Mobileye is making itself over as a player in robotaxis beyond the world of giant automobiles — and now others are along for the ride, including a developer of advanced mobility technology and intellectual property, Moovit, which has around 1,000 customers. These services are all meant to complement what is already on offer from Mobileye today: ADAS (advanced driver-assistance systems) in over 60 million cars on the road.

First, we might ask why Intel didn’t just sidestep its partnership with BMW entirely: It’s not like this hasn’t been done before. The deal, made at CES in Las Vegas, will bring a young robotics startup into the fold of one of the world’s most active suppliers of robotics and computer vision tech for autonomous driving.

- Why Mobileye is investing in humanoid robots and autonomy

- Deal structure, governance, and conflict safeguards

- What Mentee Robotics brings to Mobileye’s robotics push

- A crowded humanoid robotics field raises the bar for all

- What this could mean for automakers and major suppliers

- What to watch next as Mobileye integrates Mentee

The deal consists of about $612 million in cash and up to 26.2 million shares of Mobileye common stock. Founded in 2022 by Mobileye co-founder and president Amnon Shashua, the company will become an independent division. Shashua abstained from board discussions, and the deal was approved by the Mobileye board and Intel, its biggest shareholder. The deal is anticipated to close in the first quarter, pending customary conditions.

Mobileye said the move will increase operating expenses in 2026 by a “low single-digit percent,” which it added is manageable for a company its size and with its cash generation. The aim: to use its validated automotive autonomy stack in robots that comprehend context, infer intent, and move naturally through human spaces.

Why Mobileye is investing in humanoid robots and autonomy

Mobileye’s strength has always been its EyeQ systems-on-chips, perception software, and safety frameworks in millions of vehicles. That portfolio — vision, planning, mapping, and redundancy — intersects with what humanoids need to operate safely in the vicinity of people. A robot that needs to navigate cluttered spaces, pick up objects, and control its whole-body motion can also use the same high-fidelity sensing and decision-making Mobileye already productizes for roads.

The company also brings scaled AI training infrastructure and data operations to the mix. Mobileye revealed a $27.5 billion automotive revenue pipeline over the next eight years — up more than 40% from its pipeline count in early 2023 — hinting it has the wherewithal to incubate robotics without starving its core ADAS and autonomy programs.

Deal structure, governance, and conflict safeguards

The consideration comprises $612 million in cash and stock issuance, which aligns incentives should Mentee reach certain milestones under Mobileye ownership. With Shashua a founding presence at both companies, governance optics are important: the fact that he recused himself from board discussions, and approval by Mobileye’s board and Intel of the transaction, can help address issues of conflicts of interest always examined by shareholders in related-party transactions.

On the financial side, the company cautions that it expects only a modest near-term bump in costs. Robotics is a long game; its near-term revenue contribution expectations are very modest, as Mobileye invests in hardware, manipulation, safety validation, and pilot deployments. If the tech platform overlaps with Mobileye’s automotive stack, margins may get a boost from shared silicon, software, and data tooling.

