Nexus Venture Partners is wielding a scalpel in the midst of the AI gold rush, setting aside around half of its new $700 million fund for India-focused investments, even as it continues to support AI wagers from its cross-border nest. It’s an intentionally bifurcated bet, one that rests on the company’s American–Indian foundations and seeks to offset potential upside in AI infrastructure and applications against how deeply India will become a consumer, fintech, and digital-infrastructure giant.

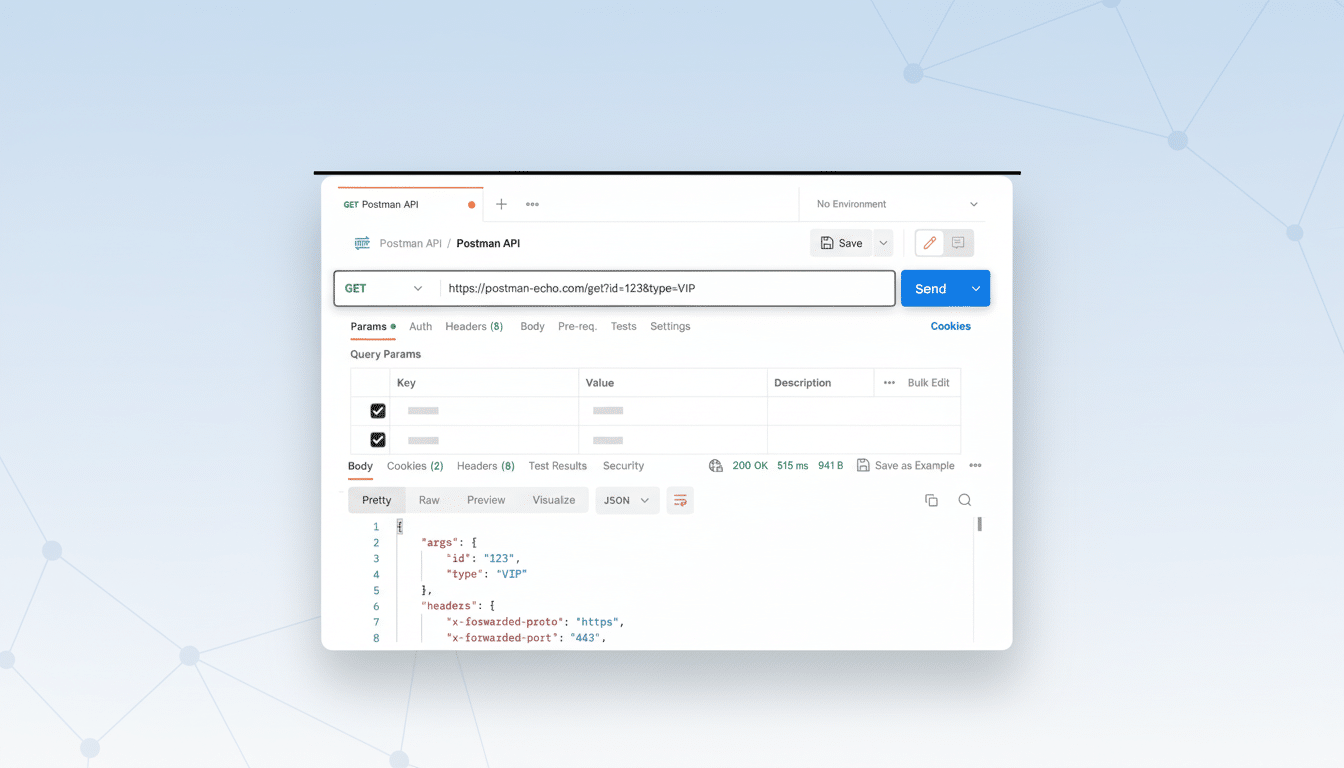

The 20-year-old firm has about $3.2 billion under management across funds and has invested in over 130 companies with more than 30 exits, including public offerings. Nexus has always functioned as a single, integrated fund and team across Menlo Park, Mumbai and Bengaluru — backing early-stage software around the world but also India-centric companies out of that same pool of capital. Its portfolio runs the gamut of developer platforms and AI infrastructure in the U.S. (Postman, Apollo, MinIO, Giga, Firecrawl) to breakout India brands in rapid commerce, logistics, insuretech, and construction supply (Zepto, Delhivery, Rapido, Turtlemint, Infra.Market).

