Lucid Motors has disclosed that it produced double the number of electric vehicles it made last year, serving as a strong rebound following a turbulent start to scaling the production of Gravity SUVs. The company said it had produced 18,378 vehicles and delivered 15,841 of them, a fourth-quarter push that helped stabilize the company and inject new life across its product range.

Lucid’s production rebound and a strong Q4 surge detailed

The growth in production was especially pronounced in the last quarter, when Lucid put together 8,412 vehicles — nearly half as many cars as it completed over the course of a year. That step-up implies bottlenecks at the company’s factory in Casa Grande, Ariz., eased, particularly in final assembly and software validation. Deliveries increased 55 percent year-over-year, indicating that logistics and retail execution have improved, in addition to manufacturing.

For a young automaker, the leap from “thousands” to “tens of thousands” is always the hardest stretch. Lucid’s ramp is starting to appear more disciplined: takt times shortened, supplier fill rates look steadier, and the production mix has expanded beyond just the Air sedan and now also includes Gravity at meaningful volumes. Tiny compared to established companies, the shift in cadence matters because it drives down unit costs and makes the case for future models more persuasive.

Gravity ramp lessons and software fixes improve quality

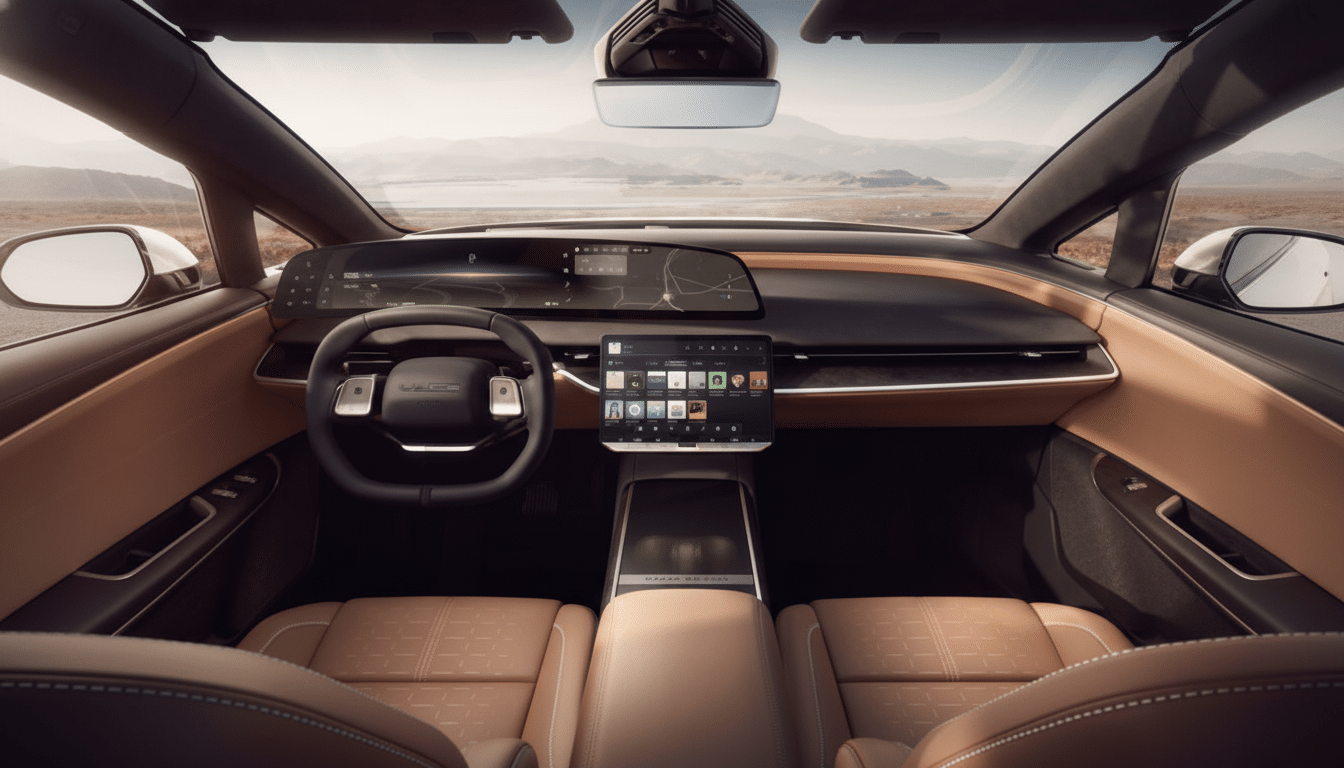

The reversal comes after a rocky start for Gravity. Early customers grumbled of quality snags and software bugs that left some cold. Interim CEO Marc Winterhoff addressed those issues in a note last month and said the company was focusing on fixes and ramping up over-the-air updates. Field input was fed directly back into the line and later builds had improved validation around infotainment stability, driver-assist behavior, and door/hatch fitment.

It’s not uncommon with software-heavy EVs. The variable is how fast an automaker closes the loop. Where Lucid has led is with its in-house efficiency tech — the motors, inverters and battery systems that contributed to the Air sedan’s class-leading EPA range — where software and body manufacturing, handled just as diligently now, are now proving out. The late-year production ramp signals that the company is not just triaging; it’s institutionalizing its fixes.

Delivery targets recast after fading SPAC-era optimism

