Jaguar Land Rover has extended a production halt at several plants as it continues to work to contain and recover from a cyber attack that shut down operations over a week ago. The company said engineering teams and other experts are bringing production systems back online in a methodical manner that would not jeopardize a safe restart, and have told impacted plant-floor workers to stay home through at least the middle of the work week.

Production disrupted at UK and global sites

Assembly lines at the Halewood and Solihull plants in the UK and the Wolverhampton engine plant are still offline, with knock-on effects in Slovakia, China and India where JLR operates factories. The company has not committed to any timeline around full recovery, but says it is focusing on controlled restarts of core IT systems to prevent any additional damage or loss of information.

Under normal circumstances, JLR is producing around 1,000 vehicles a day, so each extra day of inactivity adds significantly to the production shortfall. Tier-one suppliers and logistics partners are already modifying shift patterns on a just-in-time basis, while some have temporarily laid off staff as parts pipelines grind to a halt.

The automaker, a subsidiary of Tata Motors, has been concentrating on ringfencing critical systems and validating data backups before any broader resumption. The company is hiring third-party cybersecurity firms and working with the authorities, a typical playbook when large companies are hacked.

Dealers and garages hack workarounds

The blackout wasn’t just restrictive to factories. Retailers told of problems of registering new vehicles and passing handovers, and independent garages say they were unable to order genuine parts. We now have some Band-Aids in place for high-priority tasks, but throughput is still limited. The disruption comes at the same time as the September registration-plate change in the UK, which is usually a frenzied delivery period for the industry, and raises the possibility of backlogs and missed targets.

Supplier exposure is also meaningful. Automotive production binds scores, if not hundreds, of upstream suppliers into a specific build cadence. The knock-on effects of even brief stalling can mean lost revenue down the chain, higher inventory-carrying costs and the hassle of rebooked shipping slots. Contingency plans will be tightened, and single points of failure that could be diversified will be mapped by procurement managers.

What we know about the breach

JLR won’t confirm technical details, but the company’s defensive ploy involved closures of parts of the IT estate to contain the attack and shut out adversaries — inevitably including impacts on Manufacturing Execution Systems, supplier portals and dealer tools. A group of English-speaking hackers has taken credit on social media channels, bragging about access; those claims are unverified. The pattern is consistent with data-theft-and-extortion tactics that have risen against industrial companies, security analysts say.

