Google is expanding its AI Plus subscription to every market where its AI services are offered, with the plan now live in the U.S. at $7.99 per month. The move takes a lower-cost tier that initially targeted emerging economies and makes it widely available, positioning Google to capture a more casual, price-sensitive AI audience.

What the AI Plus Plan Includes for Subscribers

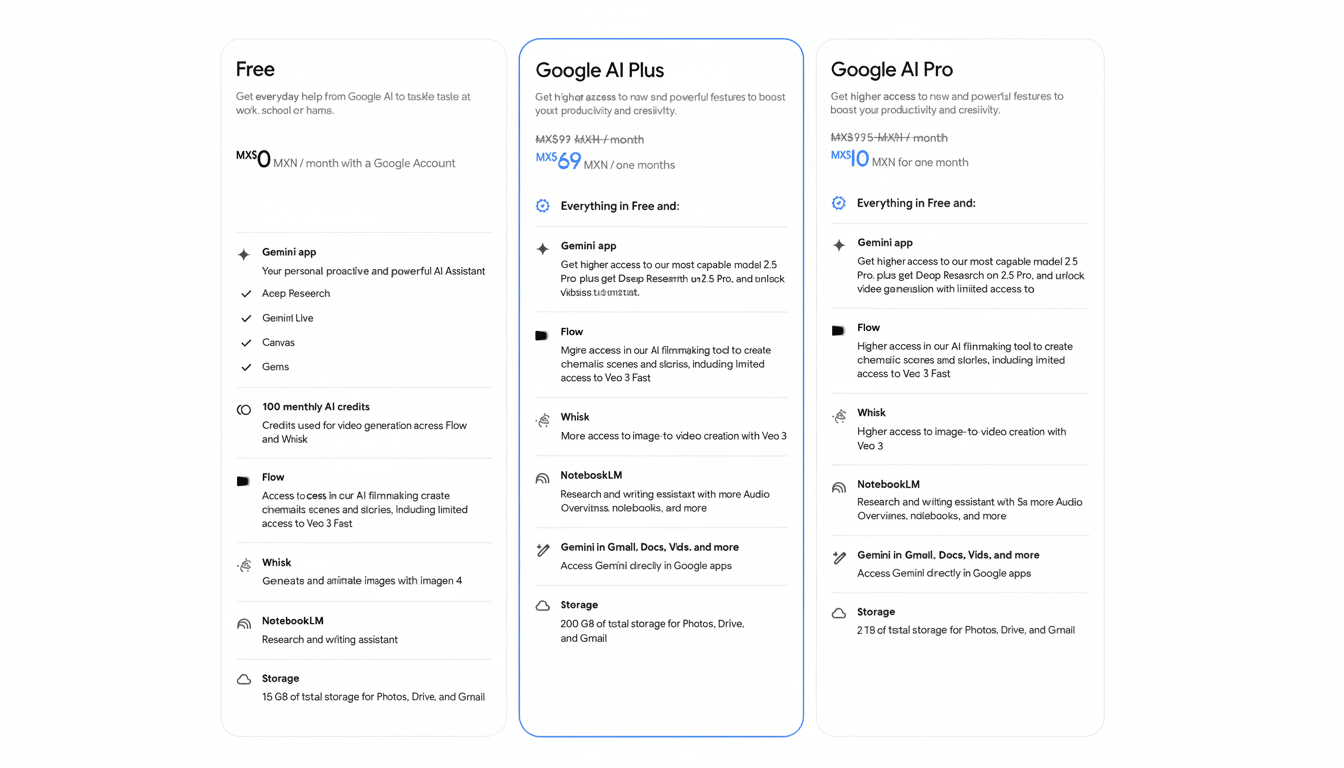

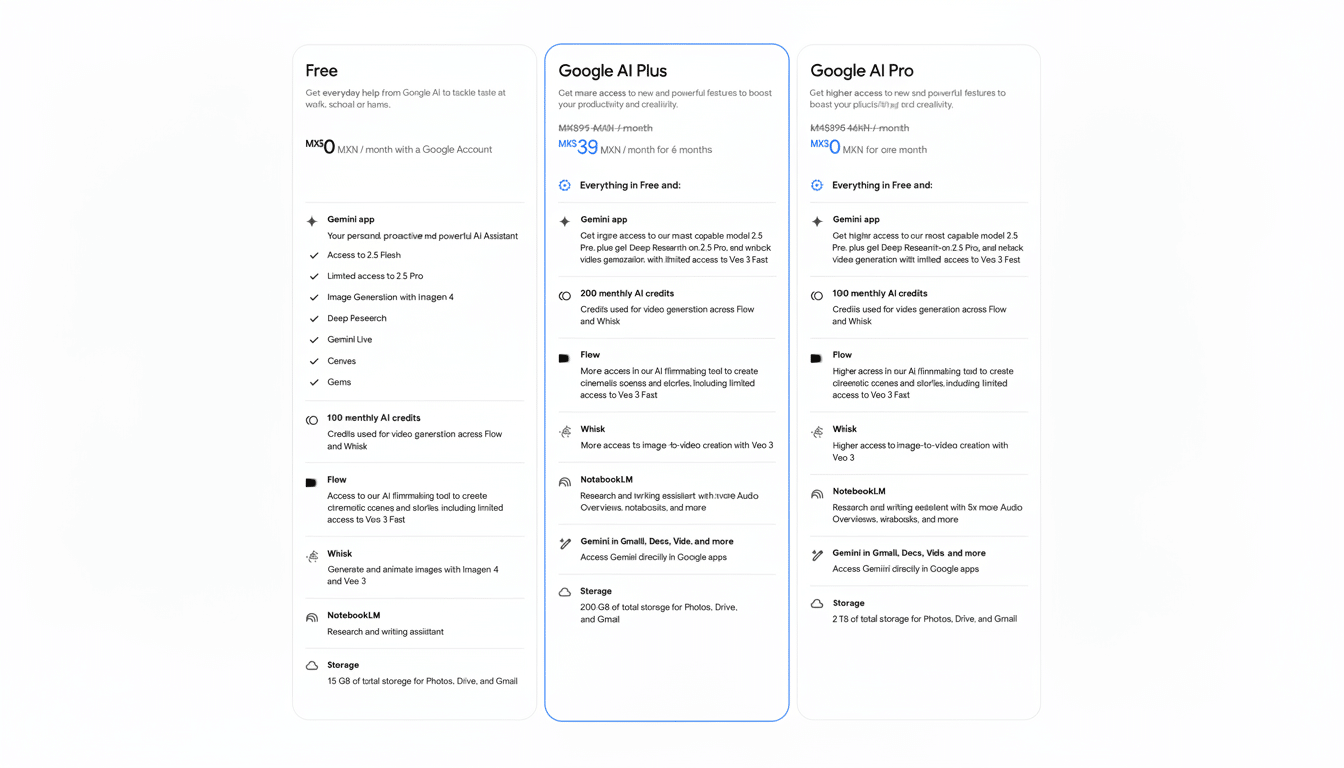

AI Plus unlocks premium access in the Gemini app, creative tools for video and image generation, and research and writing assistance in NotebookLM. The plan also bundles 200GB of cloud storage and family sharing for up to five members, a familiar Google One perk that turns AI into a household utility rather than a single-user add-on.

- What the AI Plus Plan Includes for Subscribers

- Pricing and Regional Rollout Across New Countries

- A Clear Shot at the Middle Market for Consumer AI

- Why This Matters for Adoption and Mainstream Growth

- The Competitive Picture in the Sub-$10 Consumer AI Tier

- What to Watch Next as Google Expands AI Plus Worldwide

Current Google One Premium 2TB subscribers will automatically receive AI Plus benefits, streamlining adoption across an existing base that the company said surpassed 100 million subscribers in 2024. That bundling is a classic Google tactic: add value to a mature subscription and grow engagement with newer services.

Pricing and Regional Rollout Across New Countries

The U.S. price is set at $7.99 per month, while regional pricing varies. In India, for example, AI Plus costs ₹399 monthly, roughly $4.44 USD. Google says the global expansion adds 35 new countries and territories to the plan’s footprint, following earlier phased launches that began in Indonesia last September.

For early adopters, there’s a limited-time promotion offering 50% off for the first two months. That introductory discount, common in subscription markets, reduces trial friction and lets users road-test features before committing to a full price.

A Clear Shot at the Middle Market for Consumer AI

AI Plus fills the gap between free access to Gemini and the higher-end AI Pro tier, which typically sits around $20 per month. The pricing mirrors a broader pattern in consumer AI, where providers split offerings into basic, mid, and pro levels to widen the funnel. In the U.S., the plan lands squarely against OpenAI’s ChatGPT Go, which is also $8 per month, underscoring a head-to-head play for mainstream users who want more than free but don’t need enterprise-grade capacity.

