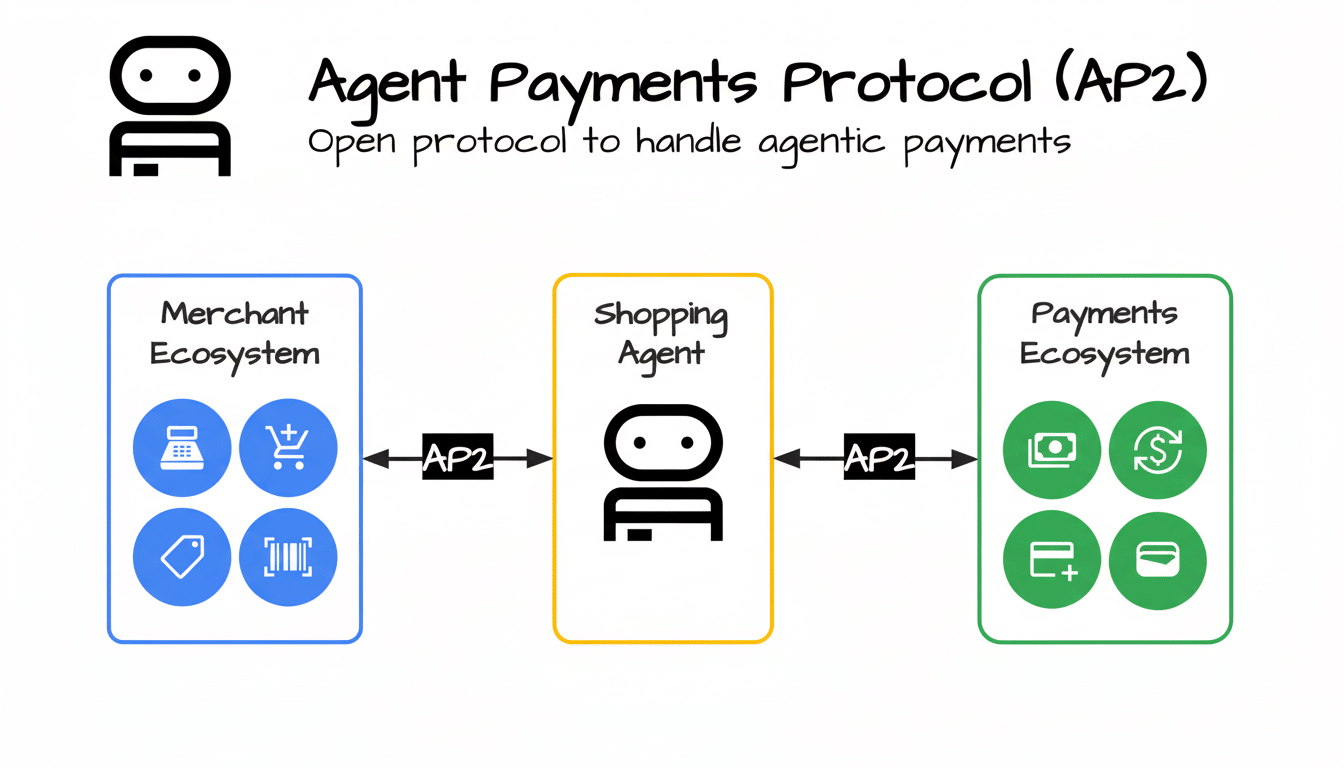

Google has released an open standard for letting autonomous agents shop and perform vaguely defined transactions. Google has announced the Agent Payments Protocol (AP2), a proposed open standard to give software agents autonomy to purchase, negotiate prices, and even check out across multiple merchants and payment rails—with clean audit trails. ZDNet.

Backed at launch by a group of over 60 merchants and financial institutions, including Mastercard, American Express, PayPal, and others, AP2 aims to be the connective tissue between AI platforms (like Alexa or Google Assistant), payment processors (Mastercard Connect, VisaNet), and retailers.