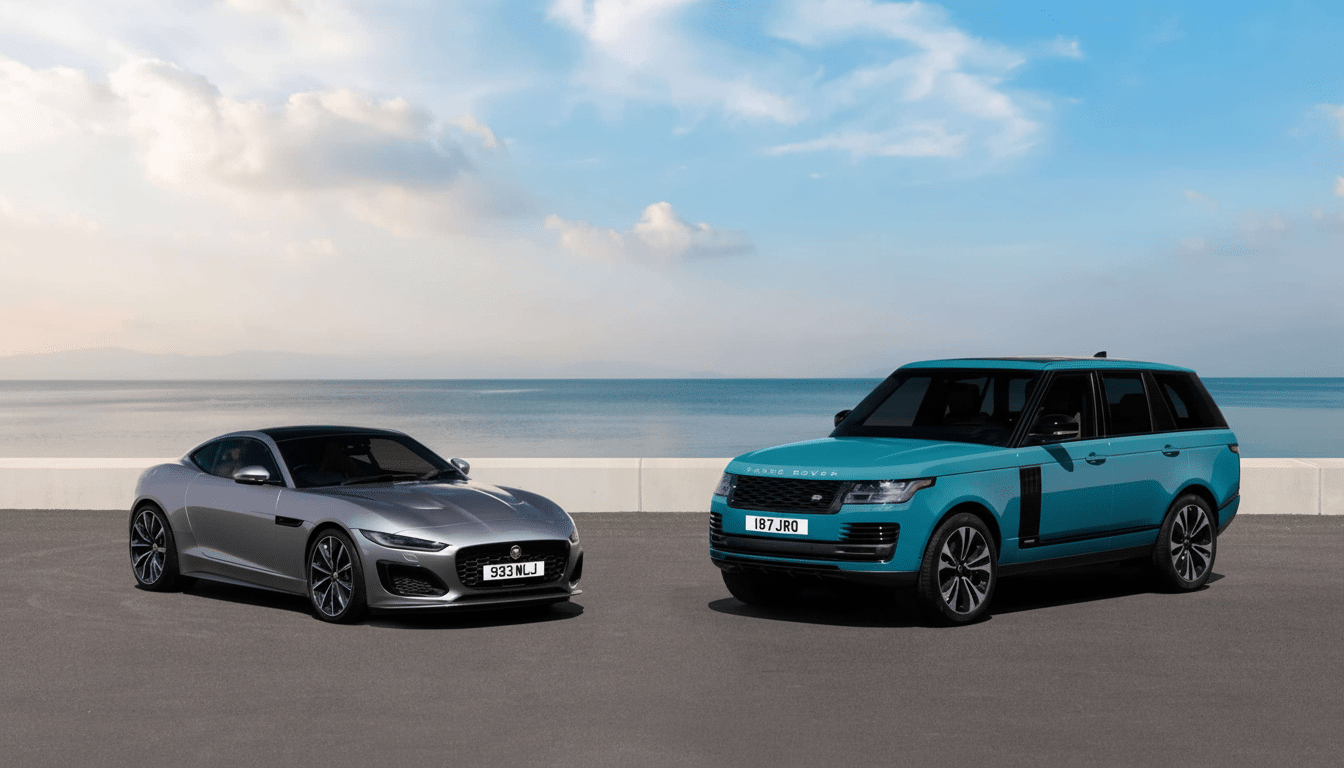

Jaguar Land Rover ATTRIBUTE TO: IMAGE: Jaguar Land Rover is to extend its shutdown due to the cyber attack having taken shape inside the company, which has forced its Wiltshire plant closed too.

Verizon’s latest Data Breach Investigations Report finds manufacturing continues to be one of the most-at-risk industries and is also one of the top targets of cyberattacks featuring system intrusion and ransomware. According to IBM’s 2024 Cost of a Data Breach report, the average global cost of a breach stands at $4.88 million, cost operational technology environments also run the additional risks associated with downtime. Coveware has cited middle ransomware-induced downtimes of 7 to 10 days — a sign of how fast cascading outages can spread across complex plants.

Why carmakers are a leading cyber target

Today, the manufacturing of cars is perched at the crossroads of factory-floor practices from the last century and cloud-connected enterprise systems. That cocktail creates a wide attack surface ranging from supplier EDI systems to dealer-facing applications. For high-end marques like JLR, IP and confidential supplier contracts are highly prized, effectively turning data exfiltration into a money-spinner for attackers even if production is back to normal in short order.

Stakes are heightened by transformation programs taking place throughout the industry. JLR’s multiyear electrification and software plan means large investment in new platforms and digital know-how. Any extended break runs the risk of delays in paperwork, stretching of working capital or expensive juggling of schedules. Investors will look for direction on pace of production recovery and the form of any backlogs clearance plan.

Impact to customers and next steps

Those waiting for new cars should expect some delivery delays, especially for builds falling during the outage period. Service departments are slowly beginning to get into ordering systems for maintenance parts, but more complex repairs could experience longer lead times. Dealers are giving preference to handovers where paperwork and pre-delivery checks can be finalised with limited reliance on the system.

For the time being, JLR is concentrating on a steady resumption, rather than getting movement through the assembly line, fast. That methodology — validate, restore, then scale — seeks to lower the risk of re-infection or corrupted data rippling back through the network. The company has not mentioned if any personal data has been compromised. If customer or employee data was impacted, regulators like the UK’s Information Commissioner’s Office would generally expect notification and action taken to fix the problem.

The more general lesson for the sector is obvious: resilience is now a competitive advantage. Organizations that compartmentalize their networks, conduct recovery drills and keep backups offline will limit downtime during an incident and mitigate reputational damage. JLR’s path to recovery in the days and weeks ahead will be a high-profile case study for how a global automaker contends with that new reality.