Nothing is preparing to raise prices on its next smartphones, and the company’s chief executive warns the broader industry may follow with hikes as high as 30%. The driver, he says, is not flashy new features but spiraling costs for memory chips that are becoming the most expensive line item in a phone’s bill of materials.

Why Memory Is Driving Phone Prices Higher

CEO Carl Pei outlined the pressures in a LinkedIn post, saying memory prices in some cases have already tripled and could climb further as demand outstrips supply. The surge is tied to an AI-fueled scramble for DRAM and NAND, with chipmakers prioritizing lucrative high-bandwidth products for data centers and reallocating capacity away from commodity mobile parts.

Pei noted that memory, historically a supporting cost behind the processor and cameras, is on track to become the single biggest component in many phones. He cited estimates that modules which recently cost under $20 could now top $100 in premium configurations. That kind of swing can overwhelm the slim margins midrange devices typically rely on.

Independent trackers echo the volatility. TrendForce has flagged sharp week-over-week spikes in DRAM module pricing, including a recent double-digit jump, as supply tightens. Industry teardowns from firms like TechInsights have traditionally put memory at roughly 10–15% of a flagship’s bill of materials; if current pricing holds, that share could eclipse the processor for some models.

Nothing’s Strategy Versus The Big Three.

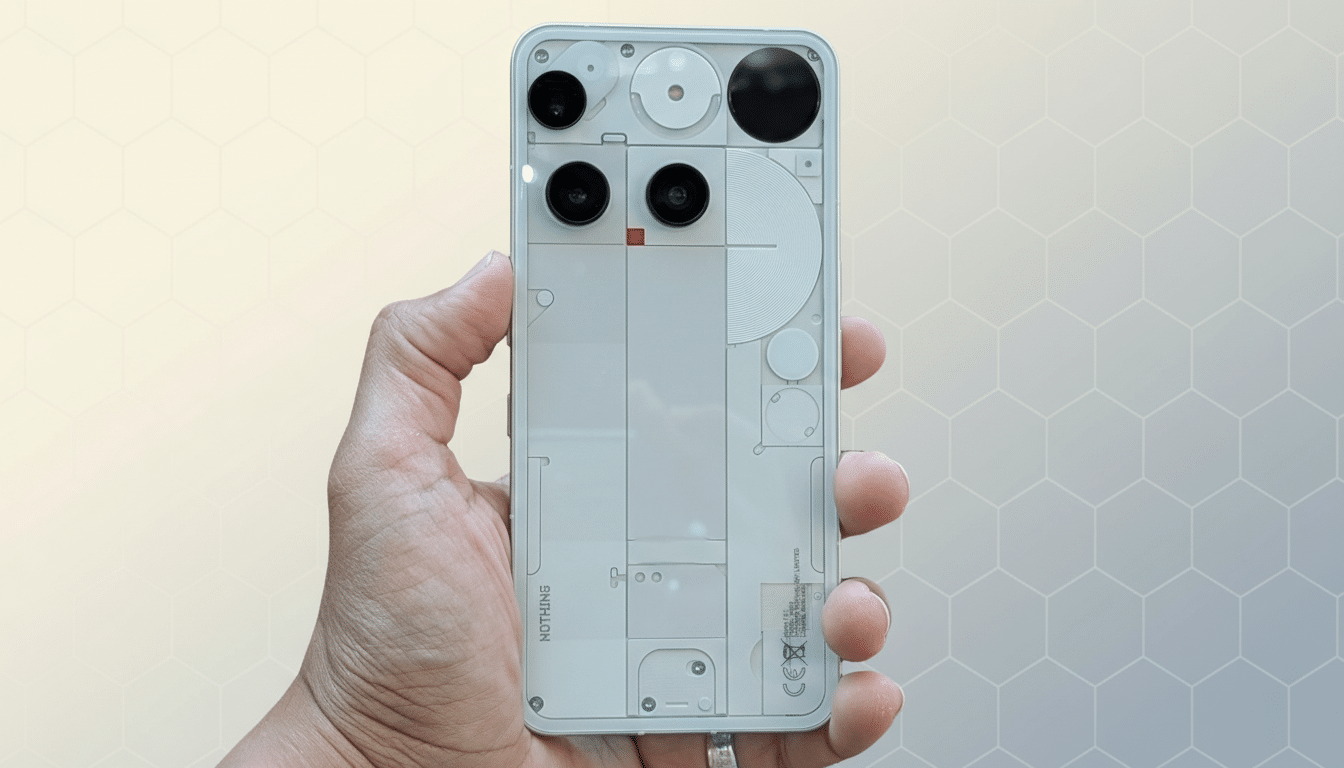

Pei said Nothing’s upcoming phones will “inevitably” cost more than prior generations. One factor: the lower-cost line is slated to adopt UFS 3.1 storage for the first time in the series, a meaningful performance upgrade that also lifts component costs. The company argues it will continue to compete on user experience rather than chasing headline specs at any price.

Larger rivals such as Apple, Samsung, and Google have more leverage with suppliers and broader scale to spread costs, but Pei expects them to either lift prices or trim spec upgrades to stay within budget. Practical options include:

- holding the line on base storage

- reducing RAM in entry trims

- offsetting increases through carrier subsidies and aggressive trade-in promotions

For Nothing, a younger brand without the same volume discounts, the choice is starker: raise prices to maintain performance targets or risk a product that feels compromised. The company appears intent on the former, betting that customers will pay a bit more if the device still feels fast, polished, and thoughtfully designed.

Signals From The Broader Market On Pricing Pressures

Nothing isn’t the only manufacturer signaling turbulence. A senior Samsung executive recently acknowledged that memory constraints will have an “inevitable” impact on pricing, underscoring how widespread the issue has become. Outside phones, Framework raised the price of one of its desktop systems by $500 as memory costs climbed, a concrete example of the pressure hitting consumer hardware.

This isn’t the first memory upcycle the industry has seen—2017 and 2018 brought similar headaches—but analysts say the current spike is different. Demand from AI servers is soaking up supply at unprecedented scale, while on-device AI features are nudging smartphone makers to increase RAM and storage footprints. That one-two punch both drives up component prices and makes it tougher to dial specs back without compromising the experience.

What Buyers Should Expect Next Amid Memory Squeeze

Shoppers should prepare for a few patterns.

- Sticker prices may edge upward, particularly on higher-capacity configurations.

- Midrange phones could see smaller year-over-year spec jumps, as brands hold base storage steady or trim bundled extras to keep entry prices palatable.

- Promotions, trade-ins, and carrier financing will likely do more of the heavy lifting to mask rising costs at checkout.

It’s also possible that regional pricing will vary more than usual if suppliers prioritize certain markets. If you’re due for an upgrade, watch for early-bird preorders, trade-in credits, and seasonal sales—they’ll matter more in a tight supply environment. And if you’re choosing between models, consider the total cost of ownership: a phone with faster storage and more RAM may stay responsive longer, even if it costs more upfront.

The bottom line from Nothing’s warning is clear: memory has become the swing factor in smartphone economics. Until supply normalizes, expect manufacturers to either charge more, ship leaner specs, or both. For buyers, that makes timing, configuration choices, and incentives more important than ever.