Navan’s public debut concluded on an anticlimactic note, with pricing that slated shares of the corporate travel and expense platform to close at a 20% “discount” to the $25 offer price, implying a market value of just under $4.7 billion. That was fitting, in a way: Navan was the first company to test out a unique Securities and Exchange Commission shutdown workaround that allows offerings to go effective automatically without the agency’s final green light.

How Navan used the SEC shutdown automatic effectiveness workaround

There’s an existing contingency mechanism attached to the automatic effectiveness provisions of the Securities Act: An issuer that files its price range in public can allow its registration to become effective after a waiting period without an actual acceleration order from the SEC. During normal operations, the SEC’s Division of Corporation Finance reviews the filing and clears it prior to pricing. But the SEC staff can’t provide such final approvals during a shutdown, so the automatic path creates a narrow window for offerings to continue.

The trade-off is a regulatory overhang. The Commission can check the documents afterward. If its staff identifies material deficiencies or omissions, the issuer may need to correct its filings; that might pressure the stock’s trading price or even result in post-IPO litigation. Navan did its best to clean up as much as possible beforehand; the company disclosures suggest it went into the window after extensive back-and-forth with staff earlier in the process. Investors still priced in some uncertainty:

Investor response, pricing dynamics, and valuation context

Bankers and capital markets lawyers commonly described the automatic route as a back-pocket solution or a rule-of-thumb playbook. However, in fact, the automatic route largely re-risks timing from the regulator’s calendar onto the issuer’s cost of capital, and dares to test investors’ appetite for freshly marketed names amid a delicate risk-off scenario. A 20% breakpoint on day one is a brutal statement.

Based on reported last 12 months’ revenue of $613 million, the market cap at close suggests a price-to-sales multiple of around 7.7x – directly in the median to upper band for growth software and fintech-adjacent platforms, albeit below the large premium earlier credited to high-growth travel tech. It also represents a firm reset from private valuations: the firm, previously TripActions, was valued at $9.2 billion in late-stage financing, and floated a public debut approximately valued at $12 billion at one point, according to business reports.

Risk-off continues the swing factor. The firm reported losses of $188 million across the same duration, a hint that shareholders are buying durable productivity rather than top-line growth. Renaissance Capital and other IPO trackers previously noted that loss-making labels can float in the shop, but only at conservative prices and with an easy view on operating leverage. Navan’s price print indicates that shareholders required more evidence on performance trajectory and unit economics before moving up. The new regulation presumably included some discount as well. An overhang analogous to terminal post-effective SEC comments can predispose caution during bookbuilding and in the following market, notably when buy-side committees favor honest, fully inspected filings.

