And the next cohort of VC judges for Startup Battlefield 200 at Disrupt 2025 promises a deep cross-section of sector expertise and operational experience to what has long been one of tech’s most-watched stages.

Their experience in health tech, fintech, enterprise software, AI and security also indicates where founders should expect the hardest questions — and where they too may get the fairest opportunities to shine.

Meet the New VC Judges for Startup Battlefield 200

Allison Baum Gates, general partner at SemperVirens, has invested in dozens of healthcare startups among other companies — fintech and enterprise SaaS. With numerous unicorns and exits already on her resume, she’s known for spotting patterns in durable business models operating in regulated, complex markets. Look for probing around workflow integration, payer dynamics, and how startups actually translate AI into measurable productivity gains for real buyers.

Katelin Holloway, founding partner at Seven Seven Six, mixes 20 years of operating experience at culture-defining organizations with early-stage investing. Her emphasis is on teams that expand human potential — in health and sustainability, culture and frontier exploration — which tends to select for founders who build durable organizations early. Seek out questions about founder-market fit, talent compounding, and values as a form of competitive advantage.

Miloni Madan Presler, general partner at Institutional Venture Partners (IVP), focuses on companies that are solving mission-critical pain points — not just innovation for tech’s sake. She is drawn to platforms that connect broken-up ecosystems, automate legacy processes, and deploy data in a way that changes decision-making. Founders should be prepared to talk about implementation timelines, ROI in months, not years, and the moat that comes with proprietary data loops.

The investor Sara Ittelson (formerly a leader in partnerships and business development for Faire and Uber) has a distribution-first lens. Early traction is required, if not sufficient; she’ll certainly lean into channel strategy, repeatable sales motion, and what it requires to break in and expand within both consumer and enterprise markets without burning runway.

The founding partner of Lockstep, Rinki Sethi, is the chief security officer at Upwind Security and former vice president and CISO for Twitter, with more than 15 years’ experience in information security across multiple industries including banking, retail, technology, healthcare, and cloud services. She will examine how products treat identity, data protection, and secure-by-design principles from the outset. Compliance checkboxes are table stakes, and threat models and responsible AI assurance will be a point of differentiation.

