In a capital-flush but access-starved market, a Washington-based venture firm backed by Mubadala is quietly collecting up allocations to some of the tech industry’s most coveted properties. AAF Management’s edge has been constructed not on outspending its competitors, but on crafting the firm’s new $55 million Axis Fund as a direct-investing/LP-position mix in top seed managers — a strategy that aims to get in early, move fast, and follow winners through stages.

A Hybrid Built for Access Across Startups and Funds

AAF’s Axis Fund is investing about 80% of its capital directly into startups and the rest into nascent venture funds, often sub-$50 million vehicles. And the dual mandate serves more than just diversification. It cements AAF in the very top of the funnel, where you’ve got the highest density and variance in deal flow, and creates mechanisms to co-invest and double down as companies scale.

The firm has supported 25 pre-seed and seed funds with its Axis vehicle, and it has invested directly in five companies across the early to growth stages. Adding it up: Across its four funds, AAF boasts 138 direct positions and relationships with 39 distinct emerging managers, which translates — sorry: should translate, in theory, anyway — to line-of-sight (or indirect) exposure to some 800 venture-backed startups founded between 2021 and 2025. That pipeline is how you turn a rather limited pool of capital into a vast funnel of proprietary opportunities.

Turning LP Seats into Deal Flow with Emerging Managers

The first believers in outlier founders are often emerging managers. By writing LP checks into these Fund I and Fund II vehicles, AAF buys early looks, co-invest invites, and intel that might sharpen conviction. Cambridge Associates has noted that smaller, specialized venture funds significantly overindex in top quartile results across multiple vintages; AAF’s approach puts this insight into action, operationalizing proximity to such managers.

