The U.S. restrictions on Huawei have reshuffled the smartphone industry, splintered Android’s app world, and rewritten global supply chains.

That ban still stands, and you need to understand what it covers, how Huawei has responded, and what it means in practice for the people buying their devices.

- What the Huawei Ban Actually Prohibits and Restricts

- How Huawei Phones Were Affected by the U.S. Sanctions

- Chips and Supply Chains Under Strain from Restrictions

- HarmonyOS and the Android Compatibility Question

- Market Share Reality Check for Huawei Smartphones

- What It Means for Consumers Considering Huawei Devices

- Key Entities and Evidence to Watch in This Ongoing Case

What the Huawei Ban Actually Prohibits and Restricts

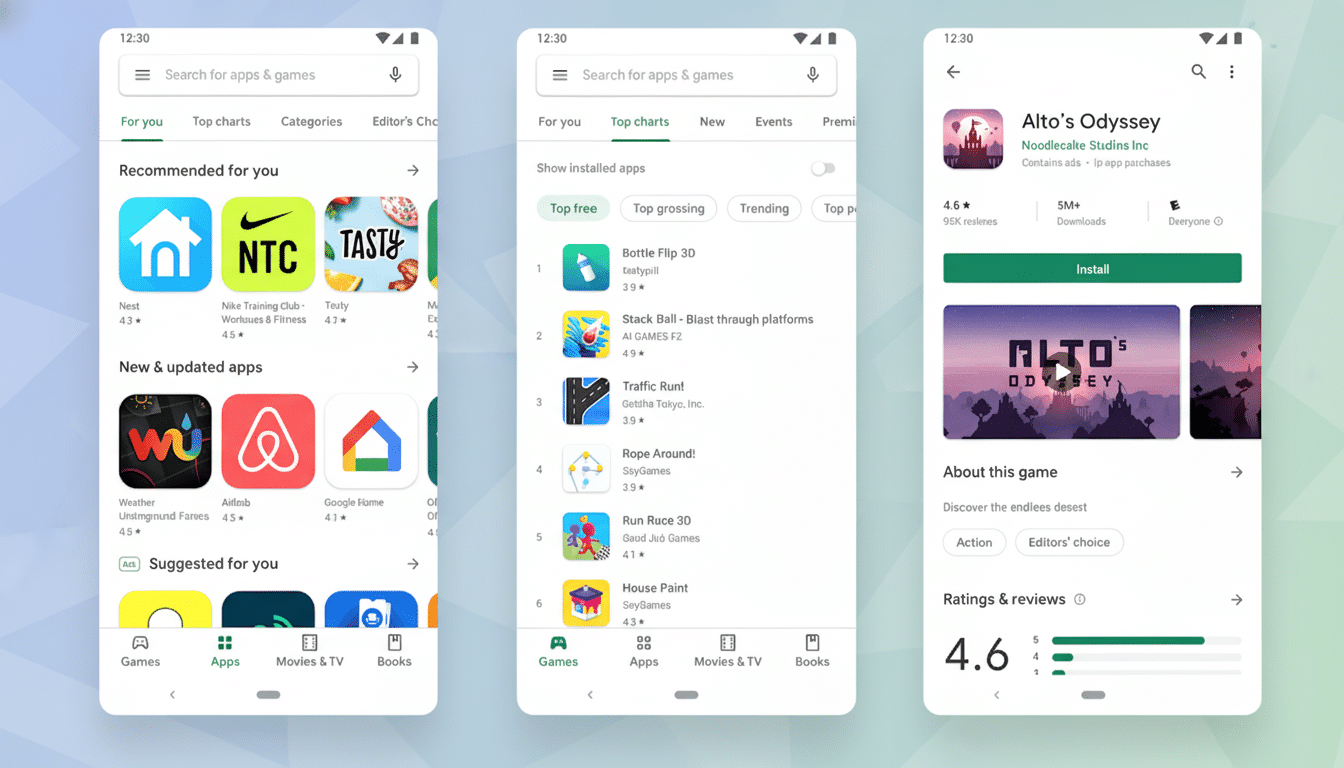

The U.S. Department of Commerce added Huawei and several affiliates to the Entity List, barring American companies from supplying them with computer chips, software, and other components without a special license. Google complied, which means that new Huawei devices sold outside of China cannot offer Google Mobile Services such as the Play Store, Gmail, Maps, and Play Protect certification.

