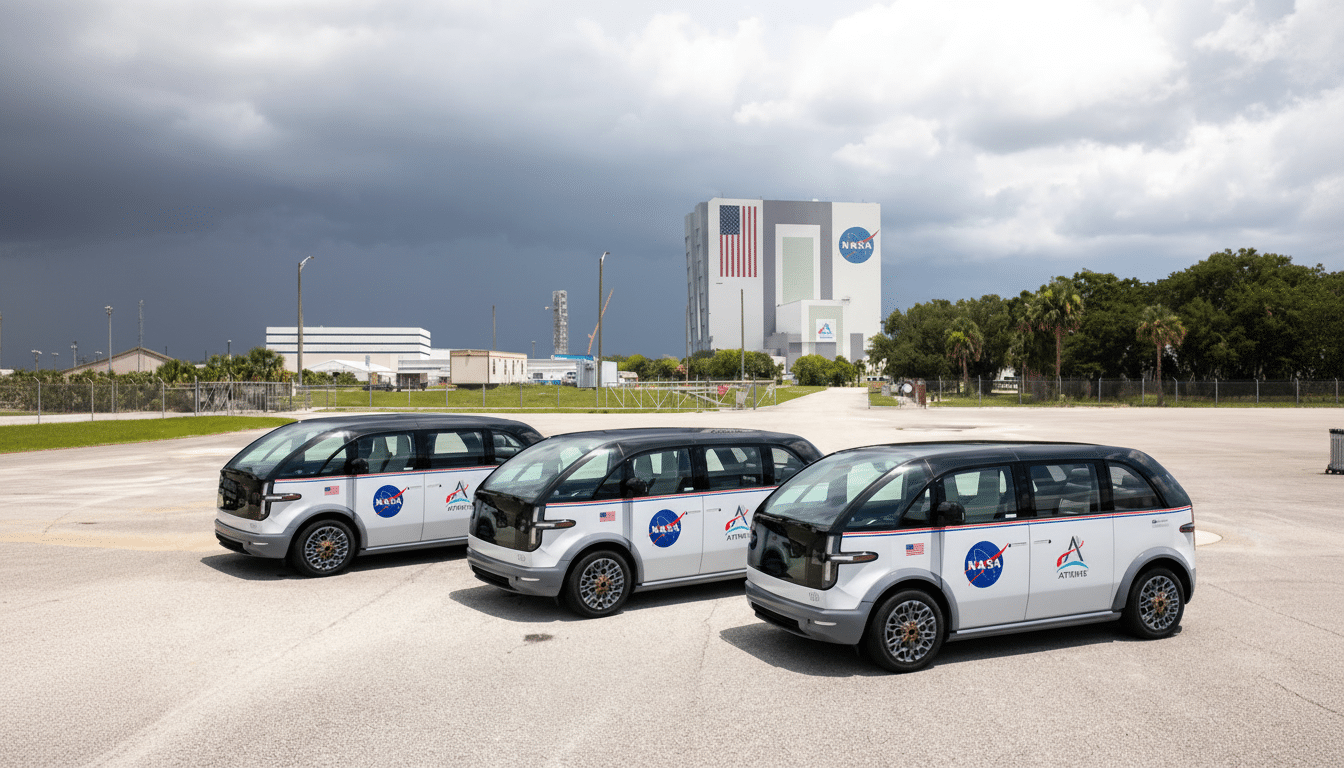

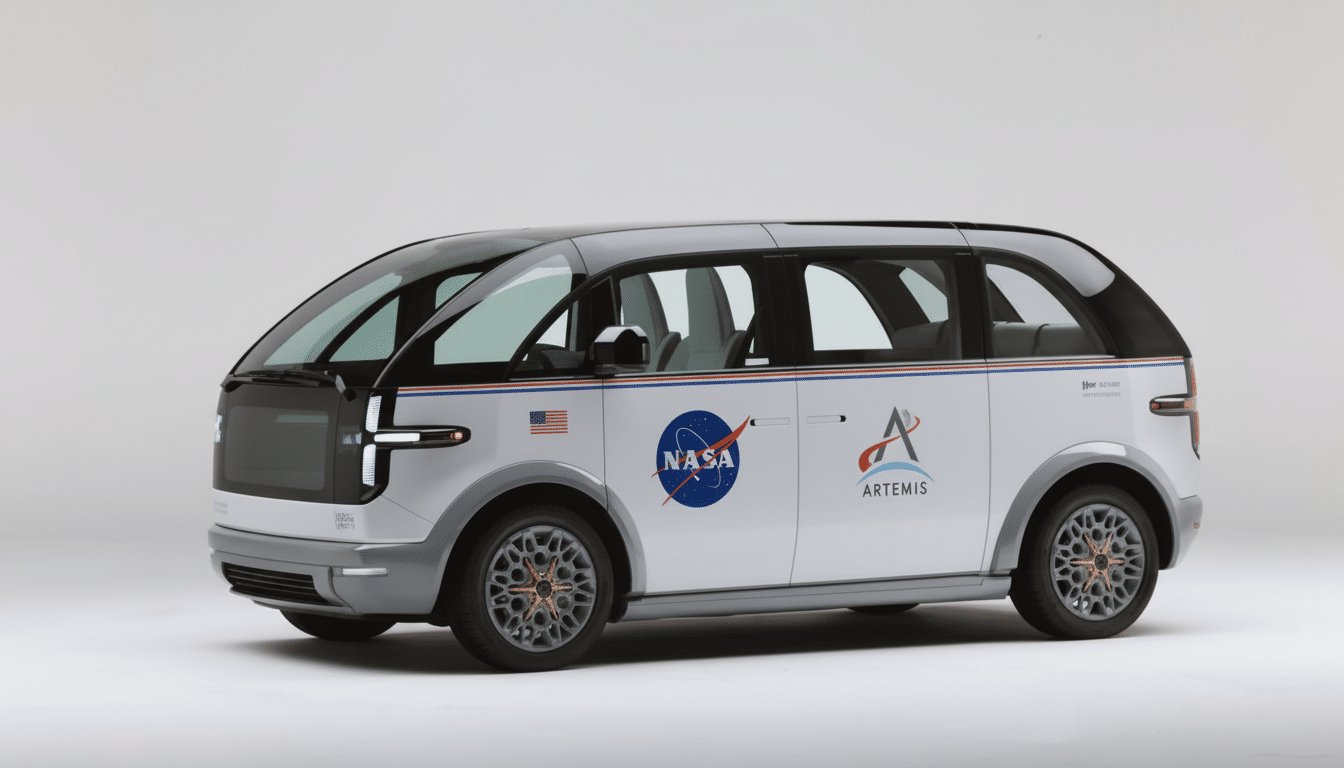

NASA and the United States Postal Service have halted use of Canoo electric vans, showing how government pilot projects can remain susceptible when a supplier collapses — even after being promised a safety net.

The move comes following Canoo’s bankruptcy and former CEO Tony Aquila’s commitment to keep support and service available for vehicles related to government programs.

Agencies Park Test Fleets With Service in Doubt

The six Canoo vans that USPS purchased for testing are no longer in use, and “the assessment has concluded there is no need to take the evaluation any further,” the agency said. The Postal Service didn’t provide any real performance stats or learnings from the trial. NASA also has stated that it has ceased using Canoo-branded vehicles and would not comment on plans going forward or if other vendors had been approached.

When parts, diagnostics, and warranty paths aren’t well-defined, fleet managers often ground vehicles. A mission-critical service without a contractual network can mean risk and escalating costs in keeping even things like battery management updates, policy component replacements, or support for telematics going — especially in the case of astronauts being shuttled back and forth or delivering last-mile mail.

Bankruptcy Fallout And A Bid To Keep Them Running

When Canoo went into bankruptcy, Aquila sought to buy some core assets for about $4 million, more as a way to fulfill service commitments associated with government programs than out of any desire to make money from the deal.

Agency officials have not indicated whether he or his team offered formal support following the sale, and Aquila has declined to respond to requests for comment through representatives.

The Department of Defense had previously tested at least one demonstration unit from Canoo, though it did not say whether that vehicle was still operational. For vehicles in government fleets where there isn’t a clear long-term path of support, many are mothballed to prevent the liability of operating noncompliant, unsafe, and overbudget systems.

Competing Bidders And Questions Of National Security

Court records indicate that numerous potential buyers were able to evaluate Canoo’s intellectual property and prototypes under nondisclosure agreements. Among them were Harbinger, a California-based maker of commercial electric vehicles that was founded by former Canoo employees; and a financier from the U.K. who said he was willing to pay much more than the winning bid but couldn’t get everything signed in time. The trustee countered that Aquila’s offer was the firmest; however, it was also possible that another potential bidder could have CFIUS issues because of foreign ownership — a touchy area considering Canoo’s NASA, USPS, and DOD work.