The new specification, published openly and placed for standards-body engagement, reflects practical realities: AI agents are going from demos to daily business. Google executives presented AP2 as a base for other innovators to build atop, not as an end in itself (a walled garden). This marks an interoperability-first stance uncommon in a market just taking shape.

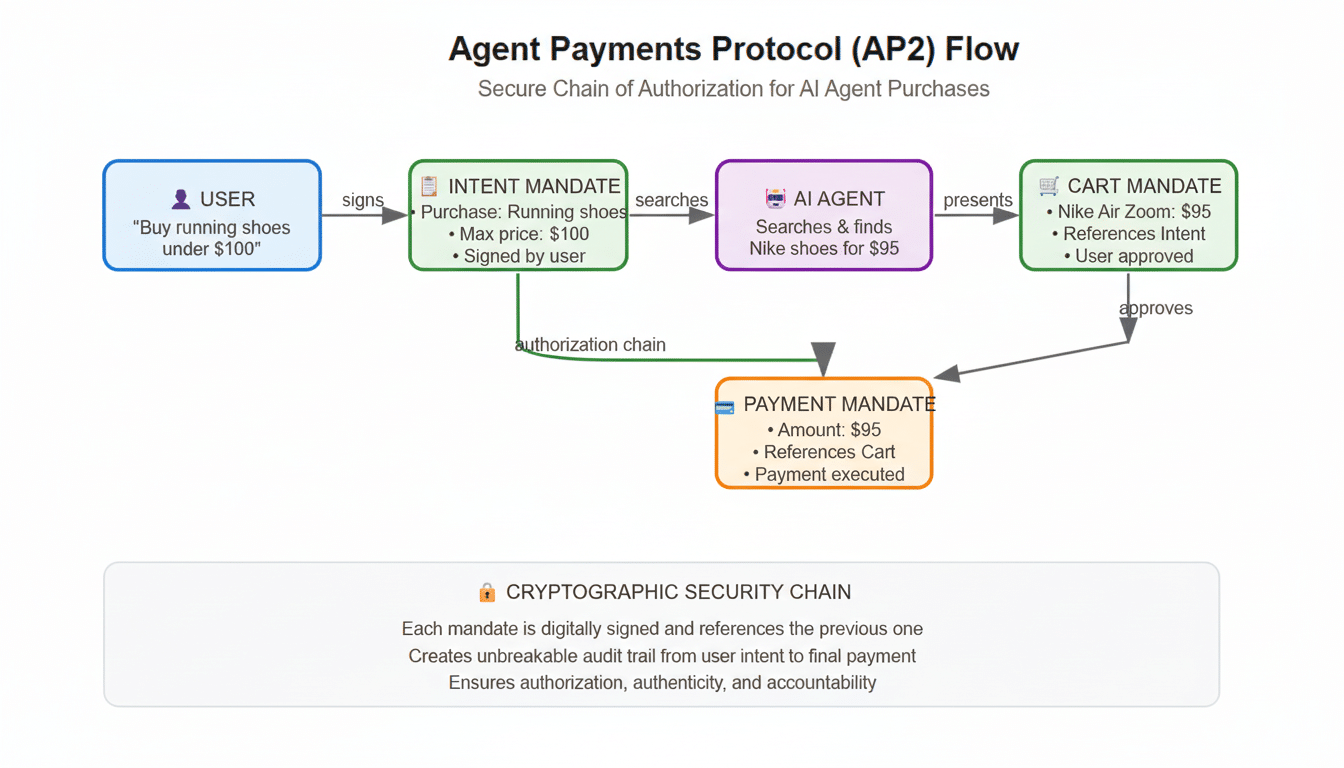

How AP2 works across consent and payment flows

AP2 provides a formalization of how an AI agent gains consent, searches offers, and executes payment. It adopts a two-step consent model, allowing an intent mandate that authorizes the agent to search and negotiate within user-defined parameters, but another mandate is required for the actual purchase: a cart mandate. The distinction is simple yet significant — it creates an auditable record of what the user requested, compared with what was actually purchased.