The order also addresses telecom infrastructure. The Federal Communications Commission acted to bar the use of federal funds for Huawei network gear and introduced a “rip-and-replace” reimbursement program for carriers. Investment gaps in the tens of billions of dollars are evident from industry filings, highlighting the magnitude of network migrations and the long tail on the policy.

How Huawei Phones Were Affected by the U.S. Sanctions

Devices certified before the Entity List action continue to receive Google services; anything after does not.

Huawei pushed back by spinning up its own ecosystem: Huawei Mobile Services, AppGallery, Petal Search, and Petal Maps, a web of developer kits meant to replicate popular Google APIs. It is more effective in China, which was never outfitted by default with the Play Store and where local stores control distribution.

For buyers overseas, it is a different story. Although there are many mainstream apps on Huawei’s AppGallery, certain ones that depend on Google Play Services aren’t able to run as they would normally. There are workarounds to sideload, but security researchers and platform vendors caution that they’re brittle and insecure. Banking, ride-hailing, and the reliability of notifications differ by app and region.

Chips and Supply Chains Under Strain from Restrictions

Historically, Huawei designs the Kirin processor and foundries run a production line for them. Export controls limited access to state-of-the-art equipment and took one path to leading nodes off the table through foreign partnership. Though some U.S. companies have been allowed to ship non-5G-related parts, the overall intention is still clear: to limit Huawei’s access to state-of-the-art chips and design tools.

Huawei has relied on domestic manufacturing in an effort to resurrect in-house chipsets. A well-known TechInsights teardown reported on a Huawei flagship in an advanced node from China, indicating progress despite equipment constraints. The open question remains yield and volume — whether local capacity can provide enough high-performance silicon to sustain flagship cycles at scale.

HarmonyOS and the Android Compatibility Question

Huawei’s strategy for operating systems advanced rapidly. Early HarmonyOS builds revealed some deep Android roots, a point that Ars Technica’s code analysis makes clear. The latter is removed from the upcoming version of HarmonyOS NEXT, which in turn forces developers to natively compile apps against Huawei’s toolchains and services.

This is a bold bet. It eases dependence on open-source Android, but it also requires developers to address yet another platform. Huawei has dotted a lot of porting incentives around, and boasts those deep integrations across phones, wearables, audio, and IoT. The result is a strong ecosystem in China, and a spottier one globally, where Android and iOS still reign supreme.

Market Share Reality Check for Huawei Smartphones

Here’s the broad arc according to analysts at Counterpoint, Canalys, and IDC: Huawei surged to become the top tier of global smartphone vendors pre-sanctions, then plummeted outside China as Google-less models rolled out. Huawei’s global share is low single-digit if not lower — but it has reclaimed the double-digits at home thanks to camera-centric flagships and patriotic binging.

There is a parallel story on the telecom side. European operators diversified from Huawei in 5G core networks, under pressure from national security reviews; some countries kept their Huawei gear at the layer where phones connect to the network radios. The patchwork policy also introduces cost, complexity, and uncertainty for carriers, which is one reason for the FCC’s reimbursement shortfall.

What It Means for Consumers Considering Huawei Devices

There is no legal reason not to buy, sell, and use Huawei stuff in most places. Current Google-certified models continue to work as they did from when first launched. The newer phones instead run Huawei’s services and store; many of the apps you use every day exist, although any Google ones do not. Contactless payment will rely on local partners and doesn’t involve Google Pay, and app notifications may vary by application.

Hardware is largely competitive: good phones with great cameras and build quality, and efficient chipsets where the supply is there. Connectivity options will differ depending on the model and region, may not be available in all regions, and are subject to change without notice. 5G network availability may vary depending on country, carrier, and user environment. Bluetooth watches and wearables already work fine because these standards are not platform-specific.

Key Entities and Evidence to Watch in This Ongoing Case

Policy changes would derive from either the U.S. Department of Commerce’s Bureau of Industry and Security licensing regime or, if congressional action informs the FCC’s position on security grounds, by way of a statement reflected in that body. On the tech side, look out for teardown analyses from outfits like TechInsights, developer adoption signals from app analytics companies, and shipment data from Counterpoint, Canalys, and IDC. If Huawei can maintain silicon at scale domestically, and speed HarmonyOS NEXT adoption, its China momentum might keep increasing even as global share stays artificially capped.

The bottom line: The ban is still in place, and Huawei has responded by developing a parallel ecosystem, retuning its supply chain, and doubling down on the home market. So for buyers, the experience is still workable even if different; for the industry it’s a stress test of how far platform and supply diversification can go under sustained geopolitical pressure.