Meta is shifting toward nuclear power at scale, signing three agreements that collectively unlock more than 6 gigawatts of carbon-free power for its data centers. The package crosses immediate supply from current reactors and long-term capacity coming online with next-generation small modular reactors, highlighting how the race to power AI infrastructure is rewriting the energy-purchase playbook.

It entered into separate agreements with Oklo and TerraPower, two developers of small modular reactor (SMR) fleets, as well as 20-year power purchase agreements for output from operating nuclear plants with Vistra. Financial terms were not disclosed, but the deal meshes near-term reliability with future growth as projects clear licensing, siting, and interconnection hurdles.

Inside the Three Nuclear Power Agreements Meta Signed

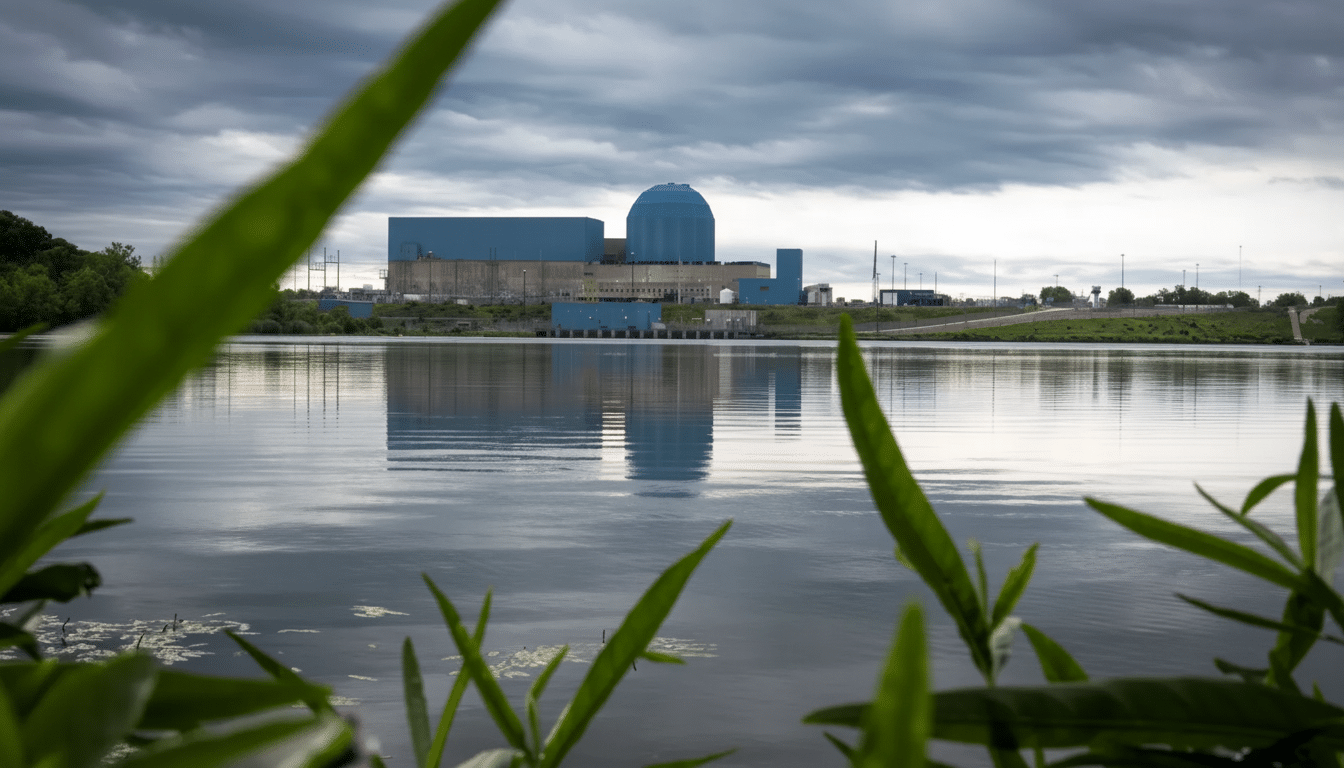

Vistra will provide Meta with 2.1 GW from its Perry and Davis-Besse plants in Ohio, offering the fastest route to firm, around-the-clock power for Meta. Vistra also plans uprates at those facilities and Beaver Valley in Pennsylvania, adding 433 MW of capacity as early as the 2030s, the companies said. Electricity from keeping the lights on at existing nuclear plants is one of the cheapest clean baseload power sources available to grid operators, thanks in large part to high capacity factors and policy support.

Oklo’s deal comprises 1.2 GW with the first output aimed for 2030. The company envisions multiple 75-MW Aurora Powerhouse reactors in Ohio’s Pike County, suggesting more than a dozen to fulfill Meta’s order. Oklo, which went public in 2023, has a previous offtake agreement with Switch already and still needs regulatory approvals from the Nuclear Regulatory Commission (NRC) before it can break ground at scale.

TerraPower, a company co-founded by Bill Gates, aims to deliver its first reactors based on the Natrium design by about 2032 (345 MW for five hours with up to an additional 500 MW). Meta’s initial tranche is for 690 MW, and with options it moves up to 2.8 GW of nuclear and 1.2 GW in storage. TerraPower is partnering with GE Hitachi on its first plant, in Wyoming, and it has advanced further through licensing than most other advanced designs.

Why Nuclear Power Is Central for Meta’s Data Centers Now

AI is reshaping load curves. The International Energy Agency recently estimated that by 2026 global demand for electricity in data centers could reach nearly 1,000 TWh — which is similar to the energy consumption volume of a large industrialized country. In PJM, the 13-state Mid-Atlantic and Midwestern regional grid, data centers are already clogging up interconnection queues and capacity planning efforts.

