PayPal PayPal is making peer-to-peer payments more intuitive with the introduction of PayPal Links, a new way to send or request money through a one-time link that can be shared in texts, DMs, and email. The twist: the company says crypto is involved, with support for Bitcoin and Ethereum coming to PYUSD along side traditional balance and bank-funded transfers. It’s a cross-app approach designed to let payments follow your conversations, rather than cramming everyone into the same app or username system.

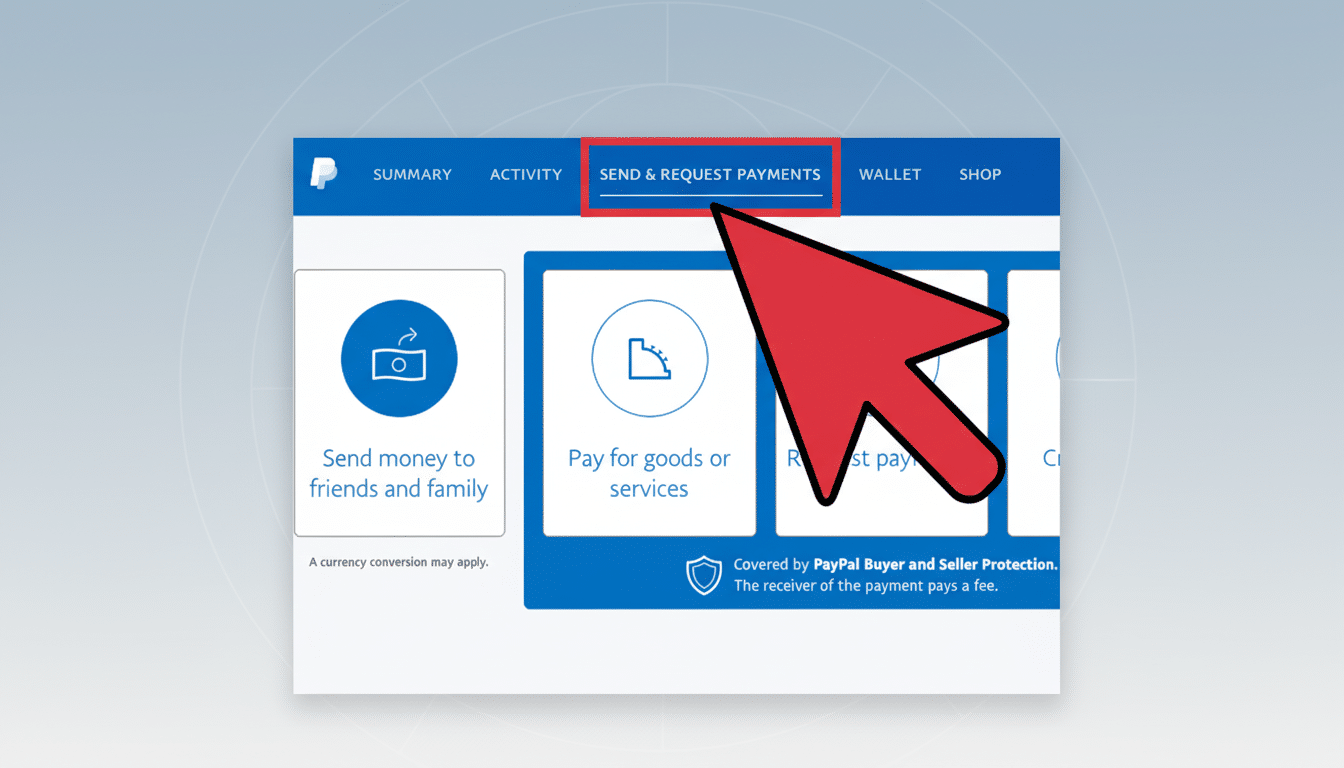

How the payments based on link function:

In the PayPal app, you select PayPal Links, type in an amount, optionally add a note or emoji and receive a special private link. Share it anywhere you chat. The recipient taps, clicks confirm and the money is in motion. Money goes to recipient’s PayPal account automatically, and one user even promised: “recipient gets it now.” What that really means in fine print is funds land within receiver’s PayPal balance instantaneously (yet still expect standardized account screening).