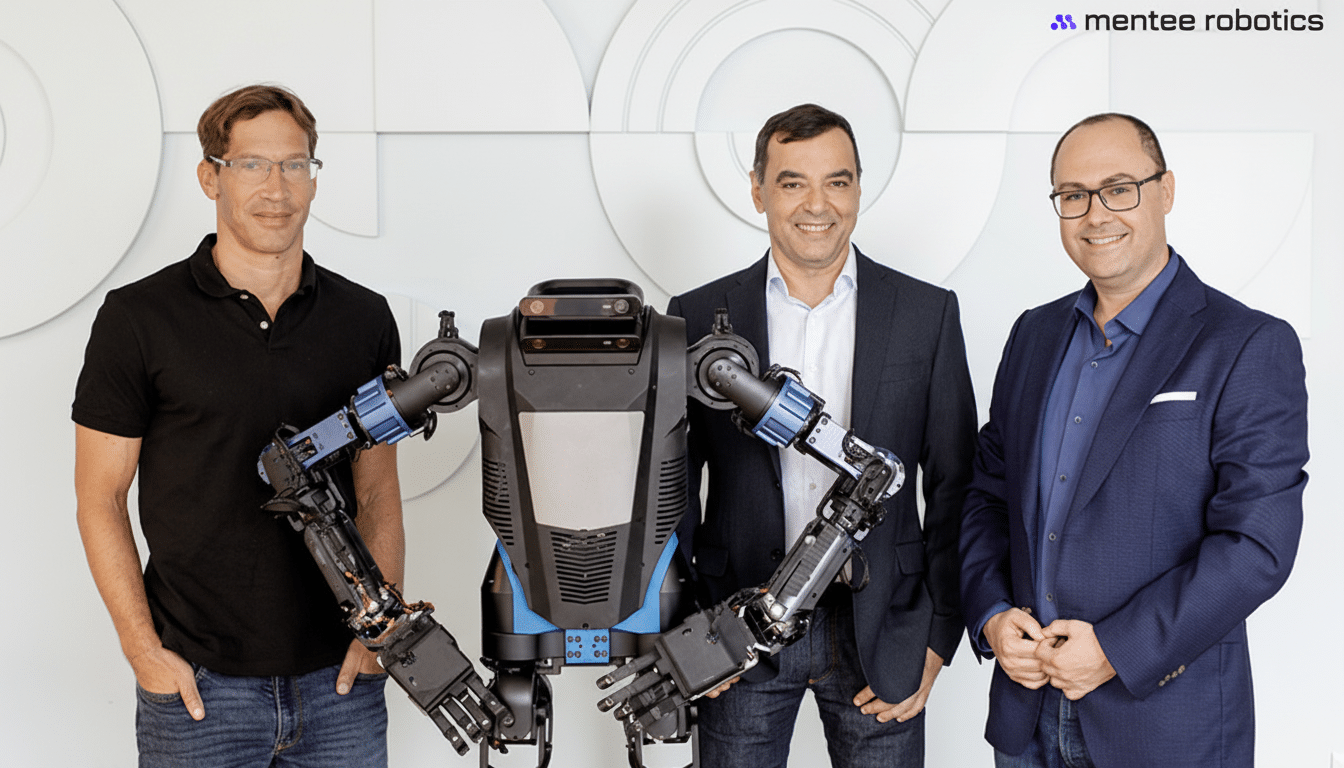

What Mentee Robotics brings to Mobileye’s robotics push

Mentee (mentee.ai).

We build humanoid robots to read context, intent, and interact with you naturally in human spaces — that is more than just walking.

That hints at integrating perception with language grounding, hand and whole-body coordination, and of course there are many other areas where simulation, motion planning, and background models are improving quickly.

For humanoid robots, these commercial opportunities have remained relatively consistent, with the following taking top billing:

- In-warehouse tote handling

- Line-side material delivery

- Back-of-house logistics work

- Basic inspection duties

In IE/networking environments, it focuses on reliability, unattended human-robot interaction, and total cost per task — targets that Mobileye is well positioned to impact via robust safety engineering and scalable computing.

A crowded humanoid robotics field raises the bar for all

Humanoid robotics is growing increasingly competitive. Tesla is developing Optimus for factory use; Figure’s founders and backers include AI and chip leaders; Agility Robotics is piloting Digit with leading retailers and logistics companies; Sanctuary AI and Apptronik are making advances in manipulation and hardware. The lesson from these efforts: The road to actual deployments leads through reliability, battery life, dexterity, and maintainability, not eye-catching demos alone.

Mobileye will need to differentiate itself by converting automotive-grade safety and validation processes into repeatable, productionized robotics products. Performance indicators such as mean time between failures, cycle time per task, and hands-off autonomy in dynamic spaces will be reasonable milestones of progress.

What this could mean for automakers and major suppliers

The purchase comes as Mobileye continues to rack up additional ADAS wins. The company recently announced a design win with a top-10 automaker for 9 million units of its EyeQ6H-based Surround system, in addition to over 19 million EyeQ6H Surround units expected on the horizon. Volkswagen Group also chose the chip for upcoming models, highlighting momentum in hands-off, camera-centric L2+ features.

That may even be a net positive for the automakers and tier-1s if their supplier Mobileye is able to converge architectures across cars and robots — common compute, perception modules, and toolchains can speed development cycles here. For an automaker, such robots are humanoids that are good at repeating ergonomically unfriendly tasks in factories or warehouses, and can be slotted alongside existing investments in “software-defined vehicles” and automated production.

What to watch next as Mobileye integrates Mentee

Key signals will be integration milestones, hardware prototypes moving out of the lab environment and toward pilot customers, or securing partnerships in warehousing, manufacturing, or facilities management. Rigorous safety frameworks and validation protocols — something Mobileye’s automotive DNA can bring to the table — are likely to be a focal point.

If Mobileye can turn that road-tested autonomy stack into a fleet of humanoids that get good unit economics, the deal will appear prescient. If not, it still has a strong ADAS franchise and an expanding chip pipeline to pay for the next spin.