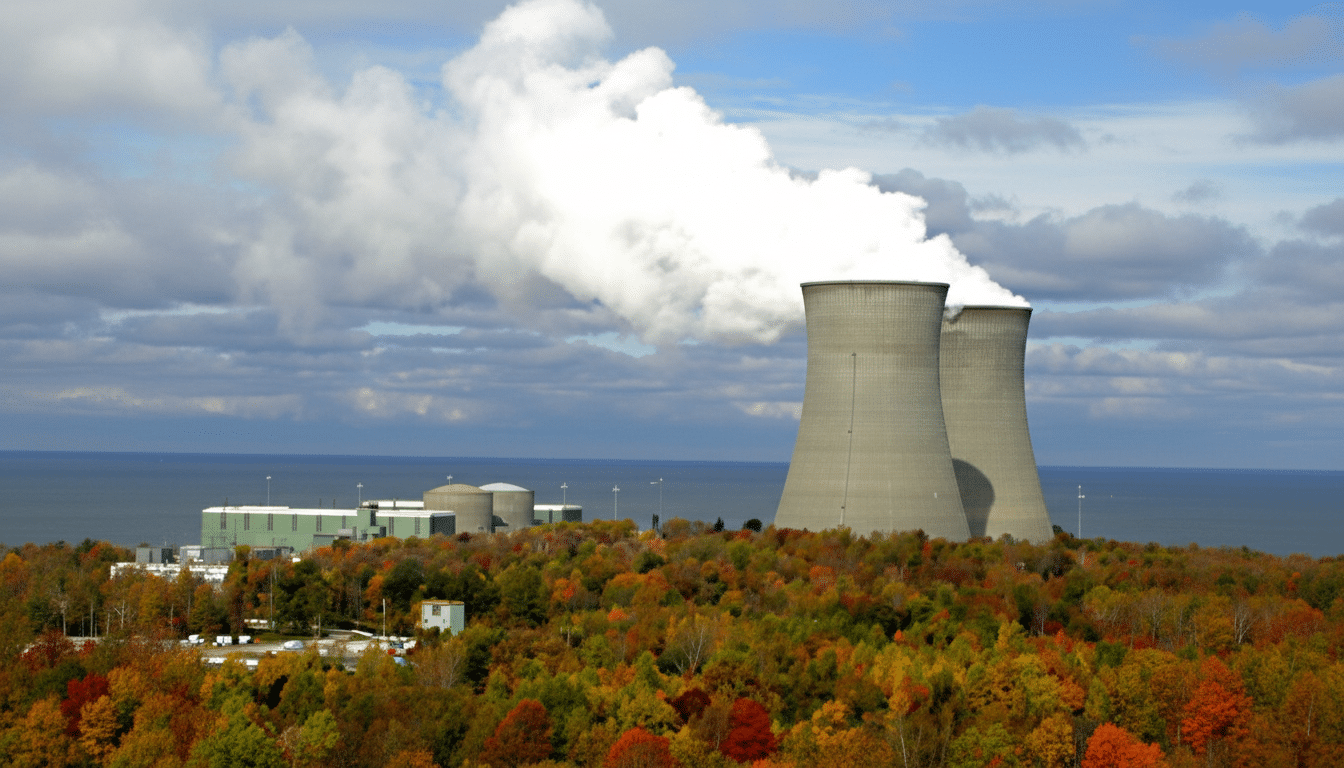

Nuclear provides what the hyperscalers are coming to want more and more: 24/7 power, with no carbon on site and a history of very high reliability. U.S. nuclear units consistently post capacity factors close to 92 percent according to the EIA, yielding firm power that pairs well with variable wind and solar. Long-dated nuclear contracts may also be used to hedge price volatility at just the point when AI training and inference loads pass mission-critical.

It is part of a larger trend by tech giants to secure carbon-free “firming” resources. Microsoft has chased 24/7 clean power deals paired with nuclear output via Constellation, and Amazon has also investigated locating data centers near existing nuclear generation. Meta goes one step further, scaling up that approach by pairing immediate megawatts with a pipeline of advanced reactors.

Costs, Timelines, and Risks for Current and Future Nuclear

The current reactors “are probably the lowest-hanging fruit in the portfolio,” Mr. Winston said, particularly with federal production tax credits for existing units improving economics. SMRs, by contrast, remain first-of-a-kind. TerraPower is aiming for $50–60/MWh and Oklo says they can do it for $80–130 on later builds, but early projects tend to come out higher as manufacturing and construction processes mature. In PJM, interconnection lead times can run for years, and advanced designs have supply chain limitations — especially HALEU availability — for the new fuel in addition to NRC licensing goals.

