Heron Power has secured $140 million to accelerate manufacturing of solid-state transformers designed for energy-hungry data centers and the electric grid, a fresh signal that power electronics are moving from pilot projects to large-scale deployment. Founded by former Tesla executive Drew Baglino, the company says customer interest already exceeds 40 gigawatts of capacity, prompting an earlier-than-planned push to expand production.

Funding Underscores Surging Power Demands

The round is led by Andreessen Horowitz’s American Dynamism fund and Breakthrough Energy Ventures, with participation from Capricorn Investment Group, Energy Impact Partners, Gigascale Capital, and Valor Atreides AI Fund. The investor mix reflects a growing thesis: AI-scale data centers and renewable-heavy grids need fast, software-definable power hardware, and they need it at unprecedented volumes.

Heron Power’s rapid fundraising cadence mirrors the urgency among hyperscalers and colocation providers. As compute clusters jump from tens to hundreds of megawatts per campus, operators are prioritizing equipment that shrinks footprint, cuts heat, integrates storage, and responds in milliseconds to volatile loads and intermittent generation.

What Solid-State Transformers Change For Grids And Data Centers

Solid-state transformers (SSTs) replace century-old iron-core designs with semiconductor-based power conversion. Instead of one bulky box that passively steps voltage up or down, SSTs actively manage energy flows, condition power quality, and coordinate across multiple sources such as solar, wind, the grid, and batteries.

