GE Aerospace is taking a large stake in Beta Technologies with an investment of $300 million and a plan to co-produce a hybrid-electric turbogenerator targeting next-generation aircraft. The strategic pact, which is subject to regulatory approval, links one of aviation’s most venerable engine manufacturers with a fast-growing electric aviation builder, in a maneuver to hasten the commercial rollout of hybrid propulsion.

The partners say, their modular system will integrate the lightweight turbine with a high-voltage generator, power electronics and battery management to allow for longer range, a higher payload capability and enhanced dispatch reliability next to battery-only designs. Key Draw-in of GE GE Aerospace will contribute in the areas of core turbine technology, manufacturing scale, and certification expertise, while Beta will bring together high-performance electric propulsion, thermal management, and air vehicle systems.

Why this alliance is important for hybrid-electric flight

Energy density its still the hard upper limit for all-electric aircraft: today’s lithium-ion batteries store about 200–300 Wh/kg, a small fraction of the energy in jet fuel. That physics gap has compellled manufacturers to search for hybrid architectures that combine a compact turbine for in-flight electricity generation — which recharges batteries and drives motors — with other propulsive systems as needed. The payoff is useful range and payload without surrendering the efficiency and low noise of electric propulsion.

Developers of advanced air mobility are already pivoting to accommodate this reality. The regional ES-30 from Heart Aerospace, for example, teams up batteries with turbogenerators to power multi-hundred-mile routes, and Ampaire has test flown a hybrid-electric Caravan for point-to-point cargo and passenger service. GE Aerospace’s move to bet on a turbogenerator is an indication that hybrids are transitioning from interesting demos to commercially credible products.