The business behind Navan’s ticker and competitive position

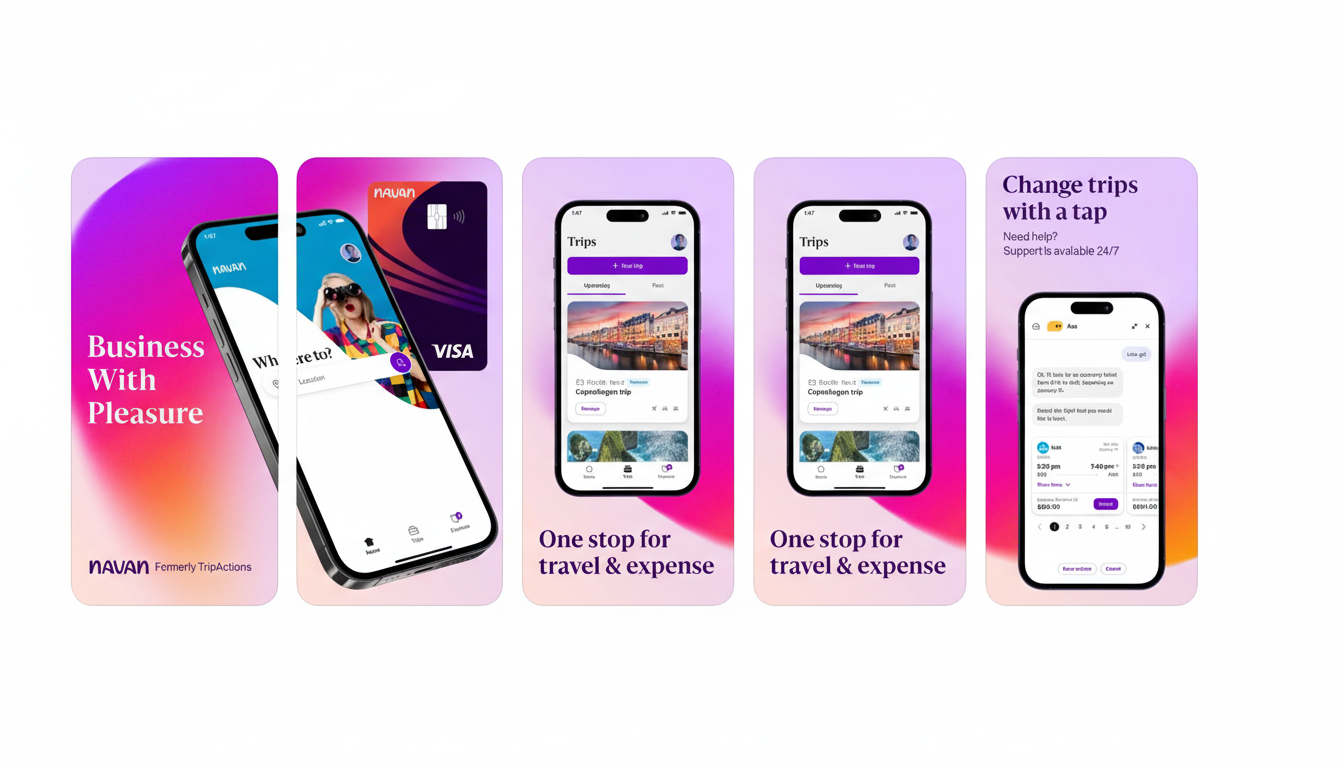

Navan sells an integrated platform stretching from corporate travel booking to expense management — essentially an effort to combine what many enterprises still do in silos. Flagship customers include:

- Shopify

- Zoom

- Wayfair

- OpenAI

- Thomson Reuters

An AI assistant, Ava, is said to work on around half of customer interactions with travel changes and reservations, while its cost tools tackle receipt capture and categorization for automation. The strategic pitch is compelling: a closed loop that can lower leakage, enhance policy compliance, and unlock better supplier economics. But the competitive set is tough: SAP Concur has a big share in the travel and expense pie, and there’s modern spend platforms like Ramp, Brex, and Divvy attacking adjacent workflows. Execution will rely on Navan’s ability to monetize the cross-sell, support net revenue retention, and grow its margins as travel volumes normalize.

On the cap table, pre-IPO holders were Lightspeed (24.8%), Oren Zeev (18.6%), Andreessen Horowitz (12.6%), and Greenoaks. Lockup expirations in the future can swing the supply-demand dynamics; investors will watch this alongside the quarterly results.

What Navan’s debut means for the IPO pipeline during an SEC freeze

Navan’s debut is a practical test for listing during a regulatory freeze. For those planning to go public in these next several weeks, the message is: the window is open, but the cost of ambiguity is real. EY’s Global IPO Trends and equivalent market turmoil have been clear: quality and predictability remain the standard for allocations; something that doesn’t add value to the disclosure fast can widen discounts or disrupt the entire process.

If the stock works and the company produces clear, regular updates and improving loss ratios, the hack may advance from hobby to specialized equipment. If it fails, or if candidates should be advised to wait until a complete examination cycle has taken place, Navan’s print will be scrutinized in each IPO meeting: in the public markets, one’s idea of balance is also one’s sincerity of leverage.