Sugar Free Capital closes its $32M debut fund to invest in MIT startups. The firm’s lens is aimed specifically at AI-native infrastructure and systems-heavy startups. The firm is helmed by Sheena Jindal, an MIT grad and former investment professional at Bessemer Venture Partners and Comcast Ventures, and will focus on investing in approximately 15 companies with initial checks ranging from $1 million to $5 million.

It has limited partners such as a number of family offices linked to senior technology executives, including those of Nvidia and Citadel, the firm said. That support mirrors LP enthusiasm for tightly focused funds providing privileged access to particular technical networks and talent pipelines.

Why MIT’s ecosystem matters now for AI-native startups

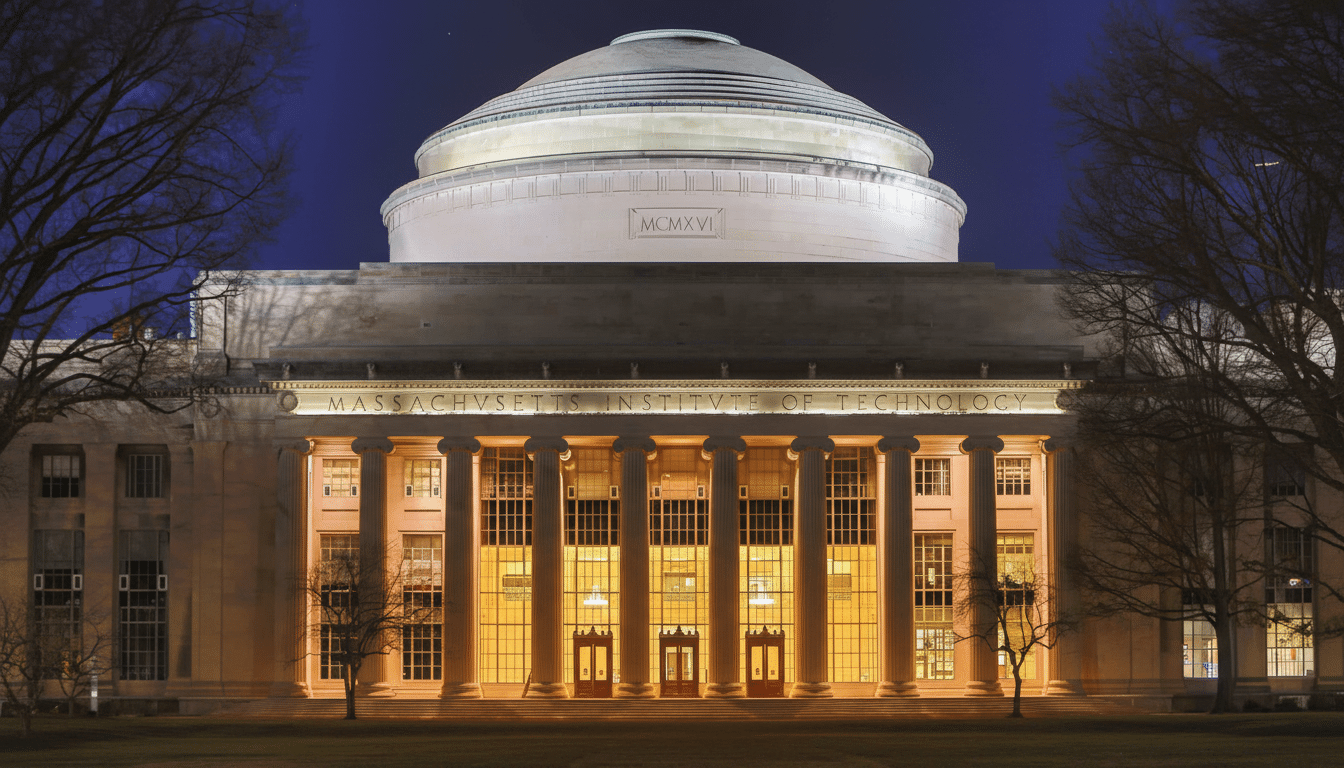

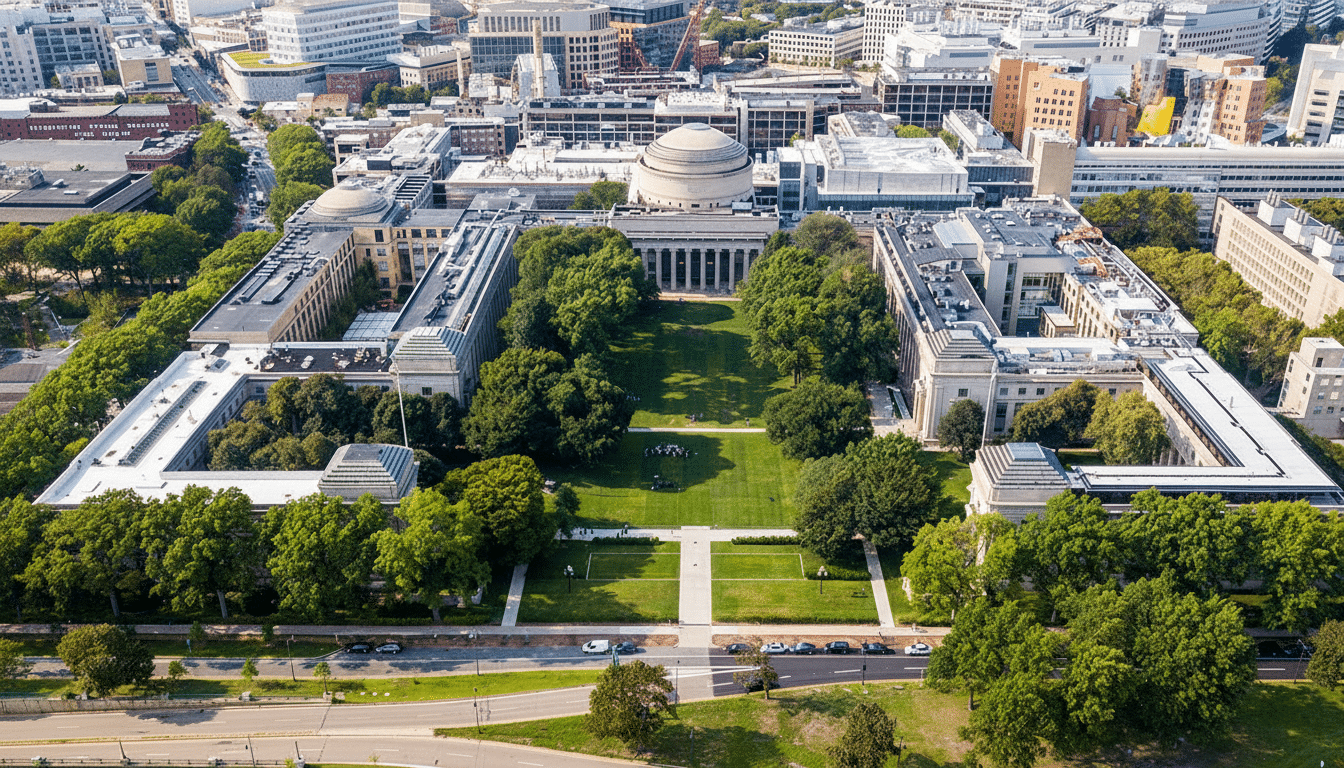

MIT has been a hothouse for companies that combine deep research with practical engineering. According to estimates by the MIT Innovation Initiative, currently active companies launched by alumni of the institute generate a combined $2 trillion-plus annually in revenue and employ millions around the world — a category that would make it among the top 10 largest economies. But the very beginning of that pipeline is still relatively under assault from alumni-led capital compared to rich seed ecosystems linked to Stanford and Harvard.

Jindal’s thesis exploits that gap. Next to reap the rewards of creative value generation, she believes, will be founders with systems engineering in their blood: people who know how to weave together compute resources, data, model architectures, and reality. It’s a skill set that is common in the MIT community and, most importantly, has become more relevant now, as AI ceases to be a feature and becomes the fabric of products and technology.

With MIT-related projects like The Engine kicking “tough tech” into gear and E14 Fund supporting Media Lab alumni, Sugar Free Capital places itself squarely at the intersection of AI infrastructure and application layers, where new platforms, experiences, tools, and workflows are being established by technical founders.

Strategy Designed For The Age Of Intelligence

The fund’s focus is on AI-native infrastructure and adjacent software, with quarterly “search themes” to help focus sourcing. Areas of interest include internet-scale systems; physical-world interfaces that bridge software and robotics/autonomy; data center optimization (energy-aware scheduling down the wire and silicon-aware tooling); and AI agents that can dependably live in enterprise environments.

Sugar Free Capital has already invested in four companies, which operate across defense technology, gaming infrastructure, and workflow automation. The portfolio reflects a preference toward founders constructing primitives — tools and platforms that other builders will use — rather than consumer applications following momentum.

