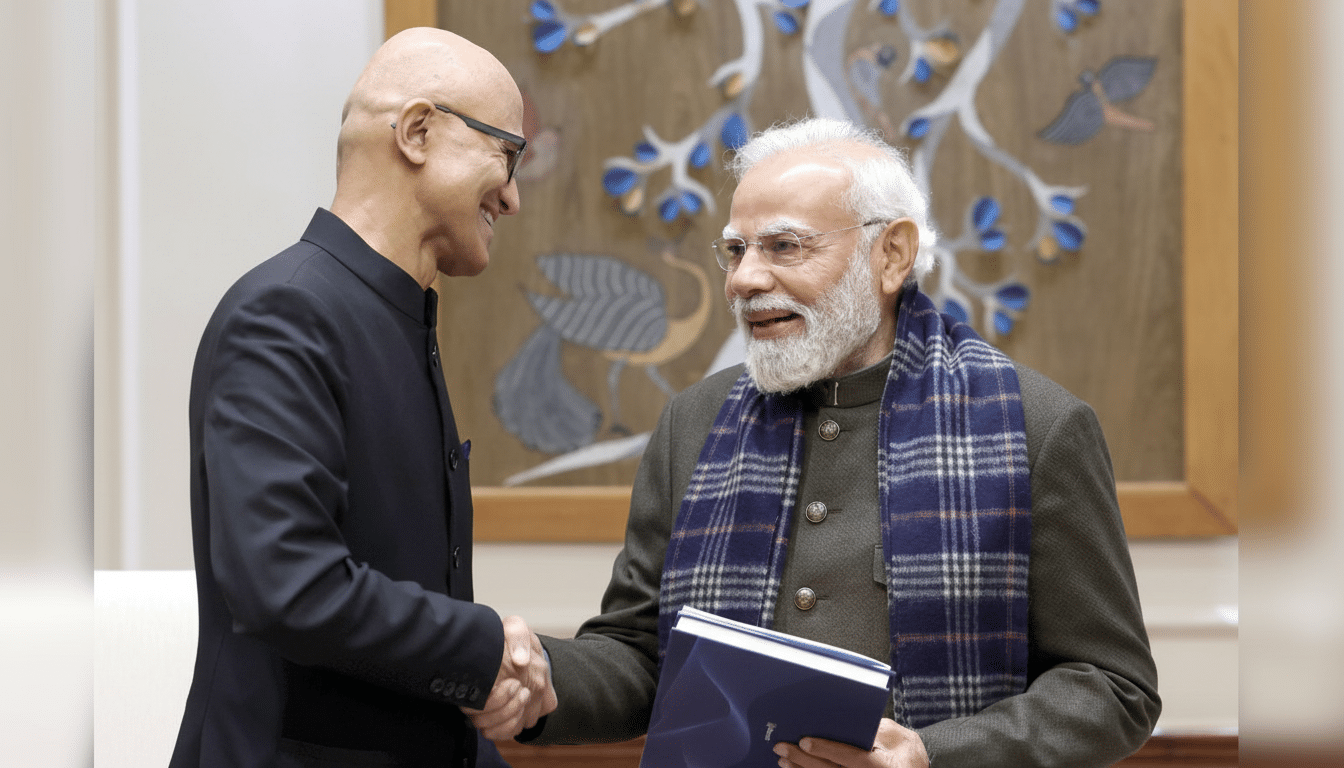

Microsoft will invest $17.5 billion in India by 2029 in an effort to bolster the country’s role as a hub for cloud computing, data and its more intelligent processing systems, the company said on Monday. The company’s largest investment in Asia, the plan lays the foundation for new opportunities across the hot AI market as well as deepens government and industry relationships at a time when demand is higher than ever for Microsoft Azure cloud services that are both compliant and deliver AI computing power.

The pledge encompasses a new data center region in Hyderabad due by mid-2026, further expansion in Chennai, Hyderabad and Pune, and more capabilities to meet India’s regulatory and data residency requirements, known as the sovereign cloud. It also comes with new skilling targets and public-sector partnerships to get AI from pilots into production across the economy.

