A new reader poll points to a clear reality for foldable phones: interest is strong, but only when prices tumble well below flagship levels. Asked about picking up a discounted first‑gen Pixel Fold, respondents overwhelmingly favored the idea at around $560 — a steep markdown from its original $1,799 sticker — signaling that value, not bleeding‑edge bragging rights, is what moves the needle.

What the poll reveals about pricing and foldable demand

The largest group, 32.5%, said they would pay $560 and make the device their daily driver. Another 21.3% would scoop it up as a secondary phone or as a low‑risk way to try the form factor. A further 12.9% already own one. On the cautious side, 14.4% want the price to drop even further, while roughly 19% say they wouldn’t be tempted at any price point mentioned in the poll.

Add it up and about two‑thirds of respondents see the appeal when a book‑style foldable lands in the mid‑$500s — roughly 69% below MSRP. That’s a striking signal for a category still considered niche, and it suggests the biggest barrier remains economics, not curiosity or skepticism about the concept itself.

Why price remains the hurdle for mainstream adoption

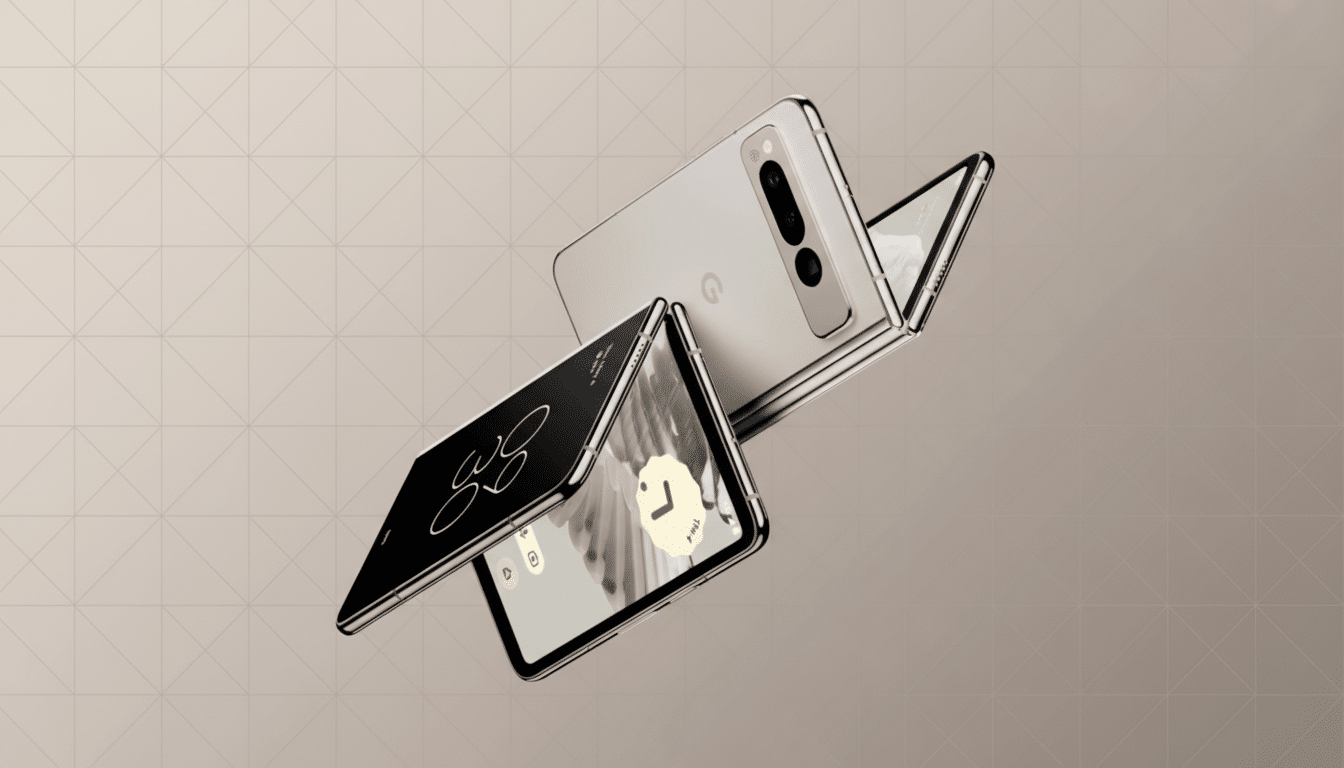

Foldables command high launch prices for good reasons: complex hinge systems, custom ultra‑thin glass, and yield‑sensitive inner displays all raise costs. First‑gen devices also invite durability worries — display creases, protector wear, and hinge longevity — and some users flag thermal behavior under sustained loads on earlier chips. Those trade‑offs are easier to accept when the entry price is hundreds lower than the latest slab flagships.

Analyst firms such as IDC and Counterpoint Research have noted steady foldable growth but also point out that mass adoption hinges on affordability. Clamshell models often outsell book‑style designs in several markets, not just for pocketability, but because they typically launch cheaper. Carrier subsidies and aggressive trade‑ins help, yet many consumers still balk at four‑figure totals. The poll’s $500–$600 comfort zone aligns with broader consumer research that consistently ranks price as the top purchase driver.

How discounts spark real‑world conversions for foldables

When the cost drops, behavior changes fast. Readers reported snapping up first‑gen book‑style foldables between roughly $379 and $480 in recent months, with one outlier deal as low as $320. Despite being a 2023 model, the Pixel Fold still delivers the essentials that make the category compelling: a roomy inner canvas for multitasking, capable cameras with strong computational processing, and water resistance that belies the moving parts.

At these prices, compromises feel acceptable. A visible crease becomes a quirk, not a deal‑breaker. The Tensor G2’s heat under heavy loads is an annoyance, not an indictment. Even long‑term wear concerns are easier to stomach when you’ve paid midrange money rather than top‑tier flagship rates. This echoes a broader trend in phones: last year’s model at the right discount can be the smarter buy.

Context from the wider market shaping foldable pricing

Major players are nudging toward affordability. Motorola’s recent clamshells have pushed sub‑$1,000 pricing, while Chinese brands have tested more attainable foldables in domestic markets. Book‑style models like the OnePlus Open and newer Galaxy Z Fold entries highlight thinner designs, brighter panels, and tougher hinges, but the price floor still sits high at launch. Until MSRPs fall, the demand curve will be dominated by refurbished, previous‑gen, and promotional deals.

It’s also telling that Apple remains on the sidelines. Without a cross‑ecosystem jolt to mainstream awareness, Android OEMs must do the heavy lifting: cutting component costs, scaling hinge and display production, and proving real‑world reliability. Independent lab testing and extended warranty options can further ease buyer anxiety, but nothing unlocks adoption like the right price.

Key takeaways for next‑gen foldables and pricing strategy

The poll’s message is unambiguous: shoppers are ready for foldables, just not at launch‑day premiums. A sweet spot appears to cluster around $500–$600 for book‑style devices, with many willing to experiment even lower. For manufacturers, that’s a roadmap — trim costs, broaden midrange options, and double down on durability. For buyers, the strategy is equally clear: watch for seasonal promos, carrier credits, and last‑gen models that still deliver the big‑screen experience at a fraction of the original price.

Foldables don’t need perfection to win over the mainstream. They need proof of value. This poll suggests that proof arrives the moment price and promise finally meet.