Intuit is offering a 50% discount on QuickBooks Online across all plans for the first three months, with a 30-day trial of Live Expert Assist bundled in. The deal applies to the cloud-based edition that has become an Editors’ Choice standout in independent reviews, making a compelling case for small businesses and freelancers who want robust accounting without the sticker shock.

The timing is notable. With small businesses navigating tight margins and volatile cash flows, cutting accounting costs while upgrading capabilities is a practical win. QuickBooks Online’s feature depth—paired with its huge ecosystem and accountant familiarity—means many teams can turn this short-term savings into long-term operational gains.

What the 50% off QuickBooks Online deal includes

The promotion halves the subscription price for the first three months on any QuickBooks Online plan, from entry-level bookkeeping to more advanced tiers with inventory and deeper reporting. New sign-ups also get 30 days of Live Expert Assist, connecting users with trained product specialists who can help configure accounts, fix reconciliation snags, and set best practices from day one.

While terms can vary, this discount typically applies to new QuickBooks Online subscribers and add-on services like Payroll are billed separately. It’s a straightforward on-ramp: choose a plan aligned to your needs, lock in the 50% rate for three billing cycles, and use the included expert assistance to accelerate onboarding.

Why QuickBooks Online stands out for SMBs and startups

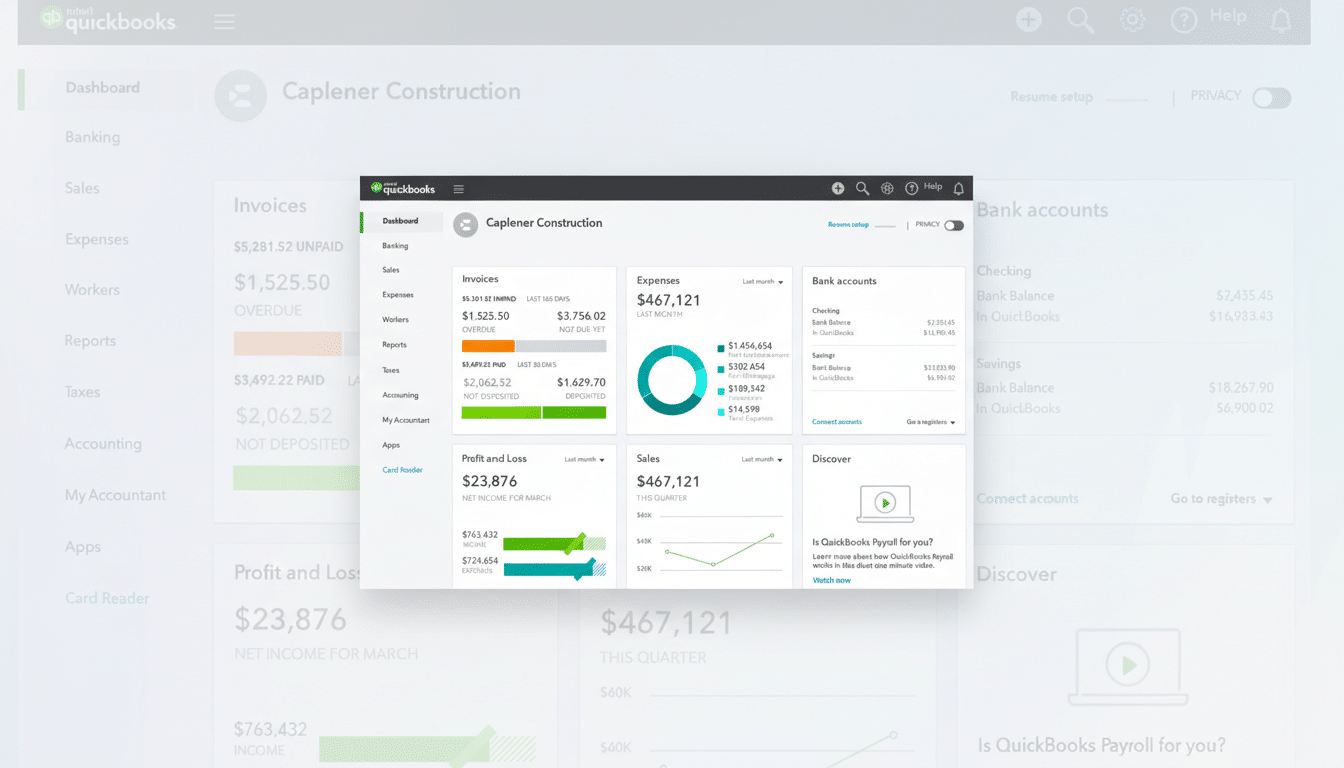

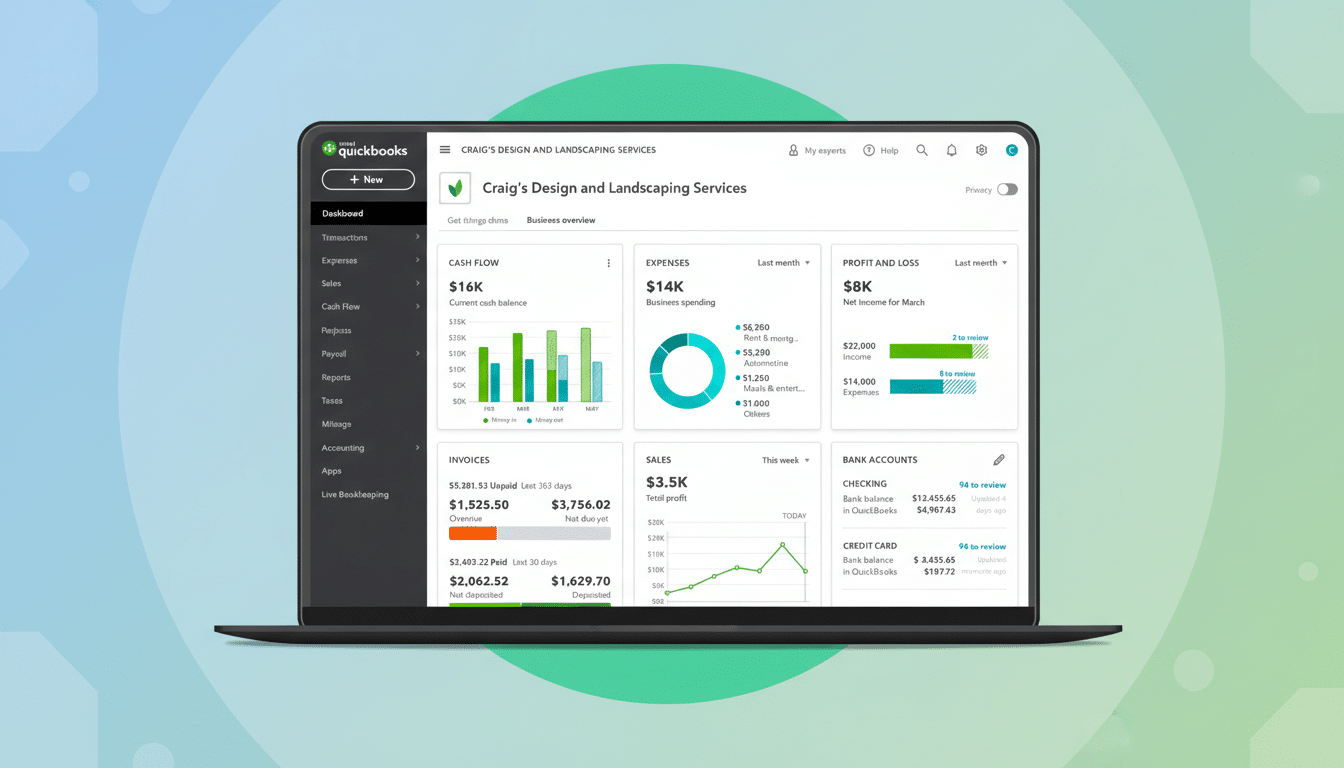

QuickBooks Online connects securely to bank and credit card accounts to automate transaction imports and categorization, reducing the manual data entry that drains time and invites errors. Customizable rules, receipt capture via mobile app, and automated reconciliation accelerate month-end close and keep books audit-ready.

