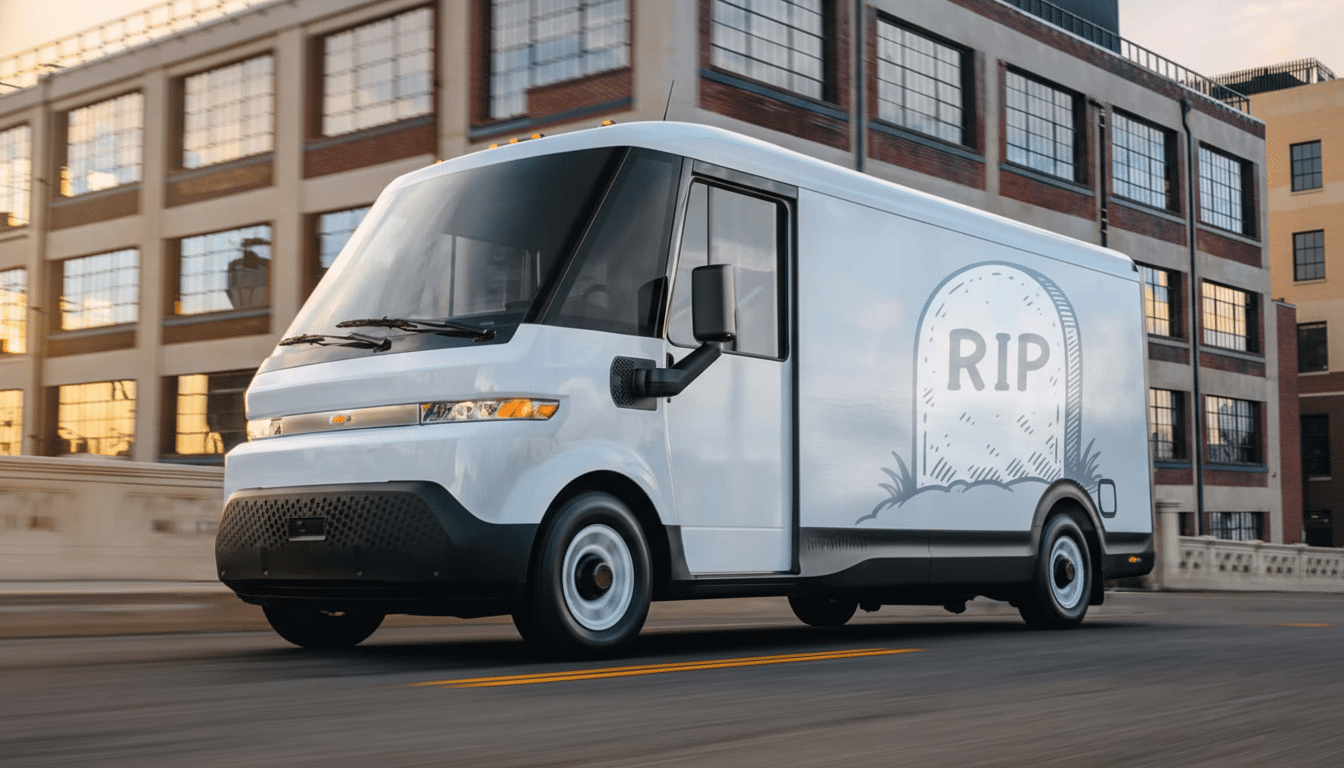

General Motors is shutting down its BrightDrop electric delivery van business, wrapping up a high-profile push into commercial EVs after a rocky and brief operation. The carmaker said in its third-quarter results that demand from fleet customers had not grown as quickly as expected, and that changing U.S. incentives and regulations undermined the economics for a scheme that once worked.