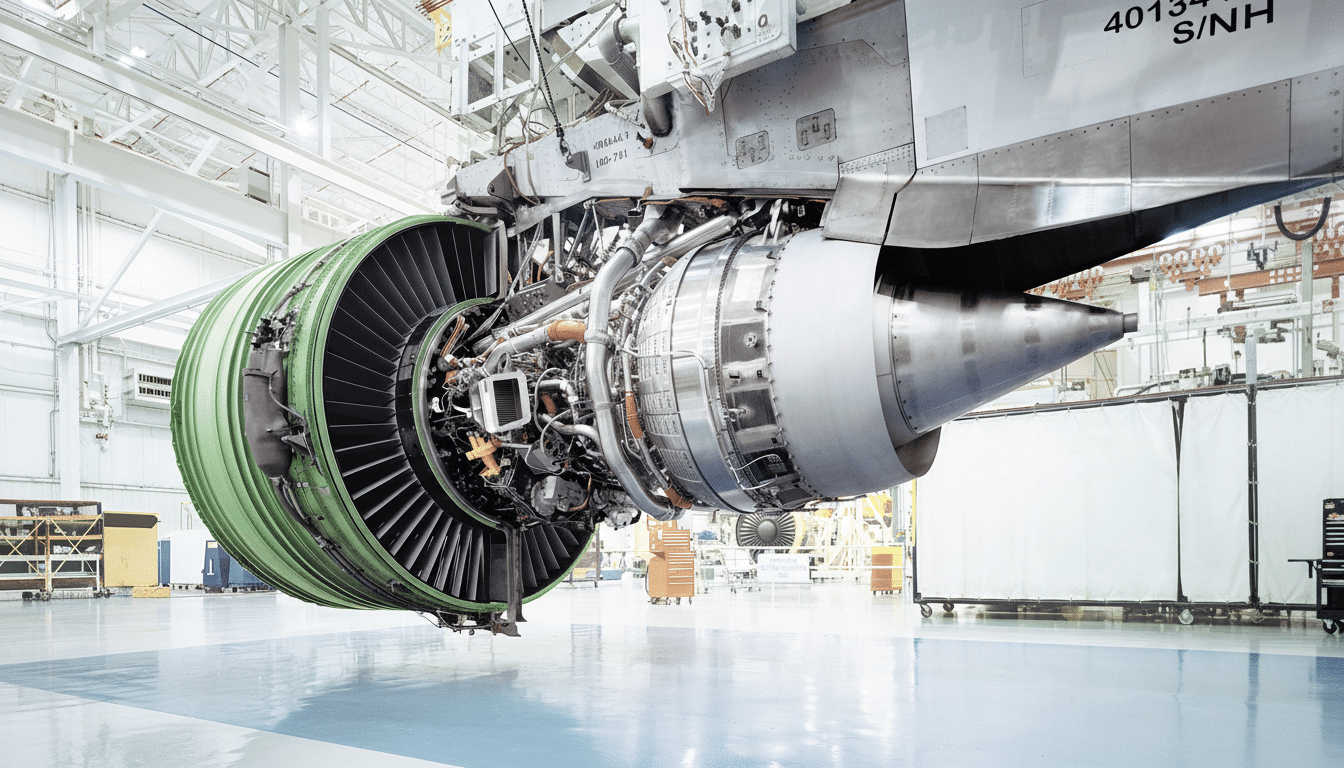

Inside the turbogenerator approach

A turbogenerator links a small gas turbine to an electrical generator, which supplies a high-voltage bus to feed the propulsors directly or recharge onboard batteries. At cruise, the turbine can operate at its most efficient point, shaving fuel burn versus conventional mechanical drivetrains. While taking off or climbing, the battery assists the generator to provide additional peak power without having to oversize the turbine.

GE Aerospace has been working up to megawatt class hybrids through programs involved with NASA’s Electrified Powertrain Flight Demonstration (EPFD) and designing compact, efficient cores in its turboprop and turboshaft families.

Beta is able to provide flight-tested electric powertrains and system integration know-how from its Alia platform, which has been designed for conventional takeoff and eVTOL configurations. The common aim: a certified, scalable power unit for air taxis, short-haul cargo, and later on for regional aircraft.

Certification and market timing

Certification is the critical path. Beta is pursuing certification of Alia as an air taxi with a conventional takeoff and landing configuration to Part 23 standards, and an eVTOL with powered lift under the type-approval landscape the FAA and EASA are developing. Having a hybrid-electric propulsion system increases scrutiny in another set of areas, such as failure modes, thermal management, battery safety, and electromagnetic compatibility.

And that’s where the certification history of GE Aerospace – for turbine cores, control software, and redundancy architectures among other things – comes in. Regulators including the FAA have issued roadmaps for the integration of AAM, and standards bodies such as ASTM and RTCA have been working on guidance for high-voltage systems—moves that will make the approval path for a turbogenerator-equipped aircraft that much easier.

A crowded, fast-evolving field

Rivalry is brewing through the electrified propulsion stack. Ligh aircraft Wanting to drive smaller aircraft, Rolls-Royce has revealed a compact turbogenerator concept, Safran is partnering with hybrid developers on distributed electric propulsion, while Pratt & Whitney Canada, with RTX’s Collins Aerospace, has flown a hybrid demonstrator on a regional turboprop platform. Honeywell is providing high horsepower turbogenerators for big UAV and AAM programs.

GE Aerospace’s participation with Beta could change the calculus that airframers face in choosing suppliers who are enabling the pure-electric, hybrid-electric, or sustainable aviation fuel focused strategies. For operators, the math is about lifecycle cost: if a hybrid can reduce fuel burn and maintenance, while maintaining useful load and turnaround times, it adds up as a practical means of moving one step closer to lower-emission fleets.

Follow the money — and the manufacturing

The $300 million commitment provides Beta more runway to industrialize its propulsion systems and complete certification work. The new capital would give Beta nearly $1.45 billion in total funding, according to the company’s statements, which were provided by an employee and would come on top of institutional backers like Amazon’s Climate Pledge Fund and Fidelity Management & Research Company. The parties also agreed that GE Aerospace would have a right to nominate one director to Beta’s board, creating even closer operational alignment.

Scaling production and support is just as crucial as engineering breakthroughs. GE’s worldwide supply chain, MRO network, and field support reduce operator risk, while Beta’s expanding charging infrastructure and service footprint establish the ground ecosystem the hybrids will still require for fast turns and battery management. And for cargo integrators, medevac providers, defense customers that want a quiet, efficient, STOL-capable aircraft, that package is compelling.

What to watch next

Key milestones will include full power, integrated ground tests of the turbogenerator; endurance tests that confirm thermal margins; and flight tests showing that the turbine and battery work well together to modulate power levels. “The pacing item will be the progress that the FAA makes with certification plans for Beta’s Alia variants.

The larger climate context is what adds urgency.

Aviation contributes only a small part, but one that is growing quickly, of global CO₂ emissions, and regional and short-haul routes are early targets for abatement, according to the International Energy Agency. If GE Aerospace and Beta can produce a trustworthy, certifiable hybrid-electric package, they won’t just be opening up range and payload—they could make electrified flight an operational reality for mainstream aviation applications.