For complete-autonomy cases, like restocking household goods, the protocol allows agents to produce a cart-seeking mandate automatically if the user’s prior intent mandate articulates specific guardrails (for instance: price caps, brand preferences, temporal considerations, or quantities). Every transaction creates a cryptographically enforceable path that can be useful for dispute resolution, or compliance, for tuning risk models across issuers and merchants.

Google’s examples suggest the next wave of “agent-to-agent” commerce: a travel agent atomically coordinating airline and hotel bookings, or a bike-shop agent offering up a time-limited package when it realizes that its user is planning a bicycle excursion. And AP2’s emphasis on interoperable receipts and signatures is what makes these multi-party, real-time transactions something finance teams can account for.

Why it matters to retailers, issuers, and banks

Merchants have long struggled to reconcile conversion and fraud controls, especially in card-not-present channels. According to a projection by Juniper Research, merchants were scammed out of approximately $48 billion through online payments in 2023. AP2’s consent artifacts — the intent and cart mandates — could help drive false declines lower by providing acquirers and issuers with greater context on what a consumer actually authorized, when they authorized it, and under which conditions.

The protocol also cleanly fits alongside pre-existing frameworks such as 3-D Secure 2 and PSD2’s Strong Customer Authentication. It is not replacing those rails; rather, it’s laying on a standardized layer that makes explicit an agent’s decision process. That context can also feed issuer risk engines, back up post-transaction analytics, and help lower “friendly fraud” by anchoring chargeback reviews to signed evidence of user consent.

For retailers, AP2 provides a method to serve agent-originating demand without remaking checkout stacks per platform. When PSPs and gateways expose AP2 endpoints, merchants can accept agent-originated orders with consistent metadata that supports dynamic bundling, negotiated pricing, and inventory holds — but all without losing traceability.

Crypto extension and multi-rail support explained

Additionally, in partnership with Coinbase, MetaMask, and the Ethereum Foundation, Google is releasing an AP2 extension to support the x402 protocol for crypto-native payments. The idea: agents should have a common way to start buying from on-chain wallets as easily as they do card or bank rails, while maintaining the same accounting semantics and consent rules.

Multi-rail design is a thing because there will be agent commerce across cards, account-to-account transfers, and digital assets. An agent booking a trip could cordon off a refundable fare with a card, a nonrefundable lodging discount with an instant bank transfer, or a loyalty add-on funded from a crypto wallet — all controlled by the same intent and cart mandates.

Early ecosystem and competitive environment

AP2 is flying into a system that is already experimenting. Agentic browser Perplexity supports a “Buy With Pro” flow, and Stripe recently released tools to enable this slew of agent-mediated transactions directly on its platform. What AP2 contributes is a neutral handshake that others can pick up — if they want to avoid bespoke integrations on both ends of every pairing, that makes sense for retailers, wallets, and AI platforms.

Initial broad support from major networks provides AP2 immediate gravitas, but the pull-through over time will be merchant SDKs, issuer support in risk decisioning, and governance under trusted standards bodies like W3C, EMVCo (a global body that develops and manages interoperable payment specifications), or the FIDO Alliance. Open specifications on code repositories are a beginning; often, certification programs and conformance tests end up deciding whether something actually works in the real world or not.

What to watch next as AP2 adoption progresses

Three questions will determine the course of AP2’s development:

- User control: Will people receive unambiguous and revocable mandates with fine-grained spending limits and time windows, exposed through mainstream wallets as well as assistants?

- Resolution: Will issuers and networks recognize AP2’s consent artifacts as “official” proof for chargebacks, lessening merchant liability?

- Tooling: How fast do PSPs, gateways, and commerce platforms deliver on AP2-compatible endpoints and dashboards?

If AP2’s openness attracts enough users, agent-driven checkout could go from edge case to everyday pattern — without sacrificing accountability. For payments, the difference between promising demos and production systems is interoperability and auditability. With AP2, Google is wagering that common consent and cryptographic receipts are the missing pieces that allow AI agents to truly click “buy” online.