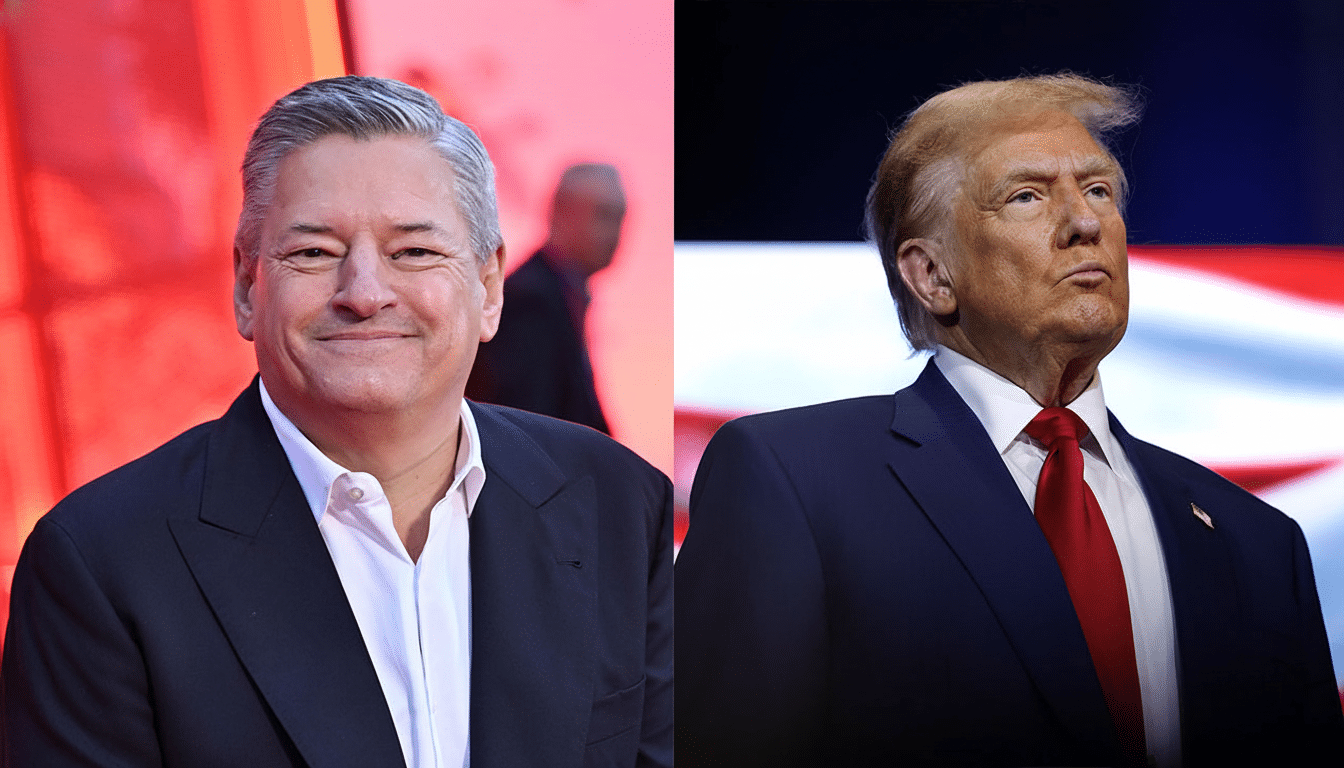

Netflix co-CEO Ted Sarandos jetted to meet President Donald Trump at the White House as part of a lobbying quest on behalf of the streamer’s bid for Warner Bros., Bloomberg and The Hollywood Reporter broke Wednesday, which introduces a political subplot into what would be one of the largest entertainment deals in years. The discussions occurred as Netflix became the top bidder among a crowded field of bidders vying for the studio, and Sarandos left the meeting presuming that the administration would not initially oppose such a deal.

What Sarandos wanted from Washington on antitrust

For Netflix, the math is simple: a proposed $82.7 billion purchase of Warner Bros. will rise or fall on antitrust scrutiny. Working early with the White House serves as a move to test the waters and tamp down headline risk ahead of formal filings at the Justice Department. The rumored Trump directive suggested that the administration might be leaning toward an argument of market price, as opposed to a structural presumption against consolidation.

