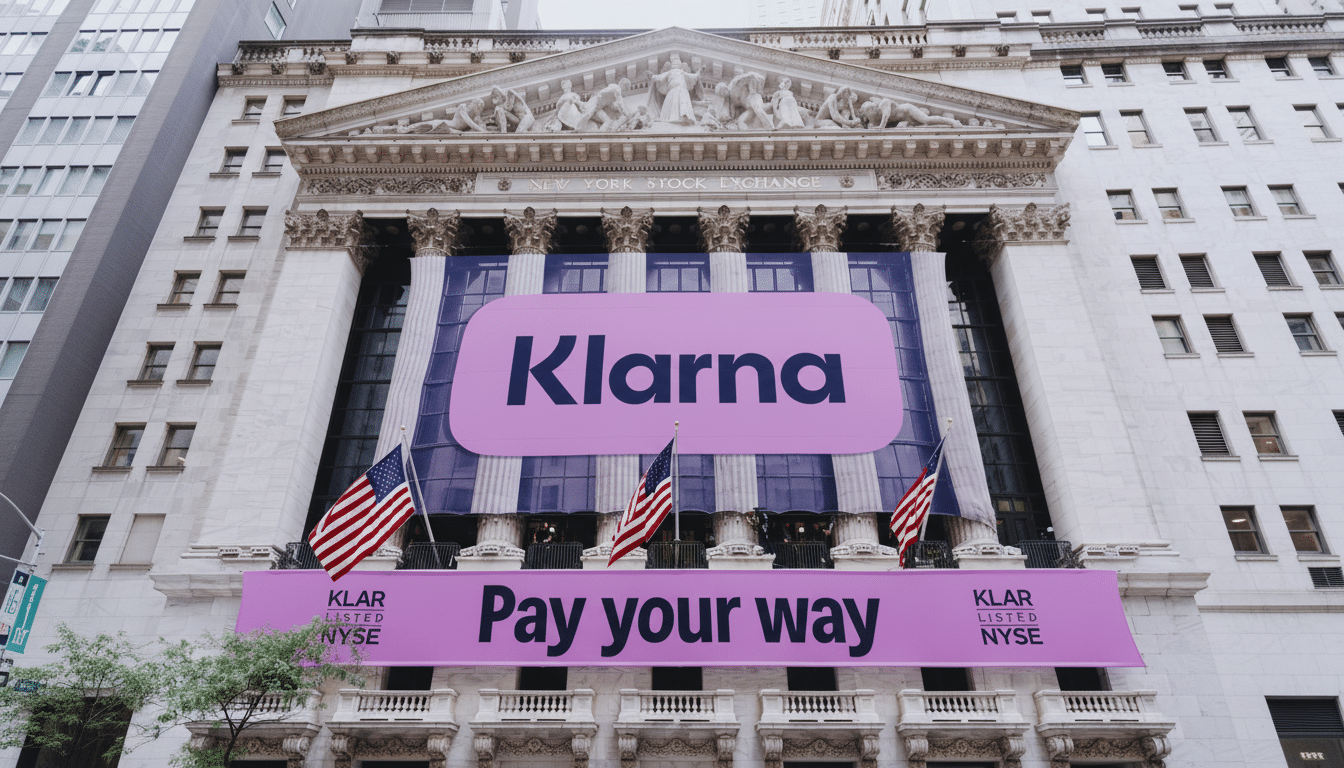

Klarna is resurrecting its listing ambitions. The Swedish provider of buy now, pay later financing and some shareholders are aiming to raise as much as $1.27 billion in an initial public offering on the New York Stock Exchange, a deal that could value the company up to $14 billion based on the proposed price range.

Deal terms and valuation

Under the company’s amended registration statement, it is selling about 34.3 million shares at $35 to $37 apiece. Klarna itself will sell about 5.6 million new shares, while existing holders will sell close to 29 million shares, a structure that offers the business new capital and longtime investors liquidity.

The listing will be traded under the ticker “KLAR” on the NYSE. Goldman Sachs, J.P. Morgan and Morgan Stanley are the lead bookrunners, with BofA Securities, Citigroup, Deutsche Bank, Société Générale, UBS and others on the underwriting bench.

The targeted valuation is a sign of how much Klarna has come since the sector’s pandemic-era peak and reset. Following a peak valuation above $45 billion as a private company, it raised money at a vastly lower valuation amid the downturn in the industry. A valuation in the mid-toddlers billions now suggests to investors that earnings (even adjusted EBITDA earnings) are finally on a steadier trajectory, and that the BNPL category as a whole is more mature.

Why this IPO now

Momentum has returned to Klarna’s top line. In its most recent reported quarter, sales jumped 54% from a year ago to $823 million, helped by a 14% increase in gross merchandise volume of $6.9 billion. Losses shrank to $53 million from $92 million, a sign of improving unit economics and tighter credit discipline.

Public market sentiment on digital lending has also found its sea legs. Investor appetite has improved for fintechs that exhibit operating discipline, a clear path to profitability, and diversified revenue beyond pure financing fees. Klarna hews to a pitch that emphasizes growing merchant solutions and consumer engagement, not only point-of-sale installment lending.

BNPL market context

BNPL has become a ubiquitous checkout offering, with usage spreading across fashion, travel, electronics and marketplaces. ( S&P Global Market Intelligence estimates come from Worldpay’s Global Payments Report, which says the category has a mid single-digit share of global e-commerce while growing as merchants target higher conversion and basket sizes.)

The competitive set is deep. Affirm is still a public comp in the U.S., Block owns Afterpay, PayPal is still driving Pay in 4, and card networks have announced installment plans at the network level. Even Big Tech has tried — Apple watered down its proprietary offering and steered consumers to bank-backed installments — indicating scale, underwriting discipline and access to funding are the ultimate advantages.

There’s also a whetting on the rules. The U.S. Consumer Financial Protection Bureau has floated expectations on dispute rights and refunds, while the U.K.’s Financial Conduct Authority and European supervisors increasingly signal intentions for stronger oversight over affordability checks and disclosures. For Klarna, clearer rules could make competition more fair but will require strong compliance systems.

What the proceeds might mean

Normally new primary capital in credit-led fintechs feeds into lending capacity, risk buffers and product expansion. For Klarna, a stronger balance sheet can lower funding costs, increase its resilience through cycles and support newer services like subscription management, advertising solutions for merchants or savings features to deepen customer relationships.

The second also gives early shareholders a more orderly exit than flooding the float. In the event of solid demand and full exercise of the greenshoe, the company is buying itself additional flexibility to deploy capital, all within a limited range of dilution that is offered to the market.

Key risks and things to watch

Two factors matter most: credit performance and cost of funds. A weaker consumer, higher delinquencies or higher funding rates would squeeze contribution margins. On the other hand, further reduction of loss rates and steady funding might be a catalyst for reaching a profitability target, and upside to valuation.

Investors will also be watching take rate trends and net credit loss rates, as well as contribution margin per order, and GMV growth per active user. Geographic mix changes and merchant concentration are other levers, as is how fast non-lending revenue (marketing and merchant solutions, say) scales versus financing income.

If the deal prices at the high end of the range and is a positive performer, it could reopen the window for late-stage fintech listings that had frozen up during the market reset. If that’s a grind, look for private fund-raising rounds to continue as the path of least resistance for a lot of BNPL and lending peers who are tuning their economics as we hook into 2022.

For now, Klarna is wagering that it can arrive at something like a more disciplined market that meets its sturdier operating profile, and called strike price of private market publicity work, to allow for a clean listing, new capital and a fresh public benchmark for the BNPL world.