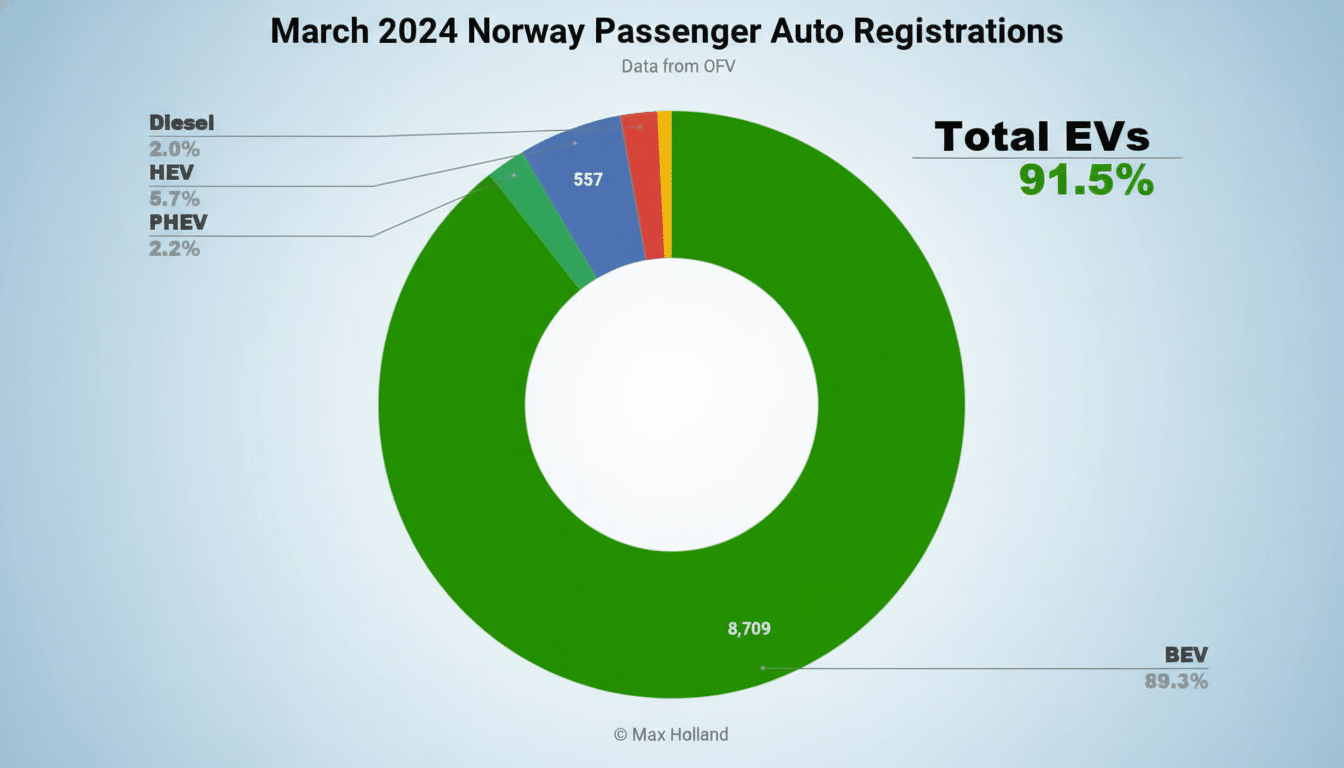

Norway has taken electric vehicles from niche to norm. New information from the Norwegian Road Federation (OFV) demonstrates that battery electric cars dominated the new car market in 2025 at 95.9%, and in December nudged to a remarkable 98%. That headline number is eye-catching, but the real story here is a multi-layered policy and market strategy that goes far beyond tax credits.

A Market Remade by Car Taxes, Fees, and Perks

Norway has deployed a durable combination that offers incentives for EVs and targeted fees for internal-combustion vehicles. It’s not just that electric models escape or are subject to lower fees: Conventional vehicles also pay carbon-dioxide and weight-based taxes that significantly inflate sticker prices. The Norwegian EV Association has said in interviews with Reuters that there is almost no competition for gasoline and diesel cars due to this fact.