- What Sarandos wanted from Washington on antitrust

- Inside Warner Bros. talks and a shifting bidding field

- What regulators will scrutinize in a Netflix–Warner Bros. deal

- Industry impact if the Netflix–Warner Bros. deal goes through

- The Paramount wild card in the bidding and next steps

- What to watch next as antitrust reviews get underway

That position would represent a major turnabout from the last major Trump-era media fight, when the DOJ sued to block AT&T’s acquisition of Time Warner. That case eventually dissolved following an ugly court fight, but it established the principle that political gales can batter even sophisticated media mixes. Sarandos’ charm tends to indicate that Netflix wants no surprises this time.

Inside Warner Bros. talks and a shifting bidding field

Warner Bros. Discovery chief David Zaslav was initially averse to selling and taken aback when Paramount started investigating a bid, Bloomberg said. Internally, Warner Bros. had been considering a split that would detach its film and streaming assets from legacy cable networks — a maneuver meant to prove value and streamline an eventual sale. Instead, the company left the door open for several suitors and kicked off a competitive process that Netflix reportedly won. Paramount-backed interests remain free to come back in with a more hostile approach, leaving the target still in play.

If consummated, Netflix’s proposal would rank as the biggest media deal since Disney spent $71.3 billion in 2019 to acquire most of 21st Century Fox — a stark reminder of just how much the entertainment business has consolidated over the past decade.

It would come on the heels of WarnerMedia’s $43 billion combination with Discovery that formed the current iteration of the Warner Bros. Discovery entity.

What regulators will scrutinize in a Netflix–Warner Bros. deal

The combined company combines Netflix’s unrivaled direct-to-consumer platform with one of the industry’s most storied content factories in Hollywood. And that opens up some good old-fashioned horizontal and vertical questions: Would Netflix owning Warner Bros. limit licensing possibilities for rivals, soften bargaining leverage for producers and talent, or tip theatrical and premium TV windows in favor of a single ecosystem?

You can expect the DOJ to look into market implications at a number of levels: premium scripted television (HBO and HBO Max originals), tentpole film franchises (DC, Dune, Mad Max), children’s programming (Cartoon Network properties), and library licensing. Monopsony fears — of a single buyer being able to exert too much leverage over creators — will loom large, especially after a year in which guilds brought economic issues to the fore.

There would be global regulators on the case, too. In the United States, Netflix has been at about 8 percent of total TV time, according to Nielsen’s The Gauge snapshots in 2024, but its share is much higher within streaming. The company ended 2024 with nearly 270 million members around the world and logged billions in free cash flow annually, providing it enough balance sheet to swallow a hefty integration. Warner Bros. Discovery’s debt load has room to be refinanced at significantly lower rates, boosting cash flow if an acquirer can get the cost from north of 10 percent closer to 7 or 8, though that process will need to be accelerated.

Industry impact if the Netflix–Warner Bros. deal goes through

A Netflix–Warner Bros. tie-up would overnight redraw competitive lines. Netflix would bring a deep slate of theatrical franchises and prestige TV to an offering already known for beating competitors on global reach and data-driven programming. The external pulley of HBO’s pipeline — Warner Bros. Pictures, New Line, and DC — might switch up release plans, while Netflix could toggle between theaters and streaming according to ROI rather than third-party deals.

The threat for competitors, in other words, is two-part: fewer premium titles to license and an even tougher battle to distinguish services stripped of Warner-caliber IP. Services like Amazon and Apple can afford to bankroll originals — but library depth and existing franchises factor heavily in outsized subscriber acquisition and retention. Meanwhile, linear networks — which are already pinched by cord-cutting — would suffer even more marquee rerun and movie scarcity if windows compress.

The Paramount wild card in the bidding and next steps

The early rounds of the auction featured some drama, with rumors surfacing in February that bidders with ties to the current administration were emboldened and started declaring their interest in the company. Even with Netflix’s apparent win in the first round, a hostile bid would also potentially disturb timelines on when it could close and muddy regulatory narratives — along with how much of an ultimate price a bidder might have to offer. If Warner Bros. revives the effort to hive studios and streaming off from cable networks, both Netflix and any rival bidder may prefer a cleaner asset, but that would also prolong uncertainty.

What to watch next as antitrust reviews get underway

Formal antitrust filings and the tenor of early agency meetings will dictate the momentum. Read the tea leaves on possible remedies — like licensing commitments or targeted divestitures — that could alleviate concerns without eviscerating the logic behind a deal. Also keep an eye on public positioning by guilds, major talent agencies and rival streamers, whose remarks help form the story line that regulators internalize.

And the headline remains unchanged: What Sarandos’ reported meeting with Trump makes overwhelmingly clear here is just how closely intertwined the business and political tracks are on this deal. At an $82.7 billion price tag, a deep library on the line and with consolidation in mind, every conversation in Washington has the potential to change that ending.