Joby Aviation has filed a suit claiming that a rival air taxi manufacturer, Archer Aviation, conducted corporate espionage by recruiting an employee of Joby who then took confidential files to Archer, where they were used in ways that threatened Joby’s business. The complaint, filed in the Superior Court of California in Santa Cruz County, highlights the increasingly tense battle over intellectual property inside the electric air taxi market as a number of rival firms race toward commercialization and defense work.

Archer has denied the allegations and has described the filing as without merit, stating that the employee at issue was not involved in technical work and noting the company maintains a rigorous onboarding process that is specifically used to prevent access or misuse of former employers’ knowledge.

What Joby Alleges in Its Corporate Espionage Lawsuit

Joby’s suit revolves around a former employee, identified in the filing as George Kivork, who downloaded “a trove” of sensitive documents shortly before he resigned and later joined Archer. According to the complaint, those files included sensitive partnership terms, regulatory and business strategies, and infrastructure details like plans for vertiports and access to airports, as well as operational information about how Uber planned to run its aerial operations — including data on aircraft.

After Kivork left, Archer reached out to a strategic joint venture partner of Joby and identified granular terms of an exclusive contract in the purportedly hacked files. The episode is described in the complaint as a case of “intentional corporate espionage” and requests the court to protect Joby’s proprietary information through injunctive relief and redress its damages.

Archer’s Response and Potential Legal Exposure

Archer argues in response that Joby has not clearly identified any trade secret and failed to prove that its secrets were misused, instead filing a lawsuit simply to slow down a rival with legal wrangling. The company says it has a strong compliance and onboarding process, including policies that prohibit new hires from bringing or using materials from previous employers.

Still, trade secret cases can hinge on forensic detail. Courts generally consider file access logs, device imaging results, and communications in assessing whether confidential materials were downloaded and used to make business decisions. Relief can include anything from temporary restraining orders to expedited discovery to long-standing damage claims.