BrightDrop’s Fast Ascent and Sudden Break From Operations

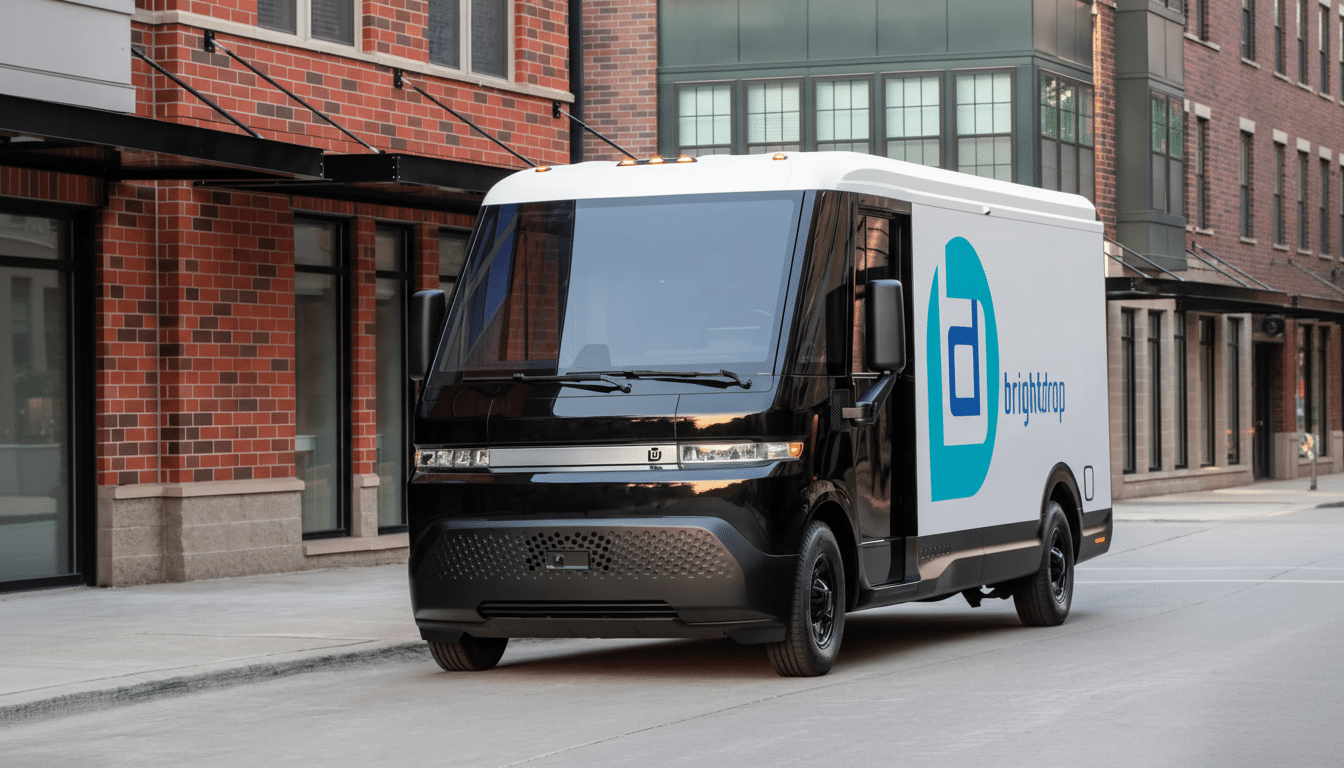

BrightDrop made a splashy debut in 2021 with customers in place — FedEx committed to early orders and Walmart an agreement in principle — and a lineup of purpose-built vans under the Zevo name. GM had spun the unit out as a start-up-like operation, only to pull it back under GM Envolve and then Chevrolet’s commercial arm after momentum dwindled.

The new model is being produced at GM’s retooled CAMI Assembly plant in Ontario, a facility originally designed to manufacture compact sport utility vehicles now producing battery-electric vans based on the Ultium platform. Ramp-up never met expectations, hampered by parts shortages, customer pilots that lasted longer than expected and a recall after a small number of thermal incidents led to further scrutiny, according to safety filings with the National Highway Traffic Safety Administration.

Midyear, sales volumes were in the low thousands — not nearly enough to support a dedicated commercial platform. The program also had leadership turnover and several reorganizations — red flags with the benefit of hindsight that the business case was shaky.

Why the Business Case for BrightDrop Vans Fell Apart

GM said it was falling behind expectations in electric delivery vans, a segment that seemed promising during the pandemic e-commerce boom but was more price-sensitive than passenger EVs. Rising interest rates inflated lease payments, and utility interconnection timelines extended fleet charging projects far beyond original timelines. Industry associations like CALSTART and the North American Council for Freight Efficiency have time after time identified depot power upgrades as a material bottleneck for medium-duty electrification.

The regulatory picture also shifted. Federal incentives that had made total cost of ownership favorable for commercial buyers in the past were dialed back, pulling out a lever BrightDrop used to close deals. Absent those credits, many fleets returned to familiar diesel or gasoline vans while they waited for infrastructure, residual-value information and maintenance networks to coalesce.

There were vehicle basics involved, too. Battery weight can cut payload and flexibility for high-cube vans, complicating route planning and load management. The 80-120 miles driven per day on average are within the EV’s range, but variability – cold weather, hills and auxiliary loads – compels fleets to maintain larger buffers that undermine utilization and payback math.

The Market’s Competitive Signals in Electric Delivery Vans

GM isn’t the only one rethinking the category. The early lead in the electric transit wars for Ford’s E-Transit has cooled off as fleet buyers are a bit more methodical. Simultaneously, Rivian has been able to line up more than 25,000 electric delivery vans for Amazon with the help of a captive anchor customer and closely integrated charging and telematics. Aside, that is, from the bucketfuls Harbinger — California-based but with deep Detroit roots throughout its staff — alone has sold some 200 truck chassis since it went into production, showing there’s still room out there for small, focused players to find a niche level of volume when product and buyer work hand in glove.

The mixed results highlight the split between big, anchor-agreement programs and open-market sales. Being a system that will serve fleets conducting commerce for various customers, BrightDrop also confronted longer procurement cycles and a diversity of readiness around infrastructure in cities and utility territories.

What It Means for GM and Suppliers After BrightDrop Exit

Backing away from BrightDrop also enables GM to reallocate capital to EV nameplates with more straightforward margins — light trucks and SUVs — and popular internal-combustion models.

During the call with investors, executives focused on the company’s ability to deliver against continued ICE demand while timing EV investment to reflect proven customer pull. That stance has found favor with investors who like cash-generating businesses in the near term.

Companies associated with the van program, such as body builders, upfit partners and charging integrators, will need to shift. Some have begun to diversify around Ford, Mercedes-Benz’s eSprinter and upcoming chassis makers. For fleets operating BrightDrop vans in the field, GM will also need to ensure ongoing service, parts availability and residual support to help protect the total cost of ownership assumptions baked into their existing contracts.

The Larger EV Fleet Picture and What Comes Next for Vans

Yet, while BrightDrop exits the scene, electrification for medium-duty isn’t retreating in full. Analyses by BloombergNEF and the International Council on Clean Transportation suggest that batteries will continue to get cheaper while rules aimed at curbing emissions tighten throughout the decade, which would favor commercial EVs. But the road is likely to be easier for manufacturers with captive anchor customers, adaptable platforms and patient capital, as well as those going after specialized use cases where EVs provide immediate operational benefits.

For GM, the move is a pragmatic reset rather than an indication that it’s giving up on electrification. The commercial offerings will remain necessary as fleets decarbonize, but the company will chase after them on a timeline that’s far more reflective of today’s policy environment, infrastructure development and customer readiness. The promise of BrightDrop was real; the runway, as it turns out, proved to be shorter than what the plan called for.