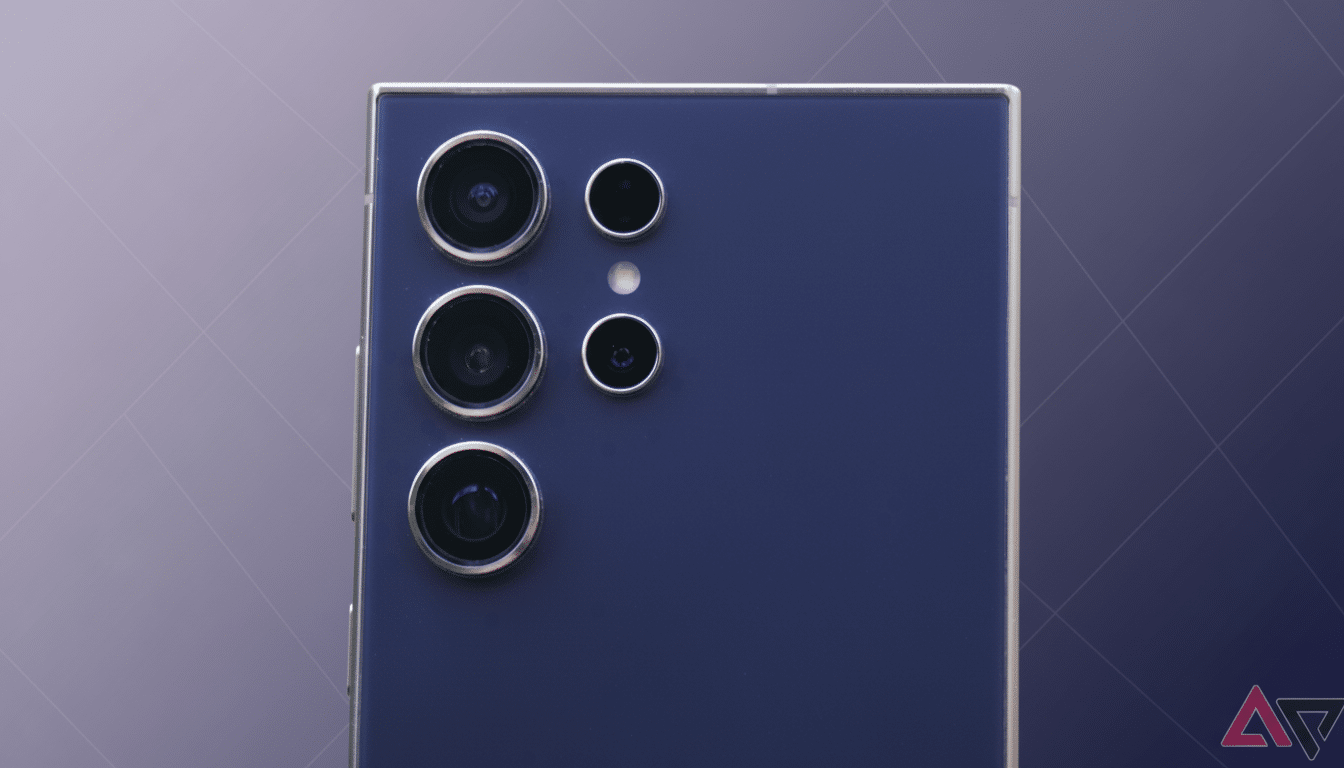

It looks like Samsung’s next high-end flagship may not deliver the massive camera hardware shift many were anticipating.

Ice Universe (1, 2) now reports that the Galaxy S27 Ultra is expected to stick with Samsung’s existing 200MP ISOCELL main sensor rather than upgrade it to a larger and newer Sony-made model.

Samsung Tipped To Stick With The Status Quo

There’s been recent scuttlebutt that Samsung ditched internal plans to shift to a larger 200MP sensor for its Ultra line, due to cost and supply chain risk. That would fit with the company’s pattern of behavior: we saw iterations on the same phone featuring variations of the resolution (108MP) three Ultra generations in a row before debuting the new HP2 family at 200MP in the S23 Ultra, and refining it further with the S24 Ultra.