All links are single use, and will expire if not claimed to prevent hijacking or reused requests. If you don’t have any, the recipient is given an opportunity to create an account before they can complete the transaction -all under the umbrella of PayPal’s verified universe.

What’s different from Friends & Family, Venmo or Zelle

PayPal already provides Friends & Family and owns Venmo, but Links solve a separate friction point: moving your tipping from one app to another without asking users to “remember our username” or taking a picture of QR codes. Rather than wading through a social feed or depending on contact discovery, a single link sends and receives money over individuals who might not already be connected within an app.

PayPal says Links include no transaction fee and are not reported on a 1099-K because they are classified as non-commercial personal payments. That fits with the treatment of personal transfers more generally, although the IRS has separately indicated a phased approach to new 1099-K thresholds. In short: Transferring money to an individual by Link won’t automatically set in motion the issuance of tax forms — but using any P2P tool for business purposes is a different story, tax-wise.

For context, peer-to-peer apps are public currency: The Pew Research Center has found that about three-quarters of U.S. adults have used services such as PayPal, Venmo, Cash App or Zelle. The new features are PayPal’s effort to engage more of that everyday money movement — splitting the rent, dividing team dues or simply settling your share of travel costs — without jamming all parties into the same app interface at the same time.

Crypto adds dark new twist

For U.S. users, PayPal says links will support sending crypto to PayPal, Venmo and a list of external wallets — an easy way to send Bitcoin, Ethereum, PYUSD (Paxos) and everything else via crypto link transfer.

That builds onto top of PayPal’s existing crypto infrastructure and its U.S. dollar stablecoin, PYUSD, which is issued by Paxos Trust Company.

For many people, a link is also less intimidating than a blockchain address or QR code. The abstraction may push some more mainstream users to experiment with crypto transfers, especially since there’s a stablecoin option for those concerned about dollar fluctuations. Data collected by Chainalysis reports that stablecoins currently represent the greater part of all on-chain transaction volume, which is why a PayPal-native stablecoin is so significant for everyday transfer use cases.

Important caveats still exist: While PayPal can waive its own transaction fees for Links, users will still have to pay the networks’ gas or transaction fee and wait for their crypto send on a public blockchain to be confirmed. In-app transfers within PayPal should seem instantaneous, but settlement on public chains moves at the speed of their base chain.

Security, privacy, and limits

Private, single-use links can expire if not claimed, which reduces the risk of unintended forwarding or reuse. You can also remind or cancel early. Because the flow remains within PayPal accounts, transactions are protected by the company’s own identity checks, fraud monitoring and dispute resolution tooling. PayPal has also crowed about AI-enabled scam detection that can identify dodgy transactions before they go through.

That’s good general practice with any P2P tool, of course: Make sure you know who sent you a link, be suspicious of impersonation and maintain a healthy skepticism for odd requests. The Consumer Financial Protection Bureau has cautioned broadly that the protections may vary by app and situation, and even when safeguards are available, “when consumers authorize an electronic transfer of funds from their bank account,” it can be difficult to get their money back if a payment turns out to have been authorized but fraudulent.

PayPal says there is no transaction fee for Links. An additional charge can still apply for currency conversion, optional instant-out bank transfers or blockchain network fees on crypto. Availability and support of assets differ by region and compliance regulations.

Availability and why it matters

PayPal Links are live in the U.S., with plans to expand to other markets such as the UK and Italy. The tactic creates competing pressure on Zelle, Cash App and even merchant-focused “pay by link” tools via its consumer-first, cross-platform handoff that functions wherever people are already chatting.

If PayPal can succesfully build off of the crypto bit, Links could subtly standardize digital asset transfer like people divvy up a dinner bill — no wallet addresses, exchange screens or cryptic setups involved. It’s a mere UI gesture, yet one that may have far-reaching implications for the way money — and now crypto — flows among people.