A Barbell Approach For An AI-Polluted Market

AI is sucking up an outsized proportion of venture dollars globally, and few dispute that it’s a generational platform shift. But crowding into one hot category can exaggerate timing and valuation risk. In a sea of conflicting interests and usually unreliable sources, for once, one voice emerges — that coming from the offices of Nexus, which is going with a barbell: stay true to AI — in relation to infrastructure, agents, and developer tooling — while keeping 50% toward India, where adoption curves are sharp and category diversity tempers cyclicality.

The firm’s AI playbook calls out pragmatic layers that lower the cost to build and run models, open-source leverage, and bottoms-up adoption by engineers. Its history in developer ecosystems provides it with a view on where value accrues — data pipelines, vector databases, model serving, observability, and agent frameworks — versus areas where margins compress to industry averages as competition normalizes.

Betting On India’s Digital Flywheel And Public Rails

India is the counterweight. Half a billion internet users and globally leading Digital Public Infrastructure — Aadhaar (identity), UPI (instant payments), Account Aggregator (consented data flows) — are rails on which startups can scale faster and cheaper. According to NPCI figures, UPI crossed 100 billion transactions in 2023, shunting through several trillion dollars of value each year — a platform that much of the rest of fintech and commerce in the nation is built upon.

Atop these rails, the pace of AI adoption is accelerating. The government’s IndiaAI mission, together with a multibillion-rupee rush for compute and datasets, reflects momentum on sovereign AI, data governance, and multilingual models for India’s myriad languages. Nexus points to its portfolio as evidence: Zepto weaves AI throughout routing, fulfillment, and support to tune up unit economics; infrastructure players such as Neysa are appearing to cover local (and sovereign) AI workloads.

The timing lines up with the funding cycle, too. India’s early-stage deal activity has held its ground by volume despite the late-stage capital reset over the last two years, as per IVCA–EY analysis. That would benefit a shop built for the early-stage discipline of company-building in categories like logistics, insuretech, healthcare delivery, and digital infrastructure — where AI can bring step-change efficiency rather than hype-driven growth curves.

Discipline Over Size And Cadence Of The New Fund

Instead of scaling into a mega-fund, Nexus is sticking to keeping the new vehicle at $700 million — the size of its previous fund. The firm tends to raise a fund every 2.5 to three years and functions with an eight-member investment team, a structure meant in part to keep partnership bandwidth in sync with its early-stage work. The capital pool is mostly re-ups from a global LP list covering the U.S., Europe, the Middle East, Southeast Asia, and Japan — which suggests that realized returns across multiple funds are blowing through all kinds of benchmarks.

Size restraint is the issue of the day in today’s AI cycle. Compute-heavy approaches require huge follow-on capital and simply concentrate all the risk into a very small number of foundation-model winners. Nexus’s strategy — backing enabling infrastructure, agent tooling, and application-layer edge cases where proprietary data or distribution confers defensibility — pairs with India bets where operational AI embeds directly into P&L, not just demos.

What Founders Should Expect From Nexus’s Latest Strategy

AI builders should anticipate that Nexus will favor a developer-first go-to-market, cross-border customer acquisition, and partnerships that fold compute, serving costs, and cloud into one. The company’s experience with tools such as Postman and MinIO indicates a bias toward products that capture mindshare with engineers and turn usage into durable revenue.

And India-focused founders should look for an investor fluent in the country’s regulatory, payments, and logistics systems — and increasingly insistent on AI-native operations — whether that be demand forecasting in commerce, fraud models in fintech, or multilingual support at scale. The lesson is obvious: show actual efficiency gains plus defensibility, not just model wrappers.

In a year in which many firms are pivoting to AI-only theses, Nexus is betting that balance will beat bravado. Half the fund is targeting AI’s compounding infrastructure; the other half surfs India’s growing digital economy. And if the cycle turns — as all cycles do — this divide could appear less like hedging than sheer advantage.