Founders today who are headed into a Series A encounter a tighter gate and a higher bar. The best rounds are getting done, investors say, but the burden of proof has shifted from potential to proof: repeatable growth, disciplined unit economics, and a defensible moat. And it’s worth noting that not every company should pursue venture scale in the first place.

The Bar Has Moved, Not Vanished, for Series A Rounds

Recent analyses by PitchBook and CB Insights indicate that the number of Series A deals has slipped from 2021 highs, even as median check sizes stayed high relative to pre-2020 levels. Carta has seen extended periods of time between seed and Series A, with companies spending more time to prove out their model. In short, fewer shots on goal, but investors still cut big checks to companies that show something repeatable.

- The Bar Has Moved, Not Vanished, for Series A Rounds

- Product-Market Fit Needs to Be Quantifiable

- Defensibility Over Demos Matters More to Investors

- Efficient Growth Beats Blitzscaling in Today’s Market

- Raise to Milestones, Not Months, for Series A Planning

- The Foundation of Diligence Is the Data Room

- The Founder Remains the Decider in Series A Outcomes

That repeatability is what takes a good seed story and turns it into an investable Series A in lights-out time. They want proof that what worked once can work every quarter, across geographies and segments, without heroics.

Product-Market Fit Needs to Be Quantifiable

Talk tracks about “strong demand” will no longer cut it. Investors crave consistency — sequential if possible; better this quarter than the last one at a slightly better cost with stable or even better conversion rates. For SaaS, it’s things like: $1M–$3M in ARR with 2–3x year-over-year growth, >85% logo retention, and net dollar retention >110%. OpenView’s SaaS benchmarks and Bessemer’s Cloud Index have historically highlighted these thresholds for durable growth businesses.

Pipeline and predictability are as important as the top line. A healthy funnel with 3x–4x next-quarter coverage, reduced sales cycles, and increasing win rates in the core ICP. Payback should reveal time-to-value acceleration and expansion revenue kicking in without substantial discounting.

Defensibility Over Demos Matters More to Investors

It has never been easier to ship a demo, and never harder to defend a category. Investors value moats that compound: proprietary data loops, locked-in distribution, workflow depth that births switching costs, or regulatory and integration hurdles competitors cannot easily copy.

AI adds a sense of urgency, but not carte blanche. They assess whether a startup has privileged data access, differentiated model or product architecture, efficient inference costs, and insulation from platform risk. Non-AI startups continue to win if they own the customer relationship (the data layer that AI players depend on).

Efficient Growth Beats Blitzscaling in Today’s Market

Growth at all costs is not in; efficient growth is in. “Burn multiple” is how many investors benchmark net burn for an ARR-based business, and that’s typically south of 2.0 in a good market, trending down as go-to-market matures. CAC payback in 12–18 months, gross margins that make sense for the model (70%+ for classic SaaS; lower but improving for usage-heavy or hardware-enabled businesses), and disciplined hiring plans are becoming more of a must-have than nice to have.

Carta and NVCA data reveal bridge rounds and down rounds are happening at higher rates as compared to boom times, a lesson that valuation discipline at Series A saves pain later on. Founders who couple credible growth plans with sober spending intentions are the ones that generally earn better terms and board chemistry.