Key policies did the heavy lifting: years of VAT exemptions for EVs (now phased in, partly, above a price cap), and reductions in one-time registration taxes and discounts on road tolls and ferries. Incentives like access to bus lanes and the use of the world’s biggest fleet of electric taxis were tolerated early on, in a period that has since been clamped down. The combined result has long since transformed the total cost-of-ownership calculus in favor of EVs, though certain advantages are already being dialed back.

These incentives were, crucially, predictable, which is not only what made them a powerful force in the U.S. market for nearly two decades but also allowed them to endure long enough to shift consumer behavior and automaker decision-making. With the state economy bolstered by oil—and as one of many markets learning a thing or two about policy steadiness (see the International Trade Administration and national transport plans)—the agencies kept things largely as they were.

Supply-Side Matters: Chinese EVs and Market Competition

Compellingly priced choice is the other element of Norway’s formula. OFV numbers show Chinese marques are hitting a combined 13.7% in 2025, up from 10.4% a year ago—adding pressure on traditional OEMs to consider how they can match value for money, too. BYD has swooped across the globe, but Norway’s number-one bestseller last year was the Tesla Model Y — in 2025. Tesla was also the highest overall market leader with a 19.1% brand share, followed by Volkswagen at 13.3%, and Volvo at 7.8%.

That mix reinforces a dynamic, competitive field: premium crossovers, sensible family cars, and lower-priced entrants all have an opportunity to take first place. Unlike in markets where tariffs, eligibility rules, or supply constraints restrict models on the lot — and where there are rather fewer EVs for sale than elsewhere — Norwegian buyers have a wider spread of EVs across segments and budgets.

Infrastructure Removes Friction for Everyday EV Use

Infrastructure is the point where adoption hopes often founder — except in Norway. The country now has over 28,000 public charging points, and the city of Oslo is one of those with the highest density in Europe — currently home to 10,247 chargers alone, according to Bloomberg. High-powered corridors minimize the wait and anxiety of long-haul travel, often with dozens of stalls per station. Towns and retailers have also maintained charging costs at low or even no cost in the case of some locations, thus reducing running costs further.

And equally important, home charging is pervasive, meaning daily driving is not a hassle for the vast majority of homeowners. The lesson is easy to state: when refueling becomes convenient enough, fast enough — especially in a cold, mountainous country like Norway — the consumer stops treating EVs as an experiment and starts treating them as the default.

Energy Mix and Building Trust Among Norwegian Consumers

Credibility is added to the climate case by Norway’s predominantly hydropower-based grid. Charging is not only less expensive than refueling with gasoline in the majority of instances, it’s also much cleaner. That personal-savings–public-benefit alignment is a powerful adoption flywheel, fueled further by unrelenting messaging from officials and consumer organizations.

Cold-weather performance, a lingering concern, has also been stress-tested. Faster heat pumps have helped: On-the-road winter range tests by the Norwegian Automobile Federation have demonstrated that today’s all-electric cars are reducing the difference between rated and real-world (winter) mileage, as advances in heat-pump tech and thermal management tools trickle down to mainstream models. Confidence comes with repetition; after a few model cycles, buyers see predictability.

Lessons and Practical Limits for Other Global Markets

Norway’s 96 percent benchmark is not just a product of tax credits. It’s the result of a long-lived policy stack — carrots and sticks — together with plenty of model choice, numerous infrastructure options, and a clean, inexpensive source of electricity. OFV’s 2025 numbers reveal solid adoption even as some incentives were wound down, indicating that the market has reached a critical mass.

Reproducing this playbook elsewhere involves forgoing one-off inducements in favor of clear and consistent long-term rules that make the economics of EVs simply superior. It means treating supply constraints and charger reliability with the same urgency as consumer rebates. Not every country is Norway; not everyone has Norway’s grid mix or fiscal wherewithal, but the strategic sequence — price signals, product availability, and frictionless charging — translates. The proof is in the showroom figures in Norway.