Invoicing is a strong suit. Users can generate estimates, convert them to invoices, enable online payments, set recurring schedules, and chase late invoices with automated reminders. For teams that bill hourly, time tracking and project tagging roll seamlessly into invoices and profitability views.

Product-based businesses get inventory tools that support FIFO costing, purchase orders, low-stock alerts, and vendor management in eligible tiers. Service firms benefit from class, location, and project-level reporting to understand job costs and margins. Payroll integration adds automated runs, tax calculations, filings, and an employee portal for pay stubs and forms.

Reporting depth is a hallmark. Dozens of built-in reports cover cash flow, profit and loss, balance sheet, budgets, A/R and A/P aging, sales by product or service, and tax-ready summaries. Customizable dashboards surface KPIs at a glance, while accountant access and closing date controls help preserve data integrity.

The platform’s app marketplace and third-party integrations—spanning ecommerce, payments, point-of-sale, time tracking, and CRM—extend functionality without duct-taped spreadsheets. For many small businesses, that ecosystem is the difference between outgrowing an entry tool and scaling on a stable accounting backbone.

Trusted by accountants and backed by scale

Accountants tend to favor QuickBooks Online because it mirrors professional workflows and keeps client files accessible from anywhere. The ProAdvisor community and extensive training resources also make it easier for firms to support clients. Independent software reviewers consistently rate QuickBooks Online near the top for breadth of features, reporting, and customizability, a track record that explains its Editors’ Choice recognition.

Intuit’s accounting ecosystem reaches millions of businesses globally, according to the company’s latest annual report. That scale matters: it yields frequent feature updates, strong compliance support, and a deep bench of certified experts. With the U.S. Small Business Administration counting more than 33 million small businesses nationwide, mainstream tools with proven reliability carry real weight.

Who should jump on this QuickBooks Online 50% offer

Freelancers and new microbusinesses can use the discount window to move off spreadsheets, automate invoicing, and get a clean chart of accounts in place before tax season. Growing retailers and wholesalers can test advanced tiers for inventory and purchase workflows. Service companies with recurring revenue will appreciate scheduled invoices, progress billing, and project profitability tracking.

Before you buy, map needs to plans. If you require multi-entity consolidations, industry-specific job costing, or advanced analytics, review features by tier. If your accountant already works in QuickBooks, that alignment alone can save hours every month on document handoffs and cleanup.

How to maximize the 50% discount window and trial

Use the first week to connect bank and card feeds, import your vendor and customer lists, and set up categories that reflect how you manage money. Turn on receipt capture in the mobile app so every expense is documented the moment it happens. Create invoice templates with your logo and payment options to speed cash collection.

Schedule recurring invoices for subscriptions or retainers, and set automated reminders for late payers. Build a core report pack—P&L, cash flow, A/R aging, and a simple budget vs. actual—to review weekly. If payroll is in scope, configure it early to validate with a test run before the first live cycle.

Most importantly, book time with Live Expert Assist during the included 30 days. A one-hour session that validates your chart of accounts, bank rules, sales tax setup, and closing procedures can prevent months of rework. When the discount period ends, you’ll have a streamlined system that pays back in time saved and decisions made.

For small teams chasing better cash control and cleaner books, this 50% QuickBooks Online offer is an easy yes. The value is not just the lower price—it’s the chance to standardize your accounting stack with guidance and momentum.