Tesla’s planned $1 trillion pay package for Elon Musk is not just huge — it is a master class in reframing. The proxy sets forward some audacious-sounding numbers, but behind the adspeak a lot of them are watered-down versions of Musk’s own previous commitments, laced with longer time horizons and fudged definitions, so that what had once seemed fantastical now looks only formidable.

Tesla’s board casts the package as a blueprint for how to build the most valuable company in history. But the yardsticks constantly drag Musk’s rhetoric down to earth. Shareholders have a history of supporting him, though, but governance skeptics won’t forget that a Delaware Chancery Court ruling cancelled his 2018 award in Tornetta v. Musk because of a process tilted heavily toward the CEO.

- A bigger paycheck with softer targets

- From 20 million a year to 20 million a to

- Robotaxi math that shifts the goalposts

- Optimus: Hype to hedged Love’s presentation transition

- Ten million FSD subscriptions versus adoption reality

- The $8.5T question: value and profits

- Governance strings attached

- Bottom line: ambition repackaged

A bigger paycheck with softer targets

The plan establishes four milestones — vehicle deliveries, robotaxis in operation, humanoid robots shipped and Full Self-Driving subscriptions — as well as financial hurdles that conclude with an $8.5 trillion market value and earnings in the hundreds of billions. On paper, that’s heroic. And it’s also conspicuously scaled back from what Musk has promised.

From 20 million a year to 20 million a to

Musk had once hyped an annual production run rate of 20 million vehicles by 2030 — more than Toyota and Volkswagen combined. The next milestone: 20 million cumulative deliveries over the next 10 years. Since Tesla has already sold something like 8 million cars, and is delivering just under 2 million per year, the hurdle is materially lower than the once-a-year number he previously set for the same decade.

The reset reflects realities. Tesla backed off its 50% compound growth religion, admitted there can be demand volatility and decelerated its growth plan, such as a Mexico factory that was a central part of the next leg of volume. Now the goal prizes stable output more than hypergrowth.

Robotaxi math that shifts the goalposts

Last year Musk predicted that one million robotaxis would be deployed the year after. Instead, Tesla is testing a small supervised service in Austin, Tex., today. The new pay plan resurrects the million-robotaxi concept but adds a key catch: It needs a “daily average aggregate” of one million vehicles deployed to deliver commercial rides over a three-month period, including customer-owned Teslas using the company’s software.