Why India Is Going To Be A Core AI Compute Hub

India offers both market scale and a deep bench of technical talent. According to GitHub, India is set to be home to the world’s biggest developer base in this decade, and GSMA Intelligence notes hundreds of millions of smartphone users and mobile broadband penetration becoming the norm. That mix accommodates both the shift of consumer AI to the edge and enterprise workloads that need low-latency, in-country infrastructure.

Public digital rails have also skewed the landscape. The India Stack — composed of Aadhaar, UPI and ONDC — equips tech companies with national-scale programmable primitives. With the Digital Personal Data Protection Act now official, businesses are focusing on sovereign solutions that keep private data local while driving innovation in AI, so it should come as no surprise that cloud providers with compliant offerings have been the focus of attention.

What the $17.5B Is Going to Be Used For

Data centers are the centerpiece. Microsoft says the new Hyderabad region will start with three availability zones and offer access to the most advanced AI-optimized GPUs, which are essential for training and serving extremely large models. Upgrades are planned for existing regions, too, that will expand capacity for industries with mission-critical workloads already running on Azure, from banks and insurers to manufacturers and healthcare networks.

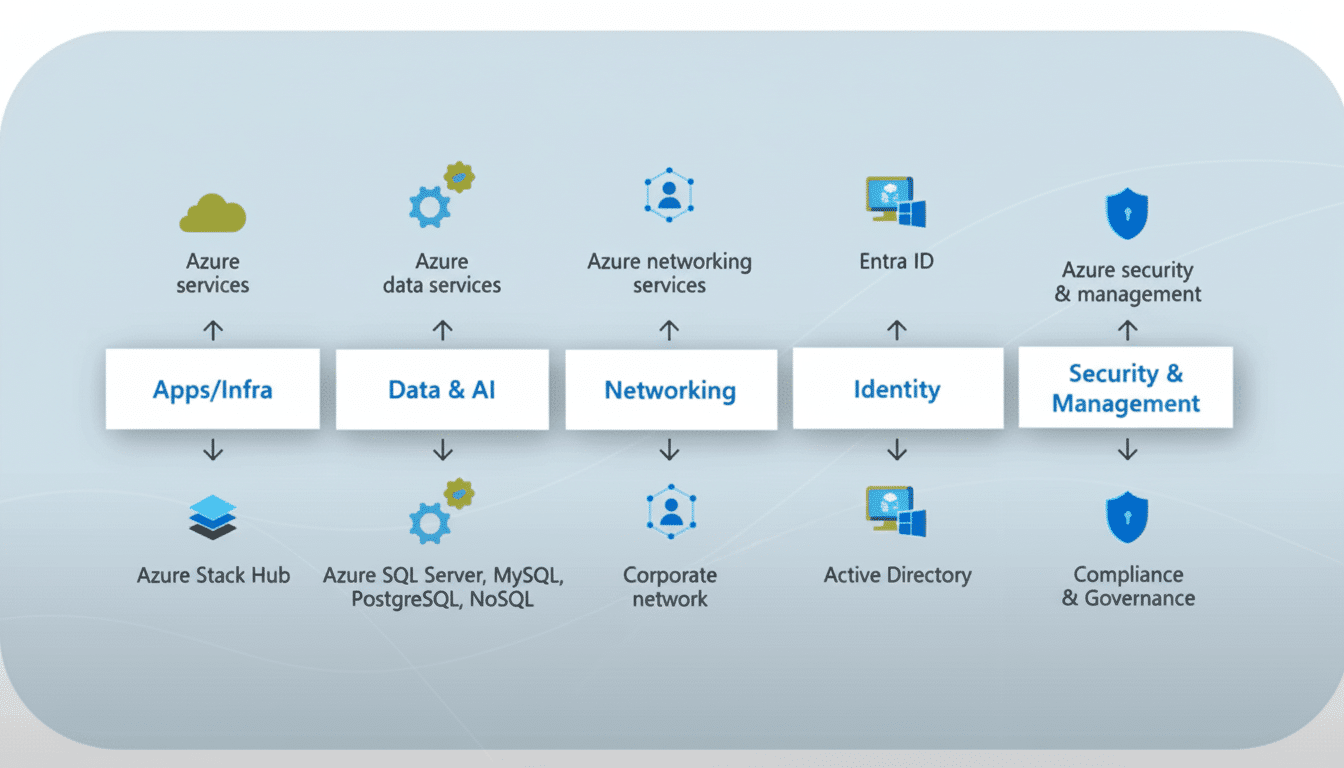

For customers with elevated compliance requirements, Microsoft is offering a Sovereign Public Cloud across India regions and a Sovereign Private Cloud from Azure Local for connected or air-gapped environments. These choices enable organizations with the most demanding levels of data residency, security and operational sovereignty to continue accessing services in areas like Microsoft 365 and Azure AI.

There’s also a focus on building workforce readiness at scale. Through its ADVANTA(I)GE India program, Microsoft says it has trained 5.6 million people this year and now plans to provide 20 million Indians with AI skills by 2030. New initiatives that the company has with government and industry partners aim to sync curricula with in-demand positions such as AI application development, data engineering and model operations (MLOps).

On the public-sector side, Microsoft will team up with the Ministry of Labour and Employment to integrate AI into e-Shram and National Career Service, platforms that serve hundreds of millions of informal and formal workers. The planned capabilities include multilingual access, AI-assisted job matching, smart résumé generation and predictive insights on skills demand — a real-world experiment to determine if generative AI can improve labor-market outcomes at national scale.

