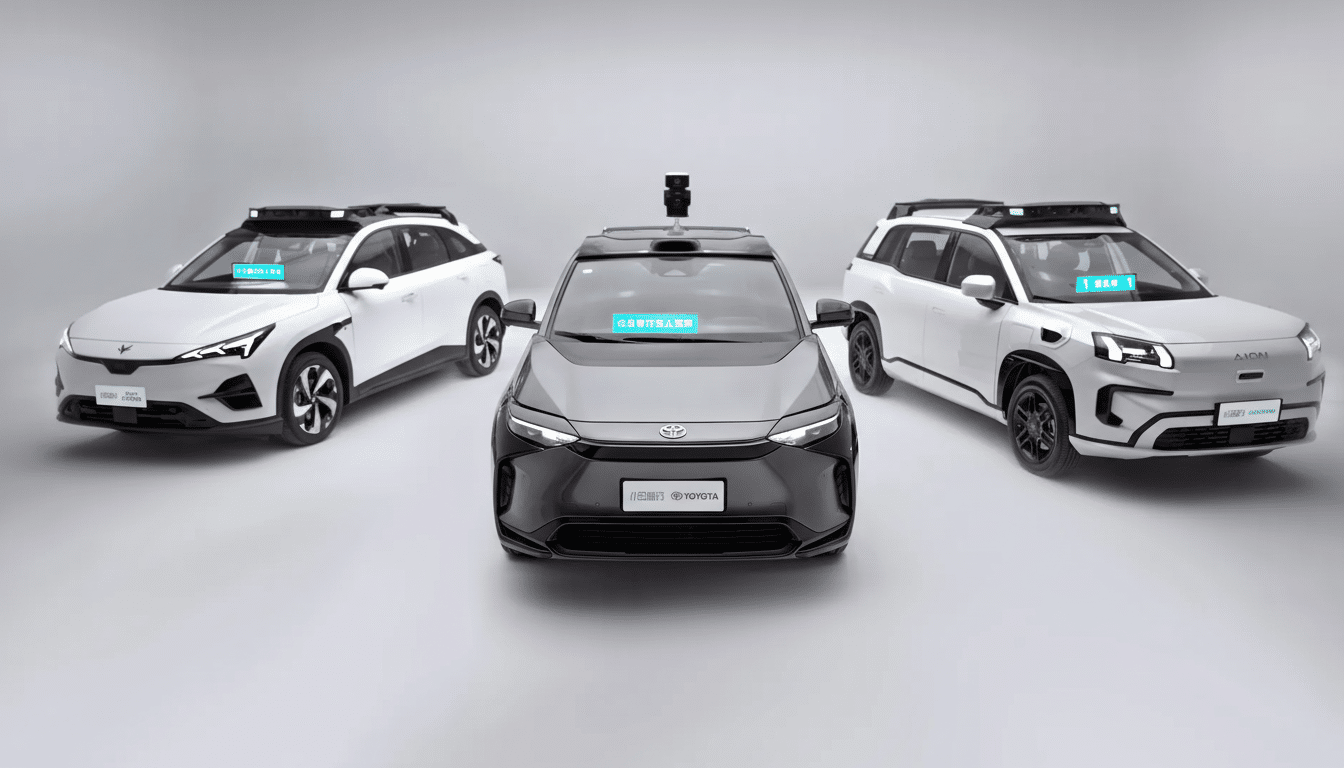

Pony.ai is running Level 4 robotaxi pilots in several Chinese cities and pursued autonomous trucking through a joint venture with Sany Heavy Industry, thereby playing on both the passenger and logistics sides of autonomy. It has been trialed in the United States, however, and its clinical experience is diverse across regulatory landscapes.

WeRide conducts commercial pilots for robotaxis, robobuses and autonomous street-cleaning vehicles, relying on manufacturing and deployment partnerships with partners such as Yutong for transit-scale platforms. The company’s multi-modal mission is to spread R&D costs across the same shared software stacks while reaching into different revenue pools in urban mobility.

Local authorities in Beijing as well as Guangzhou and Shenzhen have progressively expanded pilot zones for driverless rides and deliveries in specific areas, giving the green light to paid services. Local reports suggest millions of point-to-point (perhaps two million) miles across these zones, indicating increasing reliability in restricted geofences and forming a stronger regulatory and insurance safety case.

What Investors Should Watch in the Offering

The structure of deals will be crucial: whether companies choose secondary listings or a dual primary line can impact index eligibility, Southbound flows, and valuation dynamics relative to their U.S. shares. Likewise, investors will also take a close look at the size of the float and lock-up terms, as well as any weighted voting rights for governance.

Proceeds will probably go towards hiring, in addition to safety engineering, simulation and perception, onboard compute and the continued expansion of its fleet in approved cities. Amid export controls on more advanced chips, revelations about model training pipelines and hardware sourcing will be closely parsed for resilience.

Competitive and Policy Backdrop for Autonomous Tech

China’s autonomous driving sector is crowded with several high-profile players, including Baidu’s Apollo Go, AutoX and Didi Autonomous Driving. Policymaking persists, with phased deployment from safety drivers to fully driverless operation in geofenced zones, and new legal structures are emerging for liability, insurance and data security.

Industry analyses from consulting firms such as McKinsey and BloombergNEF project that robotaxis and autonomous shuttles could become a share of urban trips in the next decade — if safety metrics are met and cost per mile comes down. The arc benefits firms with deep war chests, good relations with municipalities and some kind of scalable partnership with OEMs and fleet operators.

Execution Risks Still Loom Over Commercial Rollout

Even with the wind at their backs in terms of regulation, that doesn’t necessarily translate to easy money. Sensor and compute costs, the risk of incident, and changes in regulations can swiftly alter deployment timelines. Cross-border data transfer requirements and cybersecurity audits also create additional challenges for businesses doing business in multiple jurisdictions.

All the same, the CSRC greenlight paves the way for Pony.ai and WeRide to woo Hong Kong investors and gauge public-market appetite for advanced autonomous systems. If the offerings land well, they might serve as bellwethers for how investors will value the transition from pilot programs to scaled, revenue-generating autonomous mobility networks in China.