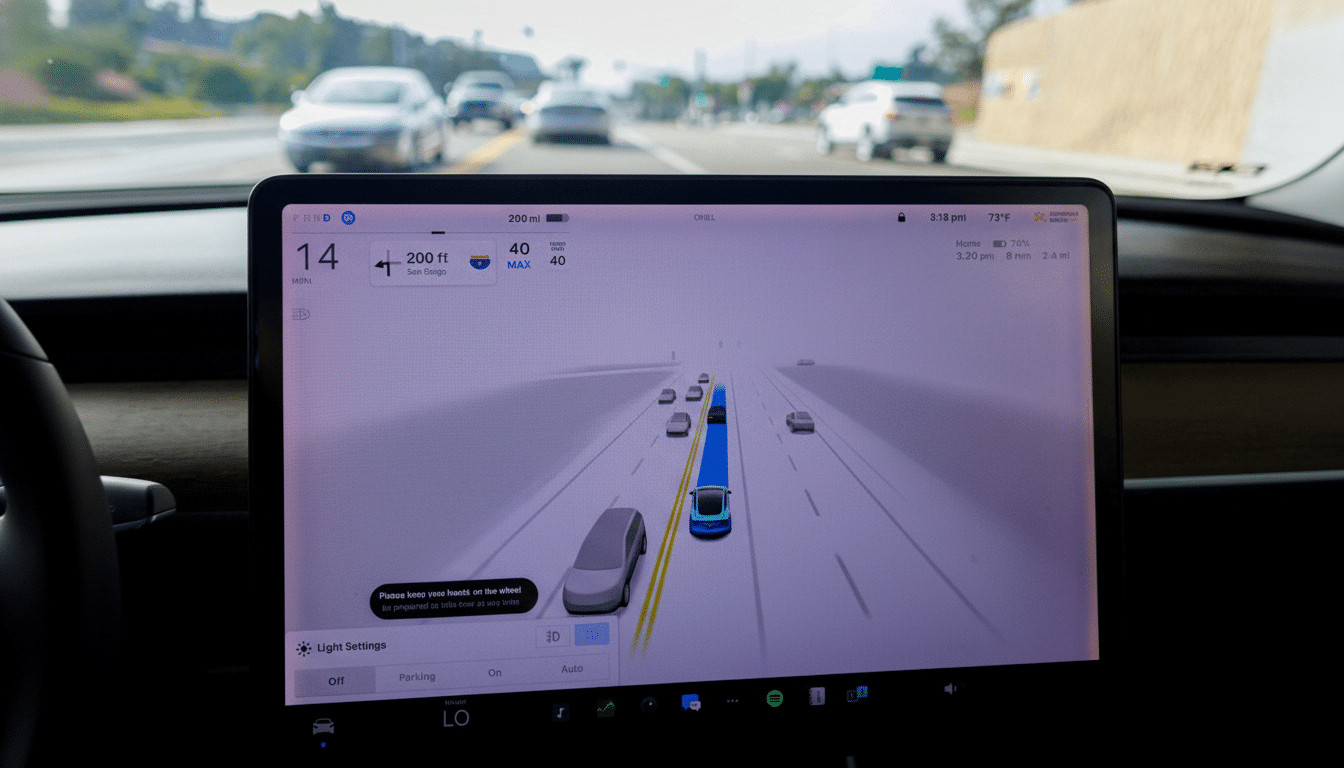

That definition reframes autonomy. It does not outright mandate completely driverless operation, or a purpose-built fleet. It might include some privately owned cars contributing part-time to a network — an easier on-ramp than constructing a scalable, driverless taxi service. Regulatory concerns still cast a large shadow: Federal safety probes and state-level permitting regimes have made autonomy timelines notoriously squishy realms, as evidenced by oversight from NHTSA and California Public Utilities Commission.

Optimus: Hype to hedged Love’s presentation transition

Musk has said that ultimately Tesla’s humanoid robot, known as Optimus, could be even more important than the auto business and make most of company revenue. He also mentioned a production rate of one-million units per year as soon as 2029. The compensation plan reduces that to a million “bots” in total over 2035 and changes the category from just Optimus to any AI-enabled mobile robot that Tesla makes.

It’s an elegant hedge. The board recognises commercialisation is a work in progress. By broadening the definition and stretching the timeline, the target is in tune with real-world manufacturing and readiness for market, not show-floor demos.

Ten million FSD subscriptions versus adoption reality

The plan’s most aggressive product metric could be 10 million active Full Self-Driving subscriptions. Tesla does not reveal the installed base, but executives have referred to the “teens” for percentage of eligible owners. That’s a mountain to climb in vehicle parc expansion and attach rates alone, especially with the software still supervised and regulators still checking on safety performance.

To make the number, it will require a powerful combination of reduced pricing, better perceived value versus one-time purchases, clear feature path and measured reliability improvements, all of which have seen mixed reception among customers. The N.H.T.S.A.’s 2023 software recall and this summer’s follow-up updates illustrate the balancing act between ambition and overconfidence.

The $8.5T question: value and profits

On a monetary basis, the plan peaks at around a $8.5 trillion market capitalization and annual earnings in the neighborhood of $400 billion.

For perspective, that profit target would be several times greater than the net incomes of today’s most profitable companies. Last year, Tesla saw about $17 billion of net income — impressive for an automaker, but still many miles from the goal post described here.

Musk has for some time said Tesla could one day be worth more than Apple and Saudi Aramco combined, and later said more valuable than the next five largest companies combined. The new thresholds preserve the rhetoric enshrined and establish formal benchmarks that are towering, although no longer toweringly unrealistic in relation to his peak pronouncements.

Governance strings attached

The board has included guardrails that address past controversies: a binding succession plan that in essence makes it difficult for Musk to leave the company anytime soon, and assurances that his political activity will “wind down” in due time. Given that the earlier award was slammed by a Delaware court for its process and board independence, these lumbering provisions seem purposefully aimed at assuring institutional investors that the watch is being tightened, not loosened.

Bottom line: ambition repackaged

If Tesla passes such milestones, the firm could transform into a diversified robotics, software and mobility platform with the auto business as a base layer. But as a constellation, the targets sound like a domesticated version of Musk’s grandest promises — less moonshot and more managed ascent. The strategy may be savvy. The open question is: Should shareholders reward record-breaking pay for ambition that, this time, comes pre-watered down?