Northwood Space has notched a pivotal double win, closing a $100 million Series B and landing a $49.8 million contract with the United States Space Force to modernize the government’s Satellite Control Network. The El Segundo company, led by CEO Bridgit Mendler, is positioning its ground-communications platform as a faster, more flexible alternative to legacy dish-based systems as satellite traffic surges.

New Capital To Scale A Crowded Ground Segment

The round, led by Washington Harbour Partners with co-lead participation from Andreessen Horowitz, arrives less than a year after a $30 million Series A—an unusually quick follow-on that underscores accelerating demand for ground connectivity. Venture interest in dual-use and space infrastructure has been building as commercial and government operators race to support larger constellations and higher data rates.

The funding is aimed squarely at production capacity and network expansion. Mendler has described a growing pipeline of operators who need turnkey ground solutions, often as they scale from a handful of spacecraft to dozens. That pain point is real: the number of active satellites has climbed into the thousands, according to the Union of Concerned Scientists’ database, and firms like Euroconsult project tens of thousands more over the next decade.

Ground infrastructure has not kept pace. The Satellite Industry Association has repeatedly noted that ground equipment represents the industry’s largest revenue segment, yet availability and scheduling remain tight for many operators that lack their own networks. Northwood’s bet is that modern, software-defined, phased-array systems can absorb the demand without the costly footprint of traditional dishes.

A Strategic Win With The U.S. Space Force

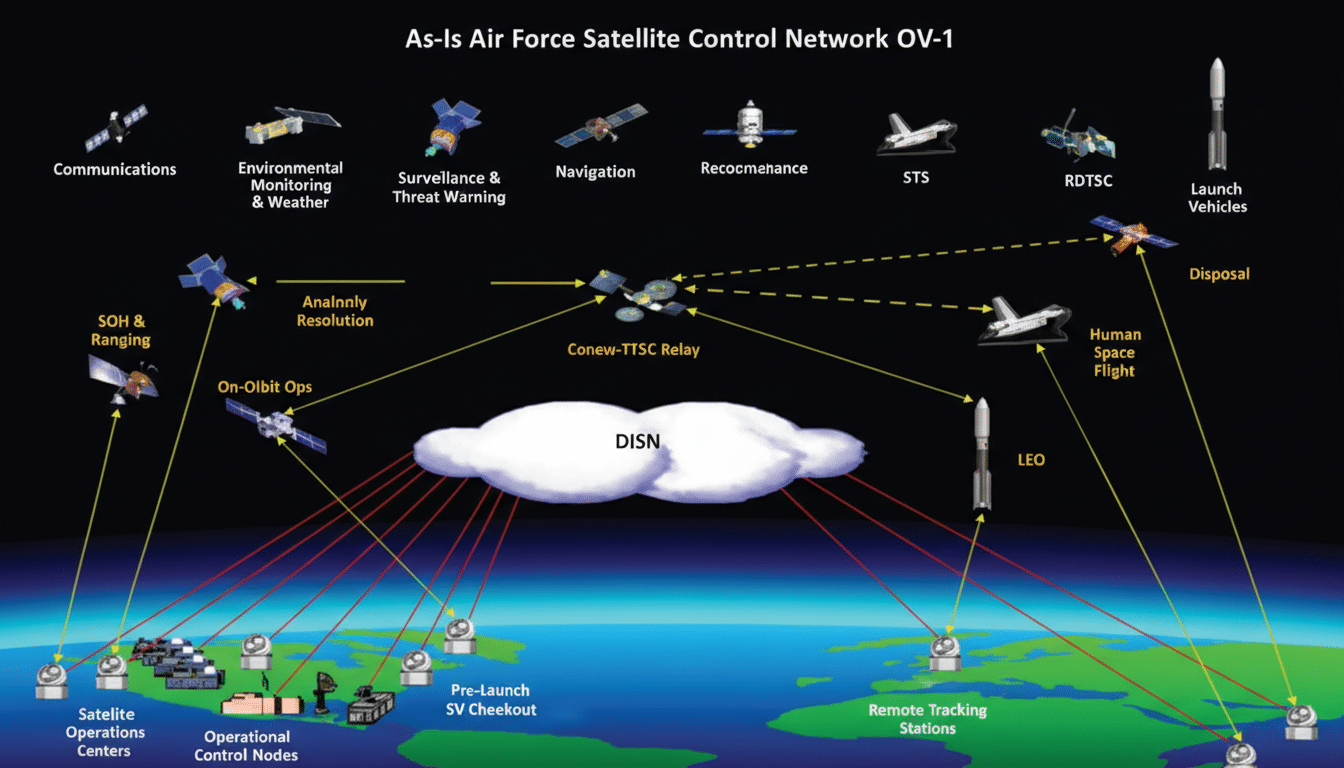

The Space Force award focuses on upgrades to the Satellite Control Network (SCN), the global backbone that tracks and commands government spacecraft, including GPS. The Government Accountability Office has warned for years about SCN congestion and aging infrastructure, noting persistent capacity shortfalls as far back as 2011. Addressing that bottleneck is a high-stakes mission for Space Systems Command, which oversees the network.

Modernization likely centers on boosting link availability, resiliency, and automation—areas where electronically steerable arrays can shine. Unlike fixed, single-beam dishes, phased arrays can repoint in milliseconds, handle multiple simultaneous connections, and reduce mechanical wear. For military users, that also means faster recovery from outages and greater flexibility in contested or congested spectrum.

Inside Northwood’s Ground Architecture And Portal Sites

Northwood builds smaller, modular “portal” sites that integrate phased-array antennas, RF front ends, and control software under one roof. The vertically integrated approach—hardware through orchestration—compresses deployment timelines and centralizes upgrades. CTO Griffin Cleverly has said current sites can support eight simultaneous satellite links, with next-gen stations targeting 10 to 12 by 2027 and network-scale capacity reaching into the hundreds of concurrent spacecraft.

That profile resonates with constellation operators who need predictable access but can’t justify proprietary ground stations. Giants like SpaceX and Amazon have built extensive in-house ground networks for Starlink and Project Kuiper, respectively. Everyone else largely relies on third-party providers such as KSAT, Viasat, AWS Ground Station, Microsoft Azure Orbital, SSC, and RBC Signals—services that can be capacity-constrained at peak demand. Northwood is carving out a lane by offering high-density sites with software-driven scheduling and multi-mission support.

Why This Matters To The Space Economy Now

As launch costs fall and on-orbit assets multiply, the ground segment is becoming the rate-limiter for everything from Earth observation to IoT to broadband. Latency, contact windows, and data backhaul can determine whether a mission meets service-level agreements. With more satellites pushing more data, ground stations need more beams, more bandwidth agility, and tighter integration with cloud workflows.

The Space Force’s selection signals that these capabilities aren’t just nice-to-have for commercial customers; they are quickly becoming mission-critical for national security. It also validates a broader industry shift away from bespoke, hardware-first ground systems toward software-centric networks that can be updated and reconfigured as orbits, payloads, and threats evolve.

What To Watch Next For Northwood Space And SCN Upgrades

Execution now becomes the story. Scaling phased-array production, qualifying hardware for government networks, and securing global site access are nontrivial tasks. Expect milestones around new portal deployments, multi-beam performance in operational settings, and deeper integration with cloud and mission-planning tools.

If Northwood hits its manufacturing targets and the SCN upgrades deliver measurable availability gains, the company will be well placed to win follow-on government work and expand commercial bookings. In a market where satellite numbers keep climbing and minutes matter, a more elastic ground layer could be the competitive edge operators are willing to pay for.