Nuclearn raised $10.5 million in a Series A round of funding to scale up its artificial intelligence software across the global nuclear power sector, hoping to prove that smarter automation can shave hours off paperwork, sharpen maintenance decisions and keep gigawatts of carbon-free electricity online. Blue Bear Capital led the round, with AZ-VC, Nucleation Capital and SJF Ventures participating.

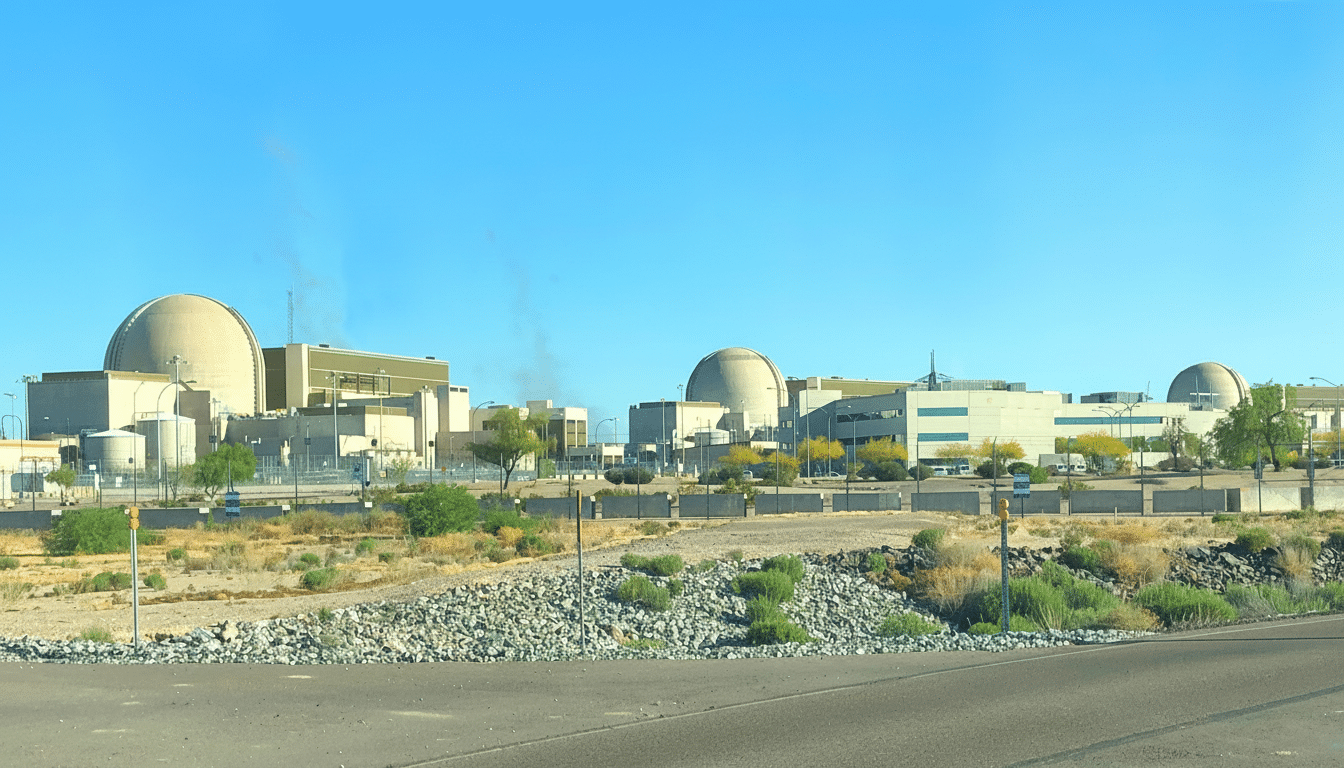

The company, which was founded by industry veterans who cut their teeth at the Palo Verde Nuclear Generating Station, says its tools are currently in use at more than 65 reactors around the world

The company’s pitch is broadly this: bring modern data science and domain-tuned AI to one of the most procedure-driven, highly regulated slices of the energy system — without making any compromises on safety.