The competitive stakes among cloud and AI hyperscalers in India

The action is drawing a response from other hyperscalers in an increasingly heated race. Google has proposed a multibillion-dollar plan for an India AI hub and infrastructure build-out, while AWS has already announced $12.7 billion in cloud investments in India over the next decade. Model developers such as OpenAI and Anthropic are growing local teams while telecom giants like Reliance Jio and Bharti Airtel are forming alliances to deliver AI services and enterprise connectivity at scale.

For enterprises, a more concentrated fabric of AI-ready regions and sovereign options reduces latency, expands availability of GPUs and makes meeting regulatory requirements more straightforward. For start-ups, compute closer to home and platform credits can compress experimentation cycles, and any company gains value from getting their AI projects out of the proof-of-concept phase into production-ready products.

Execution Risks and the Infrastructure Gap

India’s data center build-out is constrained by real things: the availability of power and reliability of the grid, energy costs, water scarcity in key metros. CBRE and JLL analysts predict breakneck capacity growth, though both warn that power procurement and renewable integration are now key for success. Anticipate major players inking long-term energy contracts, co-locating close to renewable corridors and investing in advanced cooling — all as they work to keep operating costs stable at scale and meet those sustainability goals.

Policy tailwinds are helping. Interest in AI, semiconductor manufacturing, and data center parks is growing, while states vie to attract hyperscalers with fast-track approvals and access to land banks. That said, the speed at which the grid gets updated and high-end GPUs become available will affect how quickly planned regions come online and how well they’re able to handle demanding AI workloads.

What It Means for India’s Digital Economy

The payoff could be substantial. Bodies like NASSCOM and the like have predicted that hundreds of billions of dollars can be added to India’s GDP with AI adoption in places such as manufacturing, retail, BFSI, healthcare and the public sector over the next few years. Between AI-first capabilities in digital public platforms and the MSME network, productivity boosts can extend to medium cities rather than just large urban enterprises.

Microsoft’s bet fits that trend: more compute in-country, deeper compliance guarantees and scaled skilling to ensure organizations can actually use the infrastructure they’re getting. If execution keeps pace with ambition — on power, sustainability and security — India may see its place in the global AI economy shift from market to foundational hub, with this $17.5 billion commitment as a leading catalyst.