For Google, the mid-tier strategy is more than a pricing exercise; it’s about habit formation. By baking AI into storage and family sharing, the company ties everyday tasks—photos, docs, schoolwork—directly to AI features. Over time, that increases the odds of upgrades to Pro or Workspace add-ons where heavier usage and advanced models justify higher fees.

Why This Matters for Adoption and Mainstream Growth

Lower price points have been a lever for AI growth in mobile-first markets, where prepaid spending dominates and discretionary software budgets are leaner. Bringing the same value proposition to the U.S. could convert a sizable cohort that has tested free AI but avoided premium tiers. McKinsey has estimated that generative AI could add $2.6 to $4.4 trillion in value annually across industries, and consumer familiarity is a prerequisite for that spillover into work and education.

Creators and students stand to benefit immediately: NotebookLM’s organization and summarization features reduce research time, while creative video tools lower the barrier to prototyping storyboards and edits. Families share storage and AI features, making it easier for multiple profiles to tap the same plan without juggling separate subscriptions.

The Competitive Picture in the Sub-$10 Consumer AI Tier

The sub-$10 tier is now the most intense battleground in consumer AI. OpenAI, Google, and rivals like Anthropic are segmenting access by model capability, speed, and usage limits. Bloomberg Intelligence has projected long-term enterprise and consumer spending on generative AI to scale rapidly this decade, and locking in users at a friendly price point is an early advantage.

Google’s differentiator is ecosystem reach: Gemini assistance across Android, search, and productivity apps, plus cloud storage and family tools. If the company can keep latency low and quality high at the Plus tier—especially on mobile—its installed base on Android gives it a distribution edge that pure-play AI apps can’t easily match.

What to Watch Next as Google Expands AI Plus Worldwide

Key signals to monitor include upgrade rates from Plus to Pro, usage of shared family benefits, and whether Google deepens integration with Gmail and Docs for Plus subscribers. For now, AI Plus brings a pragmatic on-ramp to paid AI at a price many users will test—especially with the introductory 50% discount—and it puts competitive pressure on rivals to match value, not just model benchmarks.