Most guides will instruct you which button to tap. Few tell you how to make a clean break. Think of closing a money app as moving out of an apartment: You do not just hand over the keys; you fix the walls, cancel utilities and take photographs of empty rooms. Whether you find the signatures crumpled in your car’s ashtray or crammed between your couch cushions, keeping them on hand will give you a clean break when it comes time to delete Cash App account history.

The clean break framework for closing your Cash App account

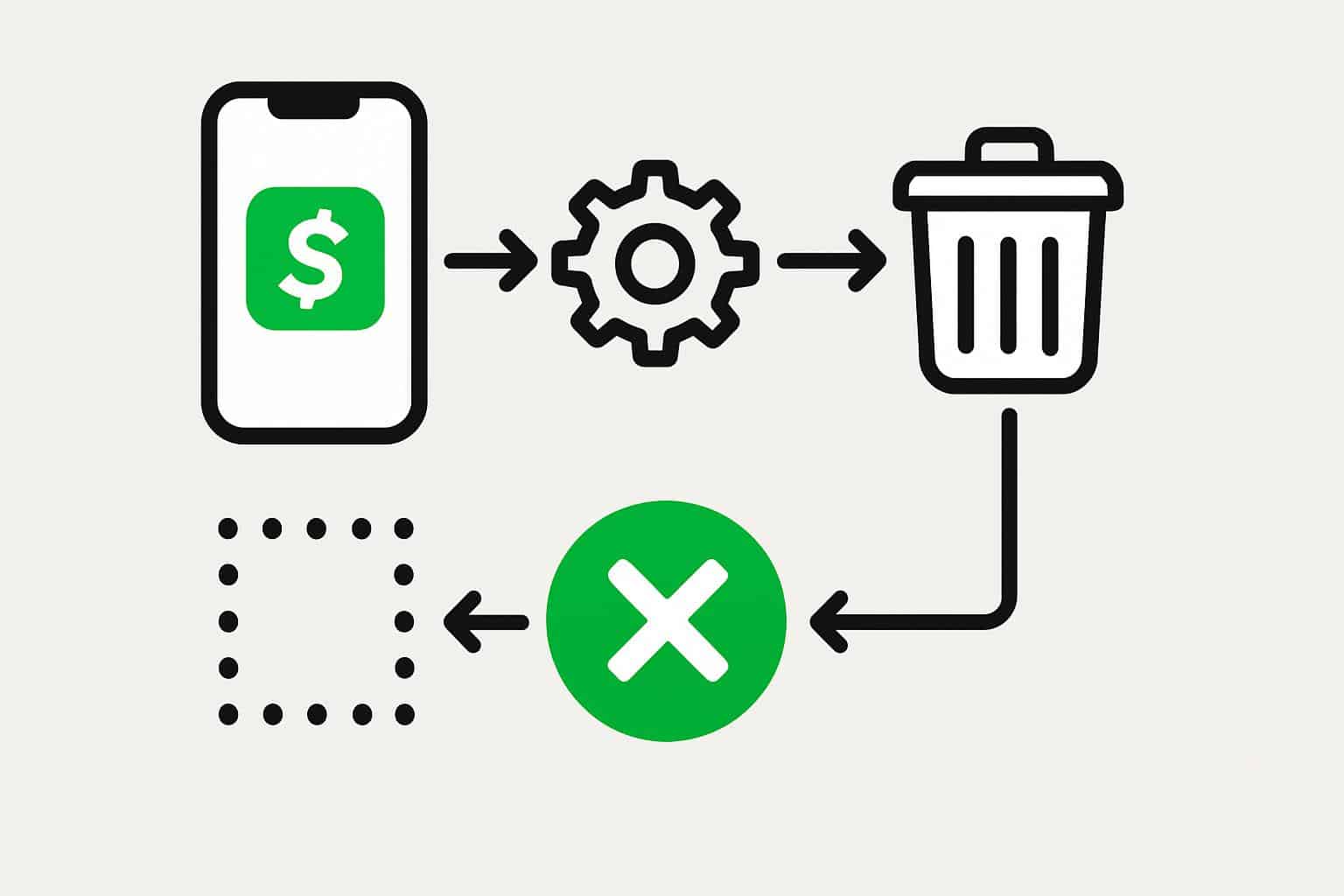

Follow this four-part flow: Plan, Move, Seal, Verify. It sounds simple, but each step precludes a different form of aftershock.

- The clean break framework for closing your Cash App account

- Before you tap close: the essential exit audit checklist

- Where the close account option lives inside the app

- Hidden gotchas people miss when closing Cash App accounts

- Recurring Subscriptions

- Refunds That Arrive Late

- Employer Timelines

- Compliance Reality Check

- $Cashtag And Reuse

- If you can’t close the app: fixes for common roadblocks

- The simple three-bucket method for moving out

- After you close: what changes and what does not get erased

- Little scenarios to stress-test your plan

- Quick close checklist and the key takeaway summary

Plan

Include all that’s associated with your Cash App account — balance, Cash Card, direct deposit, recurring payments, Bitcoin or stocks, tax statements and pending refunds or disputes.

Allow yourself a peaceful session to collect and reflect, rather than shutting in a panic.

Move

Move out all value: transfer your balance, stop or reroute recurring payments and sell positions held inside the app. If you had a Cash Card that was linked to subscriptions, switch each of those over to an alternative card before deactivating it to keep services running smoothly.