If true, the S27 Ultra would follow the 1/1.3-inch class 200MP ISOCELL, in all likelihood another tuned HP2 clone. The rumored plan spreads beyond a one-cycle approach, with murmurs that the follow-up Ultra editions could also rely on familiar main-camera silicon.

Why The Sony Sensor Option Turned So Many Heads

The LYT-901, a 200MP sensor, sits on a scale of about 1/1.12 inches with pixel size at about 0.7μm, and was recently announced by Sony. On paper, that’s a sensible progression in light-gathering from a 1/1.3-inch chip with some help from Quad-Quad Bayer coding and 16-in-1 binning down to a still more practical 12.5MP, as well as AI remosaicing for detail sharpness in low light. Sony claims the part already is in mass production, and message board whispers suggest that Chinese ultra-premium phones could adopt this piece as soon as 2026.

The appeal is obvious. In general, larger sensors produce cleaner low-light results, more realistic-looking depth and superior dynamic range. We’ve seen this pattern emerge in the 1-inch class realm of devices such as Xiaomi’s Ultra handsets and Oppo’s leading flagships, where larger silicon and tuned processing have raised image quality across the board.

Cost, Supply, and Camera Module Limitations

Shifting to a bigger sensor is not just about changing the chip. It ripples throughout the module: the size of the lens, image stabilization mechanics, thermal design and space budget for periscope zooms. A bulkier main camera is liable to impose concessions in telephoto reach or battery capacity, and it’s not uncommon for yields on the latest sensors to constrain availability during peak launch windows.

Those truths dovetail with market pressures. Despite the sense that Sony owns about a mid-50% share of the smartphone image sensors market by revenue, Samsung is estimated to own around the high-20% to low-30% range. For Samsung, going outside the family for its marquee phone is a risk in terms of both cost and reliance. Staying with in-house ISOCELL silicon makes shipping tens of millions of units more about containing the bill of materials and diversification risks.

What This Means For Real-World Image Quality

Of course, the same sensor doesn’t mean the same pics. Every new generation means new image signal processors, faster memory pipelines, and refined multi-frame algorithms. In this era, the last couple of generations of Snapdragon and Exynos chips have both gone gung-ho on AI denoising, semantic segmentation and HDR fusion, which can lead to noticeable leaps in detail retention and color constancy without even changing the sensor.

Samsung’s 200MP pipeline already supports high-res crops, 8K video modes, and adaptive binning for 12.5MP output. You can also look forward to additional advances in night mode texture, tone mapping consistency and video stabilization as software and ISP tuning progresses. That being said, physics is hard-headed: a bigger sensor like Sony’s LYT-901 ought to still have a leg up when it comes to shooting in low light and subject separation if lenses and processing are equally mature.

Rivals Are Closing The Smartphone Hardware Gap

That possible choice comes as rivals double down on big-sensor gambits. Brands like Xiaomi, Oppo and Vivo have used Sony’s top-of-the-line LYT and IMX series sensors to push computational photography further. If LYT-901 does find its way into 2026 flagships, it might establish a new low end for premium camera experiences—particularly in low-light conditions where sensor area is particularly important.

In the meantime, Samsung’s own roadmap features the 200MP ISOCELL HP5, complete with minuscule 0.5μm pixels for more compact modules and resolution flexibility.

Smaller pixels, however, generally collect less light unless bolstered through binning and algorithmic magic — which is why a bigger Sony sensor is so tantalizing on paper.

What This Means for People Buying Galaxies

If the Galaxy S27 Ultra does retain its current 200MP ISOCELL hardware, then the story could end up being more about software and optics than raw sensor size. That approach isn’t without precedent: for the S22 Ultra, S23 Ultra and S24 Ultra, we’ve seen significant camera gains come from tuning, even when they had similar (or in some cases identical) fundamental main sensor.

For power users, the pragmatic questions are simple enough. At the same exposure, will there be cleaner textures in night shots? Can the phone keep colors consistent between its ultra-wide and telephoto cameras? Does the video stabilize better with no jello artifacts? If Samsung provides the right answer to those questions, persisting with its own silicon could be a savvy and consumer-friendly decision — at least until it feels making that leap to an even larger 200MP sensor is worth the added cost and complexity.