Google has announced a cheaper AI Plus plan in India, putting it directly in competition with OpenAI’s ChatGPT Go and hastening a pricing war in one of the globe’s most intense internet markets. The plan begins at ₹199 per month for the first six months and later goes up to ₹399 monthly, keeping the subscription sub-$5 even after the initial period.

What Google is offering in the AI Plus plan

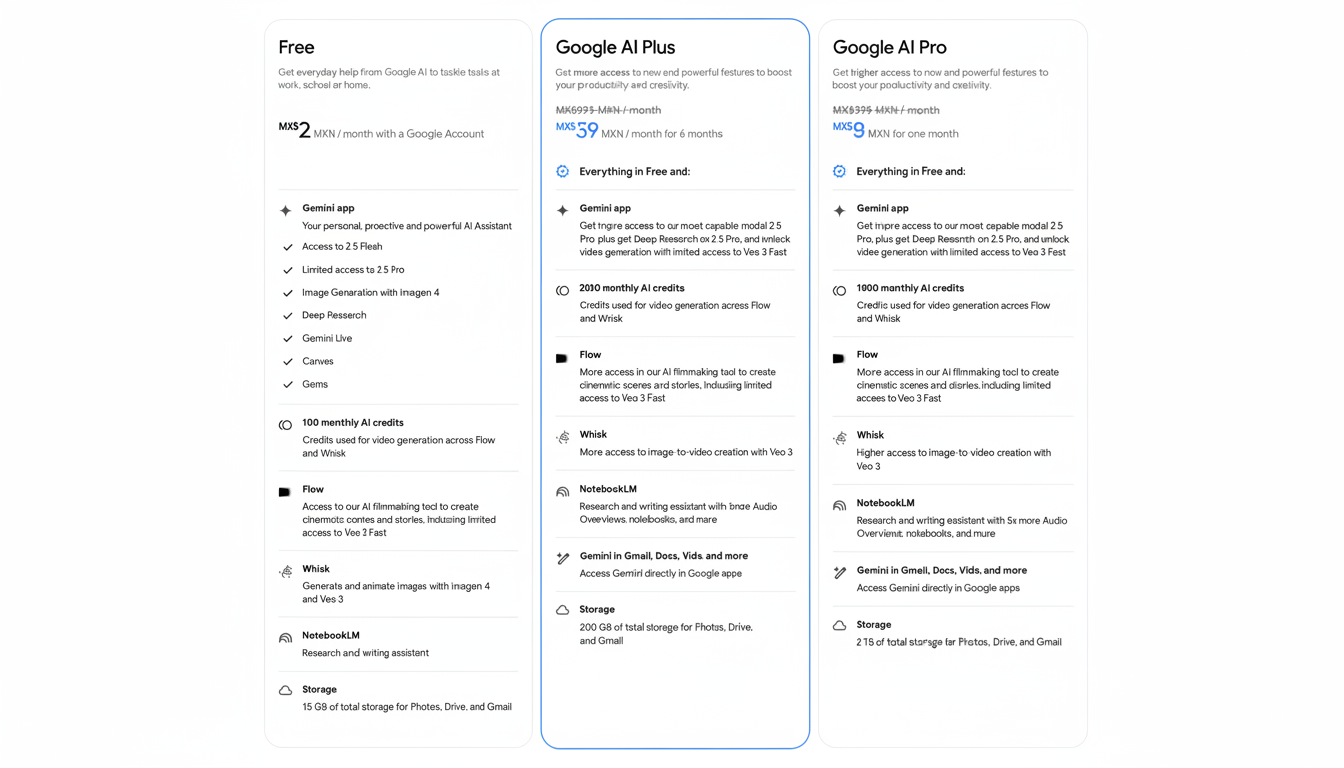

The AI Plus tier lifts usage restrictions of Gemini 3 Pro, unlocks video generation capability within both Wave and Flow apps, opens up access to deep research tools in NotebookLM, and includes 200 GB worth of cloud storage that can be divided between Photos, Drive, and Gmail. Family sharing is an option, letting more than one person take advantage of the same benefits for their own fitness journey without having to sign up separately.

Storage in it makes complete sense: it’s true to the Indian user who already pays for and receives a productivity suite with generative AI. Google is also emphasizing access to its image editing model — named Nano Banana Pro — signaling a push for creative tooling to be as essential as text generation even for everyday users.

Aggressive pricing to combat ChatGPT Go in India

The price also undercuts Google’s own AI Pro plan, introduced in India for ₹1,950 per month, and sits in the same league as ChatGPT Go. OpenAI’s plan has around 10× the free tier limits for messages, image generation, and file uploads — best suited toward active users who don’t require enterprise functionalities. Google’s counterpunch focuses on breadth — AI features across products + storage — more so than token or message caps, plain and simple.

The timing is catch-up: AI Plus originally launched in Indonesia and other markets, while ChatGPT Go has been available in India for months. It was only a matter of time before someone matched the sub-$5 price point, but with the inclusion of everything Google offers its users via Gmail, Photos, and Drive, it definitely gives them an opportunity to capitalize on their already established user base.

India’s AI land grab and telco tie-ins reshape adoption

India’s AI subscriptions are being fast-tracked by telecom partnerships and longer free trials. Perplexity partnered with Airtel to offer Pro access free for one year. OpenAI has been giving away one year of free access to ChatGPT Go to some audiences. Google, for its part, teamed with Reliance Jio to offer AI Pro free for 18 months on eligible carrier plans — an aggressive play that helped drive early adoption among high-data users.

These deals are indicative of a broader pattern in India’s digital economy: Upscale services often launch as carrier bundles before becoming standalone subscriptions. With hundreds of millions on prepaid, telco distribution has reach app stores can’t touch while decreasing friction for first-time AI users.

Why localized pricing matters in India’s AI market

India is a high-scale, low-ARPU market. With hundreds of millions of smartphone users, the nation is one that Google has had in its sights for some time now and where Android prevails by a landslide. UPI makes payments near-frictionless in a country where the national payments body says it settles billions of transactions each month. In such a setting, even a small price delta may drive substantial numbers of users.

Localized pricing also reflects usage observed in major surveys. Microsoft’s Work Trend Index has consistently identified India as one of the leading countries for experimenting with generative AI at work, and consumer use lends itself to mobile-first discovery and multimodal creation. By adding video generation and image tools to a popular plan — and coupling it with storage — Google is trying to forge a habit loop that extends beyond chat.

There’s a strategic calculus at work here: pull the monthly payout below $5 and the addressable market grows by many multiples, even if per-user margins are skinnier. The upside is scale. If even only a low-single-digit percentage of Android users are converted, the revenue consequences are significant and the data flywheel further drives product quality.

What to watch next as AI subscriptions heat up

Look for deeper integration throughout Google’s ecosystem — from Docs, Slides, and Gmail — where AI Plus might enable more dynamic drafts, summaries, and multimedia generation. Keep an eye out for offers in education and small business, which have historically spiked adoption in India when priced below psychological thresholds. You’ll see competitive countermoves, too: more free-year promotions, deeper telco bundles, and feature parity races around multimodal search and video.

For consumers, the choice might be which bundle is most useful on a daily basis. ChatGPT Go relies on higher usage limits and model power; Google is banking on convenience and the value of cloud-based storage. And now that both are locked in at a sub-$5 price point, India’s AI market is essentially one of execution — who will ensure that curiosity translates into daily use, but at scale.