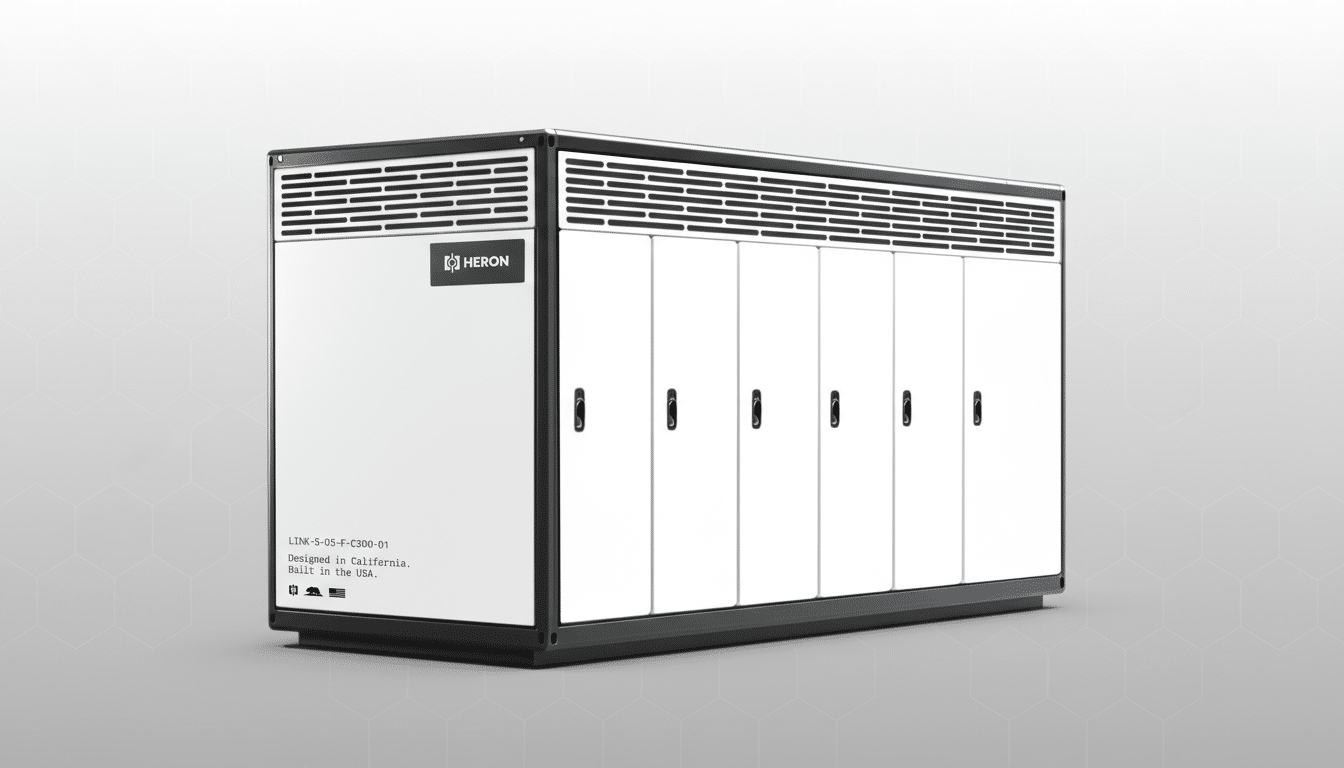

Heron Power’s system, branded Heron Link, converts medium voltage to the 800-volt power profile that high-performance AI racks now favor, including reference architectures aligned with Nvidia’s rack designs. Each unit is rated around 5 megawatts and is built from modular conversion blocks; if one module fails, it can be swapped quickly without taking the entire system offline, a stark contrast to traditional monolithic transformers that require long outages and heavy-lift replacements.

The design also embeds specialized lithium-ion cells that deliver fast-discharge ride-through power for roughly half a minute—long enough to bridge to backup supply and, in many cases, eliminate standalone uninterruptible power supplies. By consolidating multiple functions (transformer, rectifier, power conditioning, and short-duration backup), Heron says its architecture removes a large share of legacy gear, simplifying engineering, reducing points of failure, and shrinking capex and opex.

AI Infrastructure Is Rapidly Rewiring The Electrical Grid

Global data center electricity demand is surging. The International Energy Agency reports that consumption could roughly double in the near term, driven by AI training and inference workloads. That growth collides with transformer bottlenecks, interconnection delays, and aging grid assets—challenges flagged by the U.S. Department of Energy and the North American Electric Reliability Corporation as risks to reliability.

At campus scale, even a small efficiency gain compounds. A 1% improvement at 5 megawatts saves 50 kilowatts per unit—power that otherwise turns into heat requiring still more cooling. The ability to tightly control voltage and harmonics at the rack level is increasingly valued by operators who must meet strict uptime targets while pushing power densities higher.

Manufacturing Plan And Market Share Ambition

Heron Power plans to build a factory targeting annual output of roughly 40 gigawatts of Heron Link units. By the company’s estimates, that equates to about 10% to 15% of annual transformer production outside China—or roughly 5% to 10% of global demand—and amounts to capacity comparable to half of Texas’s peak load.

The company aims to begin pilot production before ramping over the following years. Beyond data centers—which currently account for about one-third of its pipeline—Heron cites strong interest from utility-scale solar and battery operators who need fast, bidirectional power control and black-start capabilities without bulky legacy stacks.

A Crowded Field Reaches Deployment Phase

SSTs are not novel in concept; they have been studied and piloted for years by major OEMs and research groups. Hitachi Energy, ABB, and Siemens Energy have all demonstrated power-electronic transformer technologies in rail and grid applications, while the Electric Power Research Institute and U.S. national laboratories have validated performance using wide-bandgap semiconductors such as silicon carbide and gallium nitride. What’s different now is market pull: AI-scale data centers and renewable buildouts are creating bankable volumes that justify factories rather than prototypes.

Execution risk remains real. Manufacturers must secure reliable silicon carbide supply, navigate standards and certifications, and win utility trust with rigorous testing on electromagnetic compatibility, fault behavior, and cyber-secure controls. Yet the direction of travel is clear: digitized, modular power hardware is steadily displacing passive iron as grids and campuses demand speed and intelligence.

What To Watch Next As Solid-State Transformers Scale

Key milestones will include large-scale site deployments with hyperscalers, proof that integrated batteries can replace standalone UPS at Tier III and Tier IV facilities, and validation of lifetime economics versus conventional gear. Watch for partnerships with utilities and independent power producers, along with performance data on efficiency, fault ride-through, and mean time to repair across multi-megawatt fleets.

With heavyweight investors and a founder seasoned in high-volume energy manufacturing, Heron Power is positioned to make SSTs a mainstream option. If the company hits its production targets and delivers reliability at scale, solid-state transformers could become a default choice for the next wave of AI data centers and renewable-rich grid nodes.