The concentration is intentional. And as Cambridge Associates and other performance trackers have repeatedly demonstrated, venture results are distributed along a power-law curve wherein a small percentage of winners deliver the bulk of returns. The interest-based micro-funnel can increase signal and conviction at seed and Series A, where the firm expects to lead or to be strongly participating.

Fund size, investment pace, and network-driven access

The goal is to deploy into 15 companies, making four to five new investments each year and leaving enough dry powder for follow-ons. Check sizes between $1 million and $5 million enable the fund to anchor or co-lead rounds when conviction is high, and continue participating as companies hit technical milestones.

Deal flow will consist of a combination of outbound sourcing, campus and lab relationships, and referrals from operators across Boston, New York, and the Bay Area. The firm says it’s still open to cold inbound, which has historically unearthed teams within the MIT orbit that are not your typical fare.

Fundraising dynamics in a hard market for new managers

The close follows a recalibration of venture fundraising. According to NVCA and PitchBook, new fund formation is at multiyear lows, with first-time managers taking a smaller piece of the total capital pie and taking longer to close their vehicles. In this environment, LP excitement tends to flow toward managers with good technical access and a clear thesis.

It’s also still uncommon to see a solo woman general partner launch her own technical seed fund at this scale. “Women represent a minority of decision-making check writers in U.S. venture partnerships, which underscores the importance of new women-led firms with differentiated pipelines,” All Raise has said.

Signals to watch as AI-native infrastructure scales

The fund will act as a bellwether for how AI-native infrastructure companies scale in today’s compute and capital climate. Look for bets that straddle GPUs and networking, data management on multimodal workloads, safety and reliability tooling, and robotics stacks that can push intelligence into the edge.

Boston–Cambridge is a good place for such a moment. The density of chip designers, robotics labs, and cybersecurity talent in the region has already spawned category leaders like iRobot, Akamai, HubSpot, and Formlabs — none of which were suggested in connection with the fund, but each a sign that research-grade engineering can become durable platforms.

If Sugar Free Capital can replicate MIT’s systems-first culture in the form of investable companies, the firm could be an A+ partner for technical founders making their way through the transition from optimization-era software to an intelligence-first stack. For LPs, it’s a concentrated bet that the next generation of iconic infrastructure companies will be founded by people who understand how the entire system interlocks.