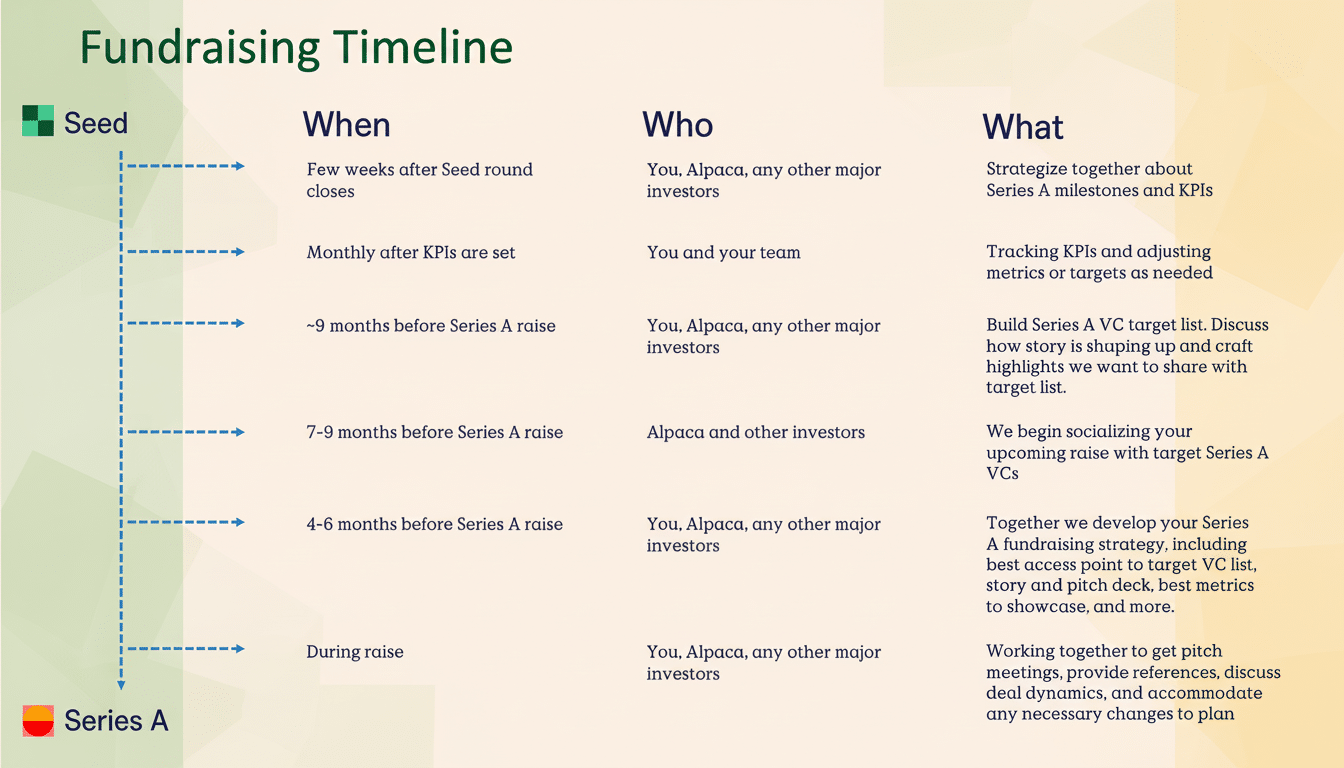

Raise to Milestones, Not Months, for Series A Planning

Leads expect a milestones-first plan. Translate the use of proceeds into two to three crisp accomplishments you can deliver before your next raise: e.g., doubling ARR while getting payback <15 months; shipping enterprise features enabling SOC 2 and a dozen six-figure contracts; proving out a second channel with predictable CAC.

Target 18–24 months’ worth of runway after the round is closed, but anchor your ask in what those months buy in terms of risk reduction. Be clear about board buildout, information rights, and a clean cap table. Don’t pyramid with heavy preferences or complicated side letters that restrict later rounds.

The Foundation of Diligence Is the Data Room

It’s a quick, clean process that speaks to execution maturity. Build a monthly financial model, unit economics by segment, cohort retention curves, pipeline snapshots, product roadmap with shipped versus planned, and security posture (SOC 2 trajectory, DPA templates), customer references, and cap table with option pool plans accessible to anyone with access to the data room. Consistency of format (deck/model/ref) in itself is a diligence win.

Founders often overlook pricing architecture. Bring proof from win–loss analyses and discount waterfalls. Investors want to see that ACV growth is coming from value packaging and promotions, not one-off concessions.

The Founder Remains the Decider in Series A Outcomes

Metrics get you the meeting; founders get you the term sheet. Traits that never show up on a dashboard and investors cite time and again: speed bias without chaos, recruiting magnetism, clarity of thought, and learning velocity. A team that compounds faster than the market can still capture a lead even in noisy areas, especially when the upside is potentially quite large.

The lesson that emerges is both straightforward and difficult. If your business is not obviously on track to venture scale, do not try and make it appear so. If it can be [based on my experience at Etsy], ground your Series A around evidence you can sell repeatedly, grow with good unit economics, and defend what you are building. Everything else is commentary.