Seal

Close only once you have a zero balance and other assets and pending items are cleared. Closing doesn’t erase financial records, but it does prevent the account from being used or charged again.

Verify

Afterward, check that the card is no longer viable, that the app reflects your account being shut, and that your subscriptions are no longer trying to bill it. Screenshot important screens and use them as evidence of how things looked before closing.

Before you tap close: the essential exit audit checklist

Consider this pre-close checklist your moving-out walkthrough.

- Balance: Send your remaining balance to a bank or person you trust. Leave zero dollars.

- Bitcoin and Stocks: Sell any positions in the app. Transferring crypto or securities out of the app is not selling; be certain that proceeds actually land in your cash balance before considering them cash.

- Cash Card: List which services charge this card. Switch each of those to a new card so you don’t accidentally get charged or lose service.

- Direct Deposit: If your paycheck or benefits load into Cash App, switch them over before you shut down. Or expect an overlap of one pay cycle for employer timing.

- Unfinished Business: Look for payments not received, refunds, chargebacks or disputes. These may hold your account open until they clear.

- Statements and Tax Forms: Download your monthly statements and any tax documents, like forms from stock sales or business deals. The availability of some records may open at a later date, but assume not.

Where the close account option lives inside the app

You close the account from within the app, not by removing it from your phone. It might be worded differently depending on your version and region, but you’ll find it from the profile area.

- Open the app and click on your profile icon.

- Find Settings or Support and open Account, or Account Settings.

- Select the option to close or delete your Cash App account, and then tap confirm.

- Click “Close Account.” (If you don’t see this link, click the in-app search bar and search for Close Account, then follow the guided steps.)

If your balance is not zero, or you still own Bitcoin or stocks, the app will typically prevent you from closing and display what to fix first.

Hidden gotchas people miss when closing Cash App accounts

Recurring Subscriptions

If a subscription attempts to charge your closed Cash Card, it will generally decline. That’s all fine until it cancels services you rely on. Update your billing info before you close it.

Refunds That Arrive Late

Merchants let refunds marinate days after a return. If your account is closed, they won’t be able to post to your old card. Finalize returns and verify refund status prior to closing, or make alternative refund arrangements with the seller.

Employer Timelines

Payroll systems typically lock details a few days before payday. Switch your direct deposit early and wait for one last deposit to the old route. Close only after you see a deposit hit the new account.

Compliance Reality Check

Shutting down your account does not erase any financial activity, and records may be kept on hand to fulfill legal or security requirements. That’s typical for banks and money services. Anticipate those to still be on the books after they close, just as a lender holds on to old loan files.

$Cashtag And Reuse

After you close, your $Cashtag and card number can no longer be used. If you later want to set up a new account, the same $Cashtag may not be available. Pick a new handle instead of assuming you’ll get the old one back.

If you can’t close the app: fixes for common roadblocks

Occasionally, the app will hang for reasons that are not clear. Work through these in order:

- Negative Balance: Some chargebacks or fees may cause you to go negative. Clear it first.

- Pending Payments: Let pending transfers or refunds complete. It can be slower to cancel them than to wait.

- Identity Check: Follow through and verify if the app requests verification. These are things the provider needs to process closure for security and compliance reasons, so often they require verified identity.

- Device Mismatch: If you can, log in on your primary device. There are also security rules that limit what kinds of sensitive actions new devices can do.

If none of that is successful, use the in-app help flow from your profile and explain that you want to close down the account once you have settled up. Support can see the blockers on their end and push you along.

The simple three-bucket method for moving out

Guide the transition by sorting everything into three buckets: Money, Access, Proof.

- Money: Balance, Bitcoin, and stocks. You can liquidate assets inside the app and transfer cash to your bank.

- Access: Via Cash Card and direct deposit. Change payment types on subscriptions and update your payroll information.

- Proof: Statements; tax forms; screenshots of zero balances and a closure confirmation. Remember to place them in a folder with an easily identifiable name and date.

After you close: what changes and what does not get erased

- Stops: Cannot send or receive money, use the card or log in to make payments.

- Retention: Historical transaction data may be kept for the period of time required to maintain such information. This is basic finance.

- Reopen: You may be able to reopen if closed in error with support assistance. If you are looking to make a fresh start, you can re-enroll with another $Cashtag.

Little scenarios to stress-test your plan

Side Hustle Seller

You sold stuff, used the Cash Card for labels, and got a few items back. Action: Keep the account open until you have received and posted the returns. Close after downloading a final statement for your records.

Investor Experiment

You experimented with small stock and Bitcoin purchases. Action: sell the holdings; after the proceeds settle in your cash balance, transfer to your bank and then close. Keep any tax summaries in case there are questions down the road.

Direct Deposit Switch

You switched jobs and prefer to have everything in a single bank. Action: 1) update your employer first, 2) wait for the new paycheck to hit the new account, and then 3) close out of Cash App. This avoids deposits being lost in the gap.

Quick close checklist and the key takeaway summary

Closing your Cash App account is not a matter of just tapping a button; it is a project that takes less than an hour in total, but you need to plan. Do what I did in the video above: plan your exit, move your money, seal everything, and verify the result. When you do that, you obtain what many people want but routinely fail in financial apps: a tidy breakup where nobody is left hanging.