Why nuclear wants AI today

The appetite for clean round-the-clock power is soaring as data centers, electric transportation and heavy industry seek low-carbon baseload. Big tech firms have signed supply deals with reactor operators and with advanced fission startups to guarantee themselves 24/7 electricity. At the same time, many current plants run far past 30 years, and for each hour that can be saved on paperwork, inspections, or outage preparations, it is one less hour needed to maintain and ensure reliability.

Some 440 reactors provide about 10% of worldwide electricity, according to the International Atomic Energy Agency, while U.S. units have consistently posted capacity factors of above 90%, according to the Nuclear Energy Institute. Small improvements can add up: An unscheduled shutdown of a big reactor can forfeit hundreds of thousands to over a million dollars a day worth of generation, depending on variation in the market such as spot prices.

What Nuclearn actually does

Nuclearn generates models that can understand nuclear related terminology, operations, as well as equipment organization and hierarchy.

The software streamlines the routine creation of work documents; corrective action drafts; procedure revisions; and, in a final step, hands off final approval to licensed employees. It also helps categorize condition reports, prioritizes maintenance tickets and draws conclusions from decades of plant records, technical specifications and vendor manuals.

It operates in the cloud for utilities that allow it, but can also be stood up on hardware sitting inside plant networks as needed to meet cybersecurity or export-control constraints. Many plant owners would prefer that so they could meet the desires of digital I&C guidance documents and AI gap environments.

One of the key features is adjustable automation. Operators establish guardrails to determine when the system automatically drafts or recommends or just organizes information for human review. If an output is not trusted or a task is not within the allowed scopes, the workflow is reverted to the original engineer or a supervisor. In reality, customers typically treat the software as a kind of junior analyst that speeds up the grunt work without shifting who is responsible.

Safety, compliance, and guardrails

Regulators are paying close attention but are not obstructing productivity tools. Today, the U.S. Nuclear Regulatory Commission treats most AI in plants as decision-support, rather than fully autonomous, with the licensed operator ultimately responsible for the decision to act upon the AI’s recommendations. That context is consistent with current QA standards, such as 10 CFR Part 50, Appendix B, with the mandate for traceability, verification, and auditable records.

Industry groups have been girding for more widespread use. Indeed, the Electric Power Research Institute has released guidance on AI validation and human factors, the IAEA has examined use cases from predictive maintenance to fuel inspection analytics. Nuclearn’s focus on provenance—taking down sources, model versions, reviewer sign-offs—addresses those requirements.

The numbers behind the business case

Plant staff devote great time to documentation and data gathering because nuclear work is inherently procedure-intensive. If AI can consistently do something like pre-fill forms, match up equipment identifications or surface the correct technical basis in seconds, the savings are multiplied thousands of times per month with the volume of labor. Reworks have an accumulated tangible effect on schedule risk reduction during short refueling outages with tight schedules and a high rate of coordinated work.

Outside of paperwork, utilities can realize value from condition-based maintenance and anomaly detection. Sensor trends, work history and operating experience can be linked to flag components that should be inspected before they fail. “While we’ve published EPRI case studies in conventional where these types of approaches have reduced maintenance costs and unplanned downtime, at Nuclearn we’re attempting to codify these benefits into a nuclear-ready, auditable workflow.

Investors and what’s next

Blue Bear Capital’s investment fits into its thesis on software that increases the productivity of assets in energy and infrastructure. Nucleation Capital is targeting innovations that speed nuclear deployment, and AZ-VC and SJF Ventures add a regional and climate-tech emphasis. The new capital will most likely be spent on expanding the model, adding features related to safety and compliance and deepening integrations into utilities’ document control and asset management systems.

Competition is looming as well-established suppliers test AI add-ons and national labs develop digital twins under U.S. Department of Energy programs. Yet nuclear operators tend to purchase that which has already proved itself at like-kind plants, and even with the vagueness about Nuclearn’s past, a claimed installed base covering more than 65 reactors gives it a credible reference base.

The point is not that AI will operate reactors; it is that well-governed software could put skilled people back in the loop by taking them off of low-value work and ensuring they make the best judgments when it counts. For a stressed fleet running right at the edge of ageing, adding capacity, and trying to service an evermore digital economy, that could well be the most pragmatic route to impact.