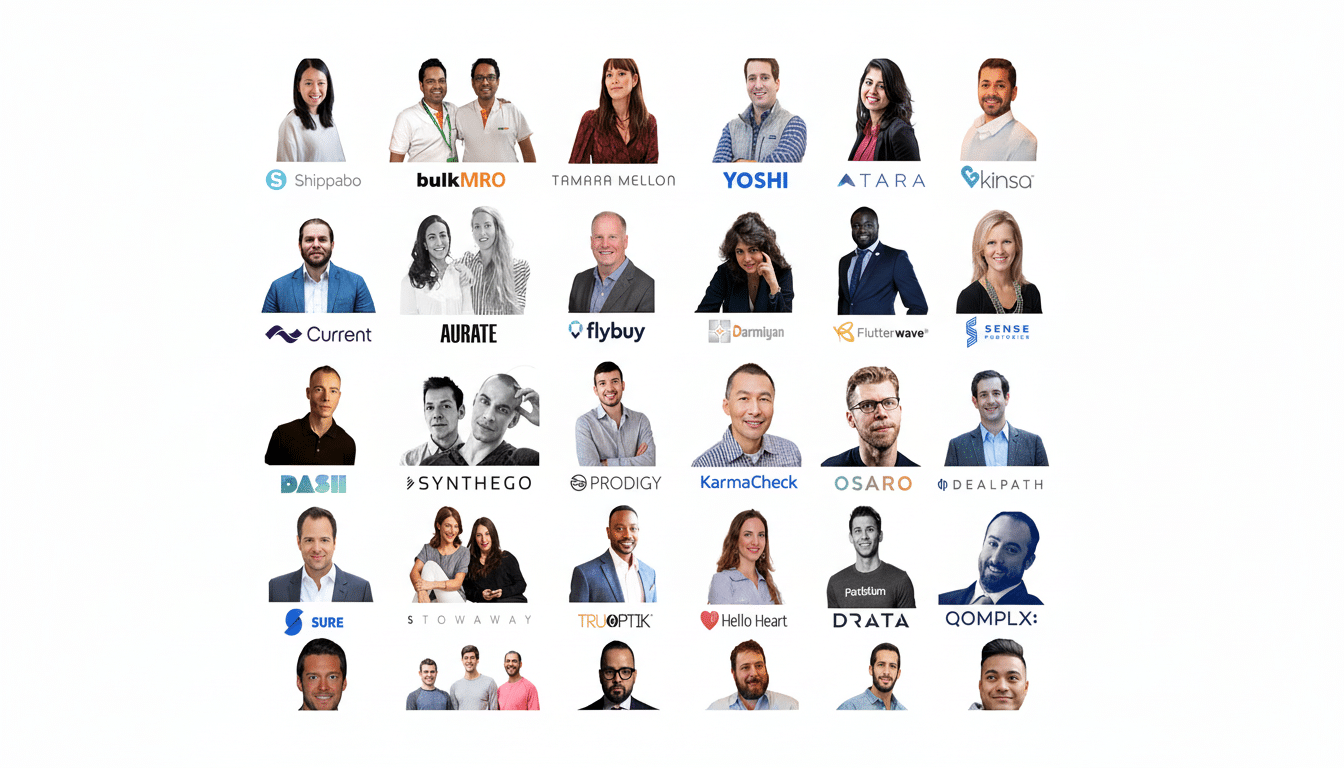

The findings appear in the names. Some of AAF’s early investments include Current, Drata, Flutterwave, Jasper and Hello Heart. The firm also has indirect exposure to high-growth companies including Mercury, Deel, Retool and a new wave of AI startups such as Motion, Decagon and ElevenLabs, through its LP stakes — e.g., in Leonis Capital, Wayfinder Ventures and Quiet Capital. It’s hard to get access like that for such a fund (size) without the LP-on-ramp.

Founder Value That Compounds At Growth Stage

Unlike recruiting- or product-help platforms, AAF doubles down on capital formation. Founders plugged into AAF’s network receive introductions within days to over 40 active venture funds in which AAF is an LP and a direct line to institutional capital ready to lead their later rounds. In stark contrast to the era of ever more capital, in a throttling fundraising market like today’s, that “instant distribution” into trusted manager ecosystems can collapse timelines between seed, Series A and growth checks.

This capital-market focus appeals to founders who are seeking flexible follow-on, cross-stage participation and a clear path to top-tier growth investors. It also caters to LPs — especially institutions in the Gulf region — hunting for diversified venture exposure minus operationally intensive direct programs.

Mubadala’s Signal and the Gulf Bridge for Venture

Supported in part by Abu Dhabi’s Mubadala as well as U.S., European and MENA family offices and other institutions, AAF aims to serve as a bridge between Gulf capital and North American innovation. This research follows a rash of activity that has seen the Gulf’s SWFs and 2nd-tier investment funds commit more and more into private markets in recent years, with an increased demand for venture access through specialist managers. AAF translates that supply into focused bets across early-stage funds and promising startups, making this two-way bridge both founder- and LP-friendly.

Measured Outcomes, Not Megafund Optics or Fund Size

A lot of that has been by design, as AAF’s partners have made an effort to keep fund sizes small — the firm manages some $250 million in assets over four funds total — and focus on being selective rather than large. The firm cites 20 exits in its portfolio that collectively were valued at nearly $2 billion, with buyers including TransUnion, GoodRx and Affirm. It also notes that previous funds rank in the top 10th percentile on a net TVPI basis for their vintages, citing benchmarks from Cambridge Associates and Carta. It is ultimately the LPs that have to verify performance, but this pattern speaks of a strategy which leans toward early signal, disciplined follow-on and non-consensus access.

Why This Works in Today’s Venture Cycle and Market

After the venture activity reset identified by PitchBook and others, founders appreciate investors who can introduce them to the right next-round leads and also help them pace capital thoughtfully. AAF’s model — small, fast and staunchly wired into seed managers — flouts the derided phenomenon of today’s market: that bottlenecking at Series A or B can be solved with both an early conviction AND a believable syndicate escalation plan. It has made the firm a favored co-investor in competitive rounds where distribution is as important as price.

The lesson is not so much about a fund, but rather a playbook. In an environment where the most valuable resources are trusted access and knowledgeable follow-on, a lean Mubadala-backed firm like AAF can out-muscle bigger competitors by concentrating on where signal comes from, snuggling close to upstarts and monetizing that network for real financing outcomes for breakout startups.