Despite the rebound, the totals remain well short of the ambitious quantities Lucid projected when it became public in a multibillion-dollar reverse merger. Back then, management had laid out a glide path to six figures of annual deliveries that entailed a hefty Gravity mix — 86,000 SUVs — along with tens of thousands of Air sedans and an intermediate-size model. And as often happens with Tesla, reality bit: supply constraints, demand shifts and the steep learning curve of auto manufacturing led to a reset.

Recalibration does bring credibility. Now investors and industry watchers will have a clearer baseline to judge momentum: output at something in the high teens per year, deliveries in the mid-teens — and a line that can swing materially higher when hardware and software are in sync. Capital support from Saudi Arabia’s Public Investment Fund also remains in place to support Lucid as it continues with operational optimization and expansion of commercial capabilities.

Mid-size platform targets the core electric-vehicle market

The next catalyst is Lucid’s mid-size platform, which the company has said will support a model with an estimated starting price of around $50,000. That puts it squarely in the middle of today’s EV market, among offerings such as Tesla’s Model Y and Rivian’s forthcoming R2. The segment sweet spot is more important than any quarter: it’s where volume, the circuitry of brand recognition and dealerless retail models get stress-tested.

And if Lucid can extend its efficiency lead down to a lower price band, and offer strong range, fast charging and a really nice ride at mainstream prices, it’s opening up its potential market hugely. S&P Global Mobility analysts observed that mid-size crossovers are dominating consideration for EVs, while Cox Automotive has pointed to continued interest if prices, incentives and charging reliability sync up. Lucid is betting that there is a place for premium engineering to win, if it’s packaged like this, at the middle of the market.

What to watch next for Lucid’s output, software, margins

From here, three metrics will tell the story.

- Sustained throughput: stave off production-line slowdown in the final quarter while achieving a marked improvement in first-time quality.

- Software velocity: faster and more reliable updates that close the lag between showroom promise and daily use.

- Margin trajectory: as scale gets better and material costs subside, the loss per car ought to get tighter over time, particularly if Gravity warranty claims are falling.

Lucid still has some ground to make up if it’s going to live up to the grand plans that the company once discussed. But to double production with a strong fourth-quarter push and exit the year on a strong quarterly note is something concrete. If the early wobbles of Gravity’s hiccups really are behind it and that mid-size hatch lands, then a move from niche luxury to credible EV contender appears rather more credible.