Why This Bench of Judges Matters for Founders Now

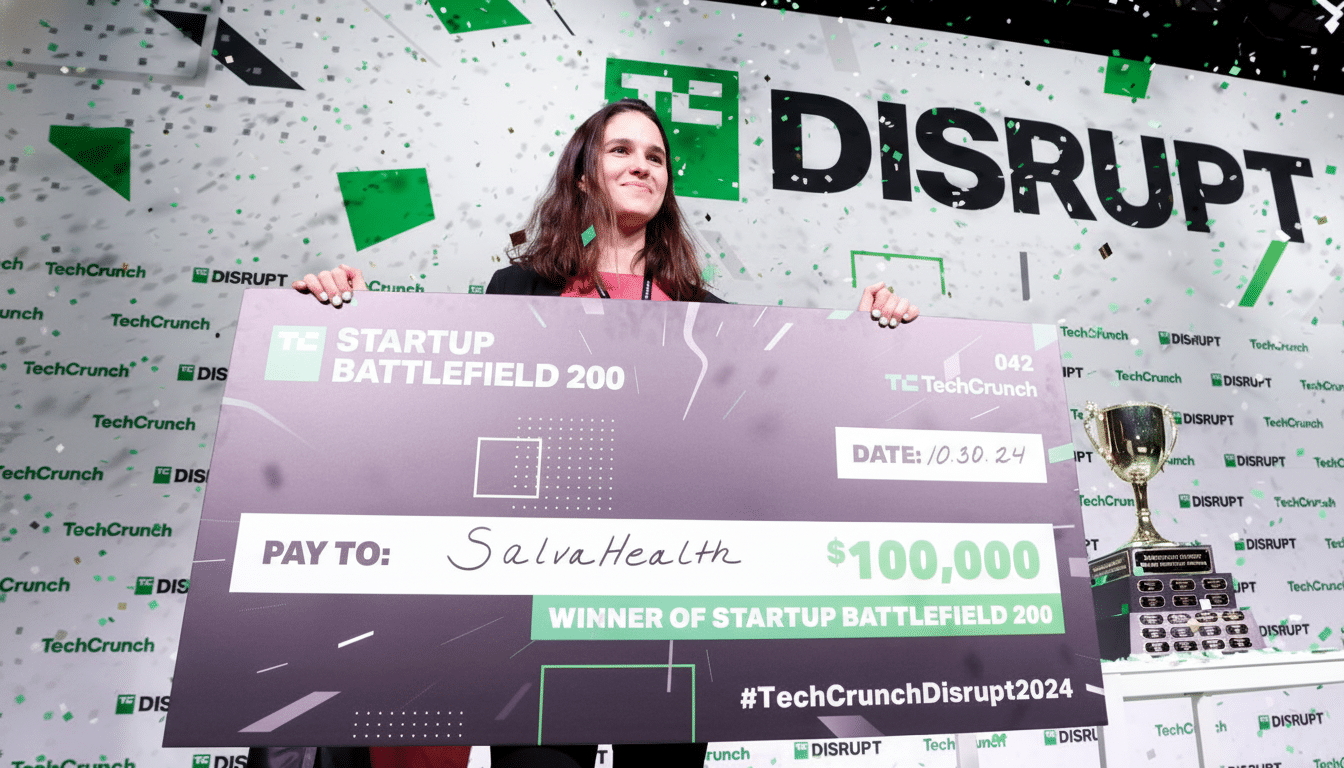

Startup Battlefield 200 culls our most competitive batch yet from an early applicant pool of more than 3,000 founders. Alums like Trello and Mint see early momentum from this stage — when the right question at the right time can kick off a round, engagement from a partner, or even a product pivot that leads to growth.

This slate of judges reflects where money and customer demand are still meeting: AI meets real workflows, cybersecurity weaves its way into product DNA, vertical software that bent cost curves in health and finance. Recent Venture Monitor reports from NVCA and PitchBook support this as well (emphasis mine): The latest editions of the PitchBook-NVCA Venture Monitor show increased selectivity combined with outsized checks for category winners — an environment which benefits clarity of execution and defensibility over hype.

What Judges Will Look for on the Startup Battlefield Stage

- Unit economics: Founders should be able to show gross margin structure, payback horizons, and a credible path to net dollar retention — not just a top-line growth story. A bottom-up TAM based on pricing and pipeline will always trump a slide of abstract totals.

- AI differentiation: It’s not just calling an API. Judges will investigate data moats, the rationale for model choices, evaluation frameworks, and how performance endures in production. You’ll also be asked about fine-tuning costs, latency, and guardrails — and what it looks like when the foundation model moves under your feet.

- Security posture: With worldwide security and risk expenditure estimated to exceed the $200 billion level by Gartner, buyers are demanding SOC 2 readiness, SBOM transparency, and resilient incident response. For products dealing with sensitive data, privacy-preserving design and compliance with NIST guidelines will be an enabler.

- Regulatory fluency: In healthcare and fintech, market momentum is often contingent on navigating HIPAA, FDA pathways, or financial compliance. Judges with strong domain perspective will roll up their sleeves on reimbursement models, clinical validation, or KYC/AML challenges that can kill or grow adoption.

Reading the Market Signals for Early-Stage Startups

Founders going into this space should aim toward a market that rewards efficient growth, distribution leverage, and customer proof. Design partner referrals, early cohort retention, and expansion revenue tell a more consistent story than vanity metrics.

The makeup of this judging cohort suggests a focus on pragmatic innovation: AI that saves hours, not wows; platforms connecting siloed players; and security architectures baked in, not slapped on. For teams that can defend their choices with data and confidence, this wave of judges offers precisely the sharp-edged feedback that helps promising startups grow into durable companies.