What It Means for Government Electrification Goals

The USPS is set to operate one of the nation’s largest fleet transitions, encompassing tens of thousands of battery-electric delivery vehicles and a deployment of chargers across its facilities around the country. The federal government, for executive-branch purchases, is aiming at 100% zero-emission sales for light-duty vehicles in coming years and a further stretch across classes after. Decisions to hold less capable EVs at bay like underperforming basketball players don’t alter those mandates, but they do signal that vendor stability, service networks, and parts availability are now as strategic as range and payload.

Agencies, as a matter of practice, diversify suppliers to keep risk associated with one vendor at bay. (For its part, USPS has ordered commercial off-the-shelf electric vans and is ramping with a dedicated next-generation delivery vehicle line.) NASA has alternated crew transport options in the past and can turn to proven OEMs with successful service histories if need be.

The Danger Of Orphaned EVs For Public Fleets

These “orphaned vehicles,” as they are sometimes called, that have no manufacturer to support software, parts, and warranties may quickly depreciate in operational value. Precedents are plenty: After Electric Last Mile Solutions and Lordstown folded, their customers were stuck with limited support; some Proterra bus owners only had service restored after the assets were acquired by new owners. This risk increases the total cost of ownership for agencies, complicates technician training, and may leave capital stranded in the yard.

The Canoo pause is a lesson that deployments should include escrowed software keys, documentation transfers, and third-party service arrangements so that vehicles remain maintainable if a supplier does not.

What to watch next for public-sector EV programs

Expect the USPS to reallocate capacity to platforms with established service networks and for NASA to call on other providers for mission transport requirements. The support of Canoo’s asset buyer (on orders, parts access, software outreach, or service agreements) could play a role in determining whether sidelined units will see limited and low-risk secondary use. Failing that, the agencies’ move is a case study in how predictability, not novelty, ultimately drives public-sector EV adoption.