And the industry has scars from previous overruns. NuScale’s municipal SMR project was abandoned in 2023 due to rising costs: a reminder that balance-sheet strength and anchor customers are important. Data center offtakers such as Meta can de-risk this with huge, creditworthy contracts and standardized, repeatable reactor orders that allow factory-style delivery.

Grid and Siting Considerations in Ohio, Pennsylvania, and PJM

Meta’s demand will use much of the same nuclear supply, which has been left in northern PJM and Brittany’s Mushroom subregion after plants closed elsewhere. Solid nuclear strength provides CM value and reduces gas reliance in peaks. Natrium’s co-located thermal storage from the design could assist with ramping and net-load volatility as renewable penetration increases.

Ohio and Pennsylvania are poised to gain from upgrades and new builds, offering construction positions and long-duration operating jobs. The nuclear units supplement voltage and inertia for local grids, which are becoming data-center-dense, as synchronous plants of generation retire.

What to Watch Next as Nuclear Deals Move from Plans to Power

Key milestones include NRC licensing decisions for Oklo and TerraPower, Vistra’s uprate approvals, PJM interconnection agreements, and HALEU fuel procurement ramp-up. If the SMRs are deployed to time and to budget, Meta’s portfolio could serve as a template for underpinning industrial-scale, firm clean power — precisely the resource profile AI-era data centers want.