A High-Stakes eVTOL Race for Market Leadership

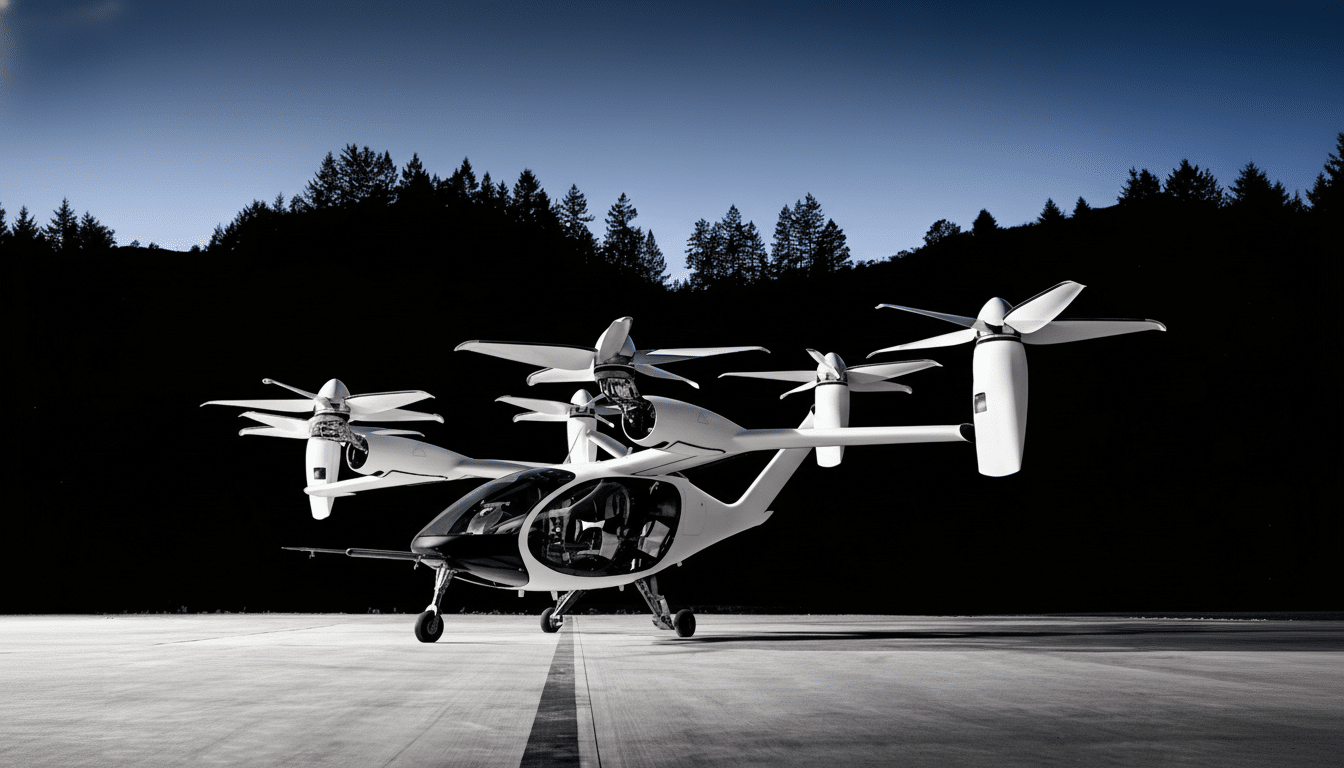

Joby and Archer, both based in California and public since last year through mergers with SPACs, are two of the most prominent players working on electric vertical takeoff and landing planes. Each is pushing for FAA certification while fleshing out that web of manufacturing, vertiport access, and operating partners — assets that can be as important as airframe performance.

The companies’ defense aspirations have brought a sense of urgency. Archer said it entered into a deal exclusively with Anduril to co-develop a hybrid gas-electric VTOL that can be used in sensitive defense missions. Joby, for its part, signed a deal with L3Harris Technologies to investigate an autonomous gas-turbine hybrid VTOL. These efforts are occurring alongside commercial air taxi efforts, and will essentially determine revenue timing prior to full-scale urban service.

Relationships with carriers and airports are important, too. Joby previously announced a strategic partnership with Delta Air Lines targeting airport-to-city-style service and Archer has collaborated with United Airlines on early-stage aircraft orders and route planning. In an industry where infrastructure, gate access, and operational slots are tight, exclusive terms can offer legitimate advantages and raise the stakes in any dispute over the details of confidential deals.

Why the Alleged Trade Secrets Matter to eVTOLs

Out of the realm of CAD files and battery chemistries, trade secrets in advanced air mobility more often now include go-to-market assets: who has vertiport rights (exclusive or otherwise) in a metro area; which airport authorities are green-lighting air taxi staging operations; how regulators are sequencing waivers to the safety and flight laws; which partners are putting down capital or minimum volumes. Having insight into a rival’s price floors or exclusivity windows can distort negotiations and compress time to market.

It’s notable that the complaint focuses on “infrastructure strategies.” Vertiports need something similar to the availability, acceptance, and integration of ground power. Mapping those nodes — and nailing them down with exclusives — may be as defensible as an airframe patent, especially in the early years of service when there are a relatively small set of workable sites.

An Industry With Legal Precedent Shaping Competition

This is not Archer’s first dance with an IP lawsuit. Wisk Aero, then part of Boeing, sued Archer last year on allegations the start-up stole trade secrets from Wisk. That high-profile case ended in a settlement two years later, after the parties agreed to work together. The settlement illustrated both the challenge of proving technical misappropriation at trial and the importance of negotiated safeguards and joint development agreements in an emerging industry.

For investors and partners, the new suit is a reminder that as eVTOL programs move from prototypes to pre-production and regulatory milestones, competitive intelligence and data governance are now board-level liabilities.

What to Watch Next in the Joby v. Archer Court Fight

Among the key near-term signals are whether Joby files an action for a temporary restraining order, how broad any expedited discovery is, and whether the court issues forensic imaging orders on devices. A protective order probably would be issued to regulate sensitive filings. Any ruling that limits partner outreach or access to some information could affect the timing of launches on the route, the pace at which defenses are prepared, and money raised by both firms.

Regardless of the outcome, it provides a window into a larger reality: In the race for eVTOLs, what matters most right now may not be visible — it is a matrix of data, agreements, and access that will determine who flies first and scales fastest.